Daily Market Outlook, January 25, 2024

Munnelly’s Market Minute…“Tesla Earnings Disappoint, ECB On Deck”

Asian markets saw modest gains, although the overall positive momentum was limited due to the impact of various earnings reports and the recent increase in global yields, which partially offset the excitement over Chinese stimulus measures. The Nikkei 225 eventually turned positive but lagged behind other regional markets, briefly falling below the 36K handle. Both the Hang Seng and Shanghai Comp received a boost, with the latter outperforming as mainland investors reacted to China's latest support measures, including a 50 basis point RRR cut that will release CNY 1 trillion of funds.

The focus now shifts to the policy meeting of the European Central Bank, particularly President Christine Lagarde's press conference following the meeting. Minutes from the December meeting revealed the policymakers' determination to resist the aggressive market expectations for interest rate cuts, and there is anticipation for questions regarding the timing of such actions.The Governing Council is anticipated to maintain the current policy at today's meeting, marking the third consecutive meeting without changes. However, market participants will closely monitor the post-meeting statement and press conference for any indications regarding potential rate cuts in the coming year. Despite futures contracts pricing in approximately 135 basis points of cuts by the end of the year, starting as early as April, statements from various ECB officials, including President Lagarde, suggest that rate cuts are unlikely until the summer months. The central bank is expected to emphasize its data-dependent approach, with a specific focus on services and wage inflation.

Stateside, Netflix saw an 11% surge in its stock due to exceptional subscriber growth, while IBM's shares rose over 8% after the company's forecasted earnings surpassed expectations. On the other hand, Tesla's stock declined by 6% after falling short of forecasts. Tesla's shares dropped in extended trading after the company reported a fourth-quarter gross margin of 17.6%, down from 23.8% a year earlier and below analysts' average estimate of 18.3%. The Q4 revenue increased by 3% to $25.17 billion, falling short of analysts' average estimate of $25.62 billion. The company posted an adjusted EPS of 71 cents, lower than the estimated 74 cents. Tesla's shares had more than doubled in 2023.Thursday will also see the release of U.S. GDP data, the initial estimate for U.S. GDP in Q4 is anticipated to reveal a 2.0% annualized expansion, a decrease from the 4.9% recorded in Q3.

Overnight Newswire Updates of Note

Fed Raises Rate On Emergency Loan Program To Stop Arbitrage

US Navy Escorts Cargo Ships To Safety After Houthi Missile Attack

UK PM Offers To Sacrifice Brexit Freedoms To Re-Establish Govt In N.Ireland

Australian Government Says Income Tax Rejig Won’t Add To Inflation

Tesla Projects Slower Growth In 2024 As EV Demand Softens

IBM Sees Strong 2024 Free Cash Flow, Plans Job Cuts

FAA Halts Boeing 737 Max Production Expansion, Clears Path To Unground Max 9

Microsoft Closes At Record, Ends Just Shy Of $3 Tln Value

Skydance Media Explores Acquiring All Of Paramount Global, Sources Say

World’s No. 2 Memory Chip Maker SK Hynix Reports Surprise Profit

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0825 (1.1BLN), 1.0850 (817M), 1.0885 (510M), 1.0900-10 (794M)

1.0925 (289M), 1.0945-50 (1.1BLN), 1.0975-80 (1.5BLN) 1.1000-10 (1.8BLN)

USD/CHF: 0.8560 (231M), 0.8655 (200M)

GBP/USD: 1.2815 (568M), 1.2850 (250M)

EUR/GBP: 0.8500 (300M), 0.8650 (200M)

USD/JPY: 146.55 (420M), 147.55-65 (795M), 147.95-148.05 (817M)

EUR/JPY: 157.75 (583M), 158.75 (467M), 161.30 (769M), 161.45-50 (573M)

Long term low FX option implied volatility seems justified given low realized volatility, but the potential reward of owning options from lower levels is attracting buyers. Central bank policy decisions, data releases, and upcoming elections, particularly in the US in November, have the potential to reignite FX volatility. The European Central Bank is expected to keep rates on hold at 4.0%, which shouldn't impact EUR/USD. Increased overnight expiry EUR/USD implied volatility is more likely to result from a broader pick-up in shorter-dated options following Tuesday's EUR/USD slump and recovery from new 2024 lows. Shorter-dated options are expected to benefit from any increased FX volatility over Friday's US PCE data and central bank announcements from the US and UK, all included within a one-week expiry from Thursday.

CFTC Data As Of 12/01/24

USD bearish decreasing -9,298

CAD bearish increasing -992

EUR bullish decreasing 14,150

GBP bullish increasing 2,443

AUD bearish increasing -3,151

NZD neutral neutral -177

MXN bullish neutral 2,370

CHF bearish neutral -542

JPY bearish neutral -4,803

Technical & Trade Views

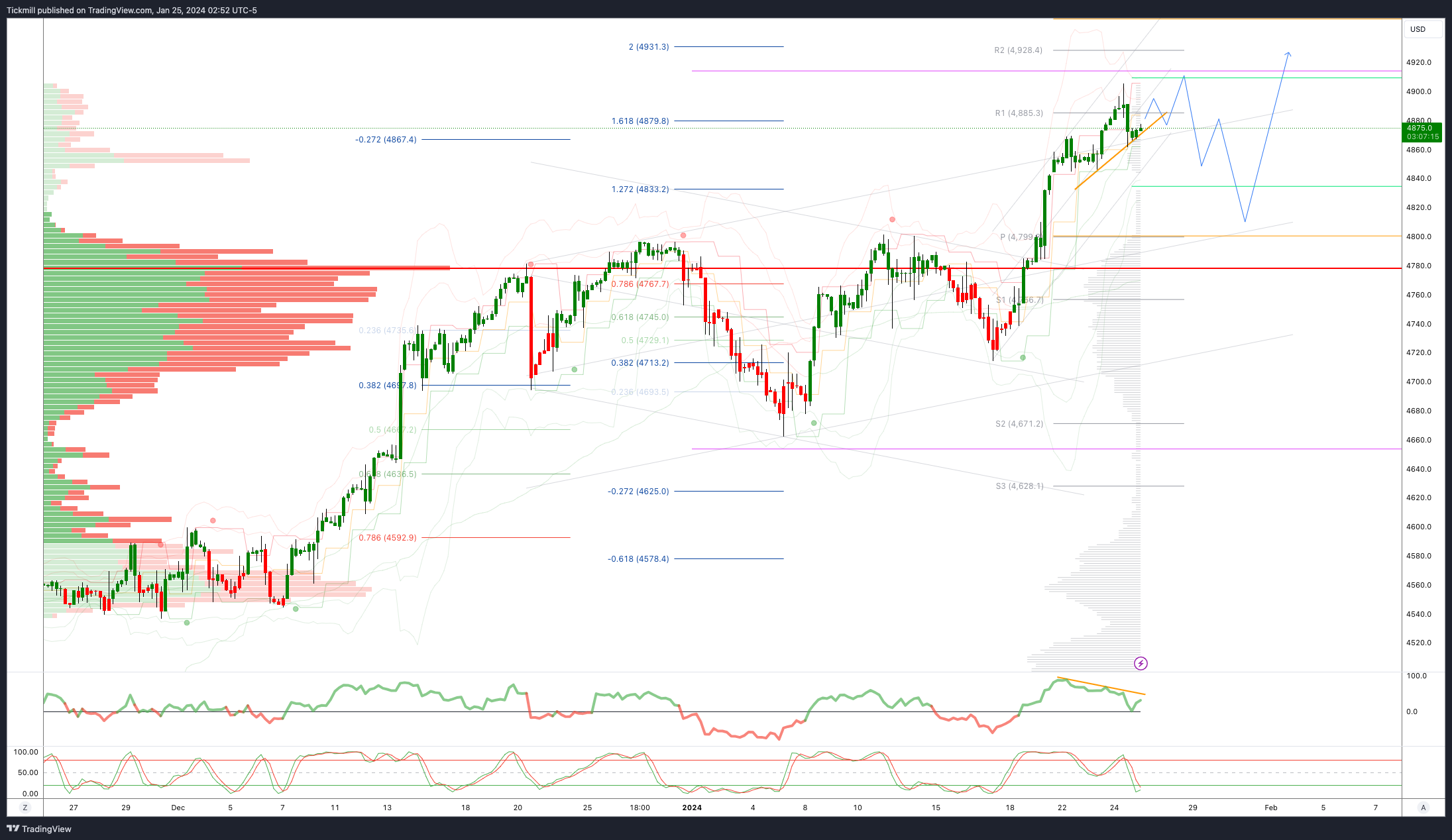

SP500 Bullish Above Bearish Below 4850

Daily VWAP bullish

Weekly VWAP bullish

Below 4800 opens 4780

Primary support 4700

EURUSD Bullish Above Bearish Below 1.0930

Daily VWAP bullish

Weekly VWAP bearish

Above 1.10950 opens 1.10

Primary resistance 1.10

Primary objective is 1.0730

GBPUSD Bullish Above Bearish Below 1.2750

Daily VWAP bullish

Weekly VWAP bearish

Above 1.28 opens 1.2870

Primary resistance is 1.2785

Primary objective 1.2570

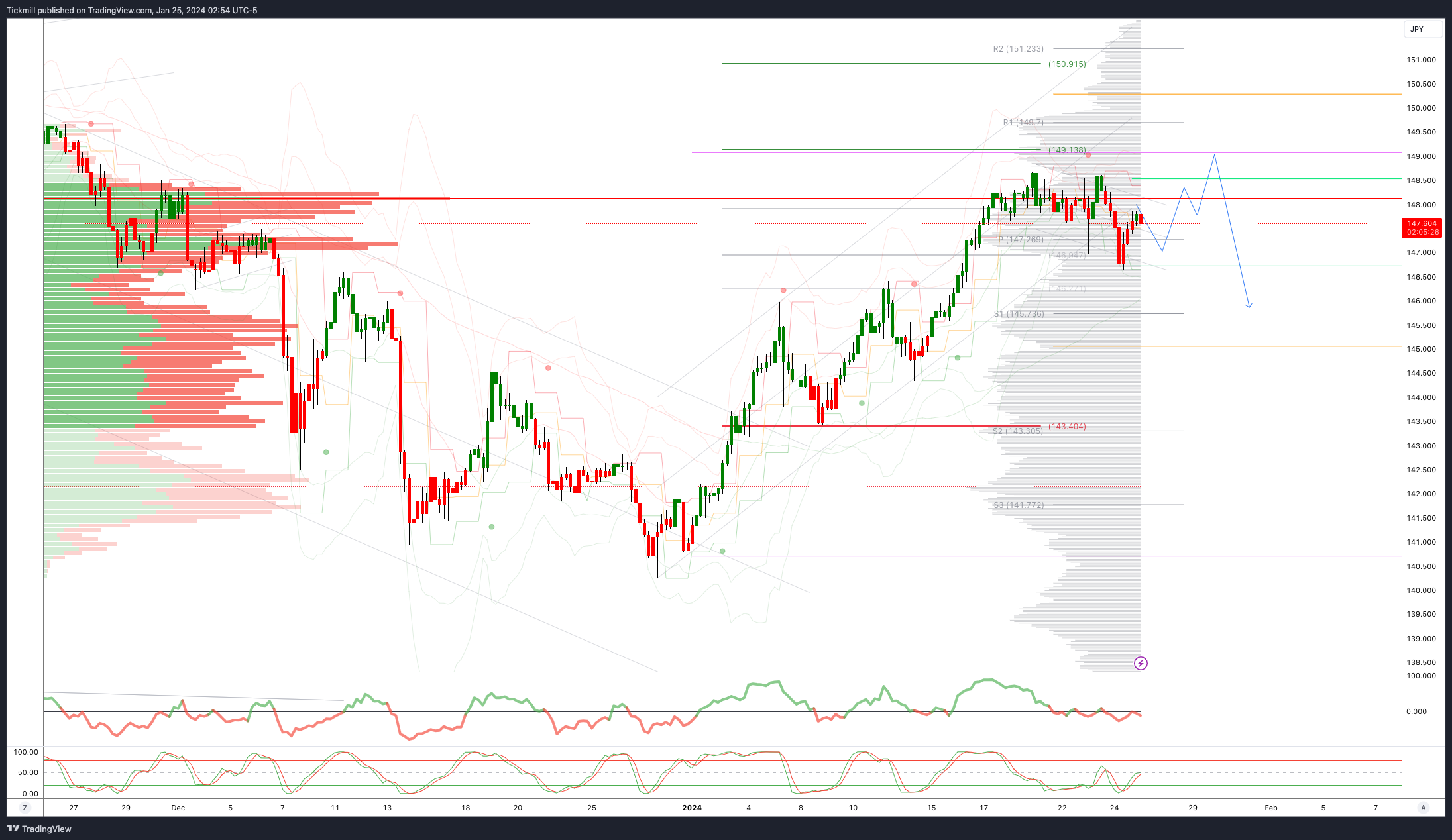

USDJPY Bullish Above Bearish Below 146.40

Daily VWAP bullish

Weekly VWAP bullish

Below 146 opens 145.50

Primary support 143.50

Primary objective is 149

AUDUSD Bullish Above Bearish Below .6650

Daily VWAP bullish

Weekly VWAP bearish

Above .6680 opens .6550

Primary support .6525

Primary objective is .6933

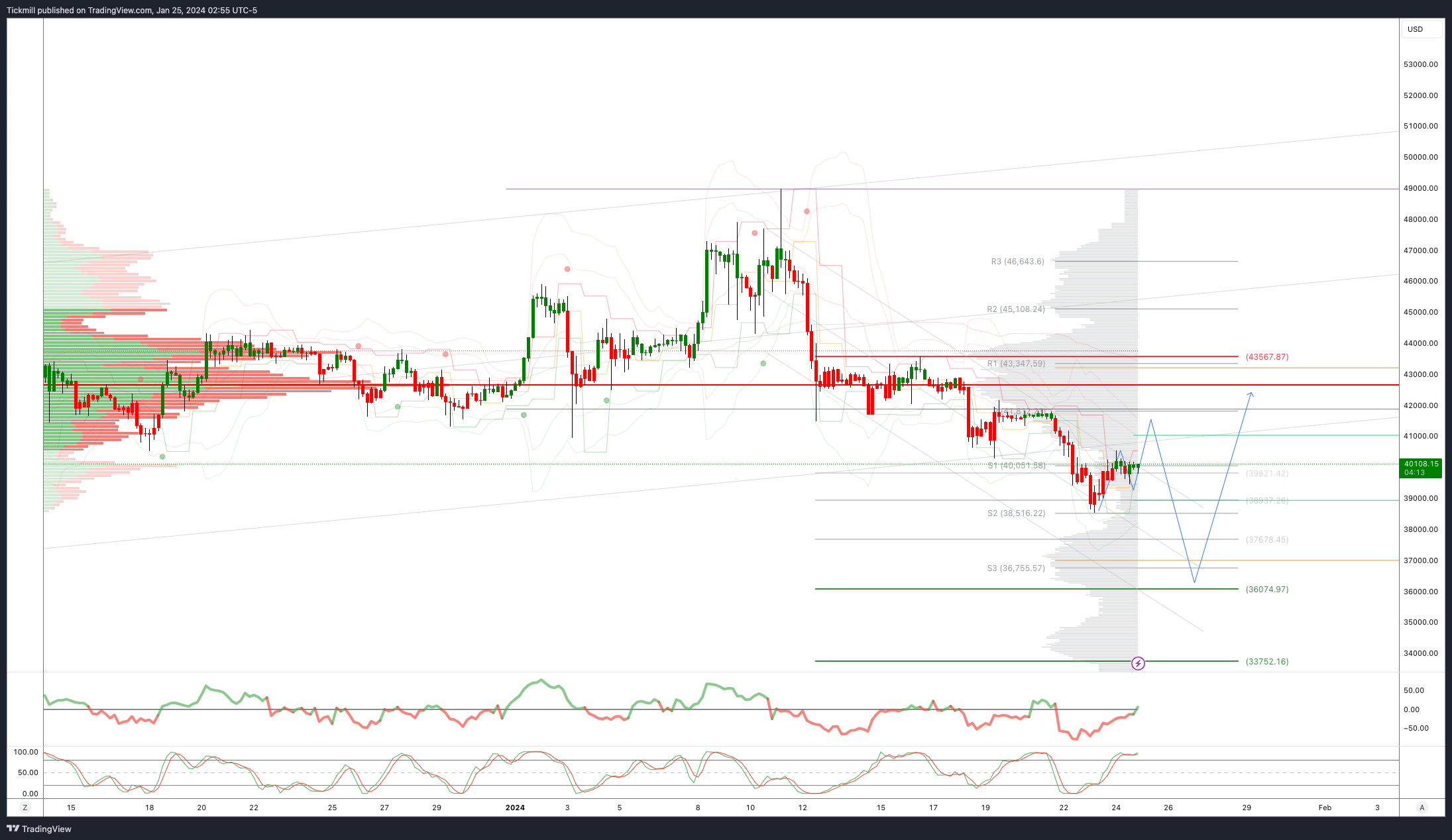

BTCUSD Bullish Above Bearish below 43600

Daily VWAP bearish

Weekly VWAP bearish

Above 43590 opens 46000

Primary support is 40000

Primary objective is 36097

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!