Daily Market Outlook, June 27, 2024

Munnelly’s Macro Minute…

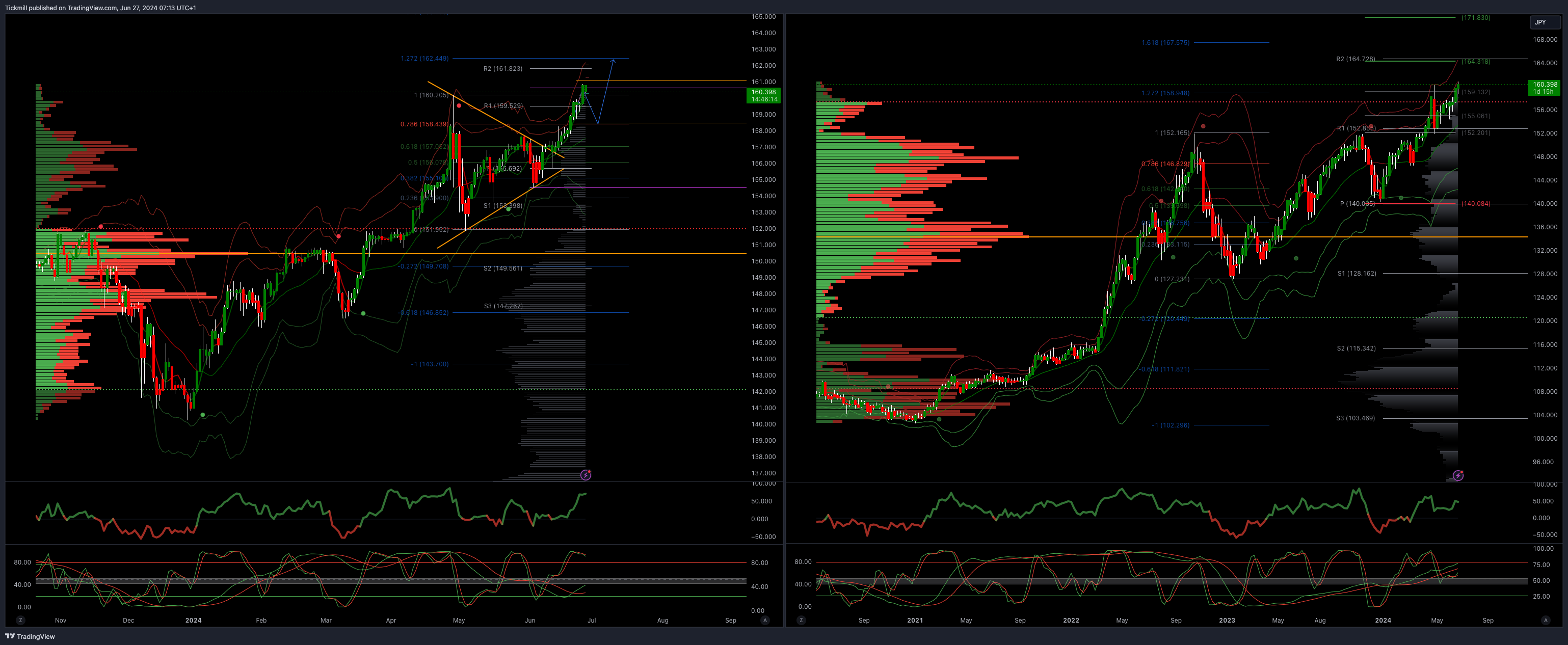

“Japanese Yen Trading Like It’s 1986 As US PCE Data Is Eyed”

After a decline in late trading for major US tech titans, Asian markets also experienced a drop. The JPY, which had plummeted on Wednesday, stabilized, leading to speculation that the government may step in to support the currency. With South Korea, China, Japan, and Hong Kong stocks all falling, the MSCI Asia Pacific index was on track for its first loss in three days. Following Micron Technology's disappointing projection, which did not meet the high expectations for the tech sector that has been driving the stock market's growth, US equity futures also decreased. The JPY bounced back by 0.3% after dropping 0.7% to 160.87 per USD, its lowest point since 1986.

Thursday will bring the release of Eurozone confidence, services, and economic sentiment surveys, as well as the final U.S. GDP data. However, the focus is expected to shift to the PCE reading on Friday, which is the Federal Reserve's preferred inflation measure.

CNN will also air the first U.S. presidential debate, where topics such as debt and the dollar are likely to be discussed. The market has been struggling to fully understand the potential impact of the November election outcome. During the debate. A new Reuters/Ipsos poll found that voters see Republican candidate Trump as better for the economy, but they prefer Democratic rival President Biden's approach to preserving democracy. However, a Washington Post poll in swing states shows that more voters trust Trump to safeguard democracy.

Overnight Newswire Updates of Note

TD Says Deep Rate Cuts Will Revive Canada’s Economic Growth

China’s Industrial Profits Rise Along With Commodity Prices

China’s Financial Elite Face $400,000 Pay Caps, Bonus Clawbacks

Japan’s FinMin Repeats Warnings After Yen Hits Lowest Since 1986

Westpac Boss Warns On Economic Risk From Sticky Australia Prices

New Zealand Pricing Intentions Signal Slower Inflation, ANZ Says

Micron’s Selloff Shows Risk Of Sky-High AI Expectations

Big Banks Sail Through Stress Test In Harbinger For More Payouts

Reports Boeing Is Resuming Widebody Deliveries To China

Boeing Faces New Whistleblower Claims Of Lapses On Some 787 Jets

Amazon To Launch Discount Section With Direct Shipping From China

US War Aid Of $6.5 Billion Discussed During ‘Productive’ Gallant Visit

US Scrambles To Head Off Wider War Between Israel & Hezbollah

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0625 (EU1.29b), 1.0800 (EU1.18b), 1.0775 (EU1.07b)

USD/JPY: 144.50 ($1.68b), 150.00 ($1.27b), 152.00 ($1.24b)

AUD/USD: 0.6630 (AUD1.69b), 0.6540 (AUD1.54b), 0.6600 (AUD769.4m)

USD/CAD: 1.3725 ($668.6m), 1.4550 ($584.2m), 1.3900 ($448.2m)

USD/CNY: 7.0900 ($562m), 7.1800 ($560m), 7.1400 ($520m)

GBP/USD: 1.2420 (GBP779.8m), 1.2470 (GBP658.8m), 1.2580 (GBP480.1m)

NZD/USD: 0.5930 (NZD729.9m), 0.6020 (NZD559.2m), 0.5900 (NZD453.7m)

USD/BRL: 5.1200 ($321.8m)

USD/MXN: 16.80 ($1.41b)

Barclays' month end model suggests that there may be dollar selling at the end of the month, despite the dollar index being up almost 1% in June and close to an eight-week high. The model indicates potential dollar selling against most major currencies by the end of the month, based on foreign versus U.S. equity and bond performance. This is driven by a continued rally in U.S. equity markets, while ex-U.S. assets are either stagnating or experiencing losses amid heightened uncertainty. The model predicts higher rebalancing demand in Europe and Japan, as these regions have experienced most of the outflows in equities.

CFTC Data As Of 21/06/24

Bitcoin net short position is -723 contracts

Swiss Franc posts net short position of -37,390 contracts

British Pound net long position is 47,621 contracts

Euro net long position is 7,951 contracts

Japanese Yen net short position is -147,753 contracts

Equity fund speculators increase S&P 500 CME net short position by 112 contracts to 353,049

Equity fund managers cut S&P 500 CME net long position by 7,915 contracts to 960,056

Technical & Trade Views

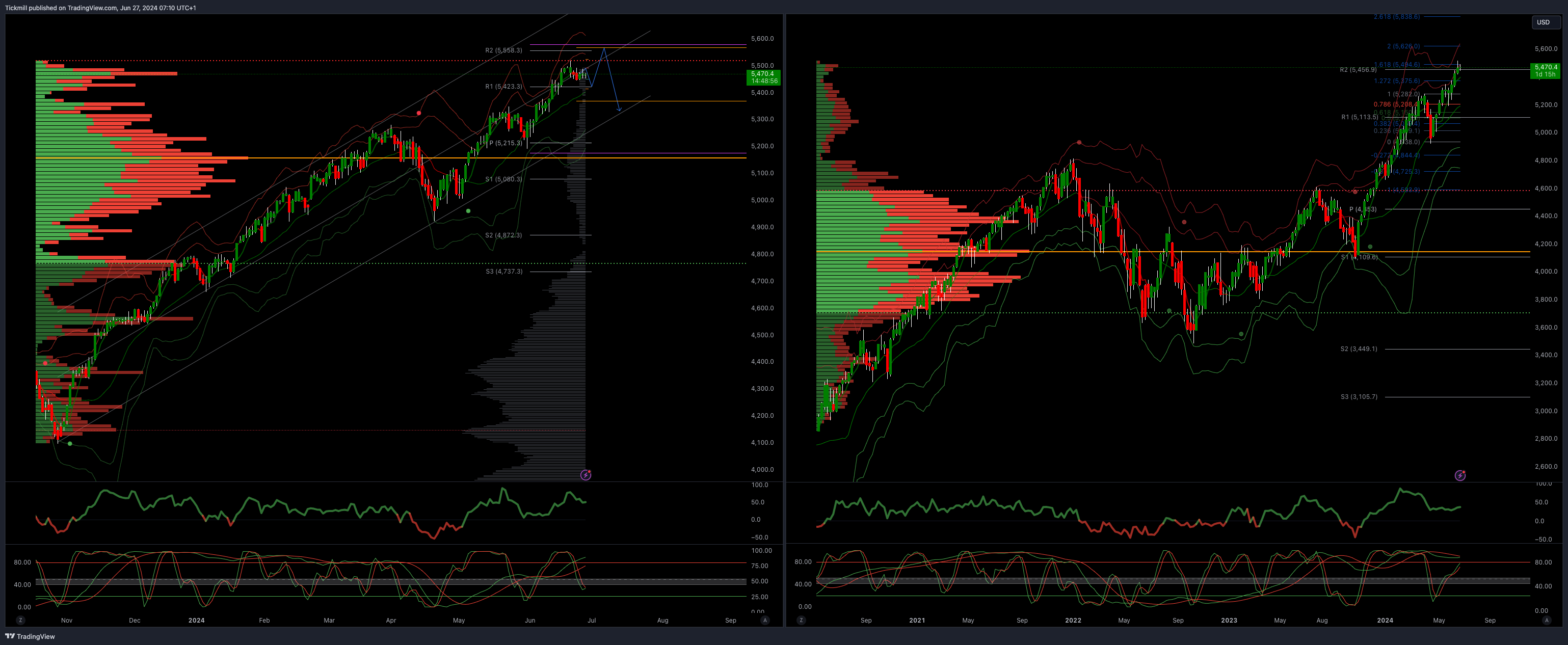

SP500 Bullish Above Bearish Below 5450

Daily VWAP bullish

Weekly VWAP bullish

Below 5475 opens 5450

Primary support 5370

Primary objective is 5580

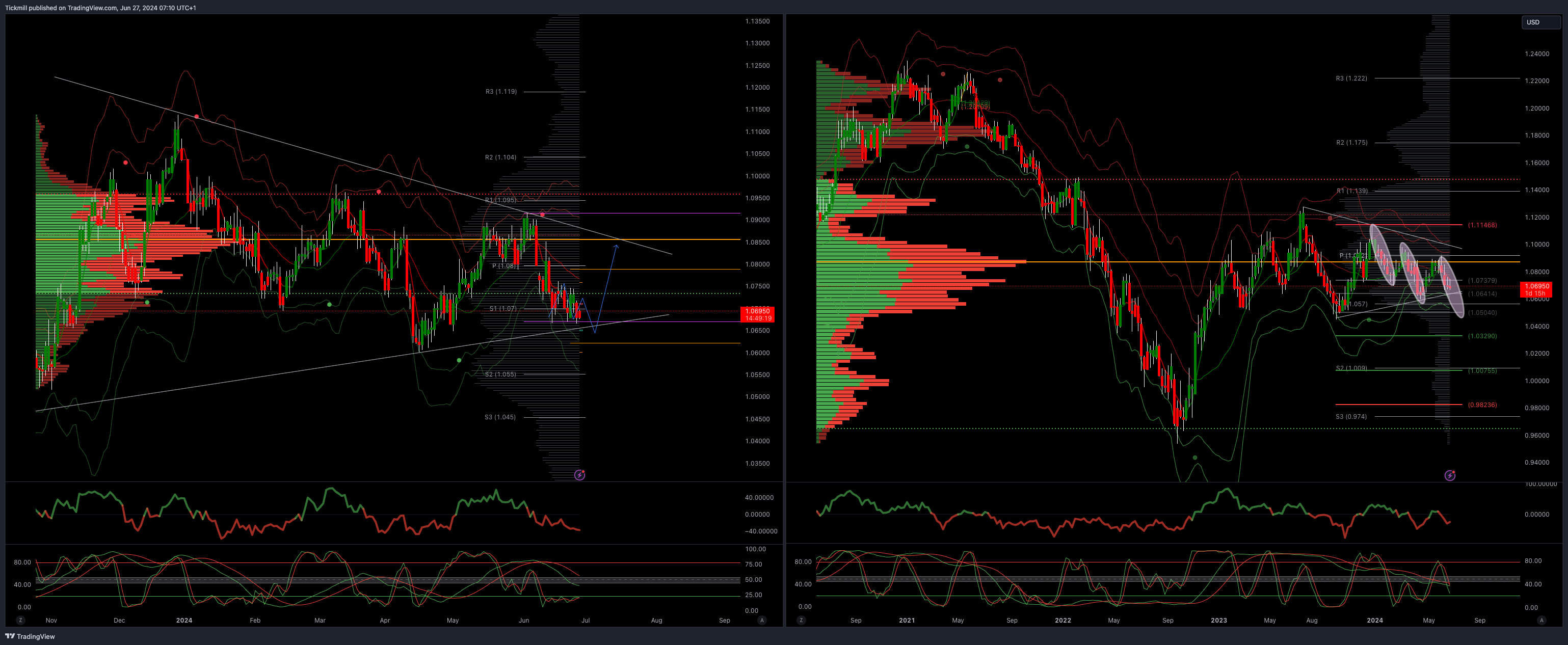

EURUSD Bullish Above Bearish Below 1.0750

Daily VWAP bearish

Weekly VWAP bearish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0650

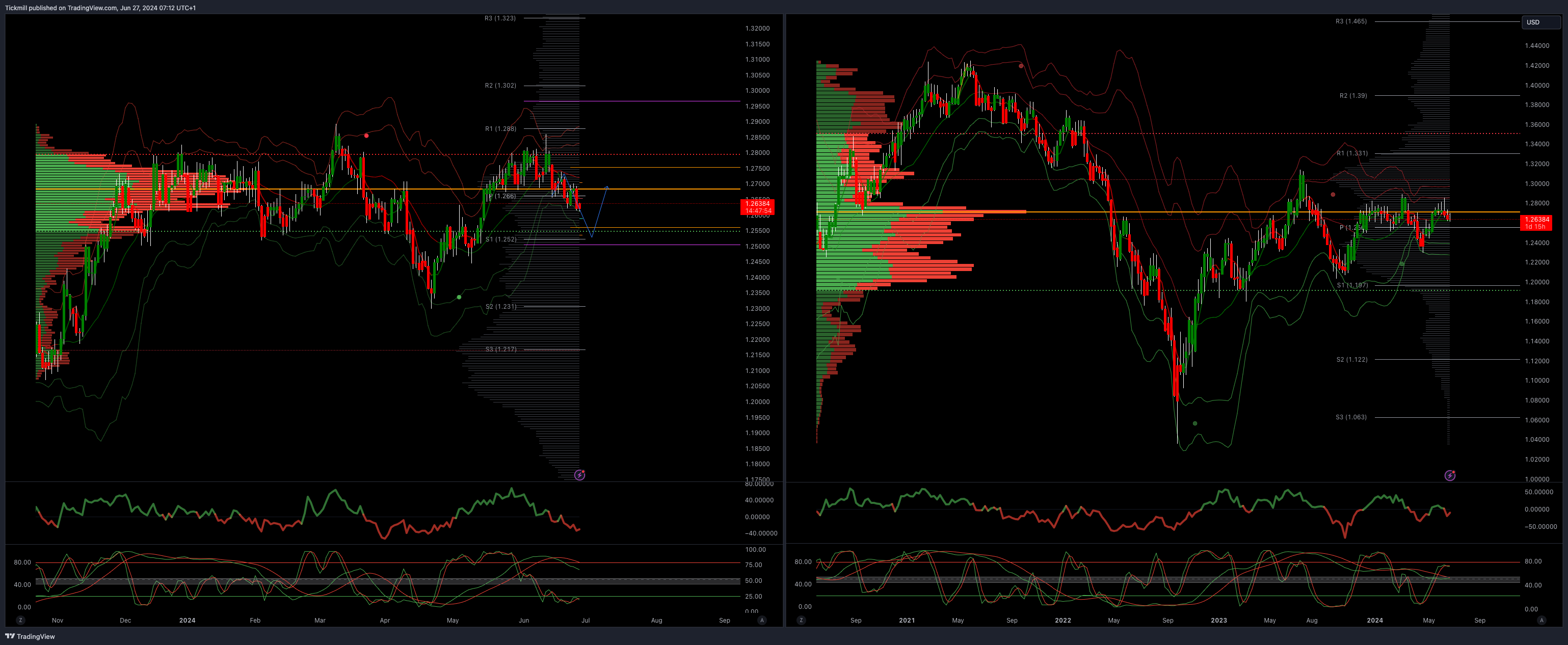

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bearish

Weekly VWAP bearish

Above 1.27 opens 1.2730

Primary resistance is 1.2890

Primary objective 1.2570

USDJPY Bullish Above Bearish Below 158.40

Daily VWAP bullish

Weekly VWAP bullish

Below 157.60 opens 157.10

Primary support 152

Primary objective is 160 TARGET HIT NEW PATTERN EMERGING

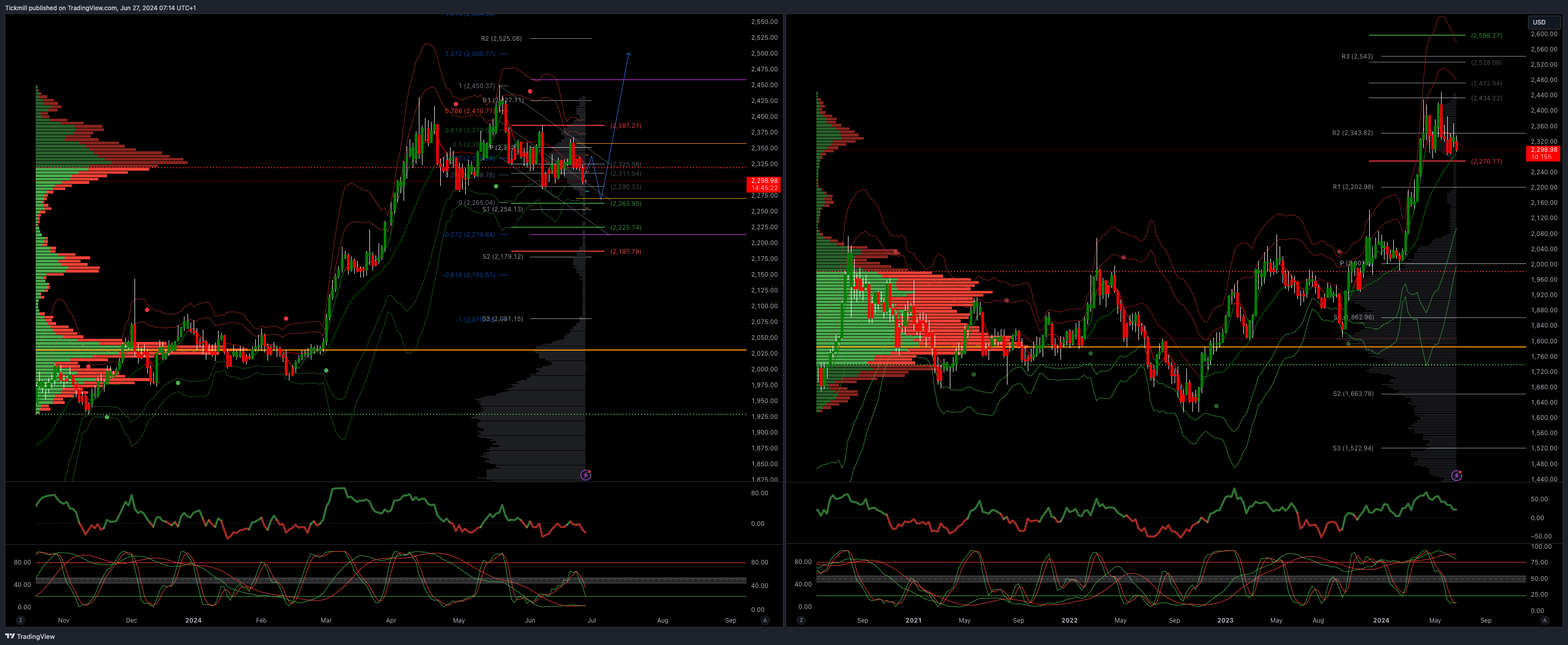

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bearish 2355

Above 2365 opens 2390

Primary resistance 2387

Primary objective is 2262

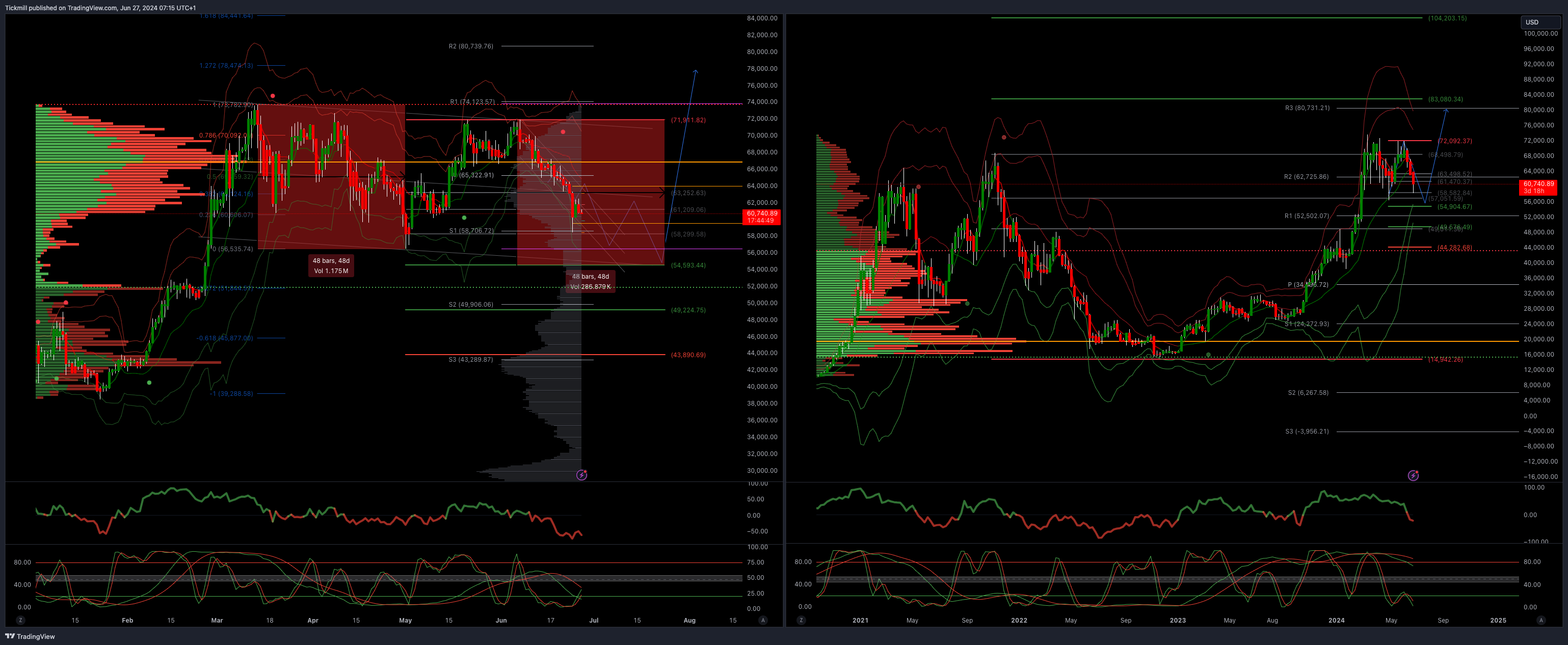

BTCUSD Bullish Above Bearish below 65840

Daily VWAP bearish

Weekly VWAP bearish

Above 67000 opens 70000

Primary support is 64481

Primary objective is 54500

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!