Daily Market Outlook, June 10, 2022

Daily Market Outlook, June 10, 2022

Overnight Headlines

- China’s Consumer Costs Remain Stable As Factory-Gate Prices Ease Further

- Covid Flares Anew In Shanghai, Sending Some Back To Lockdown

- Japan's May Wholesale Price Rise Slows As Fuel Spike Moderates

- US Ambassador Burns: China Ties At ‘Lowest Moment’ Since 1972

- President Biden’s $52 Bln Chips Plan Stuck; Lawmakers Eye Election

- Tsy’s Yellen: US Recession Unlikely, But No Drop In Gasoline Prices Soon

- US Official Sees Moderation In Goods, Services Inflation In Months Ahead

- Bank Of Canada: Inflation Will Dictate Pace, Size Of Rate Hikes

- UK’s NIESR: UK Failure To Insure On Interest Rate Rise Cost Billions

- UK Jobs Market Lost A Bit More Momentum In May, REC Says

- Dollar On Front Foot As Traders Await US Inflation Data For Fed Cues

- BoJ To Stand Pat Unless Yen Breaches 140, Polled Economists Say

- Oil Falls On Demand Worries Over Shanghai's New Partial Lockdowns

- Asian Stocks Track Global Shares Lower With US CPI In Focus

The Day Ahead

- Asian equity markets are mostly lower this morning, although Chinese indices are up. Yesterday saw sharp falls in European and US equity markets following a hawkish monetary policy update from the ECB. That indicated not only a 25 basis point interest rate increase for the Eurozone in July but also the likelihood of a 50bp move September with further rises likely to follow. In the US, Treasury Secretary Yellen warned of risks of higher energy and food prices but said there was "nothing to suggest a recession is in the works". However, former US Fed policymaker Blinder commented that the Fed probably needs to raise interest rates by 50bps at each of the next 3-4 policy meetings and will likely face a recession. Reports suggest that the UK government is making last-minute changes to a Northern Ireland protocol bill which will be unveiled on Monday.

- Today’s US May CPI is likely to seen by markets as the key economic data release of the week. The last update for April showed a fall in annual inflation on both the headline (8.3% from 8.5% in March) and core (6.2% from 6.5%) measures. Those falls suggested that US inflation may have seen its peak for the year in March. Nevertheless, the headline outturn was higher than forecast and, overall, the indications were that inflation was likely to stay elevated for some months, remaining well above the Fed’s target.

- The message from the May data is likely to be similar. Anticipate headline inflation declined slightly to 8.2% with a bigger fall in core inflation to 5.9%. However, risks for headline inflation, in particular, look skewed to the upside given the rise in energy prices through May, with a possibility that it could be above the April rate. Core inflation should soften but the key concern for markets is whether services inflation continues its steep ascent. This would suggest that broader inflationary pressures persist which will do little to provide any cover for the FOMC to slow rate rises.

- Inflationary concerns will also be to the forefront in Canada as the latest monthly labour market report (for May) is assessed. The consensus expectation is for a solid report including a further acceleration in wage growth. The Bank of Canada raised interest rates by 50 basis points last week, taking Canadian rates to 1.5%, and indicated that further rises are probably on the cards. Anything close to today’s forecast will support expectations of another 50bp rise at the BoC’s next policy update on 13th July.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0600-05 (1.03BLN), 1.0620-25 (288M)

- 1.0650 (258M), 1.0750-55 (1.06BLN), 1.0800 (294M)

- USD/JPY: 130.95-00 (621M)

- GBP/USD: 1.2400-10 (374M), 1.2575-80 (336M)

- 1.2600-05 (574M). EUR/GBP: 0.8600 (200M), 0.8650 (312M)

- EUR/CHF: 1.0350 (831M)

- AUD/USD: 0.7100 (763M), 0.7135 (475M), 0.7165-75 (900M)

- 0.7180-85 (406M)

- USD/CAD: 1.2500 (389M), 1.2690-00 (460M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.07 Bullish above

- EUR/USD opened -0.92% at 1.0618 after bearish outside day in wake of ECB

- It traded to 1.0611 before bids ahead of 1.0600 discourage sellers

- EUR/USD drifted higher and was at session high around 1.0635 late morning

- EUR/USD remains vulnerable as rising peripheral EZ yields weighs

- It may bounce if US CPI doesn't rattle markets and leads to relief rally

- Resistance is at 1.0647 and break would ease pressure

- Support is at the 50% of the 1.0349/1.0787 move at 1.0568

GBPUSD Bias: Bearish below 1.26 Bullish above.

- Cable eyes 1.2480 after falling from 1.2515 (early London intra-day high)

- 1.2480 was three-day low in Asia, as risk aversion supported safe-haven USD

- Nasdaq closed down 2.75% Thursday, steepest drop since mid-May

- U.S. May CPI data due 1230 GMT; 8.3% YY f/c (Reuters poll). Core f/c 5.9% YY

- Above f/c U.S. CPI would raise risk of (another) 50 bps Fed hike in Sept

- UK to present post-Brexit Northern Ireland legislation Monday

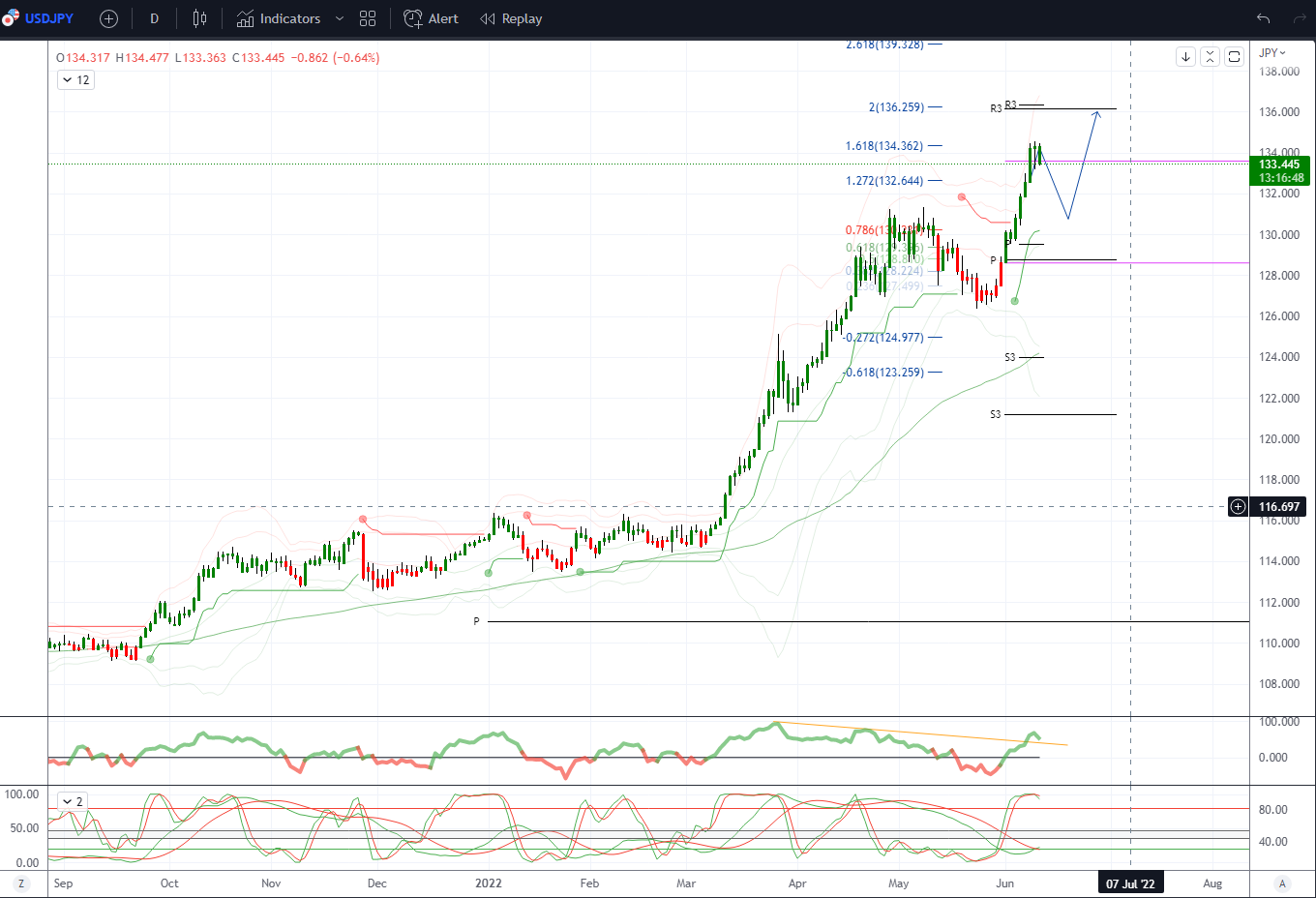

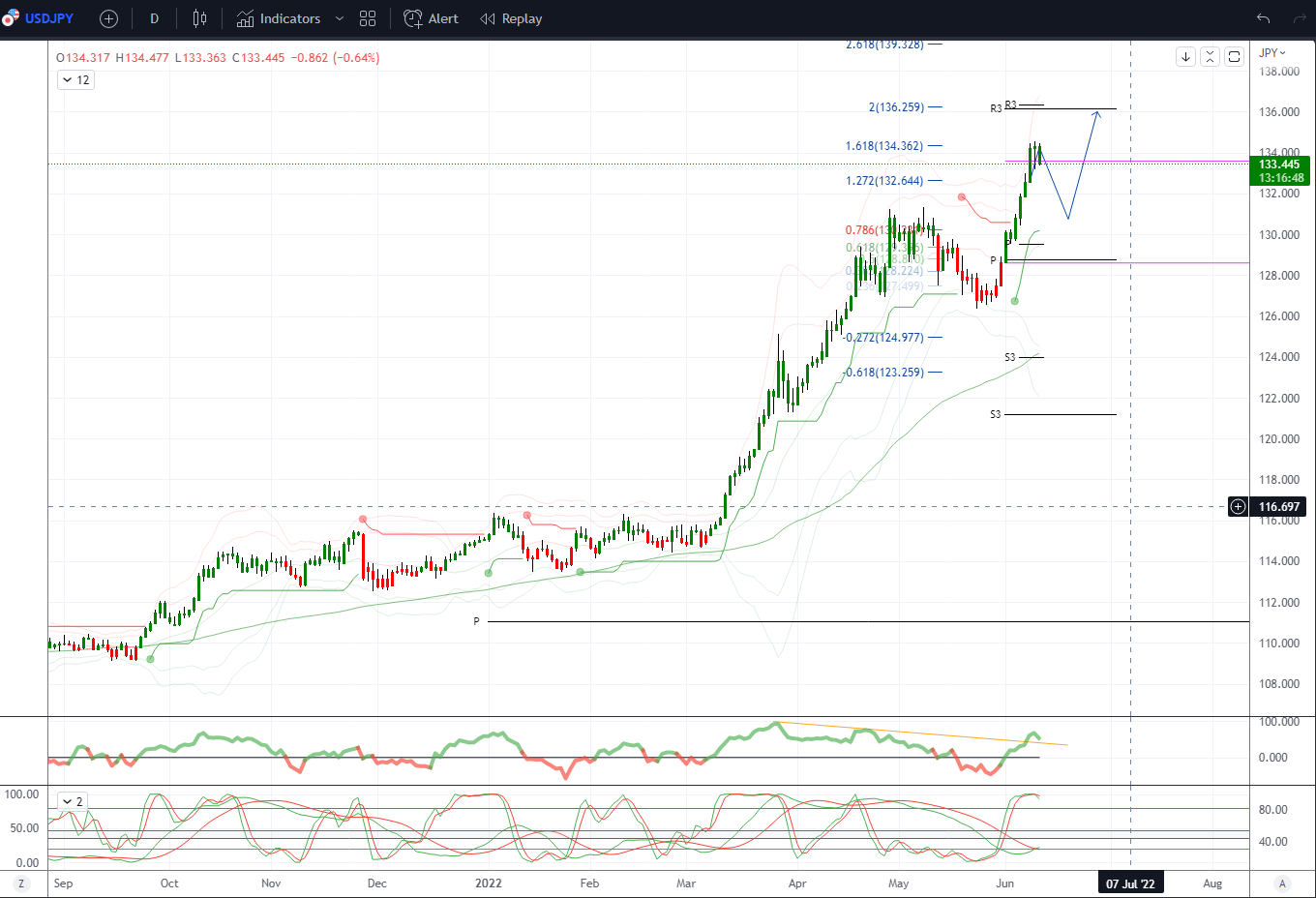

USDJPY Bias: Bullish above 127 Bearish below

- USD/JPY off another leg late Tokyo, into Europe, low so far 133.63

- Pair down from 133.48 early Tokyo, on jaw-boning from FinMin Suzuki

- Trading in Asia mostly uninspiring thereafter, market thin, volume low

- USD/JPY deeper into 133.44-92, still a cushion

- US yields not a factor, firm and steady, Treasury 10s @3.045%

- Asia mostly risk off, Nikkei closed -1.5% on day at 27,824.29

AUDUSD Bias: Bullish above .7200 Bearish below

- AUD/USD opened -1.28% at 0.7097 after equities and commodities cratered

- It traded to 0.7085 early when early Asian markets fell sharply

- Markets settled off the early lows and AUD/USD drifted higher

- Heading into the afternoon AUD/USD is trading near the session high @ 0.7107

- Resistance is at 0.7114 and break eases pressure

- Support is at the 50% of the 0.6829/0.7282 move at 0.7055

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!