Daily Market Outlook, January 19, 2024

Munnelly’s Market Minute…“China Short Sales Ban Adds To Regional Concerns”

Asian stocks mainly gained momentum from the tech-driven advances on Wall Street, where sentiment was boosted by the lowest initial jobless claims since September 2022. Tech stocks were also lifted by TSMC's earnings, which drove the company's shares up by over 6% and supported other chipmakers like Samsung Electronics. The Nikkei 225 was supported and briefly surpassed 36K handle after Japanese CPI data continued to soften, and a source report indicated no pressure for the BoJ to rush towards the exit. On the other hand, the Hang Seng and Shanghai Comp were subdued due to concerns about the uneven recovery in the Chinese economy, and a restriction on short sales by China's largest brokerage failed to stimulate a recovery.

Earlier today, the UK's Office for National Statistics released data indicating a significant 3.2% month-on-month decline in retail sales volume for December. This marks the largest drop since January 2021 during the pandemic, following a 1.4% increase in November. The result fell below the consensus forecast of a 0.5% decrease. Both food and non-food store sales experienced declines of 3.1% and 3.9%, respectively, while non-store (primarily online) sales fell by 2.1%. The ONS attributed part of this weak performance to consumers advancing purchases to take advantage of November's Black Friday sales, with post-Christmas sales being subdued. For Q4 overall, retail sales fell by a less severe 0.9% quarter-on-quarter. Other major releases are absent in the UK for today, with market attention turning to next week's data, including flash PMI and GfK consumer confidence.

In the Eurozone, the spotlight is shifting to the ECB policy update scheduled for next Thursday, accompanied by Eurozone flash PMI and German IFO business surveys. Expectations lean toward no change in Eurozone interest rates for a third consecutive policy meeting. However, President Lagarde's comments on the interest rate outlook will be closely scrutinized, and recent remarks from her and Chief Economist Lane suggest the ECB might delay rate cuts until the summer. Lagarde is participating in a discussion on the global economic outlook today at the World Economic Forum in Davos, which appears to be the last ECB appearance before next week's policy update.

Sateside, key releases include the University of Michigan's consumer sentiment survey and existing home sales. Despite a robust improvement last month attributed to a better inflation outlook, headline consumer sentiment remains historically weak. The survey's inflation expectations metrics will be closely monitored alongside the headline index, with expectations of a partial correction to consumer sentiment this month.

Overnight Newswire Updates of Note

US Prepares Rule Forcing Banks To Tap Fed Discount Window

Congress Agrees Funding To Avert US Government Shutdown

US Press Ahead With Least Bad Option In Confronting Houthis

Houthis Fire Missiles At Another US-Owned Vessel In Red Sea

China’s Biggest Brokerage Limits Short Sales After Stock Rout

Japan’s Inflation Cools For Second Month Ahead Of BoJ Meet

Chancellor Hunt Gives Strongest Hint Will Cut Taxes In Budget

German Budget Officials Approve New Borrowing Of EUR39Bln

Bitcoin Retreats To One-Month Low, ETF-Led Enthusiasm Fades

EU Commission Set To Block Amazon iRobot $1.7Bln Acquisition

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0800 (2.5BLN), 1.0850 (1.1BLN), 1.0880-90 (700M)

1.0920 (408M), 1.0950 (452M)

USD/CHF: 0.8700 (346M)45 (306M)

GBP/USD: 1.2600 (226M), 1.2650 (1.4BLN). EUR/GBP: 0.8575-85 (350M)

AUD/USD: 0.6600 (834M), 0.6650 (585M). AUD/NZD: 1.0850 (701M)

USD/CAD: 1.3335 (1.9BLN), 1.3430-40 (639M), 1.3470 (294M)

USD/JPY: 147.00 (605M), 147.45 (563M), 147.90-148.00 (1.5BLN), 149.00 (390M)

EUR/NOK: 11.40 (329M), 11.5700 (871M)

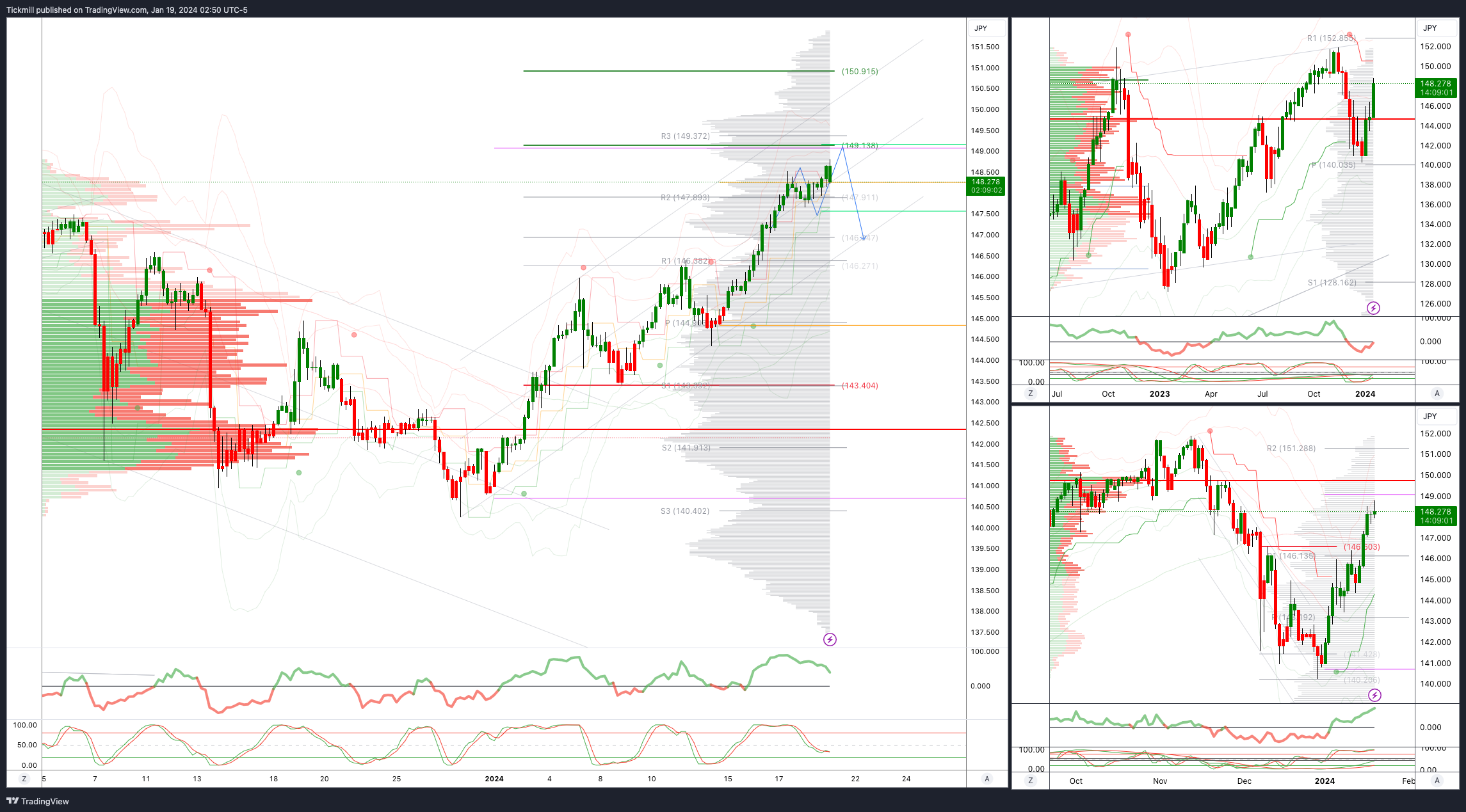

The potential for BOJ FX intervention has significantly increased. The trade-weighted yen reached a historic low at the end of December, and there has been a substantial decline in its value in January. USD/JPY has surged by over 800 points, approaching the high of 2023 by less than 400 points. The yen has experienced a sharp drop against GBP, EUR, and AUD. It has also weakened against the historically weak TRY and the very weak INR. The depreciation of the yen effectively acts as a form of monetary policy easing, which supports inflation. Selling JPY is seen as the most effective way to finance carry trades.

CFTC Data As Of 12/01/24

USD bearish increasing 12,192

CAD bearish decreasing -551

EUR bullish neutral 16,243

GBP bullish increasing 1,647

AUD bearish decreasing -2,158

NZD neutral neutral -110

MXN bullish neutral 2,606

CHF bearish neutral -644

JPY bearish neutral -4,841

Technical & Trade Views

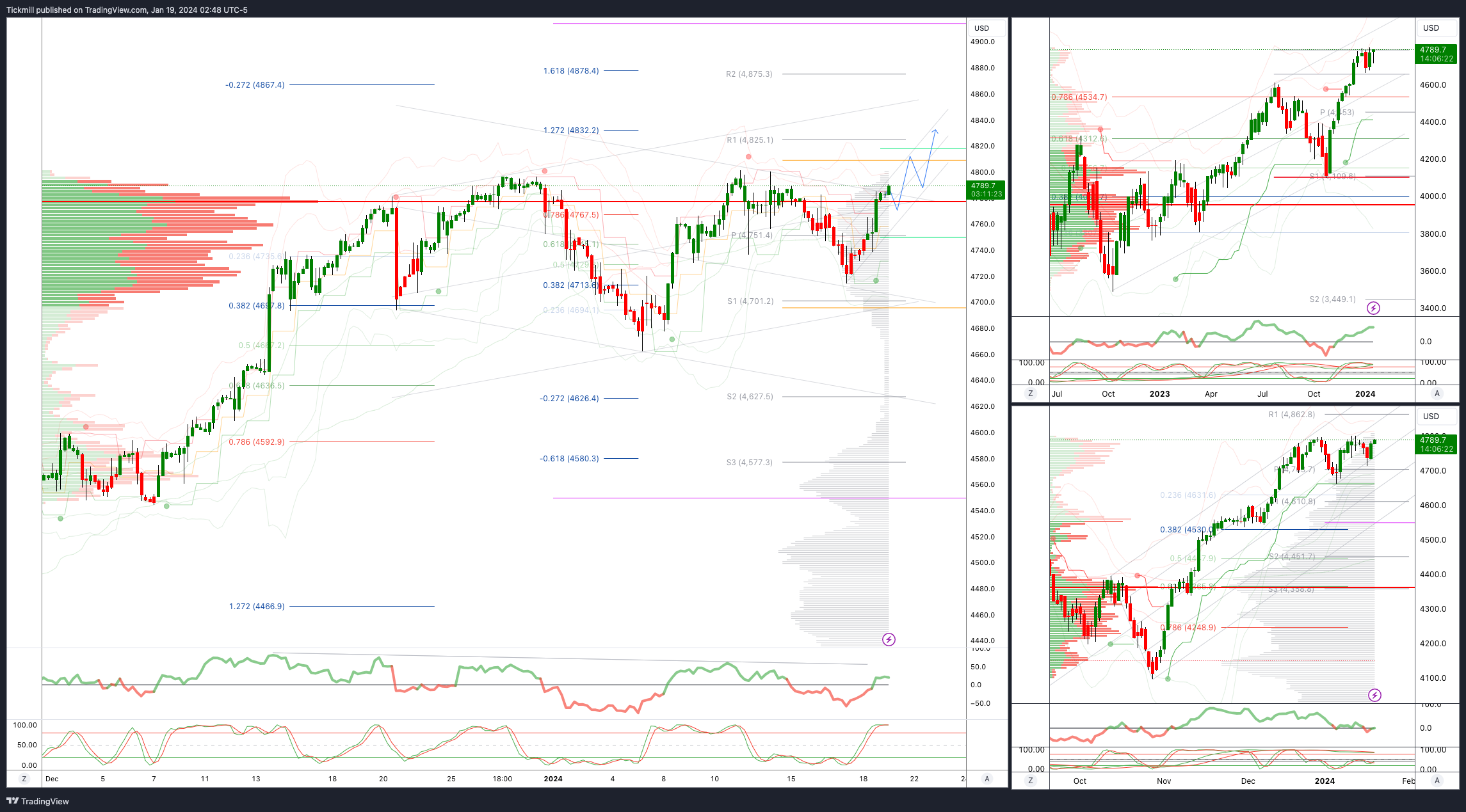

SP500 Bullish Above Bearish Below 4750

Daily VWAP bullish

Weekly VWAP bullish

Below 4700 opens 4675

Primary support 4670

Primary objective is 4830

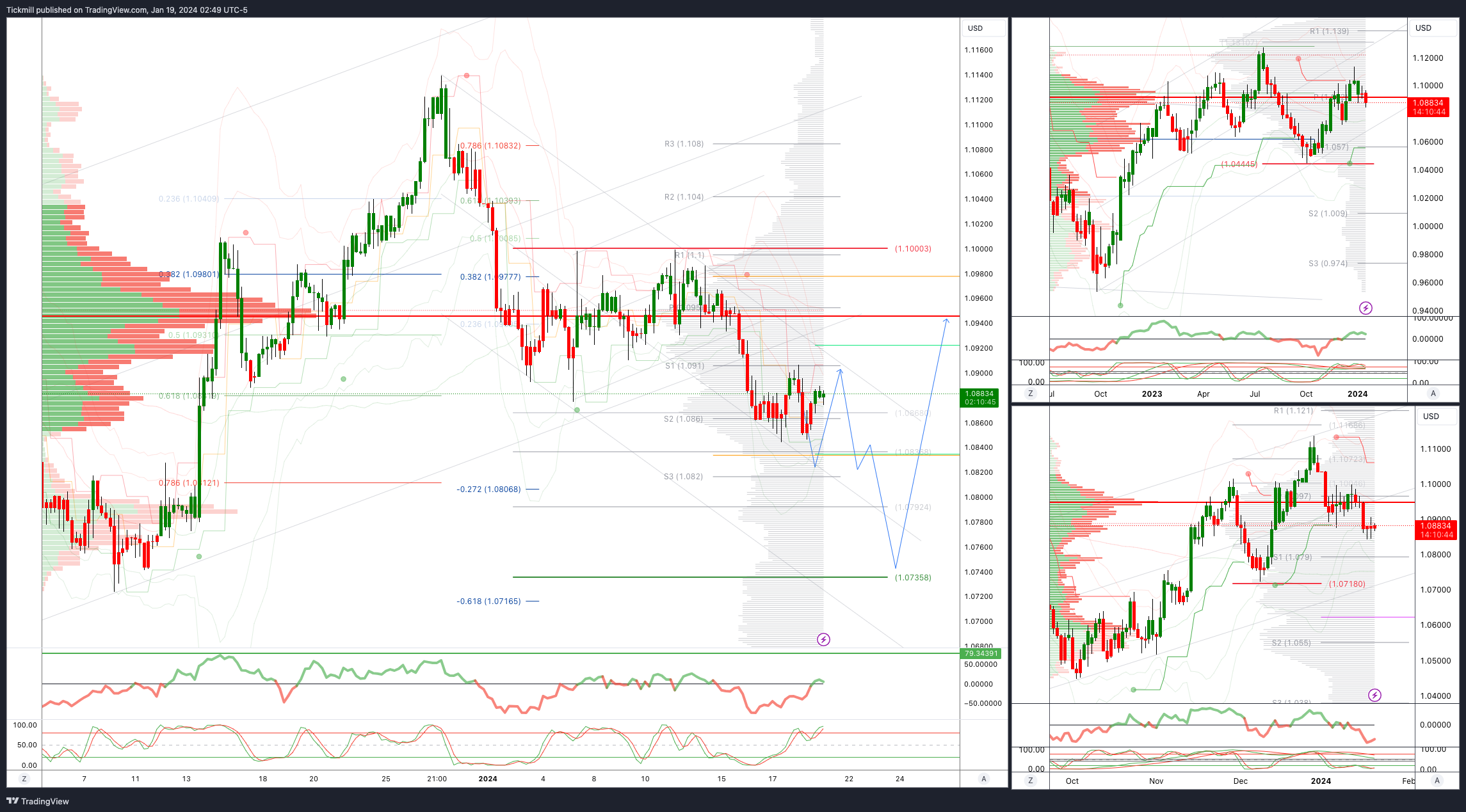

EURUSD Bullish Above Bearish Below 1.0930

Daily VWAP bearish

Weekly VWAP bearish

Above 1.10950 opens 1.10

Primary resistance 1.10

Primary objective is 1.0730

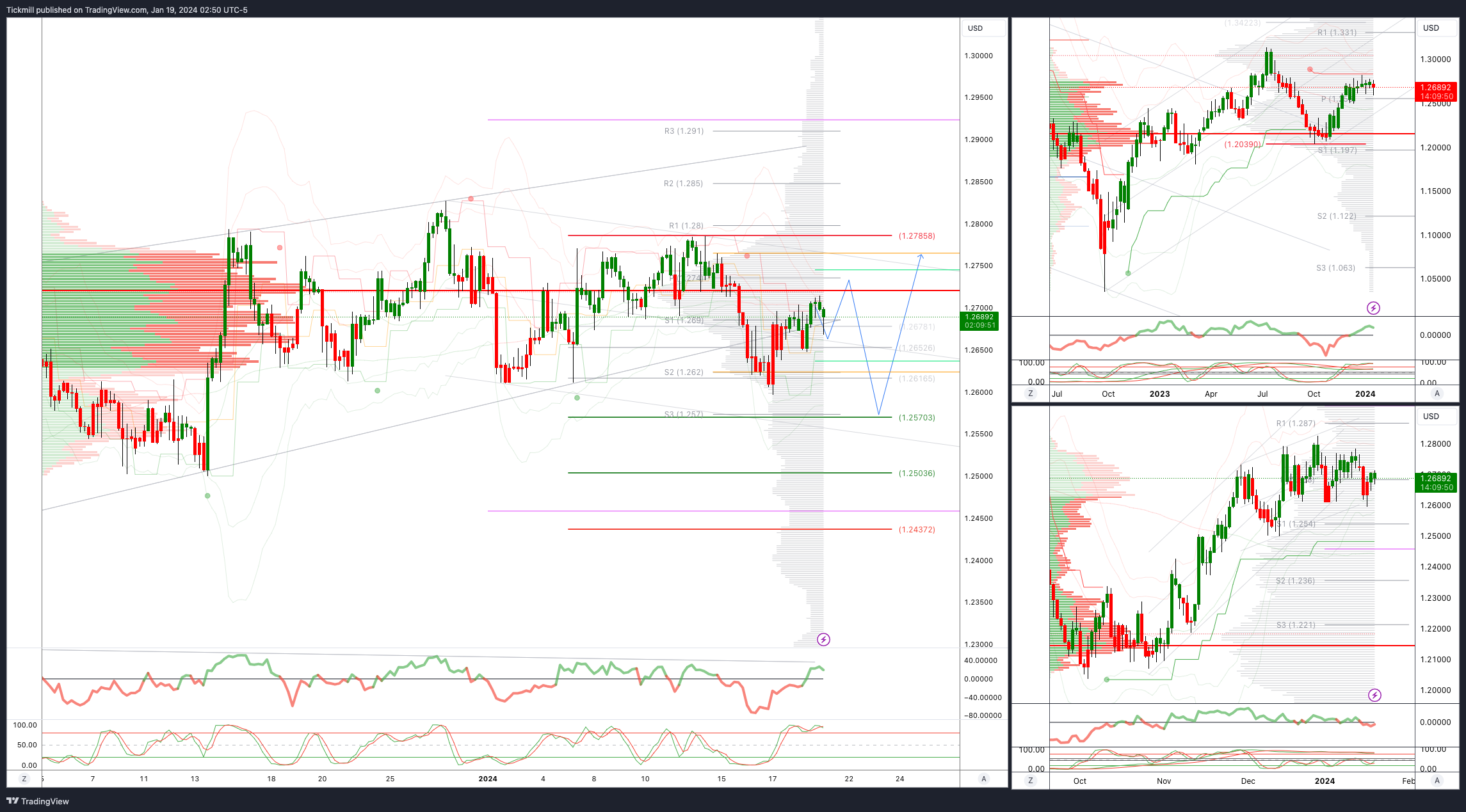

GBPUSD Bullish Above Bearish Below 1.2750

Daily VWAP bearish

Weekly VWAP bullish

Above 1.28 opens 1.2870

Primary resistance is 1.2785

Primary objective 1.2570

USDJPY Bullish Above Bearish Below 146.40

Daily VWAP bullish

Weekly VWAP bullish

Below 146 opens 145.50

Primary support 143.50

Primary objective is 149

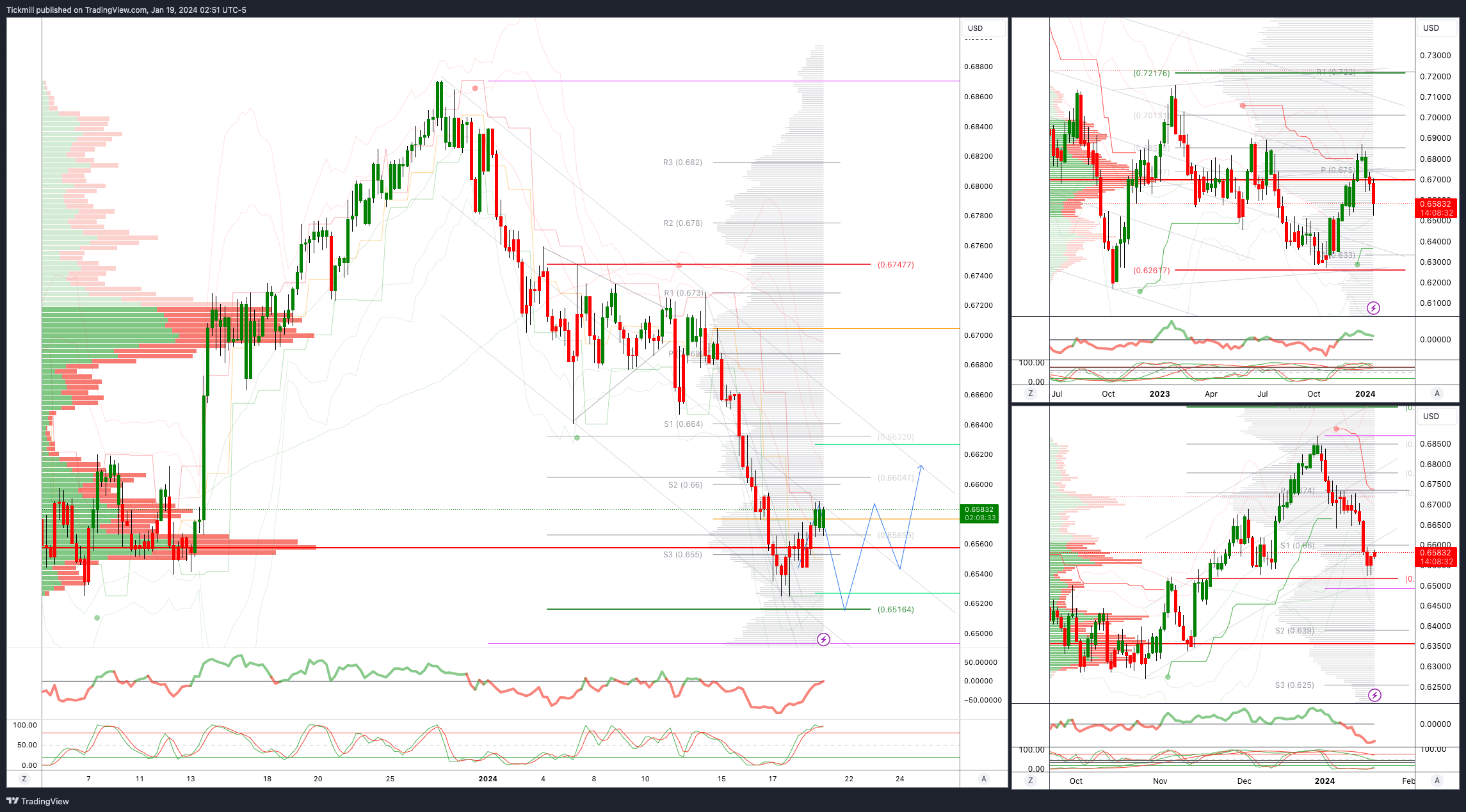

AUDUSD Bullish Above Bearish Below .6650

Daily VWAP bearish

Weekly VWAP bearish

Above .6680 opens .6550

Primary support .6525

Primary objective is .6933

BTCUSD Bullish Above Bearish below 44000

Daily VWAP bearish

Weekly VWAP bullish

Below 40000 opens 39000

Primary support is 40000

Primary objective is 50000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!