Daily Market Outlook, June 20, 2022

Daily Market Outlook, June 20, 2022

Overnight Headlines

- Biden Deciding On Chinese Tariffs And Will Speak With China’s Xi Soon

- US Rejects China’s Claims Over The Taiwan Strait As Concerns Grow

- French President Macron failed to win an absolute majority in parliament.

- Fed’s Waller Backs 75 Basis-Point Rate Hike In July, Says Fed Is ‘All In’

- Fed's Mester: Inflation Will Not Fall To The 2% Target For Two Years

- Eurogroup Chief: Europe Does Not Face Fresh Sovereign Debt Crisis

- ECB’s Rehn Underscores Commitment To Contain Bond-Market Panic

- Macron Loses Absolute Majority In Parliament In 'Democratic Shock'

- Spanish Prime Minister Set For A Heavy Defeat In Key Battleground

- Russia Advances In Battle For Ukraine City; NATO Warns Of Long War

- China Resists Loan Rate Cuts, Keeps Lending Benchmark Unchanged

- Bitcoin Hovers Around The $20,000 Level After A Volatile Weekend

- Asian Equity Markets On Mixed Footing; Chinese Bourses Outperform

The Day Ahead

- Global equities remain under pressure at the start of the week with most Asian stock exchanges lower on the day reflecting concerns that aggressive US monetary policy action will lead to a marked slowdown in growth. Speaking yesterday, US Fed member Mester said that the Fed would need to see “compelling evidence” that prices pressures are easing and that the risk of a US recession were rising to ease policy, albeit she was not expecting one in her base case.

- Meanwhile, yesterday’s French legislative elections saw President Macron fall short of attracting an absolute majority, following an unexpected surge in support for the far right. While the group of parties alliance called ‘Ensemble’ headed up Macron remains the largest bloc, the outcome means that he is likely to have a hard time in passing legislation.

- After the recent slew of ‘hawkish’ central bank policy announcements, markets will be looking for further clues on what to expect from them for the rest of the summer and beyond and there are plenty of central bank speakers in the coming week. In the US, potentially of most significance will be Fed Chair Powell’s semi-annual testimonies to Congress (Wed & Thu). Powell seems set to be questioned closely about how quickly inflation will come down, what level of interest rates will be required and what will be the impact on the economy.

- Ahead of that, today ECB President Lagarde will testify to the European parliament. She seems set to confirm that the ECB will start raising interest rates in July but will probably be asked to provide more detail on the new anti-fragmentation tool for coping with yield spread widening. A number of other ECB officials are scheduled to speak, including Muller, Visco, Centeno, Kazaks and the Chief Economist Lane.

- In the UK, BoE MPC members Haskel and Mann are scheduled to speak. While both members voted for a larger increase (50bp) increase in Bank Rate than the 25bp hike delivered last week, from a monetary policy perspective, the latter is likely to attract more interest. Mr Haskel will give opening remarks at a TechUK Policy Leadership conference on “Restarting the future, how to fix the intangible economy”, while Ms Mann will discuss “Monetary policy in a global context” at a Market News International event. At last week’s policy meeting, relative to rate increase from the US Fed and Swiss National Bank, the 25bp increase from the Bank of England was seen as modest. Nevertheless, financial markets continue to expect 180bp of rate increase by the end of the year (see chart), with most of the meetings forecast to see increases of 50bp. Ms Mann’s comments will be watched for indications of how likely this course of action will prove to ultimately be.

- Elsewhere, it is a quiet day for data with no key releases due today, while markets are closed in the US for the Juneteenth public holiday.

CFTC Data

- IMM net spec USD long gallops higher in Jun 8-14 period; amid $IDX +3%

- EUR$ slid 2.75% near 2022 low, specs -56,561 contracts now short 6,018

- $JPY rose 2.14%, hitting 24-yr high; specs +21,891 contracts now -69,755

- GBP$ -4.68% pre-Fed, BoE Wed/Thurs; specs buy 5,214 on dip now -65,596

- Rise in oil stirred CAD flip to long (+24.2k), AUD (+4.6k) & NZD (13k) buys

- BTC bottom fishers +571 contracts specs now long 1,061 contracts

- Fed 75bp hike amid timid BoE 25bp, and BoJ ultra-dovish lifted USD in new IMM period

(According To Reuters Data)

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0415-25 (400M), 1.0650 (317M)

- GBP/USD: 1.2400 (565M)

- AUD/USD: 0.6825 (250M)

Technical & Trade Views

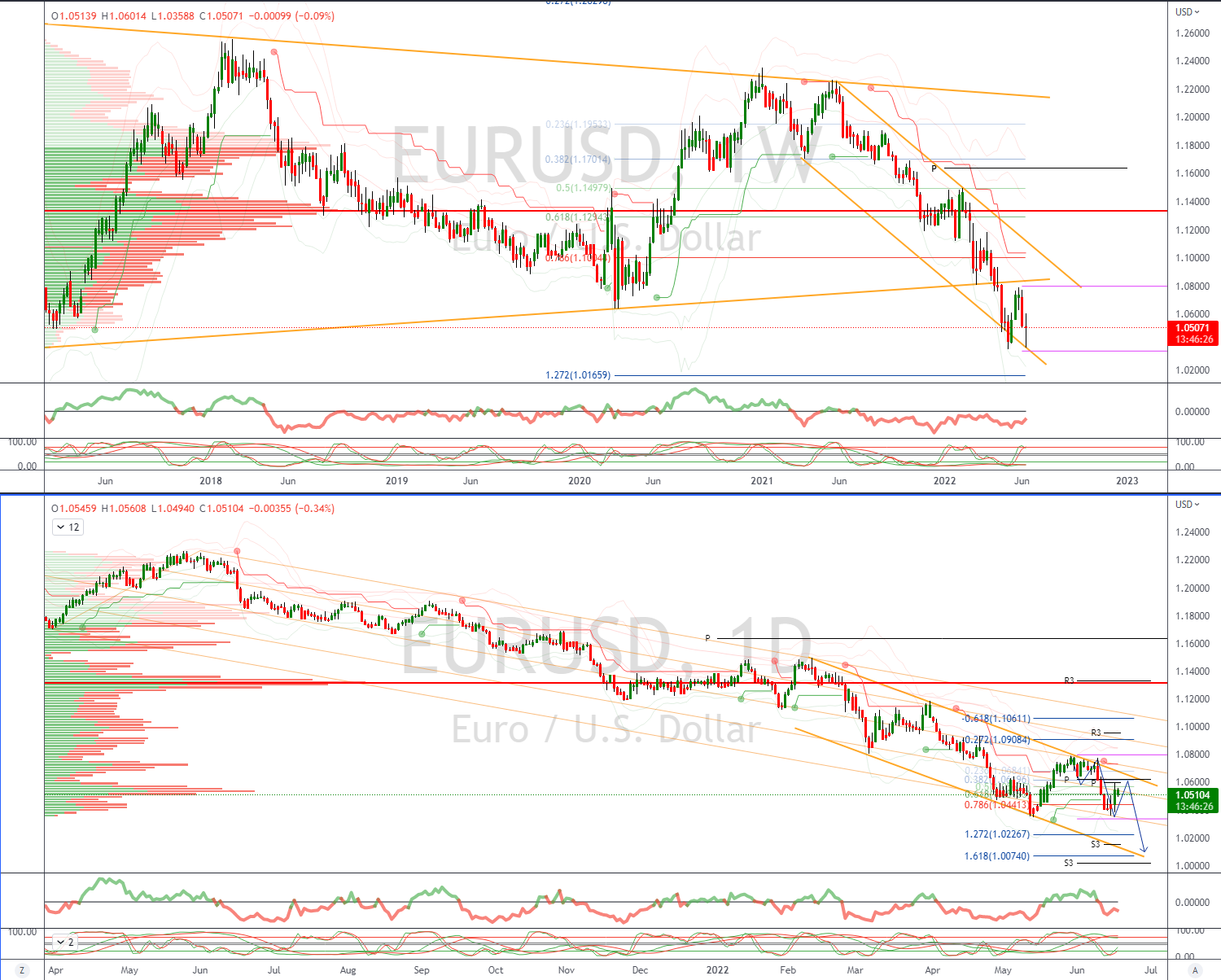

EURUSD Bias: Bearish below 1.07 Bullish above

- EURUSD is trading at highs above 1.0520 as London traders join the session

- Opened the Asian session 50pips lower after closing down 0.6% Friday

- USD remains offered in a quiet session with US public holidays

- ECB’s Lagarde speaks later today

- Initial offers are seen at 1.0560 ahead 1.0615

- Bids eyed towards 1.0450 ahead of cycle lows

- Daily VWAP is bearish

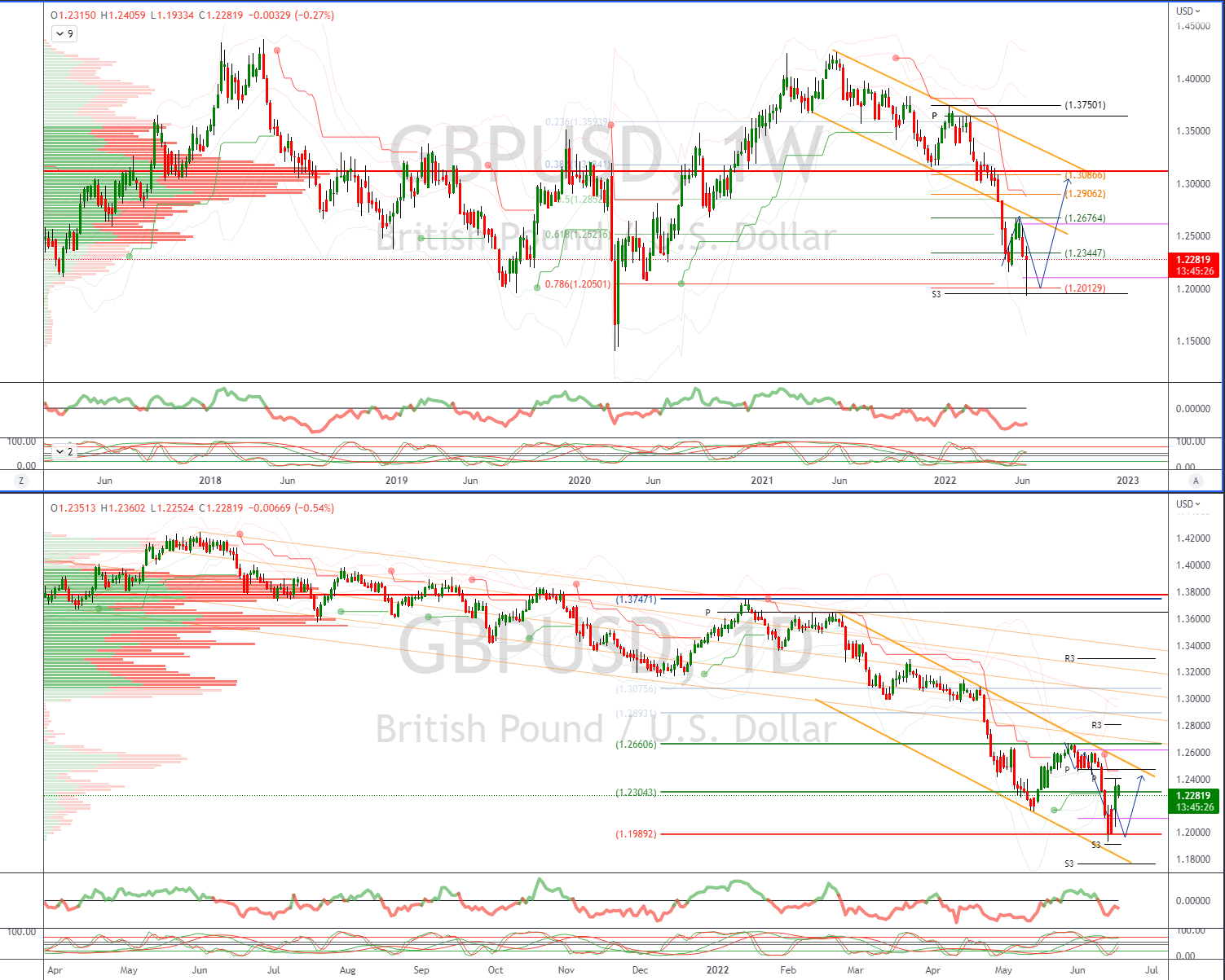

GBPUSD Bias: Bearish below 1.26 Bullish above.

- GBPUSD trades above 1.22 as the London session gets going

- Technically cable held a 50% retracement of last week's advance

- Headline risk comes with Inflation and retail sales later in the week

- Less volatility likely today following last week's fireworks around the BOE

- Resistance remains sited at 1.2410

- Support eyed at 1.2180

- Daily VWAP is bearish

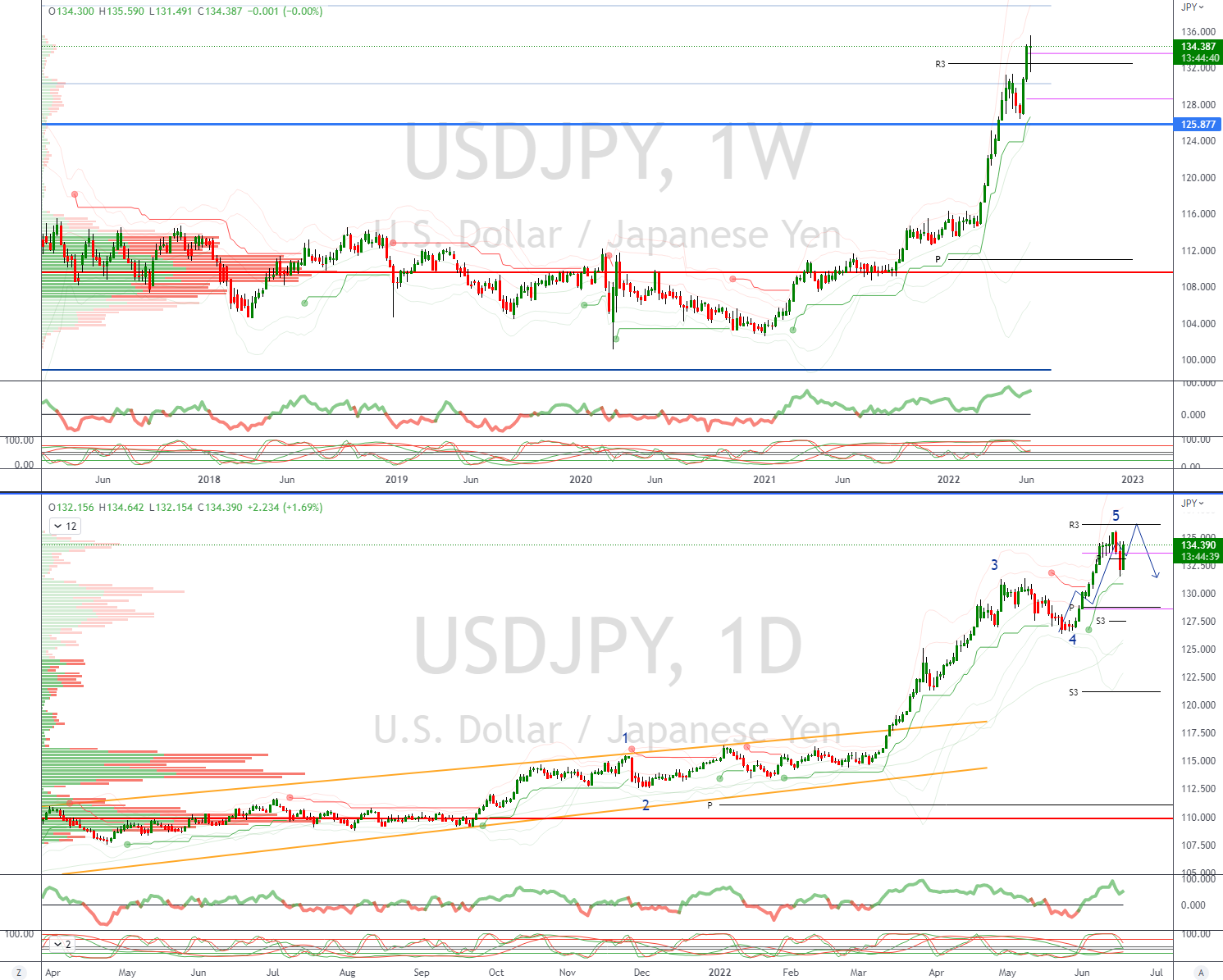

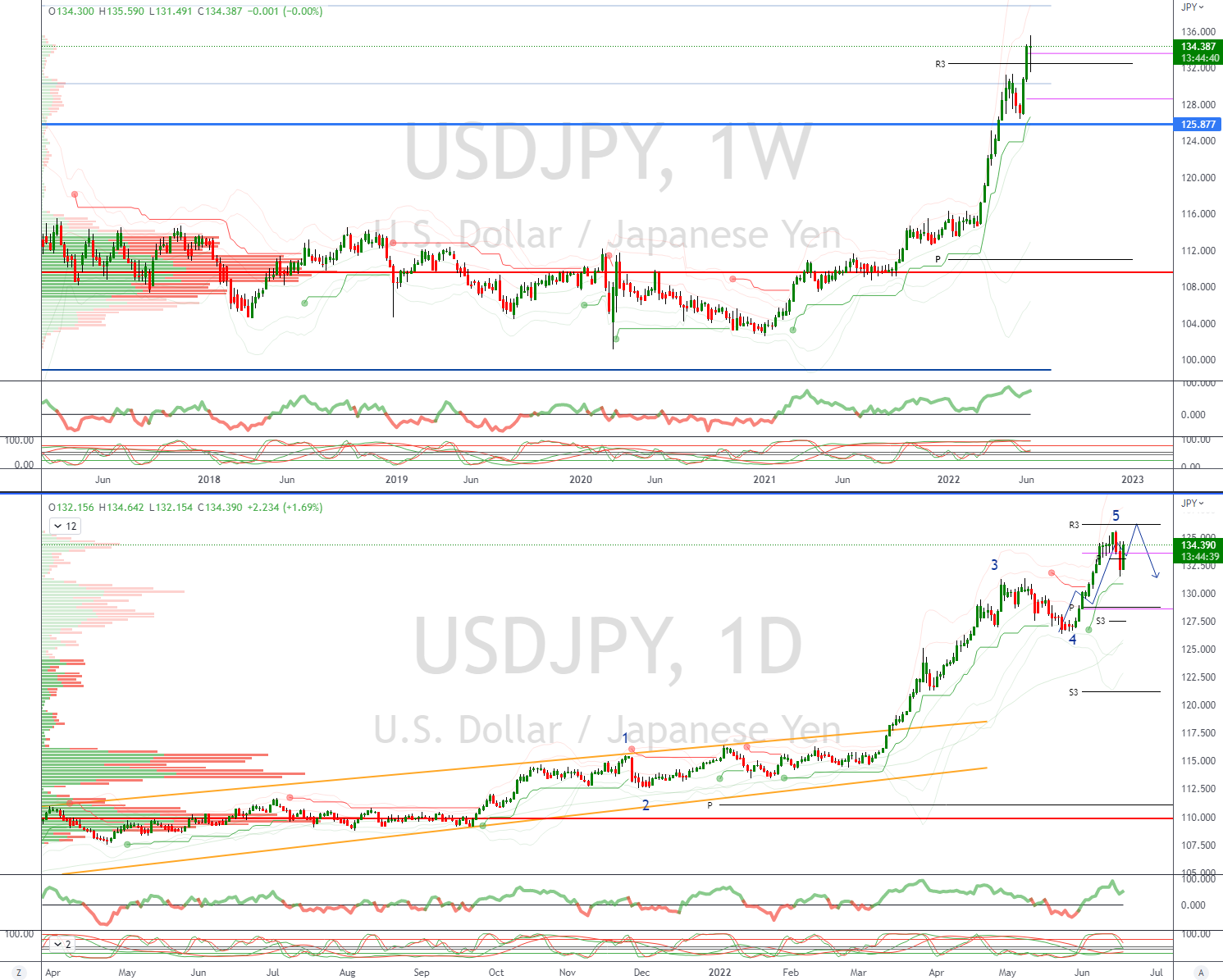

USDJPY Bias: Bullish above 132 Bearish below

- Opens the week with a bid tone, volatility in a thin Asain trade has seen a 70pip range

- Importer bids early in the session saw an initial spike to 135.44 before fading

- UDJPY has retreated in unison with US Yields.

- Headline risk FED CHeif Powell speech Wednesday

- More Importer bids seen towards 134

- Exporter offers cap ahead of 136

- Daily VWAP is bullish with strong support back at 132

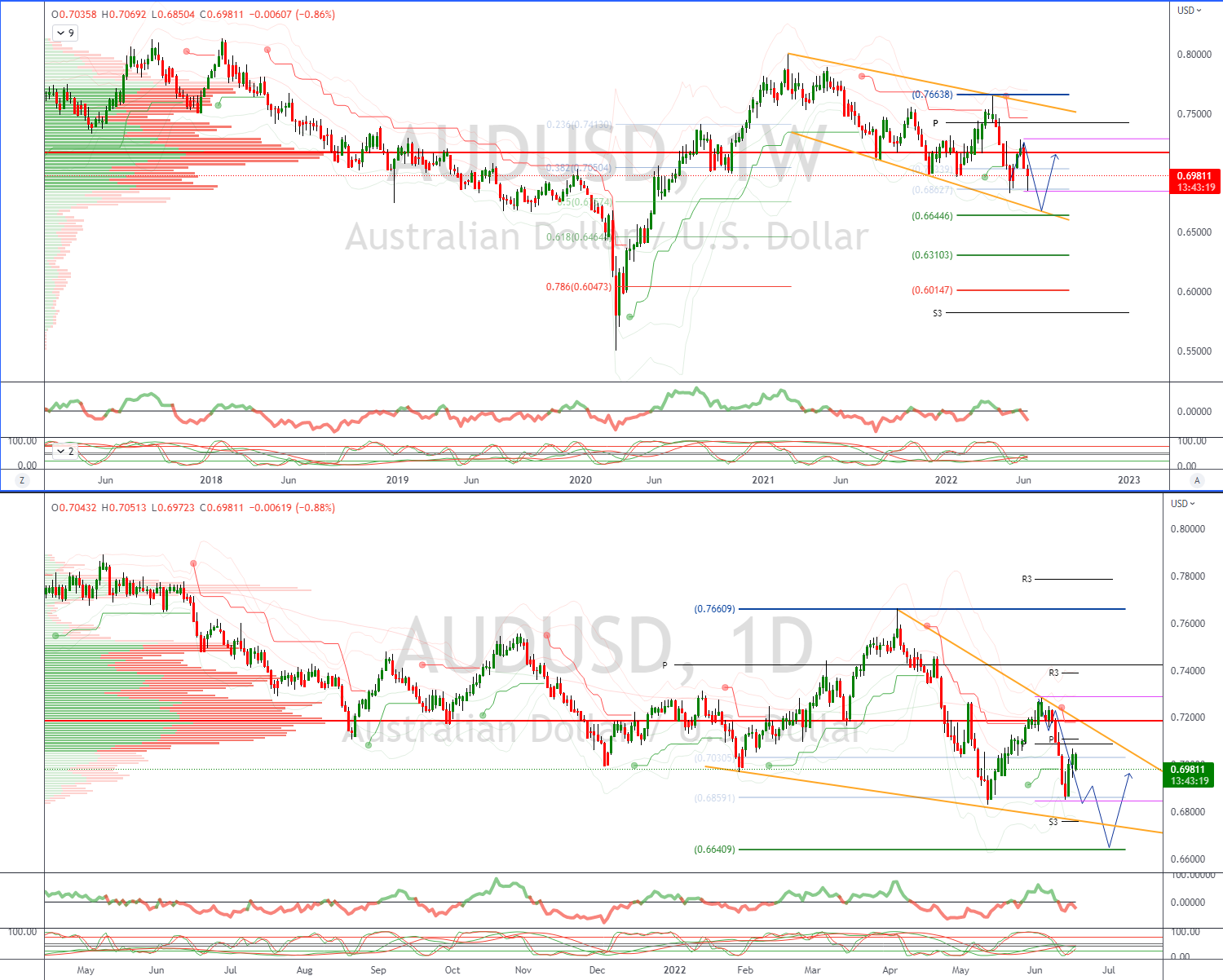

AUDUSD Bias: Bullish above .7200 Bearish below

- Aussie catches an early bid as US equity markets steady

- Aussie closed Friday down 1.5%

- Recovery sees AUD back above .6970

- Continued concerns regarding global growth likely to cap

- Offers seen towards .7075, bids eyed back at .6900

- Daily VWAP is bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!