Daily Market Outlook, January 4, 2022

Overnight Headlines

- Aus Manufacturing Growth Eases In December Amid Supply Constraints

- Japan’s Manufacturing Factory Activity Growth Softens In December

- China Faces $708 Billion Liquidity Demand On Early Lunar New Year

- China Banks May Boost Lending In Q1 Amid Slowing Economy - CSJ

- Australia Home Prices Boast Bumper 2021 As RBA Keeps Rates Low

- U.S. Sets New Global Daily Record Of Over 1 Million Virus Cases Monday

- White House Likely To Nominate Philip Jefferson For Federal Reserve Seat

- US Pres Biden Plans To Give Warren A Win With Fed Vice Chair Pick - Axios

- Japanese Yen Drops To Lowest Since January 2017 As U.S. Yields Soar

- BTC Celebrates Birthday On Dull Note, Analysts Expect Sideways Trading

- China, U.S. Bond Spread Narrows After U.S. Treasury Yields Jump Monday

- Oil Rallies Ahead Of Tuesday's OPEC+ Meeting To Discuss Oil Output Policy

- OPEC+ Expected To Stick With Planned Feb Output Increase, Sources Say

- Asian Stocks Track Wall Street Higher In Upbeat Start To 2022, China Falls

- CCP Sets Security Checks For Tech Companies Before Over Seas Listings

- Apple Becomes First $3tn Company After Boost From Pandemic Demand

- AT&T/Verizon Agree To New Delay Of 5G Rollout, Averting Safety Standoff

The Week Ahead

- The new year kicks off with a busy economic data calendar despite a holiday-shortened week in many financial centres. The main highlights include final December manufacturing and services PMIs in Europe and the U.S., the U.S. jobs report and Federal Reserve Dec 14-15 meeting minutes.

- Other key U.S. data includes factory orders, Markit PMIs, trade and ADP employment. Markets will also keep an eye on developments related to President Joe Biden's social spending bill

- In Europe, German industrial orders and unemployment, flash Eurozone December HICP, retail sales, consumer confidence and business sentiment indices will be watched. The UK has final December PMIs.

- PMIs are also due in Japan, along with household spending and Tokyo December CPI. In China, the private-sector Caixin manufacturing and services PMIs for December will be in focus, following the stronger-than-expected NBS gauges last week. FX reserves data is also due.

- There is no top-tier data scheduled in Australia and New Zealand. Canada has PMI, trade and employment data

CFTC Data

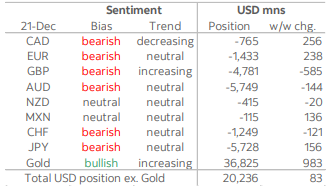

- Speculative aggregate positioning on the USD was left practically unchanged in the week through last Tuesday according to CFTC positioning data. This marks the third consecutive week where the USD net long has held close to the USD20bn mark, as investors added only USD83mn to their bullish aggregate bet on the dollar—after a USD113mn move against it the prior week.

- The GBP short saw the largest week-on-week change among the currencies that we cover with a USD585mn bet against it that takes the net short to USD4.8bn. The data period includes the BoE meeting on December 16 where the bank surprised economists and markets to a lesser degree with a 15bps hike. With markets already pricing in a speedy rate-hiking cycle, speculators may have little additional motivation to hold a sizeable bullish position on the GBP. Gross longs were reduced by 6.9k contracts to their lowest level since early-2012 while gross shorts held steady around a 2-yr high. The EUR short was reduced by USD238mn to USD1.4bn amid the ECB’s policy decision on the 16th.

- Investors trimmed the CAD net short by USD256mn to USD765mn in the second largest weekly adjustment. Speculators added to both longs and shorts, with total bearish bets at their highest since May 2020 in a week through which the CAD underperformed all the other currencies covered in this report with a 0.4% decline. The JPY, which followed the CAD at the bottom of the rankings with a 0.3% drop, saw a minor reduction of USD156mn in its net short to USD5.7bn.

- The AUD short rose by USD144mn to take the top spot among the bearish positions in this report at USD5.7bn (just slightly larger than the JPY short) as bearish investor sentiment on the Aussie remains near its record highs from October. The NZD position was left practically intact at USD415mn with a USD20mn move against it.

- Despite leading the majors over the period with a 2% gain, the MXN saw its bearish speculative position trimmed by only USD136mn to USD115mn i.e. practically neutral. The peso position is now the least bearish among those covered in this report, but overall participation has markedly declined in recent weeks ahead of year-end with short contracts on the MXN falling by 110k and long contracts falling by 56k since lateNovember.

Technical & Trade Views

EURUSD Bias: Bearish below 1.15 Bullish above

- Bargain hunting at familiar levels, as range holds for now

- +0.1% amid modest bargain hunting into the Monday's 0.6% fall

- OPEC+ expected to deliver planned February oil output increase

- Omicron appears to have a short lived economic impact

- Charts, 21 day Bolli bands flat line, 5, 10 & 21 day moving averages coil

- Momentum studies crest - neutral setup suggest further consolidation

- 1.1245-1.1368 21 day Bollinger bands continue to define the broad range

- 1.1293 Asian low and Europe's 1.1366 high initial support, resistance

GBPUSD Bias: Bearish below 1.36 Bullish above.

- Support holds, but under pressure – positive setup

- -0.1% at the base of a 1.3467-1.3483 range - busy once Asia fully opened

- Omicron surge and new restrictions hit high street retail

- Despite Monday's 0.3% dip - 5, 10 & 21 day moving averages plus climb

- 21 day Bollinger bands head higher, while momentum studies conflict

- Net positive setup targets a test of 1.3576, 61.8% of October-December fall

- Close below 1.3447 10 DMA, a base Monday needed to undermine topside bias

- NY 1.3431 low and Asia's 1.3483 high initial support and resistance

USDJPY Bias: Bullish above 112.50 Bearish below

- USD/JPY clears historical hurdle, sights 116.00 barrier

- USD/JPY clears November peak, marking new 5-year high 115.82

- Rally extends 0.4% along Bollinger uptrend channel

- Clears path toward psych barrier 116.00; stop loss orders eyed

- US Treasury yields stay aloft after Mon surge; 10y 1.628%

- Risk appetite wobbly as Nikkei +1.4% but S&P futures struggle

- US manufacturing PMI due later expected to ebb to 60.1 from 61.1

AUDUSD Bias: Bearish below 0.7250 Bullish above

- Grinds further toward technical crux point 0.7238

- AUD/USD grinds higher, adding to recovery from close 0.7191

- Last at 0.7209, rebound off 21 DMA appears successful so far

- But key technical pivot at 0.7238 could deflect the rally

- Entrance of Bollinger uptrend channel meets Ichimoku Cloud there

- If that barrier is overcome, 100 DMA at 0.7287 at risk

- Risk-on strong with ASX +1.9%, S&P +0.2% even as US yields rise

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!

.png)