Daily Market Outlook, March 13, 2024

Munnelly’s Macro Minute…

“Whipsaw Reaction To US Inflation Resolves With Risk On Response”

Most Asian stock markets are experiencing gains on Wednesday, taking direction from the overall positive performance of global markets. This was influenced by the favorable response to the long-awaited report on US consumer price inflation for February, which indicated a decrease in core price growth. This has increased optimism about the possibility of the US Federal Reserve reducing interest rates in June. The Japanese stock market opened in the green but is now experiencing a modest decline, continuing the trend from the previous two sessions. This is happening despite the generally positive signals from global markets overnight. The Nikkei 225 index is dropping below the 38.8k handle, mainly due to losses in major index components and companies that export goods. Today in Japan, major corporations are expected to propose substantial salary increases as wage negotiations come to a close. This may reignite hopes for a potential departure from the Bank of Japan's accommodative policy, a sentiment that Governor Kazuo Ueda seemed to downplay slightly on Tuesday.

Recently released January data for UK GDP showed a monthly rise of 0.2%, aligning with consensus expectations. The increase was primarily attributed to a 0.2% growth in services output. While construction output saw robust growth, manufacturing remained stagnant, and industrial production as a whole declined. Monthly fluctuations in GDP continue to be influenced by special factors such as strike activity and weather conditions. However, the rebound in January supports the perspective that the recession experienced in late 2023 will likely be relatively short-lived. Following this reading, even if there's no change in February and March, GDP would still be up about 0.2% in Q1. This would signify a notable improvement compared to the declines observed in the previous two quarters and would slightly exceed the Bank of England's current forecast for a 0.1% rise.

The remainder of today's data docket is light. Eurozone industrial production is anticipated to have decreased by 1.8% in January, offsetting much of December's 2.6% rise. Data for some of the larger individual countries has shown mixed results, with Germany experiencing a 1.0% increase after a significant decline in the previous month, while France saw a notable decrease.

Yesterday's slightly higher-than-expected outcome for US 'core' CPI inflation further underscores the need for the Federal Reserve to exercise caution when considering interest rate reductions. However, remarks from Fed Chair Powell to Congress last week suggest that a rate cut around mid-year remains a possibility. Attention will now shift to activity data later in the week, particularly whether February retail sales figures indicate that the decline observed in January was merely weather-related or indicative of a more fundamental issue.

Overnight Newswire Updates of Note

High-Stakes Rematch As Biden, Trump Clinch Party Nominations

Putin Says Ready For Nuclear War, 'Not Everything Rushing To It'

China's Treatment Of Local Debt ‘Ulcer’ Threatens Growth Target

BoJ Looks To Final Piece Of Rate Puzzle In Wage Talks Outcome

Japanese Chief Economist: Making Progress In Exiting Deflation

Toyota Agrees To Wage Hikes, Bolsters BoJ Policy Change View

Australian Household Spending Gauge Drops As Rate Hikes Bite

ECB Is In Broad Agreement To Cut Rates In Spring, Villeroy Says

ECB Must Take Bet On Rate Cuts As Prices Abate, Wunsch Says

BoE Governor Bailey Says Economy Near Full Employment Level

Oil Output In US Seen Rising More Than Expected As OPEC Cuts

Pentagon Scraps Plan To Spend $2.5 Billion On Intel's Chip Grant

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

USD/JPY: 149.50 ($1.05b), 147.75 ($899.4m), 150.00 ($862.2m)

EUR/USD: 1.0875 (EU1.8b), 1.0885 (EU688.1m), 1.0910 (EU678.6m)

AUD/USD: 0.6680 (AUD1.25b), 0.6640 (AUD670m), 0.6650 (AUD630.1m)

USD/CAD: 1.3600 ($1.04b), 1.3500 ($643m), 1.3525 ($608.1m)

NZD/USD: 0.6270 (NZD701.8m), 0.6070 (NZD649m), 0.6175 (NZD472.9m)

USD/BRL: 4.8750 ($510m), 5.0100 ($378m)

USD/KRW: 1315.00 ($575m), 1325.00 ($470m)

The dollar is increasing following the release of U.S. CPI data, which exceeded expectations at 3.2% year-on-year non-seasonally adjusted, compared to the forecasted 3.1%. The core CPI also did not decrease as much as anticipated, coming in at 3.8% year-on-year versus the expected 3.7%. The dollar index had been oversold prior to the CPI release, and it is now expected to potentially rise towards a neutral level of 103.65, indicating a rough 0.5% gain. This could serve as a target for a minor correction from the February-March drop, with the level to watch being 103.34 compared to the previous 103.07. Traders who had taken long positions ahead of the data release may see this rise as an opportunity to exit. The stronger USD is having a dampening effect on the extended rally in gold prices.

CFTC Data As Of 8/03/24

Bitcoin net short position is -1,352 contracts

Euro net long position is 66,311 contracts

Japanese Yen net short position is -118,843 contracts

Swiss Franc posts net short position of -17,551 contracts

British Pound net long position is 58,385 contracts

Equity fund managers cut S&P 500 CME net long position by 24,150 contracts to 917,973

Equity fund speculators trim S&P 500 CME net short position by 31,617 contracts to 402,895

Technical & Trade Views

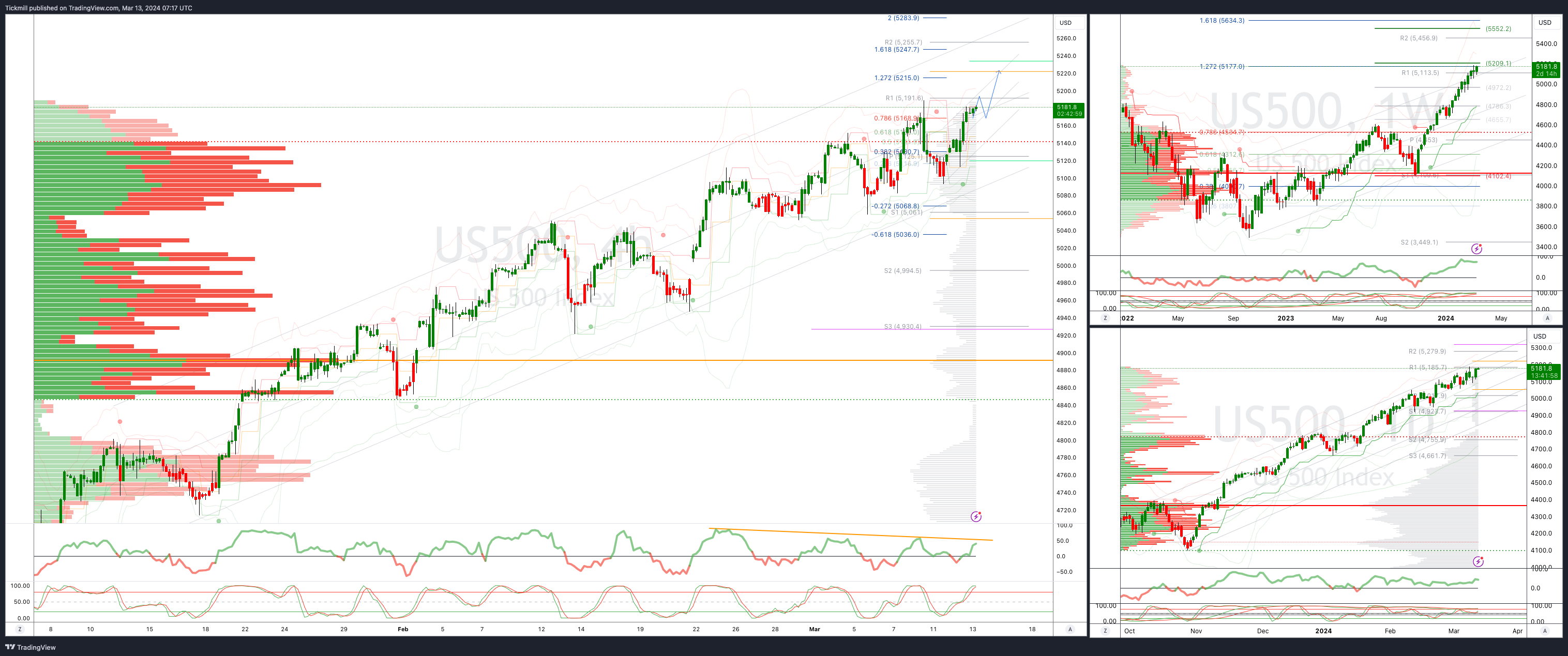

SP500 Bullish Above Bearish Below 5150

Daily VWAP bullish

Weekly VWAP bullish

Below 5150 opens 5090

Primary support 5090

Primary objective is 5220

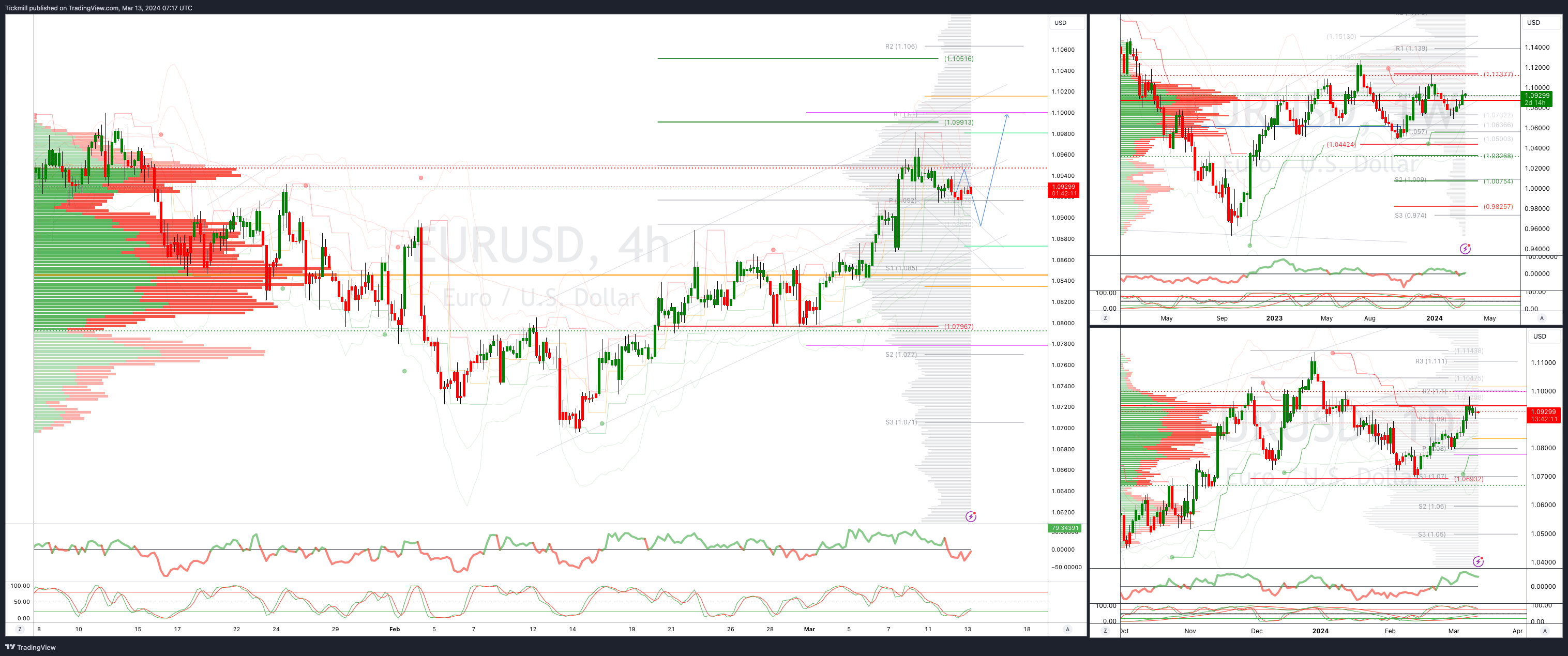

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bearish

Weekly VWAP bullish

Above 1.0880 opens 1.0950

Primary resistance 1.0950

Primary objective is 1.0990

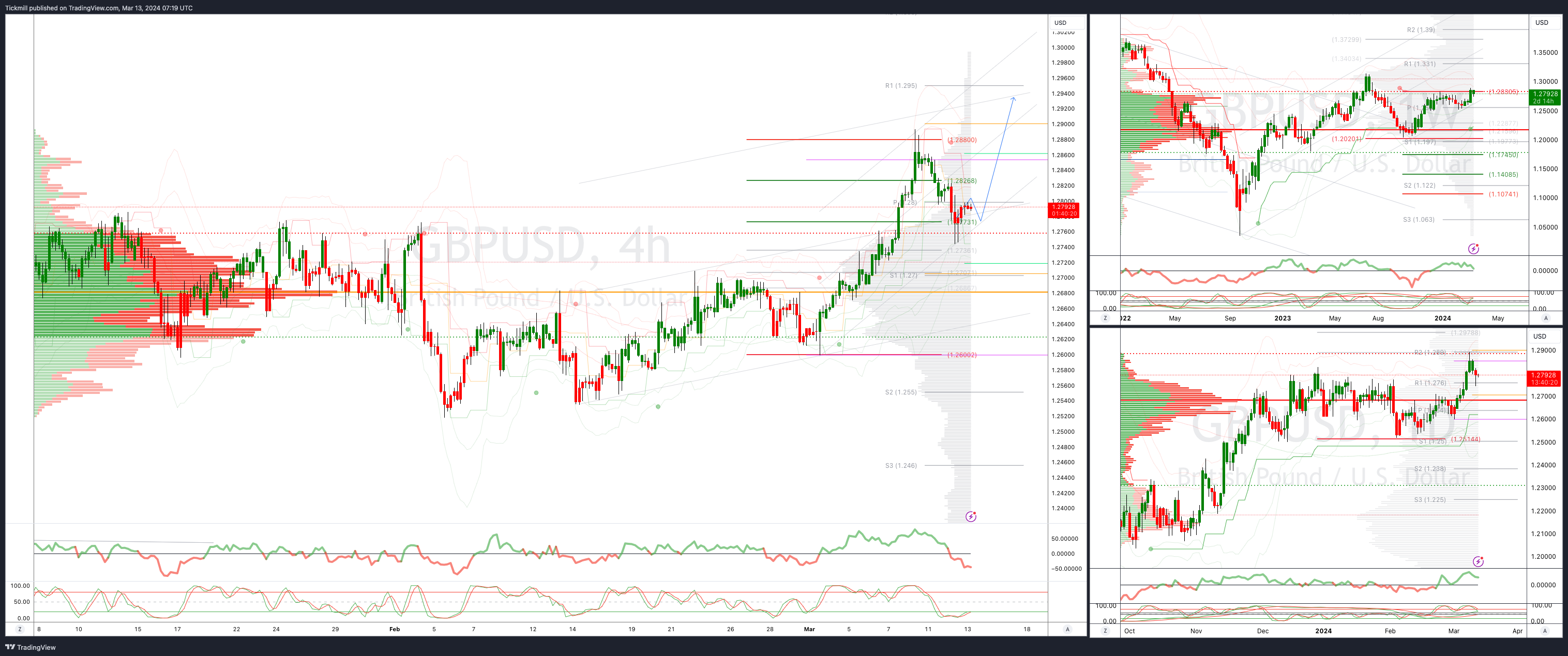

GBPUSD Bullish Above Bearish Below 1.2770

Daily VWAP bearish

Weekly VWAP bullish

Below 1.2750 opens 1.2700

Primary support is 1.2740

Primary objective 1.29

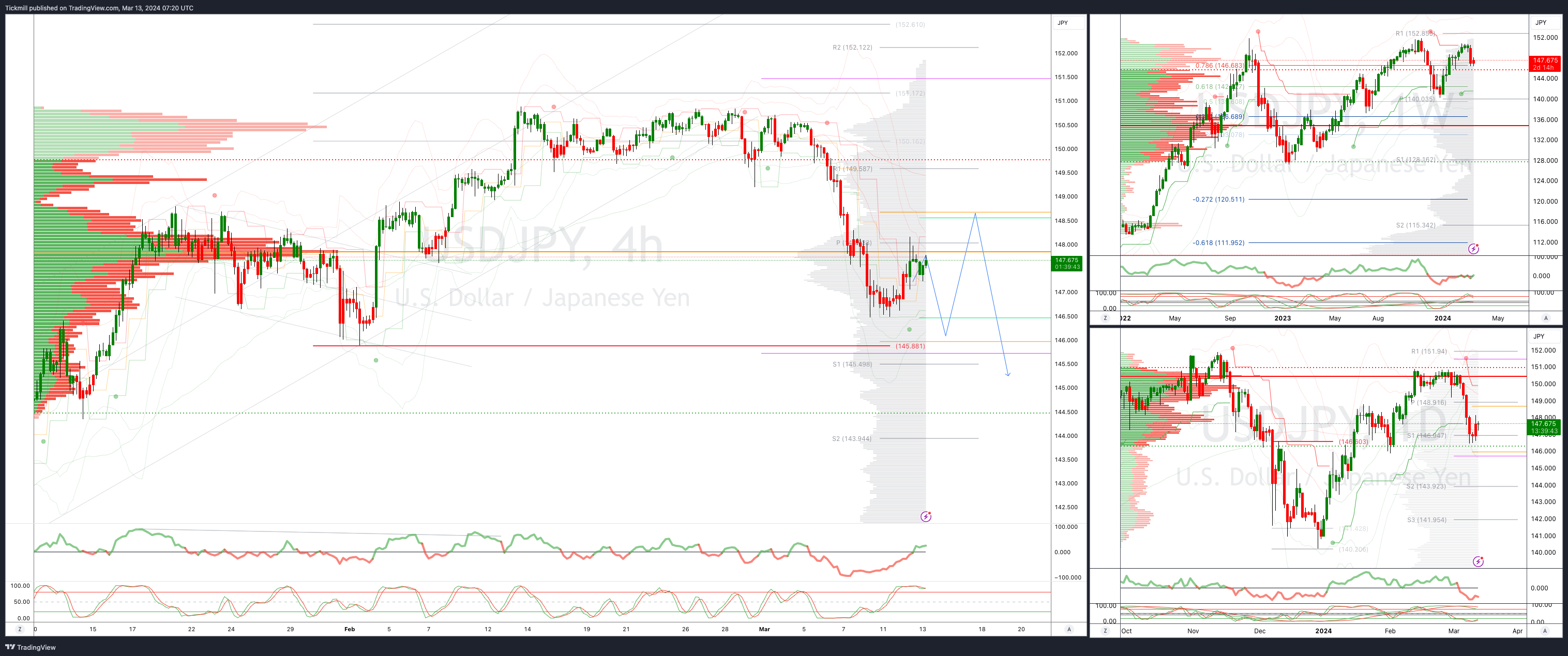

USDJPY Bullish Above Bearish Below 147.50

Daily VWAP bearish

Weekly VWAP bearish

Below 147.50 opens 145.88

Primary support 145.85

Primary objective is 152

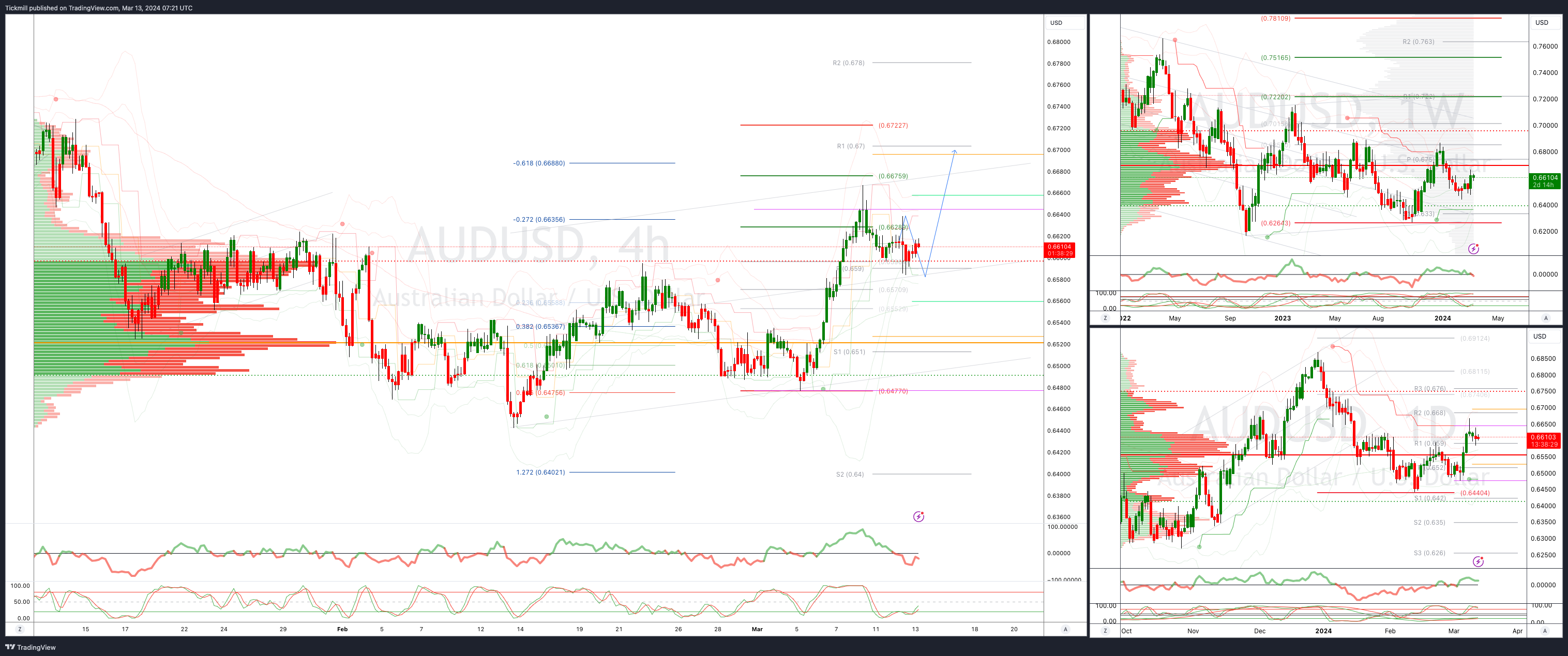

AUDUSD Bullish Above Bearish Below .6600

Daily VWAP bearish

Weekly VWAP bullish

Above .6640 opens .6700

Primary support .6477

Primary objective is .6700

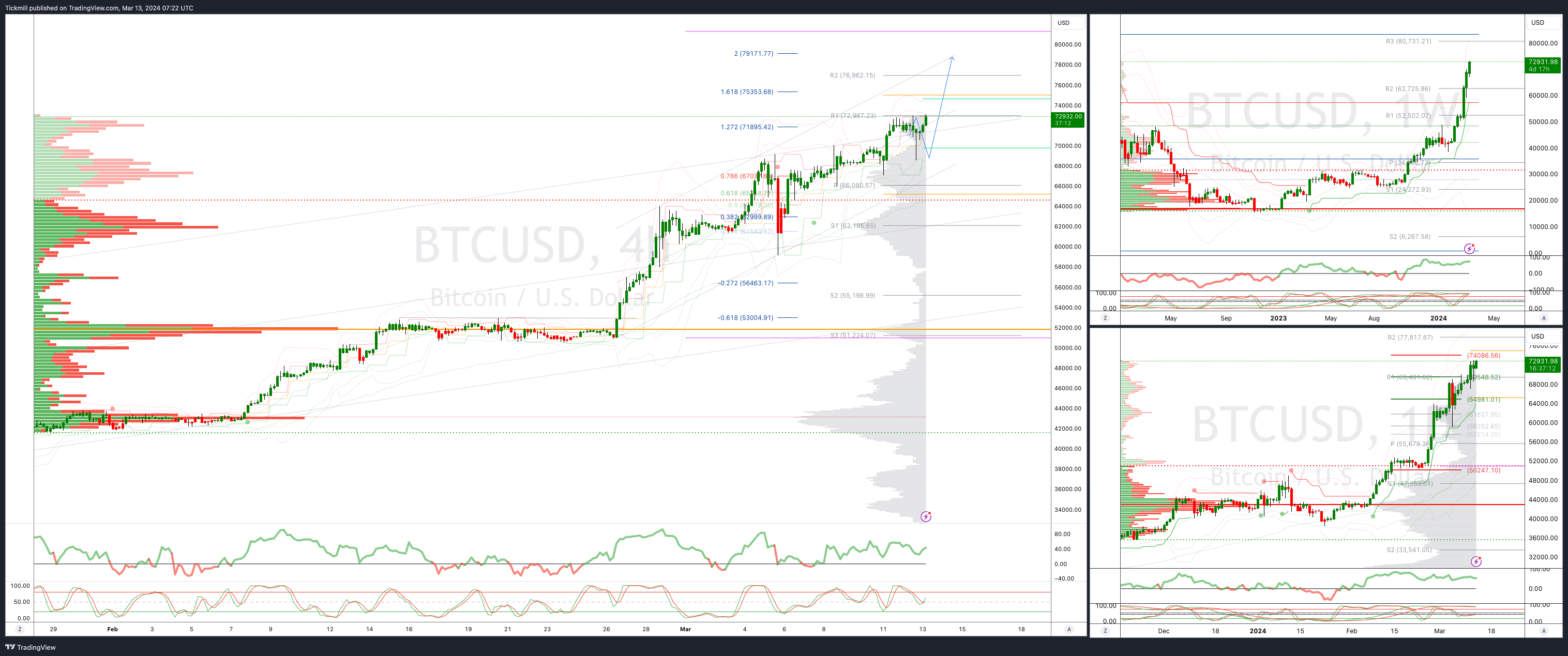

BTCUSD Bullish Above Bearish below 68000

Daily VWAP bullish

Weekly VWAP bullish

Below 66000 opens 62000

Primary support is 52800

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!