Daily Market Outlook, March 14, 2022

Overnight Headlines

- Russia, Ukraine Give Brightest Assessment Yet Of Progress In Talks

- Russian Strike On Base Brings Ukraine War Close To NATO Border

- Yellen Rejects Idea Sanctions Could Undermine Dollar Dominance

- Biden Aide To Meet With China's Top Diplomat Amid Russia Tension

- Eurozone To Back Broadly Neutral, But Flexible 2023 Fiscal Stance

- ECB's Villeroy: Caution Is Needed On Monetary And Budget Policy

- Bank Of France Flags Uncertainty As Growth Slows And Prices Rise

- Number Of UK Manufacturers Raising Prices Hits New Record High

- China Locks Down All Of Tech Hub Shenzhen As Covid Cases Jump

- Iran Nuclear Talks Stumble As US Official Rebuffs Russian Demands

- Oil Prices Fall, Continuing The Downward Trend From Last Week

- China's Tech Rout Deepens Amid Lockdown, Geopolitical Worries

- US, European Equity Futures Rise On Hopes For Ukraine Progress

The Week Ahead

- The Federal Reserve, Bank of England and Bank of Japan hold policy meetings this week, as the Russia-Ukraine conflict continues to hang over markets. Volatility is likely to persist until there is greater geopolitical clarity.

- All three central banks face the challenge of sharply rising inflation and growing downside economic risks, worsened by the blowback from the West's expanding sanctions against Russia.

- The Fed is widely expected to lift the target band by 25 basis points to 0.25%-0.50%, the first rise since 2018. The Fed's rate and economic projections will be in focus. Markets are pricing in a quarter-point hike at all but one of the remaining six meetings after Wednesday's decision – with some chance of a half-point hike at one. Fed Chair Jerome Powell will need to address the risks from the Russia-Ukraine crisis, including surging oil prices and significant falls in equity markets.

- The BoE is expected to hike rates 25 basis points to 0.75% on Thursday, its third straight increase. The central bank has the difficult task of tackling rising inflation without choking economic growth.

- The BOJ is expected to remain on hold, as inflation is far less of a concern in Japan than in other major economies.

- Russia's central bank is also scheduled to meet this week and the government is due to pay a coupon on its sovereign debt

CFTC Data

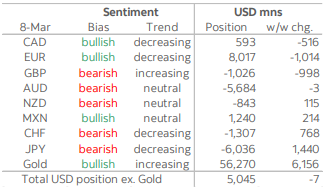

- IMM positioning and sentiment data for the week through Tuesday reflect a stabilization in the recent leakage in overall USD long positioning after successive weekly declines over the past two months. The aggregate dollar long position did fall again this week but the drop was a more or less meaningless USD7mn decline.

- While this week’s data show little change in overall exposure to the USD, there were some significant, offsetting moves in the currencies which tend to reflect the highly uncertain geo-political risk backdrop that has developed since Russia’s invasion of Ukraine. Net EUR longs were cut by a little over USD1bn while markets added nearly as much to net GBP shorts,driving demand for the USD. At the same time, havens were in better demand, with net short covering in both the CHF and JPY driving USD sales and offsetting the roughly USD2bn combined move out of the EUR and GBP.

- Investors were (mostly) cautious on the higher beta currencies; CAD net longs were cut more or less in half in the past week as gross long positions were cut and gross shorts increased. AUD positioning was more or less unchanged while net NZD shorts were cut by USD115mn. But investors continued to show some appreciation for the MXN adding a little over USD200mn in net longs to take the total to USD1.24bn, modest but still the biggest bull bet on the peso in two years. The spot rate has not, however, reflected this interest. Rising inflationary pressures, which the conflict in Ukraine risks exacerbating, are driving strong interest in gold; net gold longs jumped USD6.2bn to USD56.3bn, the biggest bull bet on gold since early 2021

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

- EUR/USD: 1.0900 (1.84BLN), 1.0925 (261M), 1.1000 (1.66BLN) 1.1050-60 (1.25BLN), 1.1145-55 (660M), 1.1165-70 (449M) 1.1190-00 (787M)

- USD/JPY: 115.00-10 (490M), 115.50-60 (605M)

- 115.75-85 (640M), 116.00 (780M)

- EUR/JPY: 126.50 (677M), 128.30 (331M), 129.00-10 (478M)

- GBP/USD: 1.3200 (388M). EUR/GBP 0.8370 (355M)

- USD/CHF: 0.9350 (280M). EUR/CHF: 1.0400 (546M)

- USD/CAD: 1.2660 (414M), 1.2735-40 (300M, 1.2795-05 (320M)

- AUD/USD: 0.7100-10 (820M), 0.7125-30 (310M), 0.7200 (738M

Technical & Trade Views

EURUSD Bias: Bearish below 1.15 Bullish above

- EUR/USD opened 1.1900 after falling 0.75% Friday when USD broadly firmed

- EUR/USD moved higher early Asia on Ukraine peace talk hopes

- It traded up to 1.0945 at one stage before sellers ahead of 1.0950 capped

- US yields moved higher with the 10-year yield trading as high as 2.06%

- USD broadly firmed and the EUR/USD drifted back to 1.0905/10

- EUR/USD resistance is at the 10-day MA at 1.0987 and break eases pressure

- Support is at the March 7 trend low at 1.0806 where buyers are tipped

- EUR/USD may consolidate ahead of the FOMC decision Thursday

GBPUSD Bias: Bearish below 1.36 Bullish above.

- GBP/USD close to 1.30 after plumbing new 16 – month low

- Cable slid to 1.3013 in Asia as the USD racked up across-the-board gains

- 1.3013 = new 16-month low (1.3028 was Friday's low)

- UST 2-year yield touches two-and-a-half year high

- GBP/USD bids expected around 1.3000, including profit-takes and option flow

- Cable was trading above 1.35 before Russia-Ukraine war started on Feb 24

- More Russia-Ukraine talks scheduled to begin at 0830 GMT

USDJPY Bias: Bullish above 114.50 Bearish below

- USD/JPY's biggest gain since 2020 puts 2017 high in reach

- Expect USD/JPY gains to eventually retest the 118.60 2017 high

- Spot rose a whopping 115 pips Friday, biggest daily gain since Nov 2020

- The tenkan and kijun lines remain positively aligned = bullish

- Also fourteen-day momentum flipped to positive last Tuesday

- Our bid has been raised to 116.50 to take advantage of near-term dips

- EUR/JPY sees a 128.09-128.71 range on Monday so far, according to EBS

AUDUSD Bias: Bullish above .7100 Bearish below

- AUD/USD opened 0.7295 after falling 0.88% Friday when USD strengthened

- It traded 0.7303 early on optimism regarding Ukraine-Russia talks

- The impact reversed when that optimism led to a swift fall in crude

- Other commodities followed suit and AUD/USD tracked lower

- Brent crude futures fell over 3% while copper eased 1% and Dalian iron ore fell 3%

- AUD/USD traded at 0.7251 and is around 0.7255 into the afternoon

- AUD/USD eyeing support at 21-day MA at 0.7249 and break ends trend higher

- Resistance is at 0.7310/15 where the 10 & 200-day MAs converge

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!