Daily Market Outlook, February 1, 2021

Global equities fell more than 3% last week, the most since October. In Asia overnight, stocks rebounded and futures markets point to rises in early European trading. At the weekend, China’s official manufacturing and services PMIs fell more than expected in January to 51.3 and 52.4, respectively. The alternative Caixin manufacturing PMI also fell to 51.5. The economy continued to grow, but the figures indicate some loss of momentum, particularly in services affected by containment measures.

This morning’s final manufacturing PMIs are expected to reaffirm the relative resilience of the sector compared with services. Both the UK and Eurozone indices are forecast to be unrevised from their preliminary January ‘flash’ estimates of 52.9 and 54.7, respectively, hence remaining above the key 50 level separating expansion and contraction. Admittedly, the UK manufacturing PMI fell sharply from 57.5 in December, partly reflecting supply-chain difficulties.

The broader picture is that more stringent or extended lockdowns have resulted in weaker services activity in the New Year (the final services PMIs for January will be released on Wednesday). There is therefore significant risk both the Eurozone and UK economies will contract in Q1, delaying the return economic growth until at least the second quarter. Tomorrow’s first release of (backward-looking) Eurozone Q4 GDP data is likely to show a decline.

Expect UK monetary policy will be left on hold this Thursday, with the Bank of England maintaining Bank Rate at 0.1% and the target level for asset purchases at £895bn. Policymakers will be assessing prospects of a much weaker Q1 than previously anticipated, while an effective vaccine rollout could also pose less downside risks further out, meaning greater confidence in a rebound later this year. In any event, MPC members will likely want to hear details of the upcoming Budget speech on 3 March, including whether the furlough scheme will be extended beyond the end of April.

The US ISM manufacturing this afternoon is likely to draw the most attention today from the financial markets. Look for a fall in the headline index from 60.5 in December, the strongest for more than two years, to 59.7 for January. That would point to the sector continuing to perform well despite the pandemic. ISM services, due on Wednesday, are also expected to remain in expansion territory (above 50), in contrast to the Eurozone and UK services PMIs. The key data release later this week will be Friday’s US labour market report, with investors watching to see if December’s fall in nonfarm payrolls extended into January.

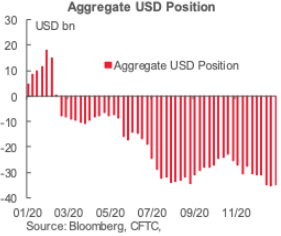

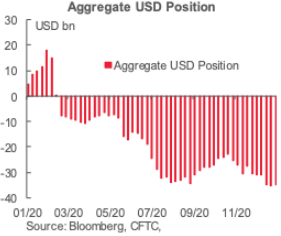

CFTC Data

This week’s CFTC data show the first decline in the net USD short position in seven weeks, just slightly offsetting the previous week’s increase, to USD34.9bn on a relatively modest USD566mn drop off an all-time-high bearish position on the dollar last week. The net EUR long increased for a sixth consecutive week, however, with a USD349mn change on the week resulting mainly from an increase in gross longs compared to only a minor decline in gross shorts; the net long position of USD25.1bn is still about USD6bn off its peak last August.

The net JPY long saw the biggest weekly adjustment as accounts decreased their net bullish exposure to the currency by USD590mn, or roughly a tenth of where the net long stood last week, to USD5.4bn; the move was driven by a sizeable 4.4k increase in short contracts while long contracts dropped by 680. The JPY was the worst performing G10 currency over the period, but still managed to eke out a 0.2% gain versus the dollar. All things considered, bullish JPY sentiment remains elevated, sitting only about USD700mn from its cycle peak in early-Jan (highest since late-2016).

Speculative sentiment turned less bullish on the GBP as both longs and shorts rose but the former’s increase of 1.5k contracts was no match to the 7.2k increase in gross shorts, for a combined decline in the net GBP long of USD484mn to move back below the billion mark at USD684mn.

Net AUD longs were cut to practically neutral with a USD314mn net bearish bet on the Aussie over the week as investors trimmed their outright longs by the most in seven weeks

G10 FX Options Expiries for 10AM New York Cut

OPTIONS: Expiries for Feb01 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2000(E1.5bln), $1.2220-30(E1.2bln-EUR puts), $1.2300-05(E786mln)

USD/JPY: Y102.30-50($805mln), Y104.45-60($924mln), Y104.75-78($504mln), Y105.50($500mln)

GBP/USD: $1.3550(Gbp547mln)

AUD/JPY: Y77.50(A$600mln), Y79.10(A$605mln), Y83.00(A$614mln)

USD/CNY: Cny6.4835-00($530mln)

USD/MXN: Mxn20.82($580mln), Mxn21.00($720mln)

----------------

Larger Option Pipeline

EUR/USD: Feb02 $1.2150(E1.4bln-EUR puts), $1.2200-20(E1.1bln), $1.2290-1.2300(E1.1bln); Feb03 $1.2070-80(E1.1bln-EUR puts)

USD/JPY: Feb04 Y104.30-40($1.5bln), Y104.90-00($1.1bln); Feb05 Y103.00($1.0bln-USD puts), Y104.95-105.00($1.0bln)

AUD/USD: Feb02 $0.7600(A$1.2bln-AUD puts), $0.7685(A$1.1bln-AUD puts)

USD/CNY: Feb02 Cny6.55($1.1bln)

USD/MXN: Feb04 Mxn20.50($1.7bln)

Technical & Trade Views

EURUSD Bias: Bullish above 1.20 targeting 1.24

EURUSD From a technical and trading perspective, as demand persists above 1.20 bulls will be targeting a retest of prior cycle highs en-route to a test of offers and stops above 1.24. Only a closing breach of 1.20 would concern the bullish thesis opening a move to test the yearly pivot back towards 1.17

Flow reports suggest downside bids into the 1.2050 area with increasing bids into the 1.2000 level with weak stops on any move through into the 1.1980 level with break out stops a possibility, Topside offers through the 1.2100 level light with the topside likely to remain weak through to the 1.2180 area before some stiffness appears through to the 1.2200 level with very little in stops until 1.2220 level and weak stops easily absorbed in stronger resistance.

GBPUSD Bias: Bullish above 1.35 targeting 1.3830/60

GBPUSD From a technical and trading perspective, as as 1.35 supports then prices can extend higher to test interim wave 5 upside objectives to 1.3830/60 area

Flow reports suggest topside offers through the 1.3750 area and increasing on any move towards the 1.3800 level weak stops on a break through opens up a larger rise with limited stops through the 1.3850 area but opening the 1.41/1.42 over time. Downside bids light through to the 1.3650 area and stronger bids currently being tested with weak stops likely on a dip through light for the moment and stronger bids into the 1.3600 level and increasing on any move to the 1.3550 area.

USDJPY Bias: Bullish above 104 targeting 105.50

USDJPY From a technical and trading perspective, as 104 acts as support look for a test of 105.50 from here watch for bearish reversal patterns to suggest a resumption of the dominant downtrend

Flow reports suggest topside offers through the 104.80 area increasing through to 105.00 level normal offers are likely to be thin with an old trend line in the area and weak stops are likely joined by break out players for a move through to the 105.50 area before congestion starts to appear. Downside bids light through the 104.00 level and weak stops limited, market likely to remain weak through to the 103.50 area where interest starts to increase with congestion around that level and stronger bids through to the 102.80 area.

AUDUSD Bias: Bullish above .7600 bullish targeting .8000

AUDUSD From a technical and trading perspective, as .7600 now acts as support, look for target wave 5 upside objective towards .8000. Note .7800 is an interim measured move upside objective that may prompt a profit taking pullback before the uptrend resumes from.7450 trend support

Flow reports suggest bids likely just below the lows and through into the 0.7580 area before weak stops appear opening the market a little through to the 0.7550 area with stronger bids again and possibly continue through to the 0.7500 area. Topside offers light through the 77 cents level and likely to continue through to the 0.7750 with very little interference however beyond that level is likely to see stronger offers the closer the market gets to the 78 cents area and continuing through to the 0.7820 area before stops appear and open a higher move over the next couple of days.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!