Daily Market Outlook, March 20, 2024

Munnelly’s Macro Minute…

“All Eyes On The FOMC & Fed Chair Powell’s Presser”

On Wednesday, most Asian stock markets are seeing higher trading, influenced by the positive performance of global markets and the recent monetary policy announcements from the Bank of Japan, People's Bank of China, and the Reserve Bank of Australia. Investors are also cautiously anticipating the monetary policy decision from the US Fed later in the day. The Bank of Japan made a historic shift by ending 8 years of negative interest rates and implementing the first-rate hike in 17 years. It is widely anticipated that the Fed will maintain unchanged interest rates, but the accompanying statement from the central bank could have a significant impact on rate outlook.

Earlier this morning, UK data revealed a decline in headline CPI inflation to 3.4% in February, down from 4.0% in January, marking the lowest level since September 2021. This outcome slightly undershot the consensus forecast of 3.5%. Core CPI, excluding energy and food, also decreased to 4.5% from 5.1%, slightly below the consensus forecast of 4.6%. Notably, within core inflation, services CPI fell to 6.1% from 6.5%. The main contributors to the decline in inflation were food and hotel and restaurant prices.

Later today, the focus will shift to the US Federal Reserve policy decision, with Chair Powell's press conference following shortly after. While no immediate change to interest rates is expected, market attention will be on the Fed's guidance regarding future policy moves. In its last update in early February, the Fed hinted at potential interest rate cuts later in the year, although not as early as March. Since then, US economic data, including inflation, have generally exceeded expectations, though some activity indicators such as retail sales have disappointed. Given the uncertain economic outlook, the Fed is likely to maintain flexibility regarding the timing of any policy adjustments. This suggests that while a rate cut in May seems improbable, reductions in June or July remain distinct possibilities. The Fed will also release updates of policymakers' forecasts, including the 'dot plot' of interest rate projections. Speculation abounds that this may indicate a reduction in the number of forecasted rate cuts for the year from three to two, signaling a cautious approach following the initial move. However, it's more likely that policymakers will await further developments before revising their forecasts.

In addition to the Fed's policy update, the ECB will host a conference titled "The ECB and Its Watchers XXIV," focusing on inflation and monetary policy. Key speakers include ECB President Lagarde, Chief Economist Lane, and Executive Board member Schnabel.

Overnight Newswire Updates of Note

China Banks Hold Lending Rates As PBoC Refrains From Easing

Chinas Economic Recovery Is Still Facing Challenges

Investors, Economists Split On Whether BoJ Will Raise Rates Again

NZ Consumer Confidence Rises In Q1 To Highest In More Than 2 Yrs

Fed To Give Fresh Clues On Path Of Interest-Rate Cuts

US Air Force Says It Conducted Hypersonic Weapon Test In Pacific

Expected Decline In UK CPI Could Reinforce Early Rate Cut Bets

Yen Falls To Lowest Against Euro Since 2008 After BoJ Rate Hike

Pimco Says BoJ Rate Hike Has Put Japanese Bonds Back On The Map

Ether ETFs Likely Won't Get Approved In May, Bloomberg Analyst Predicts

Oil Steadies As Focus Shifts To US Stockpiles And Fed’s Decision

Nvidia Looks To Procure High-Bandwidth Memory Chips From Samsung

US Weighs Sanctioning Huawei’s Secretive Chinese Chip Network

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

USD/JPY: 150.00 ($1.51b), 150.50 ($1.24b), 147.50 ($852.5m)

EUR/USD: 1.1000 (EU1.24b), 1.0800 (EU1.14b), 1.0875 (EU1.06b)

AUD/USD: 0.6700 (AUD1.22b), 0.6500 (AUD1.14b), 0.6375 (AUD934m)

USD/CNY: 7.2000 ($3.6b), 7.3000 ($798.1m), 7.1800 ($401m)

USD/CAD: 1.3400 ($630.1m), 1.3600 ($497.3m), 1.3515 ($496.7m)

GBP/USD: 1.2700 (GBP489.5m), 1.2385 (GBP475m)

USD/MXN: 16.70 ($610m), 17.50 ($325.9m)

NZD/USD: 0.6175 (NZD362.7m)

EUR/GBP: 0.8545 (EU465.3m)

The risk premium for EUR/USD options has doubled due to the Fed's influence, as indicated by the implied volatility in FX options premiums. The overnight expiry has doubled in price from 6.0 to 12.0, indicating increased FX volatility expectations. However, the long-term low of 6.0 suggests a recent lack of realized volatility. The benchmark 1-month expiry volatility is at 5.4, close to the multi-year low of 5.0 last week. This may return to those lows if the Fed does not lower rate cut expectations.

CFTC Data As Of 15/03/24

Bitcoin net short position is -994 contracts

Euro net long position is 74,407 contracts

Japanese Yen net short position is -102,322 contracts

Swiss Franc posts net short position of -17,870

British Pound net long position is 70,451 contracts

Equity fund managers cut S&P 500 CME net long position by 3.983 contracts to 913,990

Equity fund speculators increase S&P 500 CME net short position by 71,149 contracts to 474,044

Technical & Trade Views

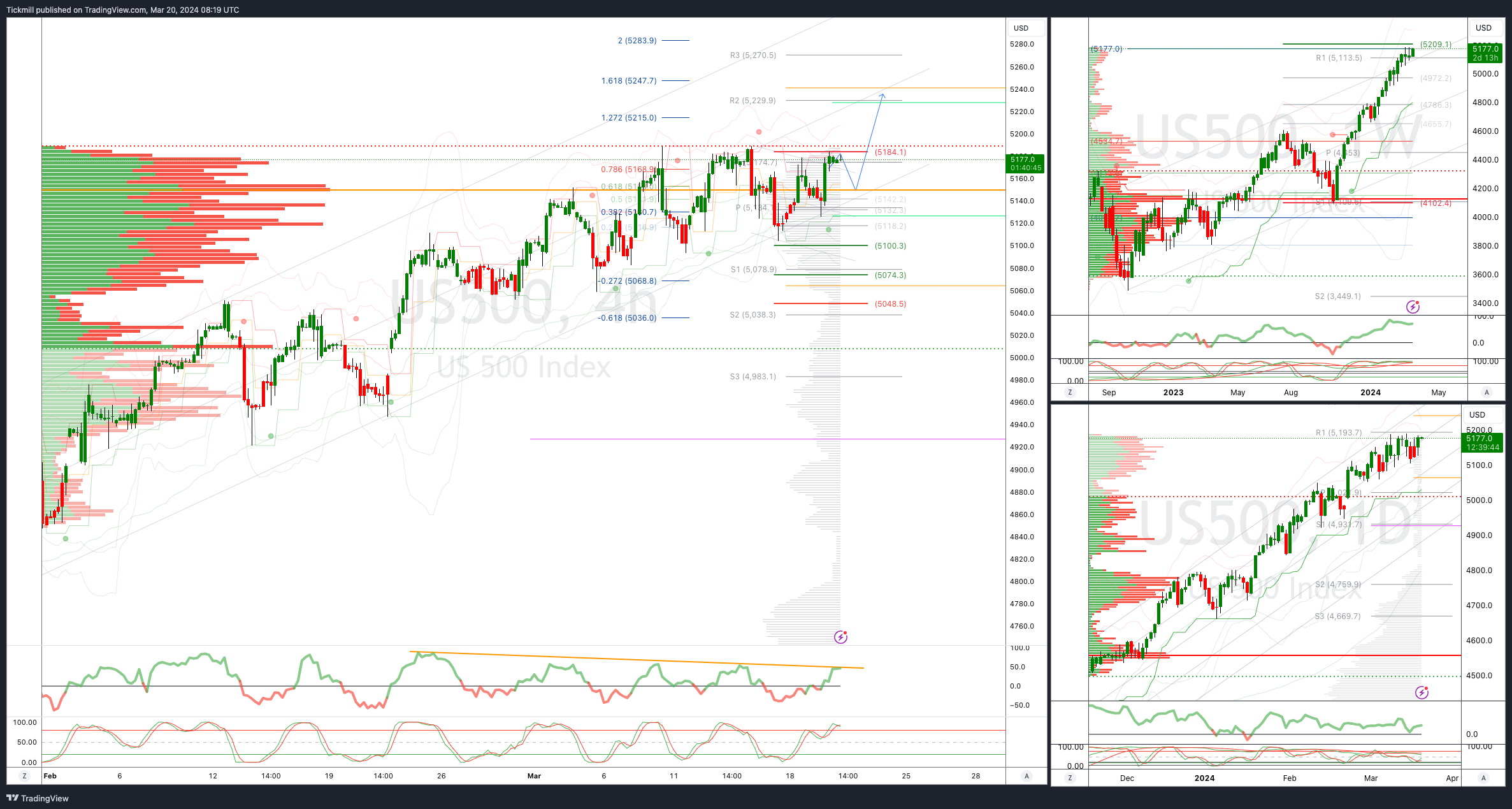

SP500 Bullish Above Bearish Below 5150

Daily VWAP bullish

Weekly VWAP bullish

Below 5090 opens 5060

Primary support 5096

Primary objective is 5220

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bearish

Weekly VWAP bullish

Below 1.0840 opens 1.0795

Primary support 1.08

Primary objective is 1.10

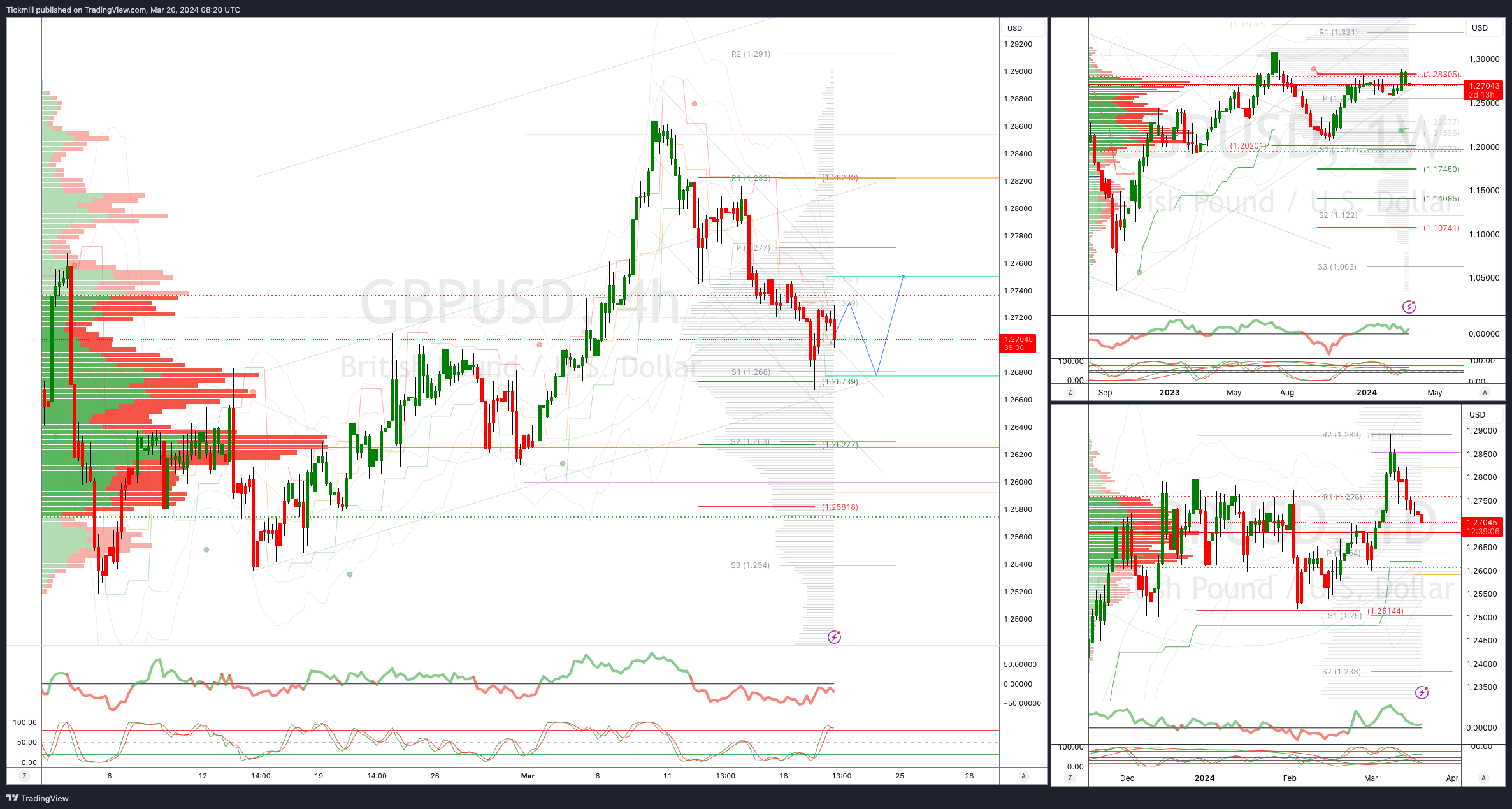

GBPUSD Bullish Above Bearish Below 1.2770

Daily VWAP bearish

Weekly VWAP bullish

Below 1.2670 opens 1.2630

Primary support is 1.2660

Primary objective 1.29

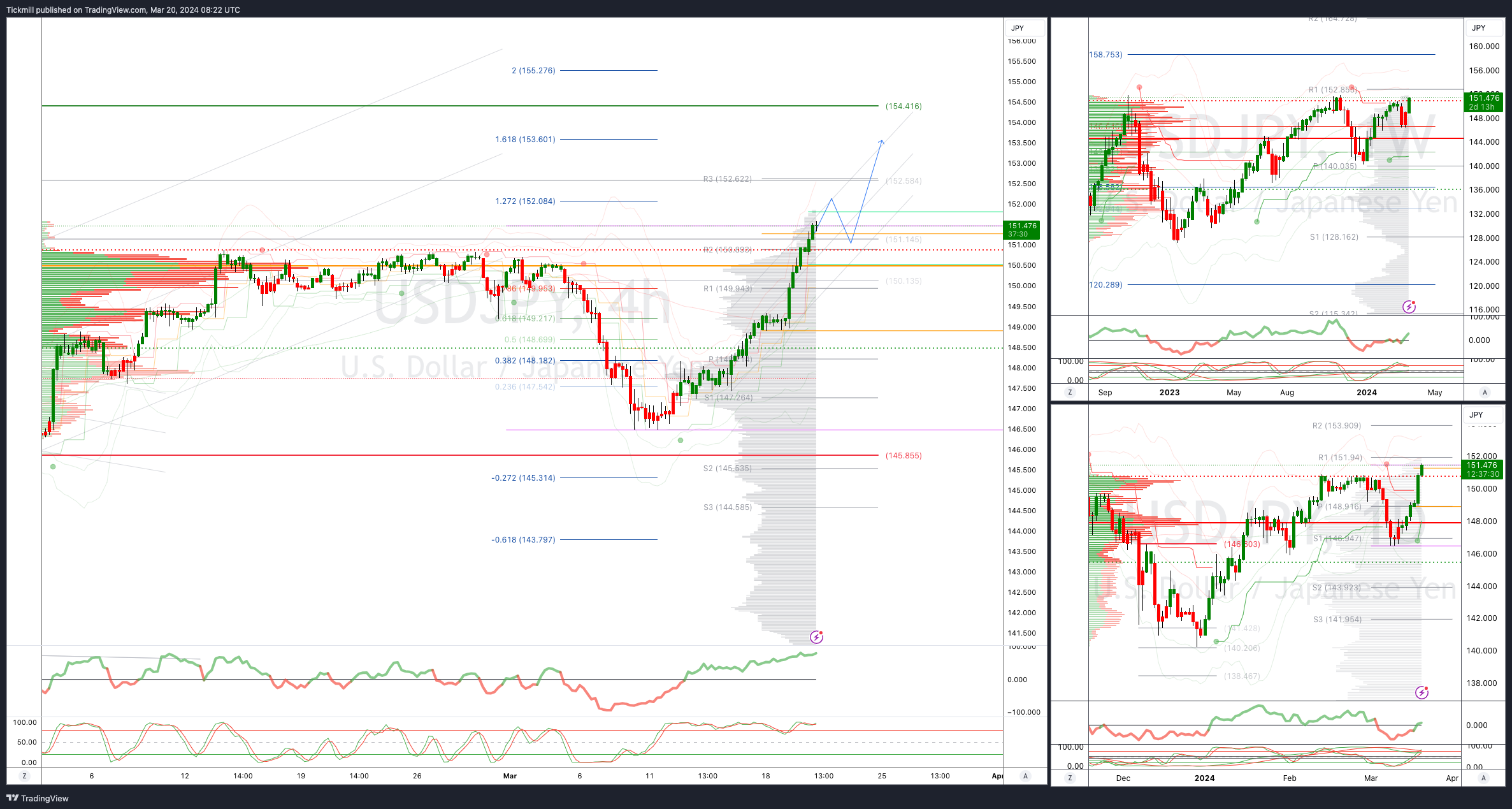

USDJPY Bullish Above Bearish Below 150.50

Daily VWAP bullish

Weekly VWAP bullish

Above 151 opens 152

Primary support 145.85

Primary objective is 152

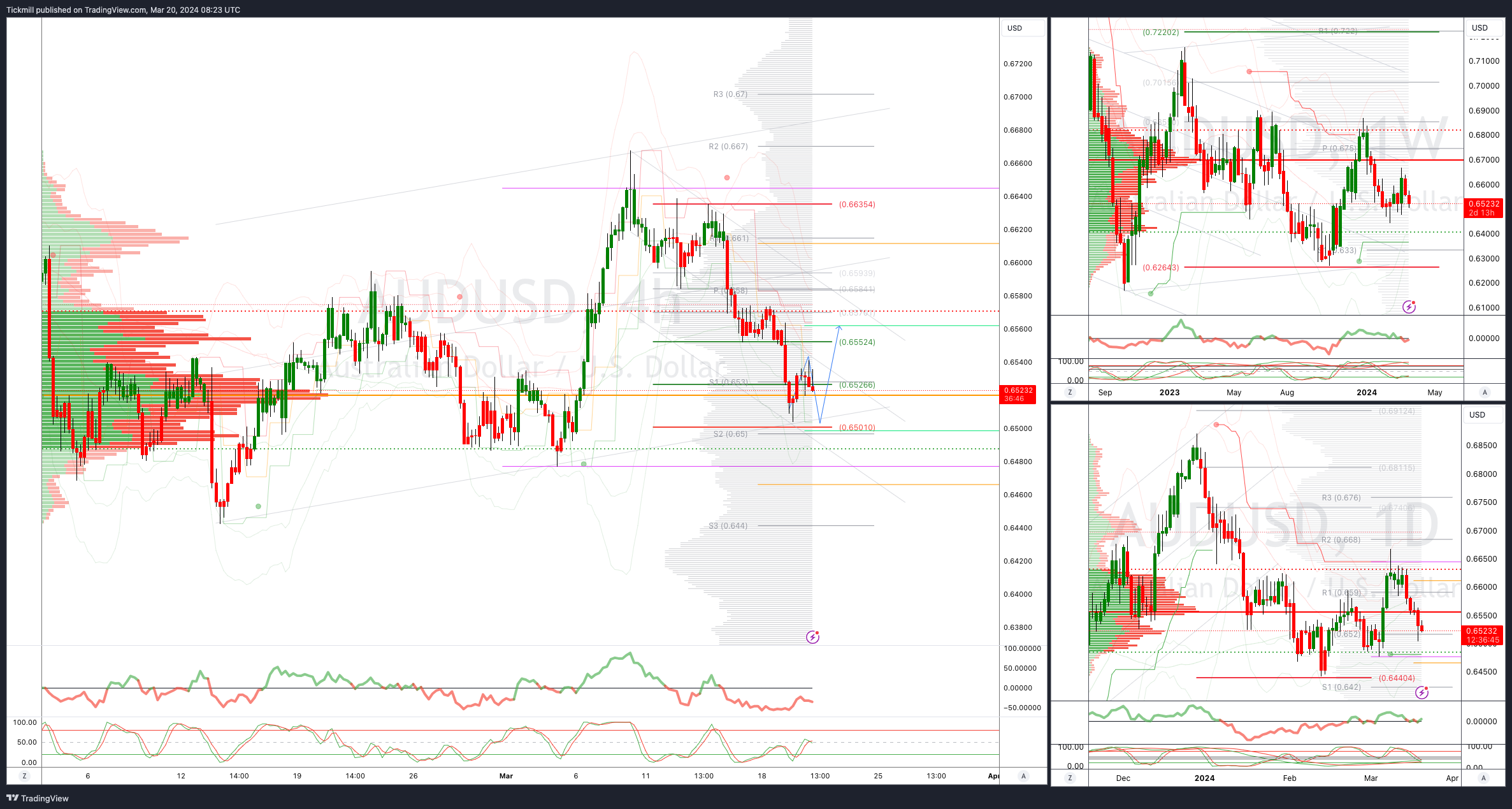

AUDUSD Bullish Above Bearish Below .6600

Daily VWAP bearish

Weekly VWAP bearish

Below .6550 opens .6520/00

Primary support .6477

Primary objective is .6700

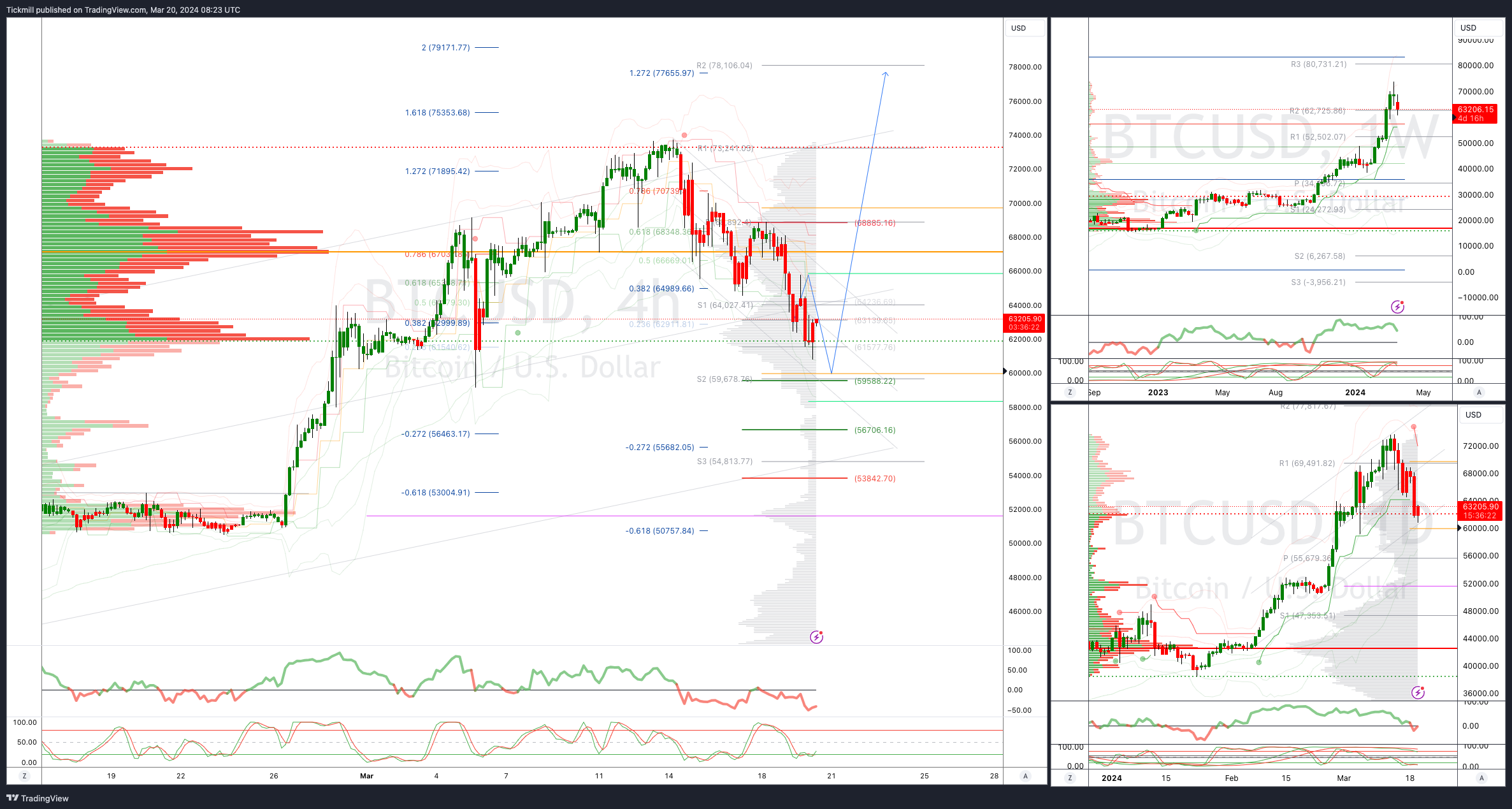

BTCUSD Bullish Above Bearish below 68000

Daily VWAP bearish

Weekly VWAP bullish

Below 64000 opens 59588

Primary support is 52800

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!