Daily Market Outlook, July 18, 2023

Munnelly’s Market Commentary…

Asian equity markets failed to sustain the momentum from Wall Street. The Nikkei 225 initially made gains upon its return from a long weekend but eventually erased those gains, reflecting weakness in its peers. The Hang Seng and Shanghai Composite were also lower, with property stocks leading the declines in Hong Kong. This was attributed to the long-delayed results of Evergrande, the world's most indebted developer, which reported significant net losses for 2021 and 2022. The US-China relationship remained in focus, with amicable comments in talks between US Climate Envoy Kerry and China's top diplomat Wang Yi. However, reports that the US aims to propose investment limits on China and potential new curbs on chips and semiconductor-making devices tempered the positive sentiment.

In the US, the economy has so far exceeded expectations of a recession. GDP grew in the first quarter and is likely to have continued growing in the second quarter. Data releases for June, including retail sales, industrial production, and business inventories, will provide further insights into the likely economic outcome. Despite ongoing headwinds from higher interest rates and inflation, US retail sales and consumer spending have surpassed expectations this year. It is expected that consumer spending will continue to contribute positively to Q2 GDP growth. However, the outlook for the second half of 2023 remains uncertain.While there have been reports of struggles in the manufacturing sector globally, official industrial production measures have been relatively strong, outperforming unofficial sources such as the ISM surveys. Another small increase in output is predicted for June, potentially supported by incentives in the US to encourage "green" investment in the sector.

CFTC Data As Of 14-07-23

USD net spec short fell a touch in the Jul 5-11 period as $IDX slid 1.37%

Fairly serious moves among majors w/hardly any position changes

Suggest a fair amount of position replacement as specs were getting stopped

EUR$ +1.2% in period, specs -2,675 contracts into strength now +140,162

$JPY -2.84% in period after breaching 145 last wk, specs buy 738 contracts

GBP$ +1.73% as BoE seen a cointoss for +50bp Aug 3, specs +7,798 now +58,063

CHF specs relatively active -4,503 contracts now short 7,907

$CAD +0.06%, Aussie -0.06% specs sell less than 1k contracts

BTC fell a scant 0.74%, specs +221 on dip now short 1,855 contracts(Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.1100-10 (5BLN), 1.1225 (706M)

GBP/USD: 1.3010 (852M), 1.3130-40 (300M). EUR/GBP: 0.8580 (300M)

AUD/USD: 0.6800 (1BLN), 0.6815 (242M), 0.6850 (1.1BLN), 0.6865 (358M)

0.6875-80 (450M), 0.6885-95 (807M). NZD/USD: 0.6400 (400M)

AUD/NZD: 1.0800 (603M), 1.0850 (627M), 1.0900 (535M)

USD/CAD: 1.3200 (200M), 1.3240 (525M). EUR/JPY: 155.50 (230M)

USD/JPY: 138.0 (234M), 139.50 (481M), 139.75-85 (485M)

Overnight Newswire Updates of Note

Stocks Rise To Kick Off Busy Week Of Earnings Reports

RBA Hit Pause As Policy Clearly Restrictive, Risking Growth

China Recovery Uneven And Differentiated By Sector, Moody’s Says

China Likely To Cut RRR In Third Quarter To Boost Economy - CSJ

US Limits On China Tech Investment To Be Narrow And Slow

US Banks Face Stiffer Mortgage Capital Rule Than Basel Standard

More Americans Are Getting Turned Down For Loans, Fed Data Shows

ECB's Visco: Inflation May Drop More Quickly Than Forecast

Officials: EU's AI Lobbying Blitz Gets Lukewarm Response In Asia

Dollar Teeters Near One-Year Low; Euro Scales 17-Month Peak

Dollar’s Painful Rout Looks Overdone, Says Barclays FX Executive

BofA: Yen Could Fall In 2024 As Officials Face 'Policy Trilemma'

HSBC: Dollar May Weaken As Fed’s Hiking Cycle Nears End

Goldman Sachs Says This Yield Curve Inversion Is ‘Different’

BofA Says Credit Market Bears In Retreat As Recession Fears Ease

Oil Holds Two-Day Drop As China Angst Offsets Russia Export Cuts

Asia Shares Mixed Tuesday Amid Lingering China Concerns

BofA Says Earnings Season Is Off To A Better-Than-Average Start

JPMorgan Strategists Predict Further Euro-Area Stock Weakness

JPMorgan’s Kolanovic Sees ‘Modestly Wider’ Path To Soft Landing

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

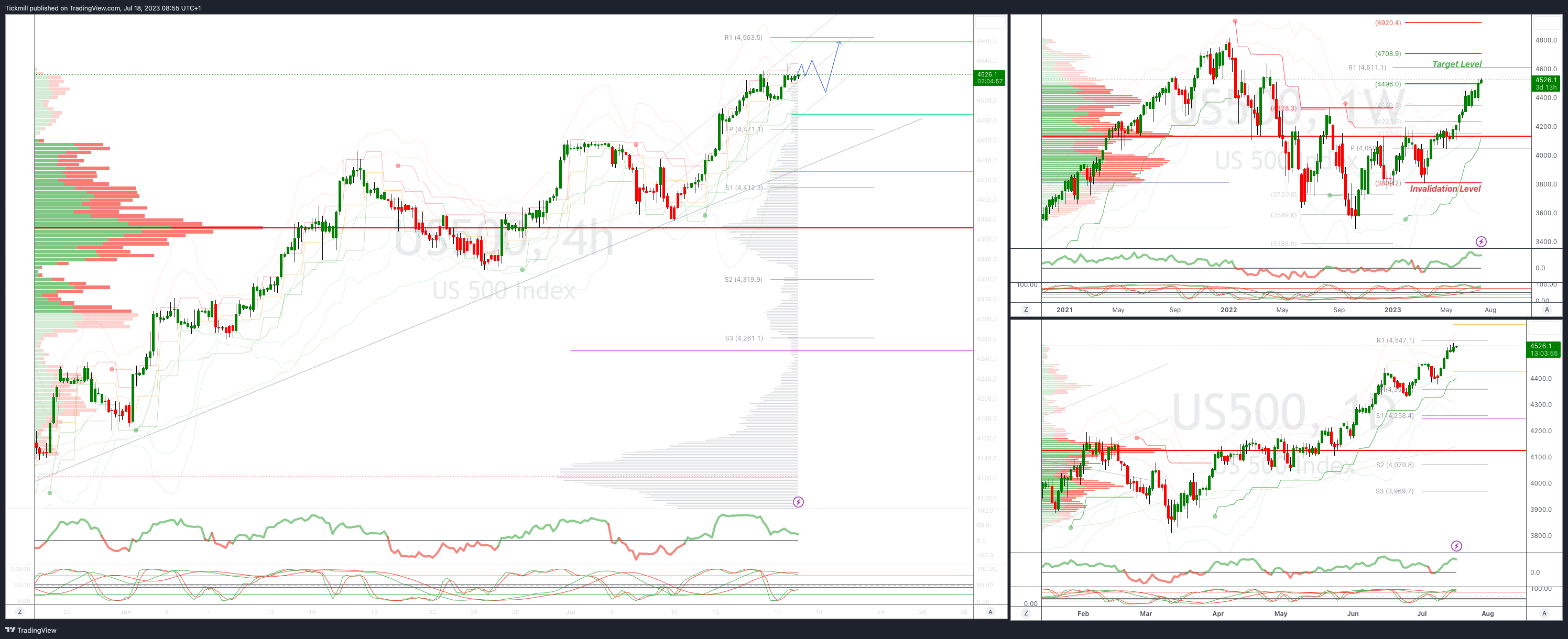

SP500 Intraday Bullish Above Bearish Below 4490

Below 4480 opens 4460

Primary support is 4370

Primary objective is 4630

20 Day VWAP bullish, 5 Day VWAP bullish

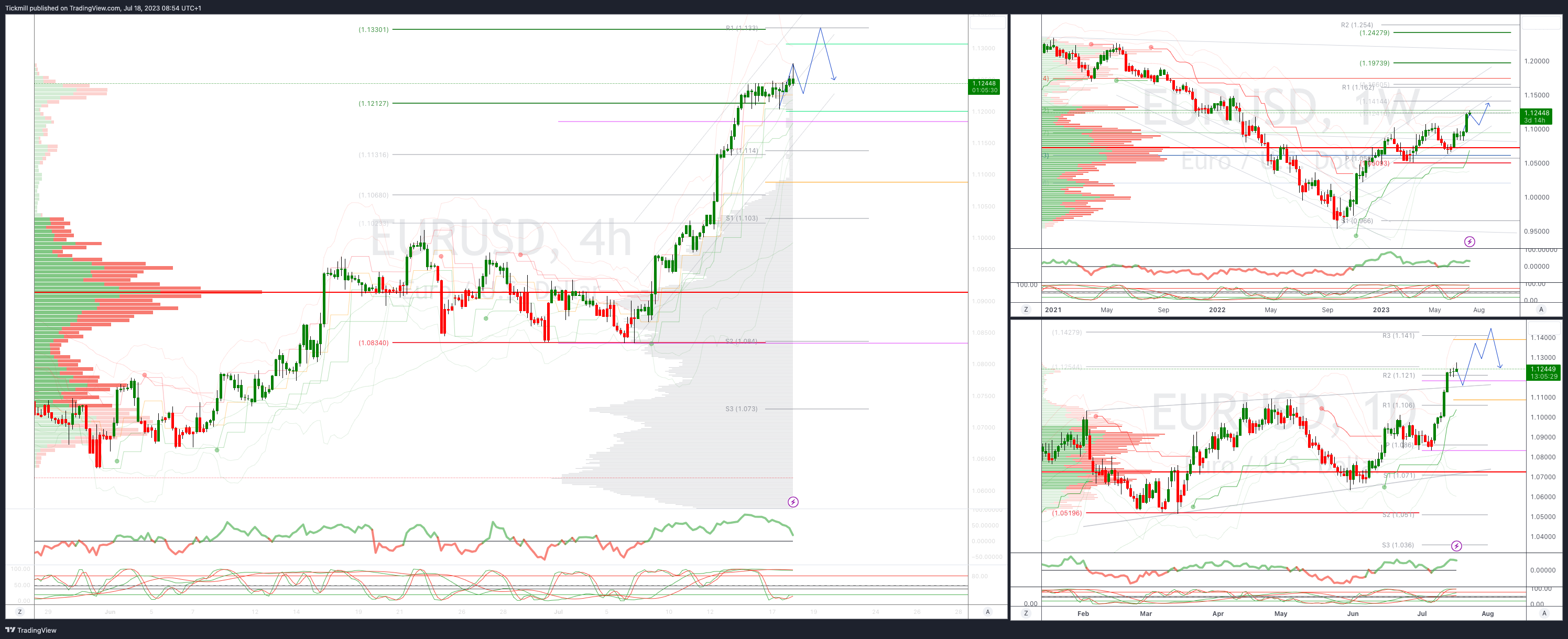

EURUSD Intraday Bullish Above Bearsih Below 1.12

Below 1.1150 opens 1.1050

Primary support is 1.10

Primary objective is 1.13

20 Day VWAP bullish, 5 Day VWAP bullish

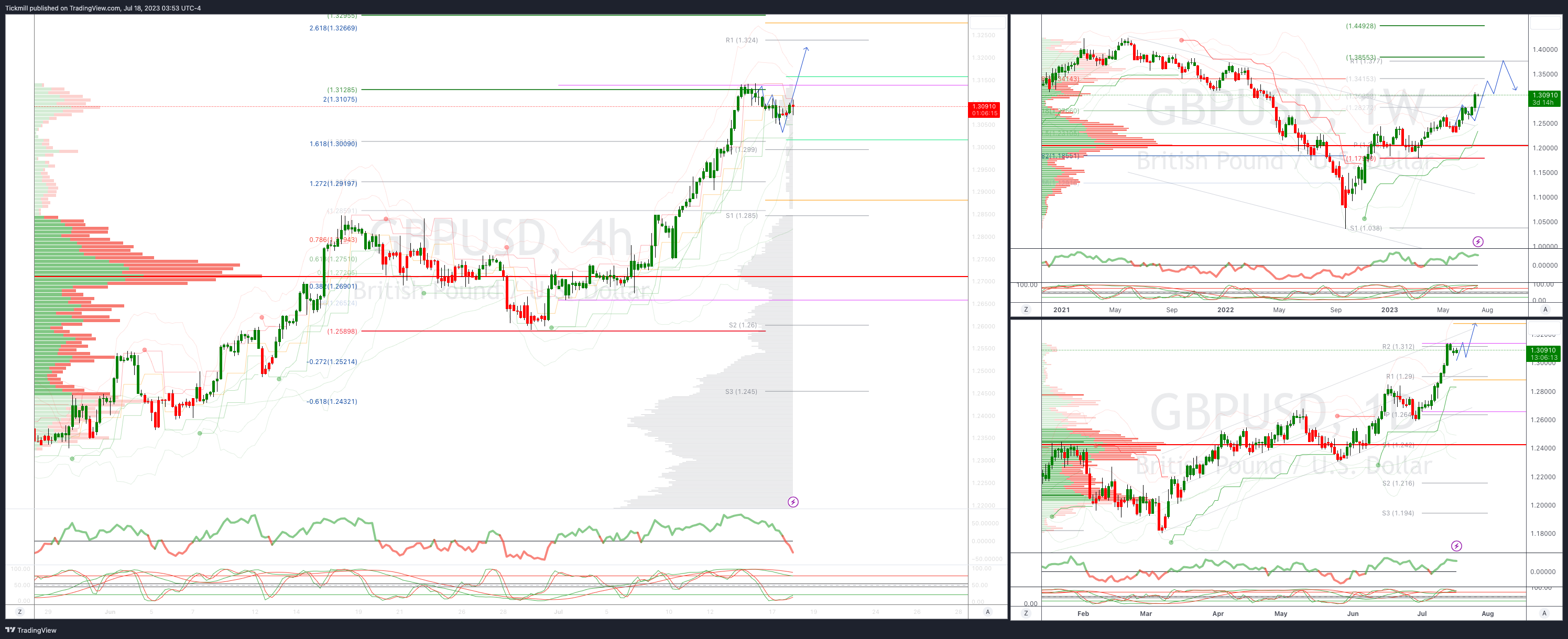

GBPUSD: Intraday Bullish Above Bearish Below 1.30

Below 1.2830 opens 1.2710

Primary support is 1.26

Primary objective 1.3850

20 Day VWAP bullish, 5 Day VWAP bullish

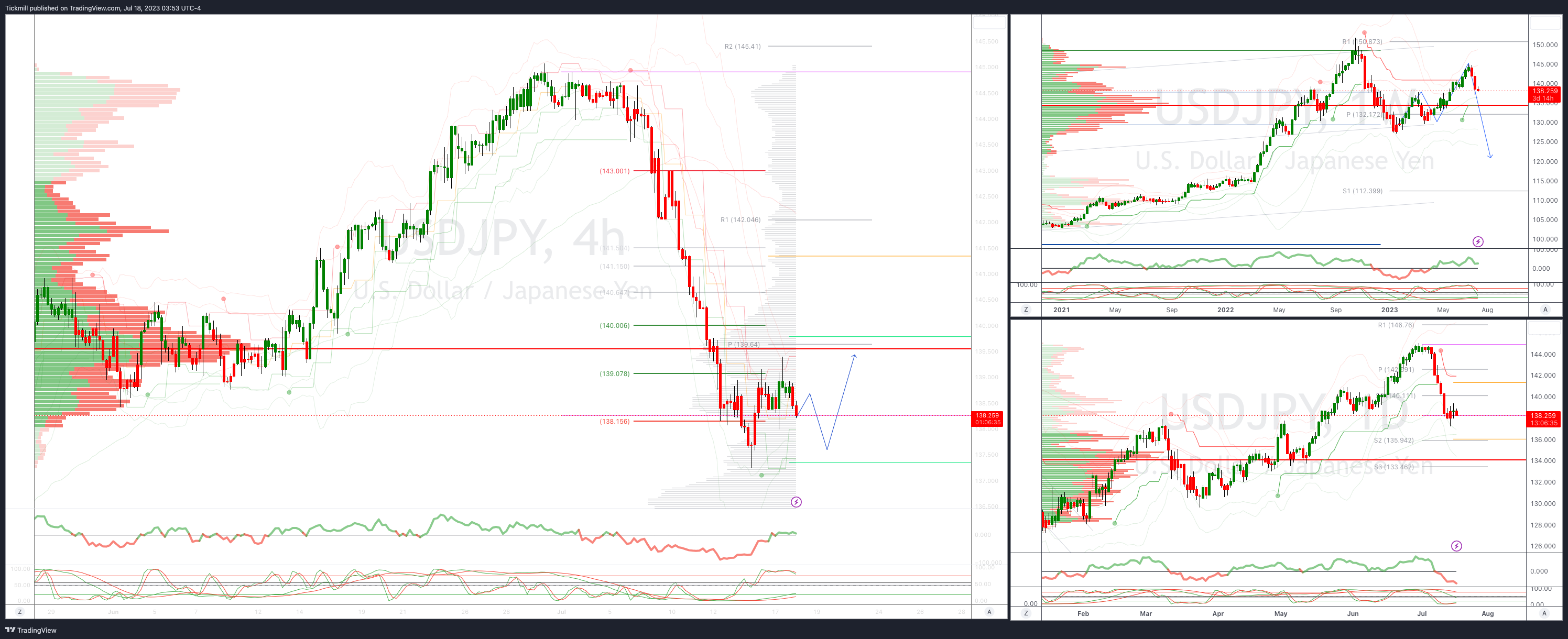

USDJPY Bullish Above Bearish Below 139.60

Above 139.60 opens 141.80

Primary resistance 142

Primary objective is 136.20

20 Day VWAP bullish, 5 Day VWAP bearish

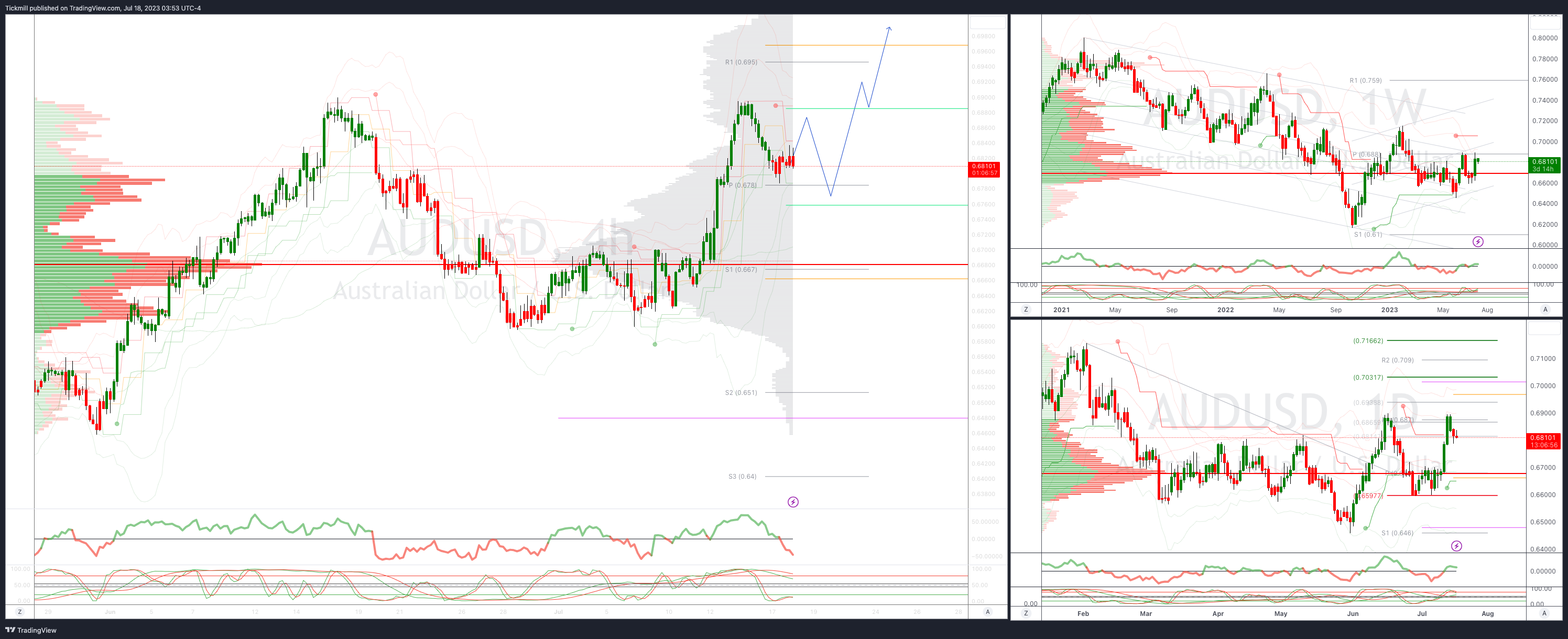

AUDUSD Intraday Bullish Above Bearish Below .6800

Below .6795 opens .6750

Primary support is .6448

Primary objective is .7000

20 Day VWAP bearish, 5 Day VWAP bullish

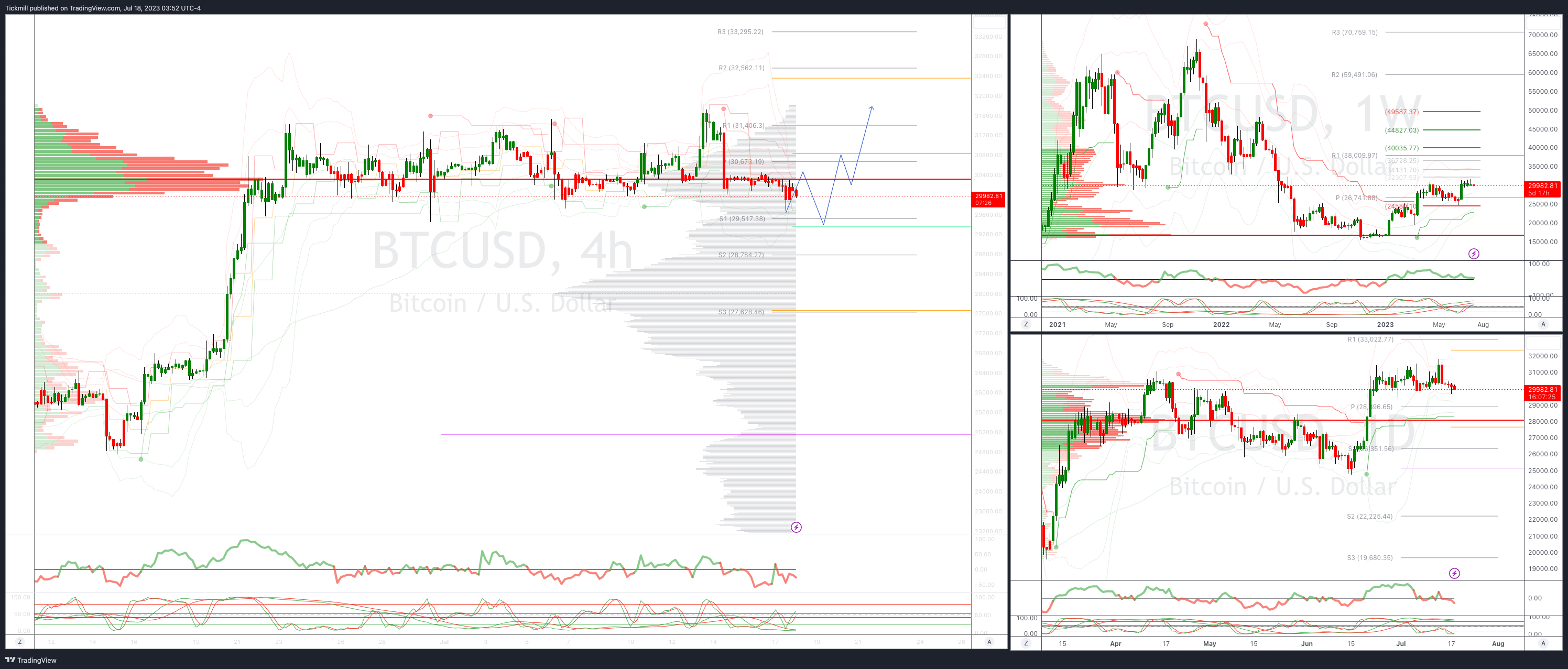

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28600

Primary support is 28400

Primary objective is 32750

20 Day VWAP bullish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!