Daily Market Outlook, February 15, 2021

Asian equity markets started the week on the front foot, with the Nikkei 225 gaining nearly 2% and closing above 30,000 for the first time since 1990. European stocks are poised to open higher. The continuation of the positive risk tone reflects falling global Covid infections and hopes of economic recovery fuelled by vaccines and policy support including the potential $1.9 trillion fiscal stimulus package in the US.

In the UK, the target to vaccinate 15 million in the top four JCVI priority groups has been met. Attention now shifts to vaccinating a further 17 million in the remaining priority groups, including the over-50s, by the end of April. PM Boris Johnson is expected to provide a roadmap out of lockdown on 22 February.

It is a quiet start to the week in terms of scheduled economic data and events. Backward-looking Eurozone industrial production figures this morning are likely to show a fall of about 1.2%, the first decline since April, driven by some volatile national data. Still, output in the sector is expected to be only slightly lower than a year earlier, as the broad trend has been improving activity since last spring’s lows.

Looking ahead, tomorrow’s German ZEW and Friday’s Eurozone ‘flash’ surveys will provide timelier updates for economic sentiment and activity in the single currency area. The ZEW survey is expected to confirm current economic challenges relating to Covid containment measures, but greater confidence for a recovery later in the year. That is also likely to be reflected in the PMI surveys, which currently show a two-speed economy, with services activity bearing the brunt of lockdowns currently in place across the continent. Markets will also be focused on the account of the ECB’s January monetary policy meeting, which will be published on Thursday.

Outside the Eurozone, February ‘flash’ PMI reports will also be released for the US and UK on Friday, while UK CPI is due midweek. There will also be particular attention on US and UK retail sales figures for January, due on Wednesday and Friday, respectively. The extent to which US consumer spending holds up will be closely watched, given last week’s unexpected and second consecutive monthly fall in consumer sentiment as well as mixed signals about the labour market. The minutes of last month’s FOMC meeting will be published on Wednesday.

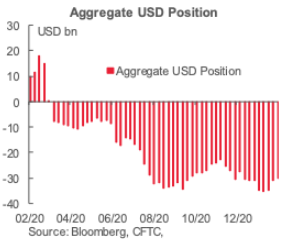

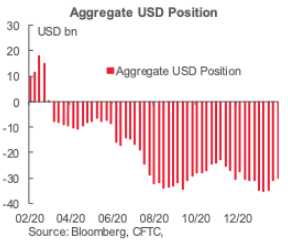

CFTC DATA

Investors continued to trim their net USD short for a third consecutive week, although with a significantly smaller decline this week of USD450mn compared to the previous drop of nearly USD4bn. At USD30.4bn the net USD short is still around 15% below its peak in dollar terms in mid-January.

The week’s data shows a combination of bearish and bullish bets with no particular narrative behind the change in the overall USD position, if only possibly a move away from haven currencies, the CHF and the JPY which may also be reacting to increasing long-term US Treasury yields, as was Gold, which saw a USD1bn decline in its net long.

The net JPY long declined by USD1.18bn upon a large reduction in gross longs, falling to their lowest point in terms of contracts since late-Nov at 60.7k, down from 69.9k the previous week; gross short contracts also rose to their highest point since late-Oct. The weekly position change in CHF mostly reflected a reversal of the gross short increase the previous week—with the net CHF long holding relatively steady since last-Aug.

The GBP position saw the largest week-on-week bullish bet with an increase of USD1bn taking the pound’s net long to its highest mark since Feb 2020. On Tuesday, the GBP broke past the 1.38 mark to record a new high since April 2019 with markets favouring the currency amid a reduction in BoE negative rate bets and a quick rate of vaccinations in the UK. The Eurozone has lagged its neighbor in its own vaccinations drive but that was not enough to extend the large decline in the net EUR long (USD4.5bn) two weeks ago as investors added a net of USD616mn to their bullish EUR position in the week to Tuesday.

Net CAD longs fell back below the USD1bn mark with a half a billion week-on week decline following from a decline in gross longs and a (twice as large) increase in gross shorts. On a contract basis, net bullish sentiment in the CAD is at its lowest since flipping from a net short in mid-Dec—with USDCAD holding in a relatively narrow ~1.26-1.2950 range since then.

Elsewhere, positioning was practically unchanged with speculators bringing the AUD’s and the MXN’s closer to neutral with a +USD95mn and –USD34mn change, respectively, while the NZD net long was left flat with only a USD2mn increase

G10 FX Options Expiries for 10AM New York Cut

EUR/USD: $1.2045-55(E528mln), $1.2300(E931mln)

EUR/GBP: Gbp0.8725-30(E765mln-E615mln of EUR puts), Gbp0.8800(E984mln-EUR puts)

AUD/USD: $0.7730(A$799mln-AUD puts), $0.7850(A$609mln-AUD puts)

----------------

Larger Option Pipeline

EUR/USD: Feb16 $1.1940-50(E1.2bln), $1.2000(E1.25bln), $1.2200-05(E1.5bln); Feb17 $1.2120-35(E1.5bln), $1.2155-70(E1.1bln); Feb18 $1.2000-10(E1.8bln), $1.2200(E1.3bln)

AUD/USD: Feb17 $0.7615-25(A$1.8bln); Feb18 $0.7400(A$1.2bln), $0.7555-75(A$1.26ln)

USD/CNY: Feb18 Cny6.35($1.8bln), Cny6.45($1.1bln), Cny6.50($1.2bln);

Technical & Trade Views

EURUSD Bias: Bullish above 1.2050 targeting 1.2350

EURUSD From a technical and trading perspective, the closing breach of 1.21 and the descending trendline is a bullish development opening a retest of prior highs at 1.2350, only a move back through 1.2040 would suggest further consolidation

Flow reports suggest topside offers into the 1.2150 area and then after a brief weak period increasing into the 1.2180-1.2220 level with weak stops above the level and increasing on any push above the 1.2250 level with possible strong offers into the 1.2300 level Downside bids light through to the 1.2080 area and possible weak stops appearing through the level and opening the chance of a test to the 1.2000 level in the short term with stronger bids into the 1.1950.

GBPUSD Bias: Bullish above 1.3750 targeting 1.40

GBPUSD From a technical and trading perspective, look for profit taking pullback to test 1.3750 as support as this level attracts fresh demand bulls will target 1.40 next.

Flow reports suggest weak stops possible just above the highs however, congestion likely to continue through to the 1.4000 area with 2018 ranges playing out, a push through is likely to see option plays and strong resistance likely psychological levels will be concentrated with congestion through to the 1.4100 levels, downside bids light through to the 1.3800 area with weak stops on a move through the level and very little support through to the 1.3700 area and stronger bids then start to appear.

USDJPY Bias: Bullish above 104.50 targeting 107

USDJPY From a technical and trading perspective, 105.50 target achieved anticipate a profit taking pullback to develop ahead of 106 to retest bids back to 104.50. As 104.50 supports there is potential for a further squeeze higher to test offers towards 107. A loss of 103.50 would negate further upside and suggest a resumption of trend

Flow reports suggest strong bids are likely to appear on any test of the 103.50 area and continuing through to the 103.00 level, Topside offers light through the 105.00 level and increasing into the 105.40-60 area however, strong resistance remains in the 105.80-106.00 level with congestion likely to continue through the 106.70-107.00 areas

AUDUSD Bias: Bullish above .7560 bullish targeting .8000

AUDUSD From a technical and trading perspective, as the major trendline support at .7560 now acts as support, look for target wave 5 upside objective towards .8000. A closing breach of .7730 of the internal descending trendline will encourage the bullish thesis.

Flow reports suggest offers through the 0.7800 area and then likely to see increasing offers through to the 0.7820 area before congestive offers then start kicking in on any move through the area into the 0.7850-60 areas. Downside bids light back through the 77 cents level and weak stops on a dip through the 0.7680 area and limited bids through to the 0.7620 level and increasing through to the 0.7580 level before stops appear.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!