Daily Market Outlook, July 27, 2022

Daily Market Outlook, July 27, 2022

Overnight Headlines

- Asian Stocks Follow Wall Street Ahead Of Likely US Rate Hike

- Microsoft Posts Slowest Sales Growth Since 2020 On Strong Dollar

- Google Parent Alphabet's Small Sales Miss Eases Recession Worries

- Australia Headline Prices Miss Forecast, Easing Rate-Hike Bets

- Biden Will Speak To Xi On Thursday As US-China Ties Worsen

- Italy Outlook Revised To Stable From Positive By S&P

- Spain Slashes 2023 Growth As Inflation Weighs On Economy

- UK Retailers Report Prices Rising At Sharpest Pace Since 2005

- Asian Currencies Weaken As Markets Remain Cautious Ahead Of Fed

- China's Overnight Repo Rate Falls Below 1% For First Time Since Jan 2021

- Oil Steady As Demand Concerns Offset U.S. Crude Stock Drawdown

The Day Ahead

- Asian equity performance is mixed this morning. In China, the overnight repo rate fell below 1% for the first time since January 2021, a signal that China will keep monetary policy loose to support growth. Reports suggest that US President Biden will speak with Chinese President Xi tomorrow. Annual Australian consumer price inflation rose to 6.1%. That was its highest rate in 21 years but less than expected, causing some forecasters to scale back their expectations for next week’s rate decision. Conservative Party leadership candidate, Rishi Sunak, promised to temporarily scrap VAT on energy bills.

- Today’s US monetary policy update is the key event of the week for markets. The announcement of a fourth successive interest rate increase is seen as a near certainty. The three previous hikes since March have all seen the Federal Reserve up the ante with an initial increase of 25bp, followed by rises of 50bp in May and 75bp in June. Markets briefly discounted a 100bp hike following a larger than expected rise in June CPI to a new high for the year of 9.1%. However, subsequent comments from some officials that they are more likely to opt for a 75bp hike and signs that longer-term inflation expectations remain under control have led markets to price in the same sized hike as in June. Also of interest will be any signals that the Fed sends about its future policy intentions. Markets continue to price in further rate rises of just over 100bp by early 2023. However, rising concerns about downside risks to growth are reflected in just over 50bp of rate cuts now priced in for later in 2023. This is not one of the meetings where Fed policymakers update their forecasts, but both the press statement and Fed Chair Powell’s press conference will be watched closely for clues on whether these expectations are still justified.

- Most Fed officials are still indicating that they think the US economy looks strong. However, recent activity data has mostly surprised on the downside, and this will be acknowledged to some extent today. Powell’s key message is likely to remain that getting inflation under control is the number one priority, but he is bound to be quizzed on what would cause the Fed to hold off from further rate rises and on the risks of a ‘hard landing’ for the economy.

- Prior to the Fed’s policy decision, durable goods orders and the advanced trade report will provide further insight into whether growth is slowing. Elsewhere, it’s a quiet day for data with only Eurozone Money Supply of note.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0000 (1.18B), 1.0100 (1.84B), 1.0125 (650M), 1.0150 (497M)

- EUR/USD: 1.0200-10 (1.63B), 1.0250-55 (2.13B), 1.0270 (532M), 1.0300 (1.06B)

- USD/JPY: 136.24-25 (755M). EUR/JPY: 142.40 (1.42B). EUR/CHF: 1.0015 (477M)

- GBP/USD: 1.2200 (404M). AUD/USD: 0.6945-50 (451M), 0.7040-50 (687M)

- USD/CAD: 1.2850-55 (900M), 1.2870-80 (604M), 1.2910 (498M), 1.3000 (392M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.0350

- EUR sold off across the board due to more bad news regarding energy flows

- A further cut to supplies from Russia have heightened EZ recession fears

- Pair looks vulnerable ahead of FOMC decision during US Wednesday session

- Resistance 1.0250/60, support 1.0100-05, 1.0070-75

- Price testing the 20 Day Bearish VWAP

- 20 Day VWAP is bearish, 5 Day bearish

GBPUSD Bias: Bearish below 1.2150

- Pair moved successively lower from Asia session high

- Fed +75bp Wednesday in focus

- GBP traders unsure of +25 or +50 at Aug 4 MPC

- GBP needs help from the Fed, BoE to make run at mid-June hig

- Offers sited at 1.21 bids 1.1890

- 20 Day VWAP is bullish, 5 Day bullish

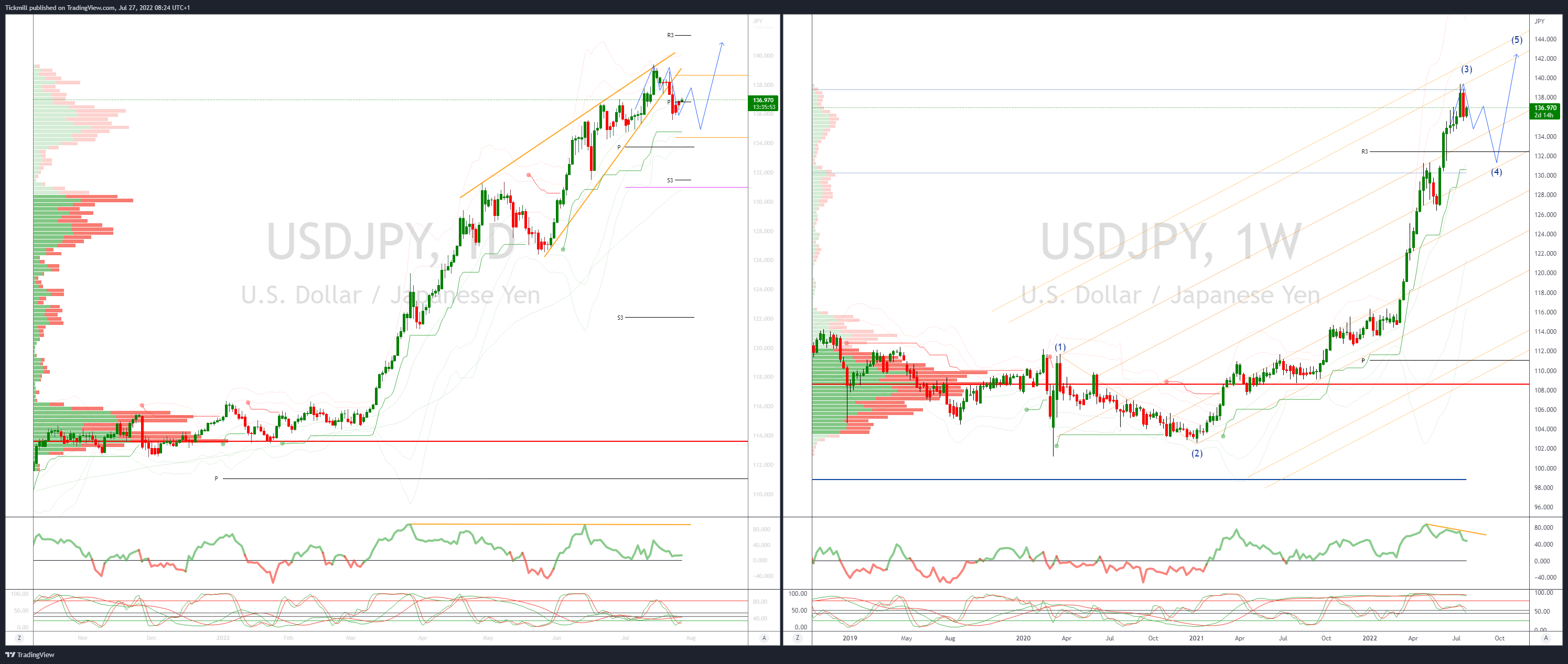

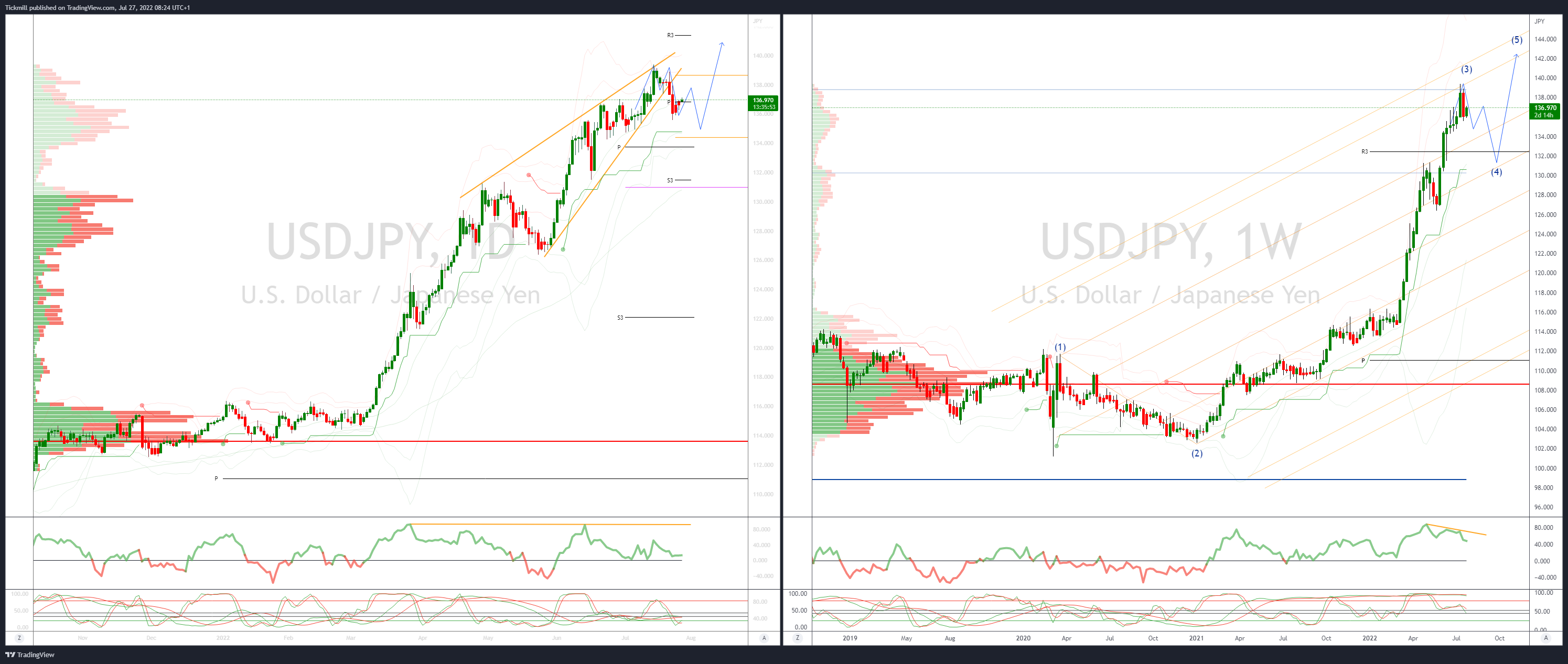

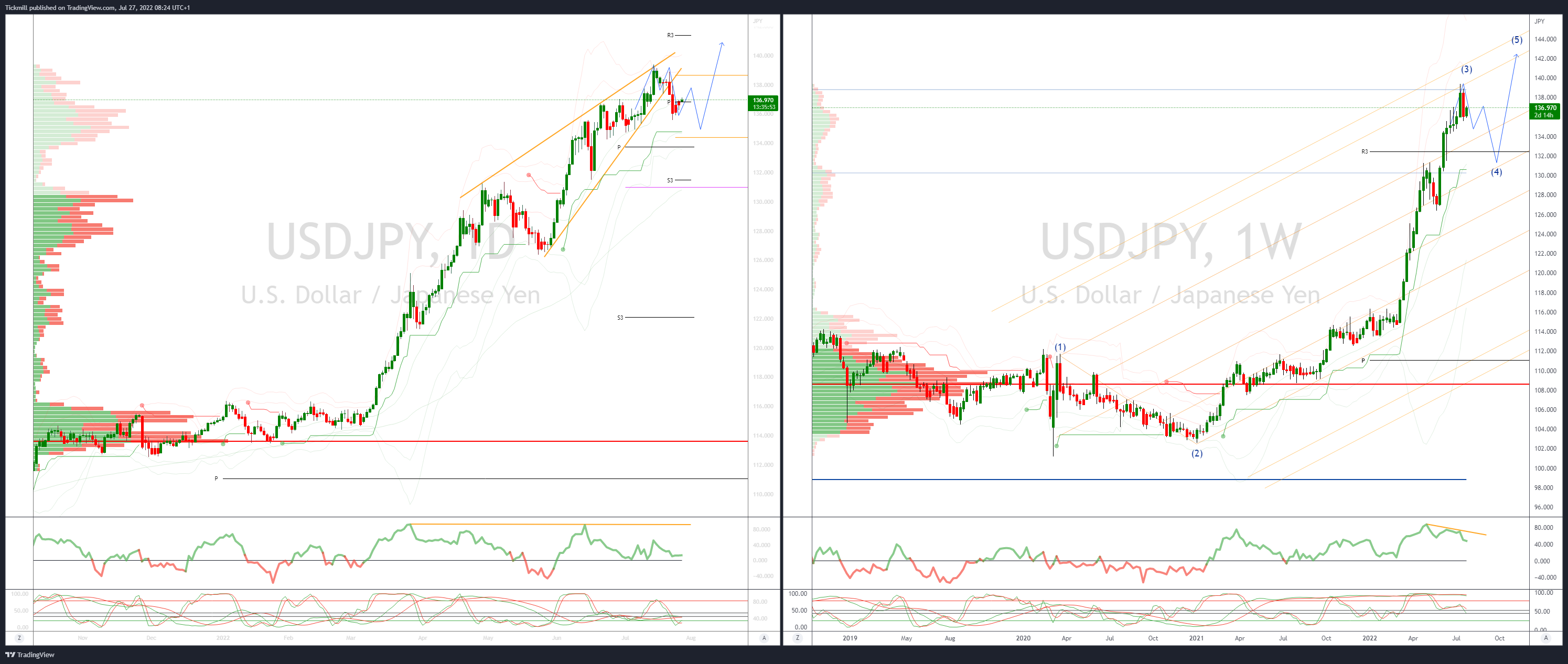

USDJPY Bias: Bullish above 134

- USD/JPY up with US yields on FOMC 75 bp hike view, Japan buys on dips

- USD/JPY ratcheting gradually higher from 135.58 EBS low last Friday

- Japanese importer, other bids on almost every dip, likely will continue

- USD/JPY moves up matching moves back up in US Treasury 2s, to 3.065% o/n

- FOMC looking to hike Fed funds 75 bps tonight, 50 bps in September

- Offers sited 137.30/50 bids at 135.10

- 20 Day VWAP is bearish, 5 Day bearish

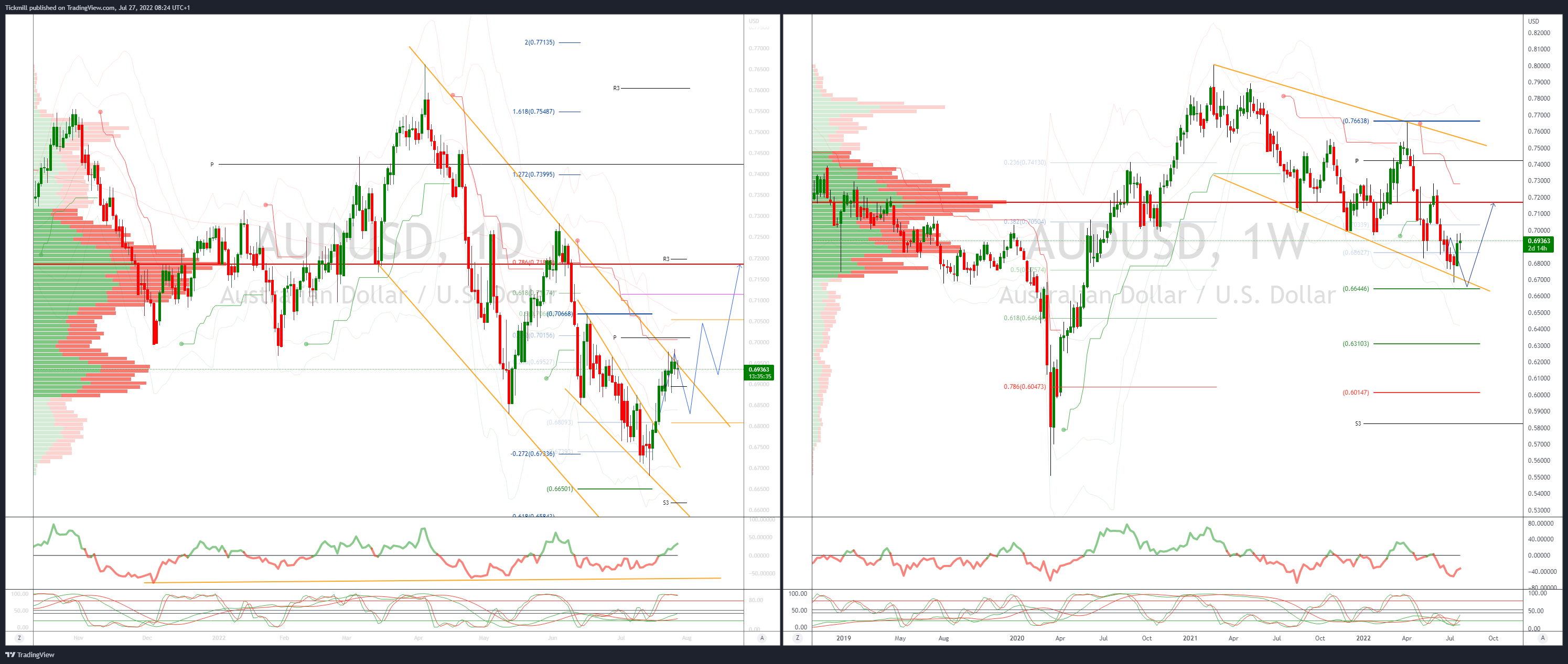

AUDUSD Bias: Bearish below .7050

- Edges lower after Aus CPI soft print

- AUD/USD slipped from 0.6950 to 0.6930 in initial reaction to Aus CPI

- Weighted mean & headline slightly lower than forecast - trimmed mean slightly higher

- Impact on AUD/USD likely to be fleeting as the numbers lined up with expectations

- AUD to take its lead from USD response to FOMC

- Offers sited .7000/10

- AUD/USD support is at Friday's 0.6876 low and break targets 0.6840/45

- 20 Day VWAP is bullish, 5 Day bullish

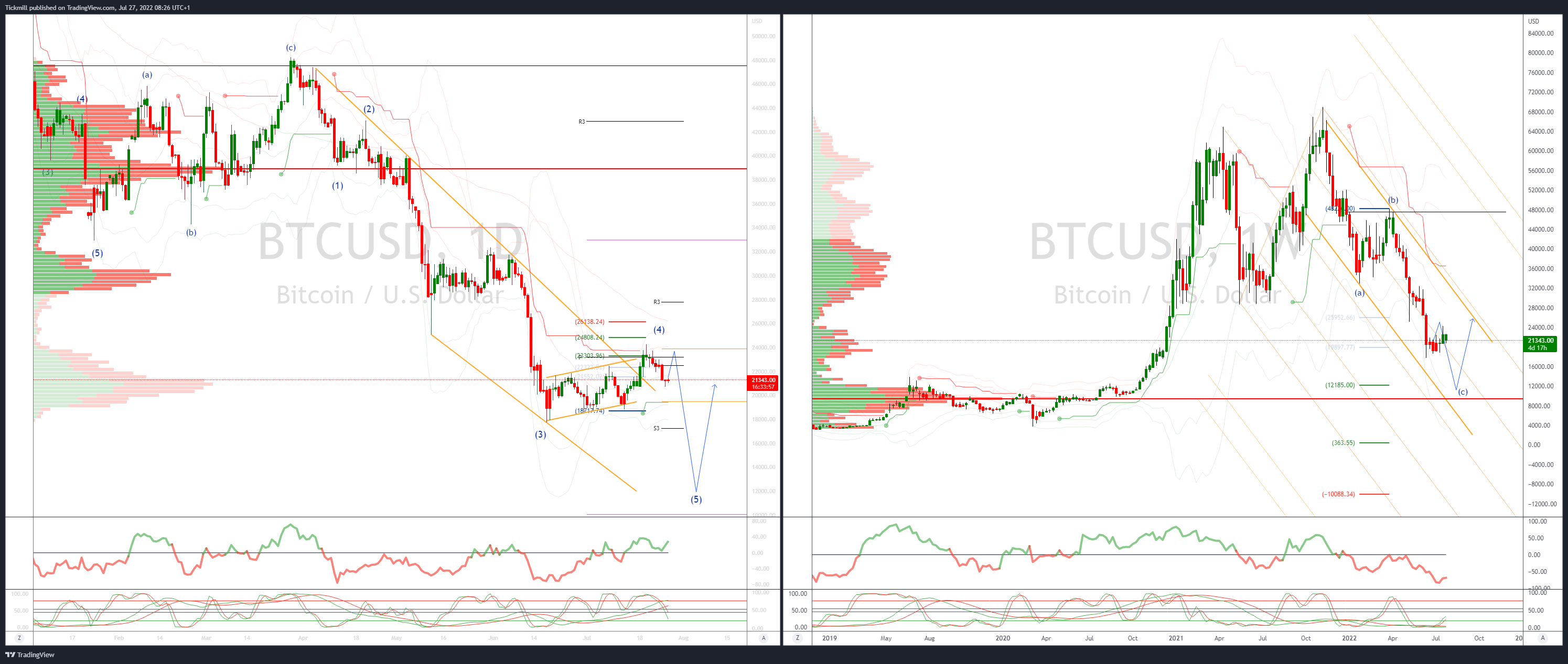

BTCUSD Bias: Bearish above 22k

- Risk appetite fragile leading up to FOMC decision

- Possibility of 100bps hike can't be ruled out

- Falls out of VWAP uptrend channel

- Closing below 21k will be a meaningful downside development

- If below 20.5k, downtrend channel back in play

- 20 Day VWAP is bearish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!