Daily Market Outlook, November 1, 2023

Munnelly’s Market Commentary…

Asia - stocks experienced predominantly higher trading conditions. However, the gains were limited for most indices ahead of the FOMC announcement. The region also faced a series of data releases, including disappointing Chinese Caixin Manufacturing PMI, which marked its first contraction in three months. The Nikkei 225 posted the most substantial gains, benefiting from reports of a new economic package in Japan totaling around JPY 17 trillion, as well as recent currency depreciation following the Bank of Japan's modest YCC adjustment. Conversely, Hang Seng and Shanghai Comp. saw choppy trading. Chinese Caixin Manufacturing PMI data mirrored the recent deterioration in the official release, and there was some disappointment after the People's Bank of China's open market operations resulted in a net daily drain, despite prior reports of the central bank's likely addition of further liquidity and expected declines in money market rates from the day.

Europe - Today's October PMI manufacturing data for the UK and the Eurozone are second readings, and they are not anticipated to be revised. The initial estimates indicated a decline in the Eurozone measure. In contrast, the UK's index increased to its highest level in three months. Nevertheless, both readings remain significantly below the pivotal 50 level, indicating that economic activity is still in a contraction phase.

US - Stateside, October ISM manufacturing survey is a new release. In September, the overall index climbed to 49.0, its highest level since last November, and it's not far below the crucial 50 level. The reading for the alternative PMI measure also rose to 50 in October, suggesting the ISM could potentially follow suit. However, it is more likely to remain at 49.0. Both measures indicate that the decline in the manufacturing sector may be stabilising. This could be due to a combination of reduced inflationary pressures, some reshoring of activity, and government support for manufacturing as part of President Biden's green agenda. Additionally, the US will release the ADP employment measure for October and construction spending data for September. Today's Federal Reserve monetary policy update in the United States is anticipated to keep interest rates unchanged. Prior to entering their pre-announcement quiet period, multiple Fed officials expressed the view that the recent increase in bond yields effectively amounted to a tightening of monetary policy, reducing the necessity for another rate hike. The Fed is known for avoiding sudden market surprises in its rate decisions, so it is highly probable that US interest rates will remain unaltered for the second consecutive policy update. Nonetheless, the Federal Reserve finds itself in a challenging position. While inflation has moderated throughout the year, the US economy continues to perform strongly, and the job market remains highly competitive. This situation creates uncertainty about whether inflation will return to the Fed's target of 2.0% and remain there without the need for additional policy adjustments. Consequently, Fed Chair Powell is unlikely to rule out the possibility of future rate hikes or provide strong support for expectations of an imminent rate cut. Instead, he is expected to emphasise the ongoing uncertainty and avoid making definitive commitments about future policy actions.

FX Positioning & Sentiment

USD/JPY made significant gains, surging 1.6% following a perceived disappointment from the Bank of Japan (BoJ) and positive US economic data, pushing it toward the 2022 peak at 151.94. Notably, this level marked a 32-year high and triggered substantial Japanese Ministry of Finance (MoF) yen buying, leading to a decline in the USD/JPY price. The current high on Tuesday reached 151.715, potentially testing the waters for intervention by the MoF. The most recent intervention on October 21, 2022, occurred when USD/JPY reached an intraday low of 144.50. However, any intervention-driven sell-off in USD/JPY is likely to be short-lived if US data continues to outperform expectations. Positive economic reports are propping up expectations for the Federal Reserve's policy and pushing short-term Treasury yields higher. Wednesday's calendar includes crucial data releases such as the ADP employment report, ISM manufacturing data, JOLTS job openings, and several events leading up to the non-farm payrolls (NFP) release and ISM non-manufacturing data on Friday. Federal Reserve Chair Powell is expected to maintain a stance of steady interest rates while refraining from discussing easing measures. If US data persistently beat forecasts, and the MoF remains silent, the market may attempt to break the 155 level. However, even if there's no intervention, verbal interventions from Japanese authorities are likely above 152. The market sees significant expiries around 151 and 152 as the week concludes, with 150 now considered a key support level. This push toward 2022 highs in USD/JPY comes despite the narrowing spreads between US Treasury (Tsy) and Japanese government bond (JGB) yields compared to the levels seen in October.

CFTC Data As Of 27-10-23

USD net spec long up a touch in Oct 18-24 period; $IDX rose 0.03% in period

Since period closed ECB dovish hold & Japan CPI may moot period adjustments

EUR$ +0.12% in period, specs -2,843 contracts; weak growth trump inflation

$JPY +0.05%, specs +3,029 contracts now -99,629; pair hovers near 150

GBP$ -0.16% in period specs -18,636 contracts; dovish BoE rate view weighs

AUD, NZD net spec short grew amid low rates, growth view; weak China growth

$CAD +0.67% in period, weak glbl growth and stagnant BoC rates weigh

BTC +18.2% period, specs sell 781 contracts flip to short, BTC steady since

End of developed mkt hikes and global growth remain key determinants ( Source Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0445-50 (740M), 1.0500 (753M)

1.0540 (450M), 1.0575-85 (823M), 1.0590-05 (1.86BLN)

1.0625 (226), 1.0665-75 (1.42BLN), 1.0700 (255M)

USD/JPY: 148.00-10 (1.29BLN), 148.25-35 (1.51BLN)

148.40-50 (1.7BLN), 149.25-30 (909M), 149.50 (412M)

149.70-80 (959M), 150.00 (1.25BLN), 150.50-60 (2.52BLN)

151.00 (867M), 151.50 (230M)

EUR/JPY: 159.00-10 (426M), 160.00 (280M)

USD/CHF: 0.8900 (262M). EUR/GBP: 0.8675 (500M)

GBP/USD: 1.2175 (245M), 1.2190-1.2210 (395M)

AUD/USD: 0.6250 (257M), 0.6325 (359M)

0.6400 (470M), 0.6430 (348M), 0.6460 (309M)

USD/ZAR: 18.86 (300M)

USD/CAD: 1.3650 (300M), 1.3750 (425M)

Overnight Newswire Updates of Note

China’s Manufacturing Production Falls Slightly In October

Japan’s Manufacturing Conditions Continue To Deteriorate In October

Japan 'On Standby' To Take All Possible Steps Amid Yen Decline

Japan Plans Economic Measures Worth JPY17 Tln

RBNZ's Hawkesby: NZ Can Handle Higher Rates Of Unemployment

RBNZ Says Full Impact Of Interest-Rate Hikes Still To Be Seen

China’s Central Bank Drains Liquidity After Overnight Rate Surge

BoJ Spurs Bets Against Yen, Testing Threshold For Intervention

BoJ Steps Into Bond Market To Slow Rising Yields

S&P 500 Logs First 3-Month Losing Streak Since March 2020

AMD Gives Soft Q4 Guidance, Expects To Sell $2 Bln Of AI Chips Next Year

Toyota More Than Doubles Quarterly Profit, Shares Surge

Toyota To Pour A Further $8bn In North Carolina Battery Plant

Evergrande Proposes Offshore Creditors Get 30% Equity Stake In Subsidiaries

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

SP500 Bias: Bullish Above Bearish Below 4130

Above 4195 opens 4240

Primary resistance is 4280

Primary objective is 4075

20 Day VWAP bearish, 5 Day VWAP bullish

EURUSD Bias: Bullish Above Bearish Below 1.06

Below 1.0550 opens 1.0480

Primary support is 1.05

Primary objective is 1.04

20 Day VWAP bearish, 5 Day VWAP bearish

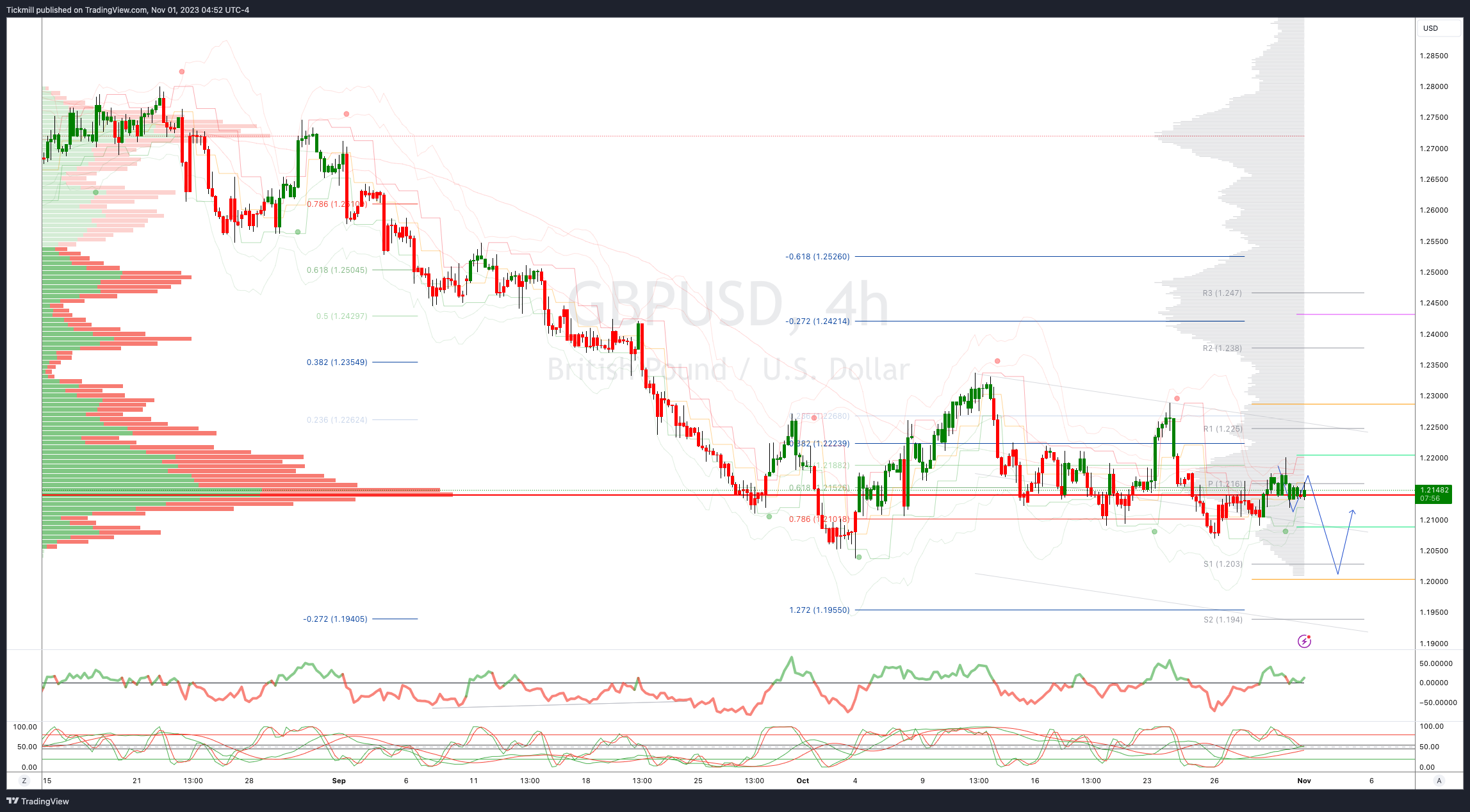

GBPUSD Bias: Bullish Above Bearish Below 1.22

Below 1.21 opens 1.1950

Primary support is 1.21

Primary objective 1.24

20 Day VWAP bearish, 5 Day VWAP bearish

USDJPY Bias: Bullish Above Bearish Below 150

Below 149 opens 148.50

Primary support 144.50

Primary objective is 152.50

20 Day VWAP bullish, 5 Day VWAP bullish

AUDUSD Bias: Bullish Above Bearish Below .6400

Above .6475 opens .6525

Primary resistance is .6620

Primary objective is .6270

20 Day VWAP bearish, 5 Day VWAP bearish

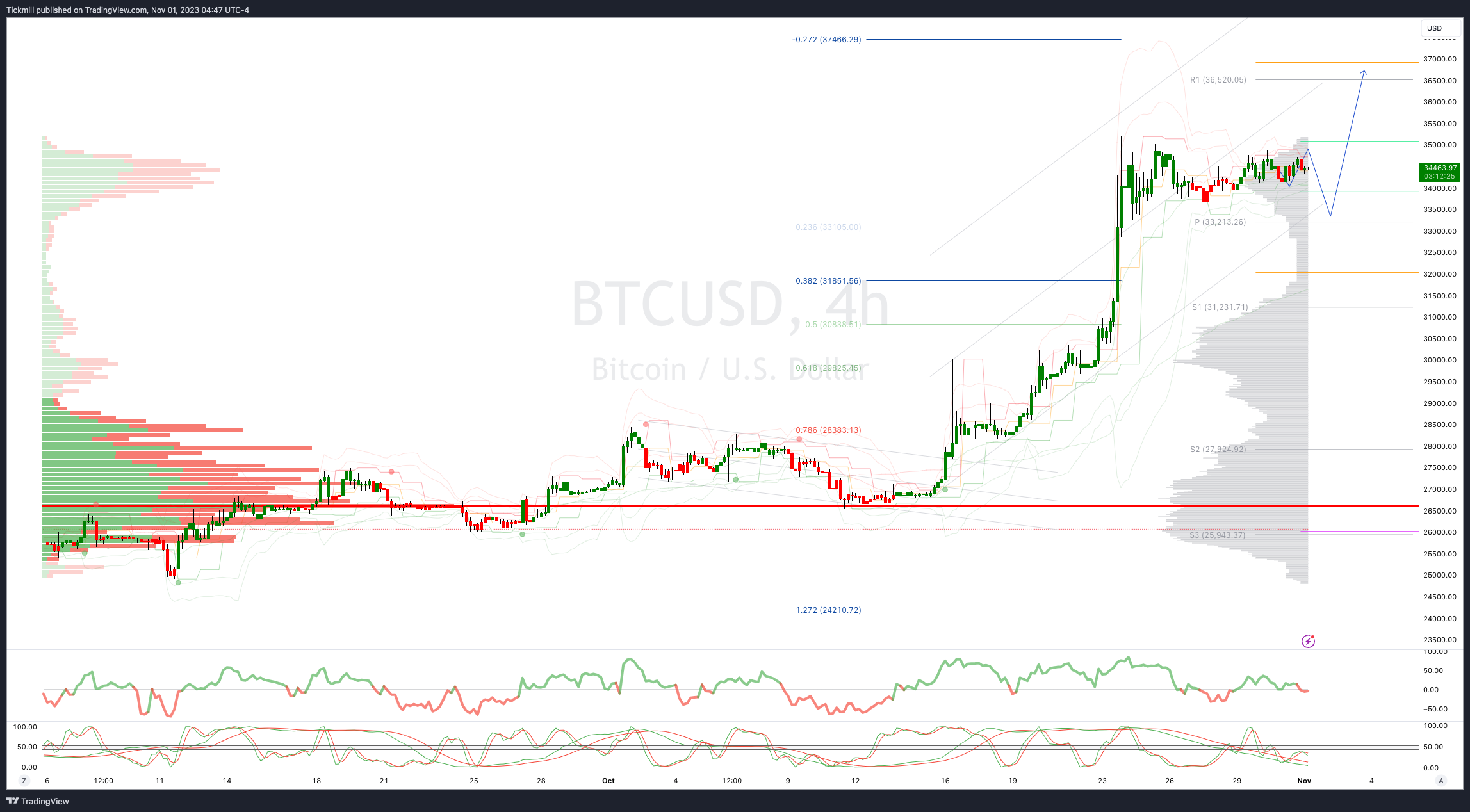

BTCUSD Bias: Bullish Above Bearish below 32000

Below 27100 opens 26500

Primary support is 30000

Primary objective is 37000

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!