Daily Market Outlook, July 26, 2023

Munnelly’s Market Commentary…

Asian equity markets traded in a mixed fashion overnight with a lack of clear direction as major central bank policy decisions are approaching. The US Federal Reserve (FOMC) is expected to make an announcement today, followed by the European Central Bank and the Bank of Japan later in the week. In Japan, the Nikkei 225 index swung between gains and losses, affected by softer Services PPI data and uncertainty ahead of the Bank of Japan meeting. In China, the Hang Seng and Shanghai Composite indices were weaker after a previous stimulus boost lost momentum. However, expectations for further support measures and increased liquidity efforts from the People's Bank of China (PBoC) limited the downside.

The Federal Reserve is widely anticipated to raise interest rates by 25bps, with more than a 95% probability assigned by markets. The majority of Fed policymakers have been indicating support for at least one further rate hike in the autumn. However, recent market scepticism, triggered by lower-than-expected US inflation in June, raises the question of whether today's expected hike will be the last one or if there will be more. Given the unusually long gap until the next policy update in September, Fed policymakers might be inclined to keep their options open and state that further rate moves will depend on economic data.

The data docket for the day is light, with Eurozone money supply data and US June new home sales data being of interest. The Bank of Canada will also release the minutes of its last policy meeting when it raised rates. Overall, market participants are eagerly awaiting guidance from the central banks on their future policy actions, and any statements made during the announcements could have significant impacts on financial markets

CFTC Data As Of 18-07-23

USD net spec short grew in the Jul 12-18 period amid a $IDX 1.65% slide

EUR$ +2% in period, specs +38,670 into strength, now long 178,832 contracts

$JPY -1.05%, specs +26,943 contracts, short reduced to -90,239

GBP$ +0.77%, specs +5,666 contracts now +63,729; data pre-UK CPI Wednesday

AUD$ +1.88%, specs -5,317 now -50,401 contracts; $CAD -0.46% specs -3,923

BTC -2.6% in period specs buy 694 contracts on dip, now -1,161 contracts

Note since Tuesday reporting period close the $IDX is down near 0.9%

EUR$ has dipped 0.88%, $JPY rose 2.11% after period closed leaving recent EUR & JPY buyers in the red(Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.1000 (1BLN), 1.1025 (1.5BLN), 1.1060 (302M), 1.1070-75 (2.3BLN)

1.1085-1.1100 (1.1BLN).

GBP/USD: 1.2800 (205M), 1.2875-80 (291M), 1.3035 (223M)

AUD/USD: 0.6725 (488M), 0.6800 (329M), 0.6900 (718M)

EUR/AUD: 1.6350 (448M), 1.6400 (448M)

USD/JPY: 140.00 (885M), 141.00 (416M), 142.00 (1.3BLN)

Options Market Positioning

The current implied volatility premium for JPY calls is near a one-year high, last seen before a Bank of Japan event in March. USD/JPY, the 1-week implied volatility is sitting 4.0 points above the levels observed before the Bank of Japan announcement. But what truly reflects the perceived risk from the BoJ is the continuously increasing premium for JPY call options compared to put options through 1-week expiry risk reversals. These JPY call options are being seen as a hedge against any potential policy changes that might impact USD/JPY. EUR/USD has been facing ongoing pressure, but the decline has been slowed by long gamma positioning, which indicates that market participants are adjusting their options exposure to limit potential losses in case of sharp price movements. In the case of GBP/USD, the implied volatility for the benchmark 1-month expiry FX options remains elevated in the mid-8s compared to the mid-7s in early July. Traders appear to be more interested in covering two-way volatility, rather than taking any specific directional bias, as uncertainty looms.

Overnight Newswire Updates of Note

US Futures Little Changed As Investors Digest Big Tech Earnings

Fed Poised For Hike, Unlikely To Signal Further Action Past July

JPMorgan Trading Desk See Fed ‘Hike And Pause’ Lifting Stocks

Bond Traders Placing Even Odds On Post-July Fed Interest Hike

US GOP Speaker McCarthy Ponders Biden Impeachment Probe

Investment Banks Warning Investors On Potential BoJ Surprise

Australia Q2 Cooler Prices Bolster Case To Extend Rate Pause

Dollar Near Two-Week High As Fed Decision Next, Aussie Falls

Wells Fargo Shares Jump After Approving $30Bln Buyback Plan

Alphabet Profit Beats Expectations, CFO Porat In New Position

Microsoft’s Azure Slowdown Overshadows AI Growth Optimism

FTC Finish Long-Awaited Lawsuit That Could Break Up Amazon

Snap Falls As Sales Forecast Misses Estimates On Ad Demand

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

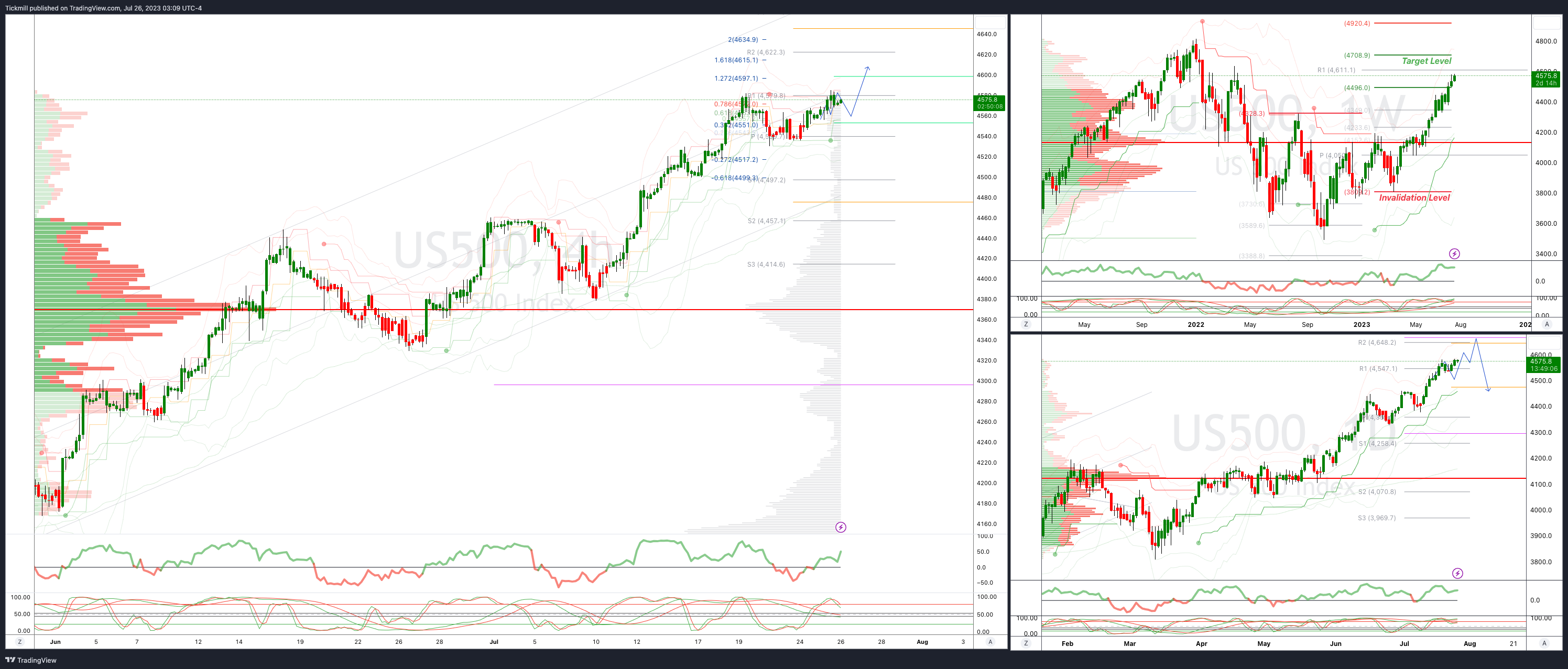

SP500 Intraday Bullish Above Bearish Below 4570

Below 4530 opens 4512

Primary support is 4370

Primary objective is 4630

20 Day VWAP bullish, 5 Day VWAP bullish

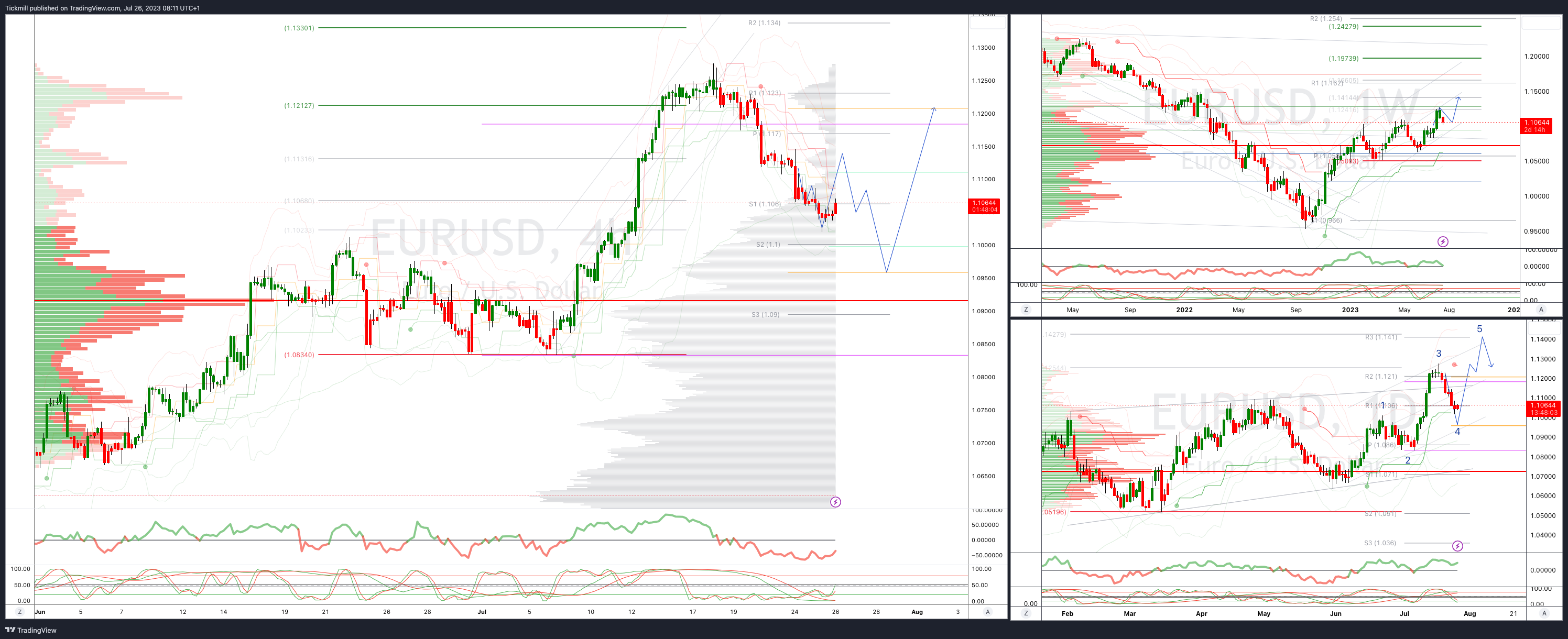

EURUSD Intraday Bullish Above Bearsih Below 1.1130

Below 1.1050 opens 1.0955

Primary support is 1.10

Primary objective is 1.13

20 Day VWAP bullish, 5 Day VWAP bearish

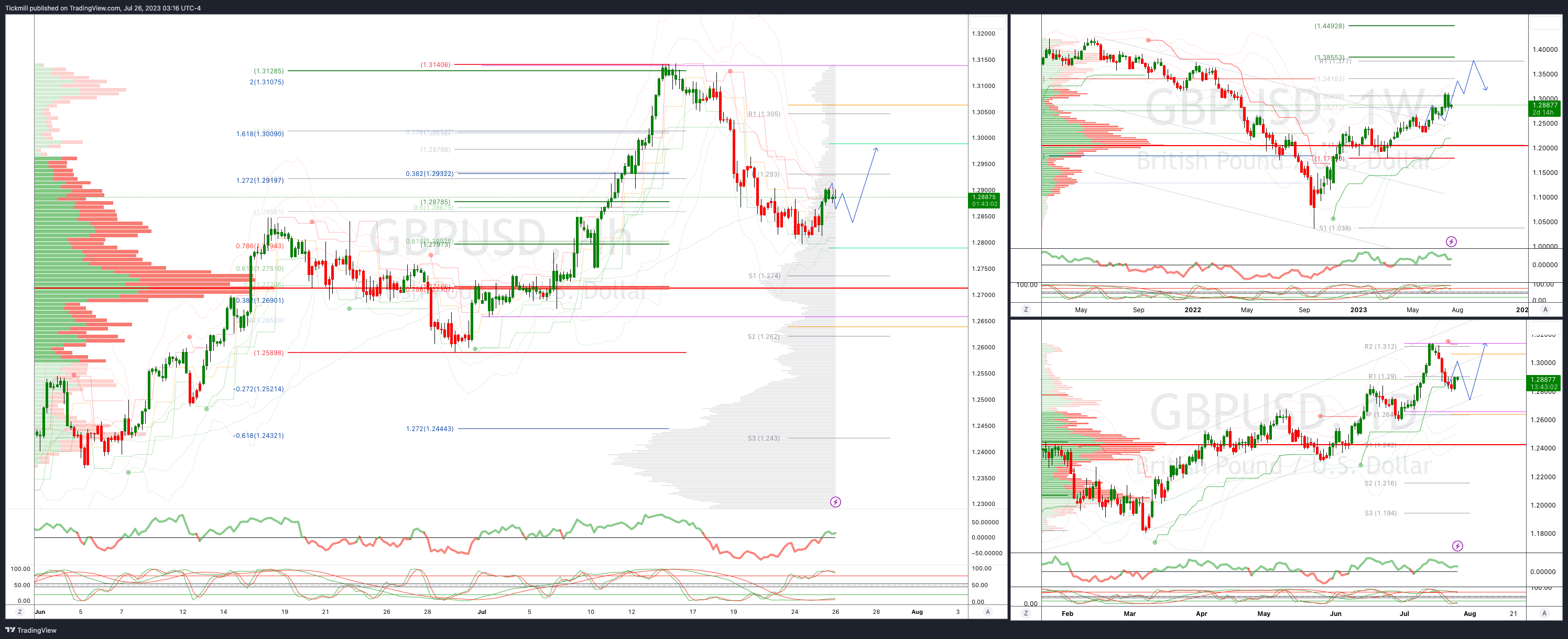

GBPUSD: Intraday Bullish Above Bearish Below 1.2850

Below 1.2830 opens 1.2710

Primary support is 1.26

Primary objective 1.3850

20 Day VWAP bullish, 5 Day VWAP bullish

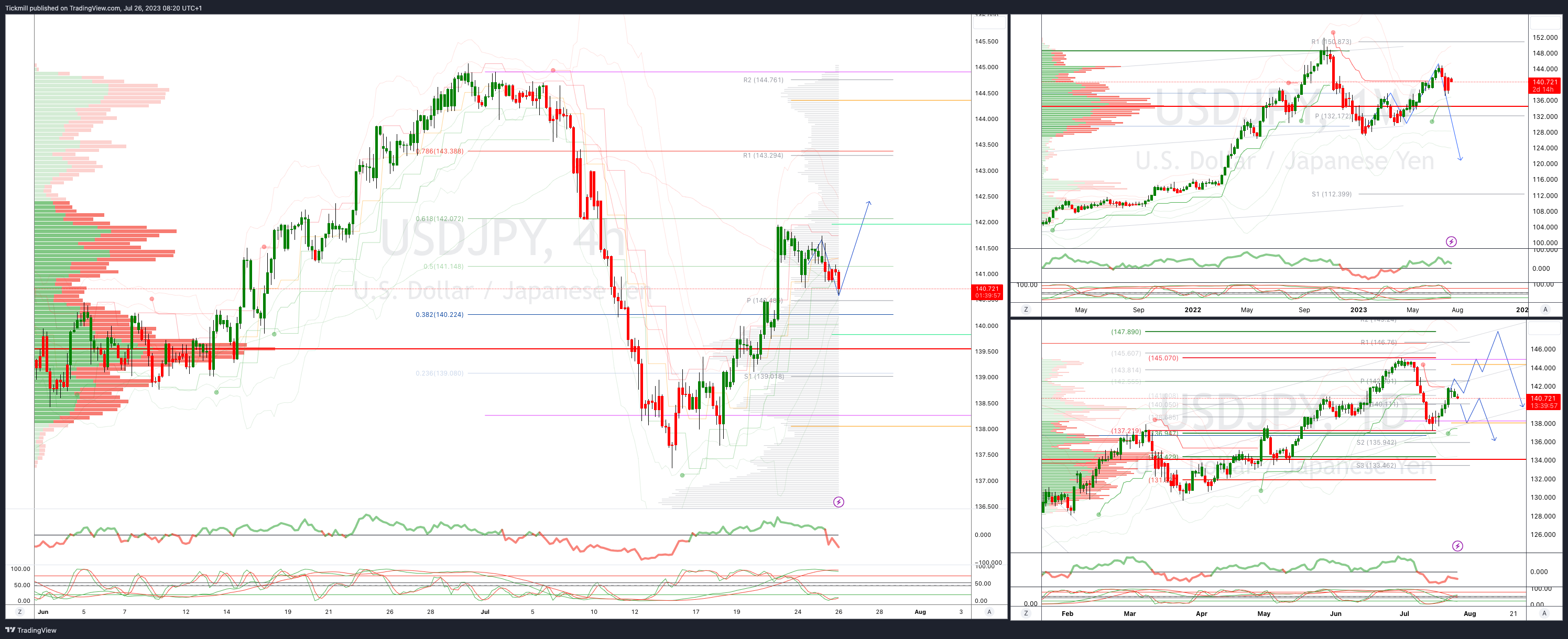

USDJPY Bullish Above Bearish Below 139.60

Above 143.50 opens 145

Primary resistance 143.40

Primary objective is 136.20

20 Day VWAP bearish, 5 Day VWAP bullish

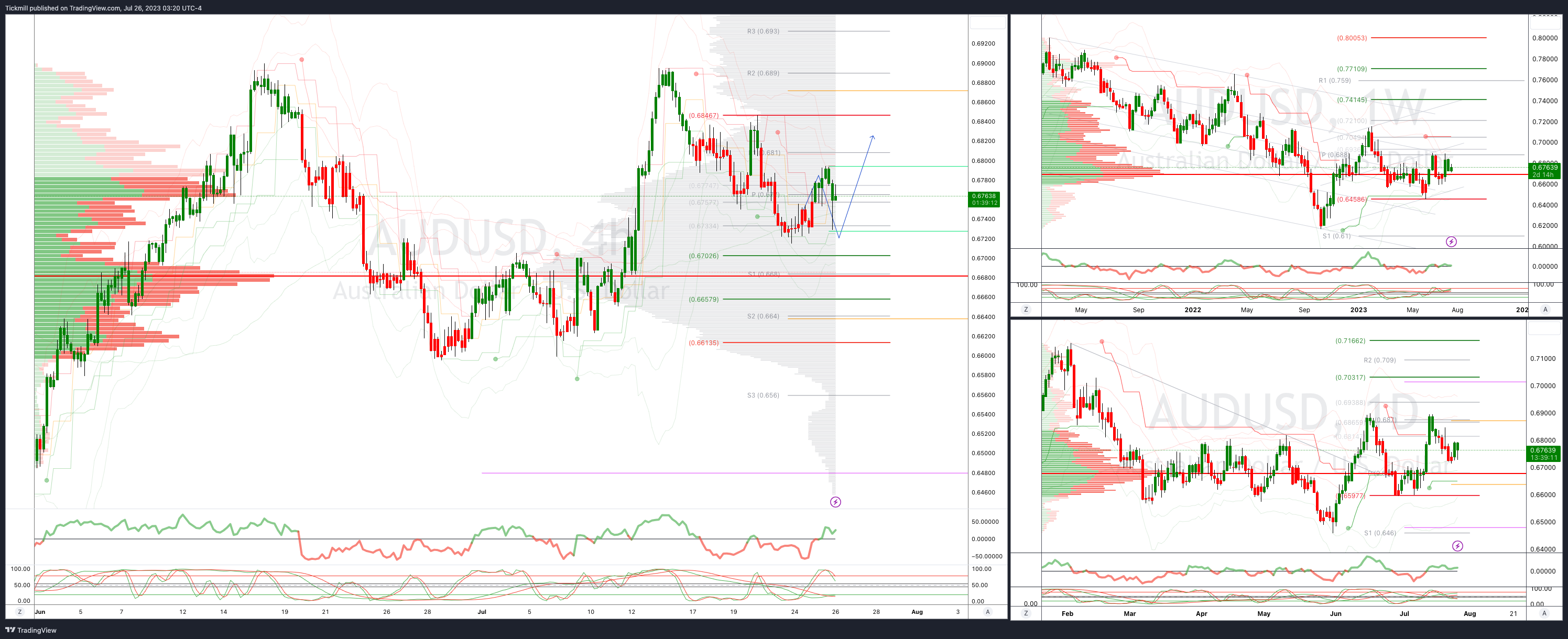

AUDUSD Intraday Bullish Above Bearish Below .6800

Below .6795 opens .6700

Primary support is .6448

Primary objective is .7000

20 Day VWAP bearish, 5 Day VWAP bearsih

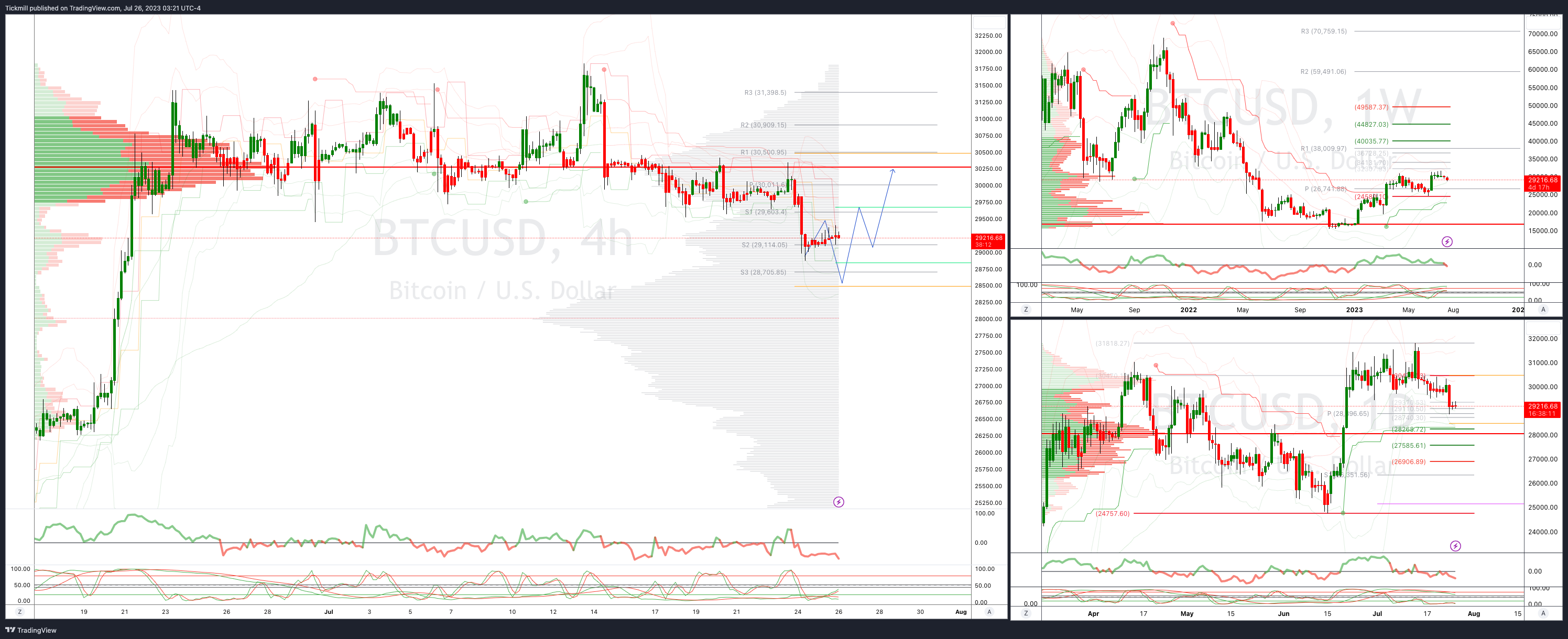

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28600

Primary support is 28400

Primary objective is 32750

20 Day VWAP bullish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!