Daily Market Outlook, August 8, 2023

Munnelly’s Market Commentary…

Asian equity markets saw a varied trading session. The initial sense of positivity driven by the favourable performance on Wall Street was dampened as Chinese markets became active participants. Simultaneously, the region had to process disappointing trade data from China.

At the start, the Nikkei 225 index exhibited a modest increase of 0.2%. This uptick was influenced by a weaker currency and positive earnings releases. However, the gains were mostly nullified as concerns arose due to the selling of Chinese stocks. Conversely, the Hang Seng index faced a notable decline of 1.3%. This was a result of significant pressure on tech and property stocks, which consequently triggered broader declines across various sectors. Similarly, the Shanghai Composite index displayed a lack of substantial movement, indicating a relatively stable situation. Adding to the overall negative sentiment was the release of unsatisfactory Chinese trade data. This data showcased contractions in both Chinese exports and imports that surpassed earlier expectations. This news further contributed to a more cautious atmosphere among investors in the Asia-Pacific region.

Following the conclusion of major central bank policy announcements, including the recent Bank of England update, this week's data docket carries a subdued, summer-like tone. This sentiment is reflected in the limited number of scheduled speeches by policymakers from the Bank of England, European Central Bank, and US Federal Reserve. Unlike previous patterns where policy announcements were followed by a flurry of speeches, such a trend is absent this time. The recent talk by BoE Chief Economist Pill is the sole scheduled appearance by Bank of England policy makers for the week, while the calendars of other central banks also show minimal activity. Despite the past couple of weeks' messages from all three central banks emphasising the uncertainty of the interest rate outlook for autumn and its dependency on data, financial markets cannot afford complacency. The heightened volatility witnessed prior to and post the recent US labour market report could potentially be replicated around other pivotal data releases in the upcoming weeks, creating an edgy atmosphere throughout the summer. The next significant data release in this regard is Thursday's US inflation report, with Friday's UK GDP update also poised to garner considerable attention. Nonetheless, the immediate days ahead seem less eventful.

Stateside, today the July update for the NFIB index is expected to provide insights into the performance of the small business sector. June saw the headline index reaching its peak for the year, while previously released July readings on job creation and wages indicated marginal variation from June. Additionally, data on US trade in goods, already disclosed, indicates a substantial reduction in the international trade deficit for June compared to May. A notable figure scheduled to speak today is Philadelphia Fed President Harker, a key participant in US monetary policy decisions this year. Given his history of supporting prior interest rate hikes, his remarks might serve as an important preliminary indicator of the probability of another rate increase in September.

CFTC Data As Of 25-07-23

USD spec net short pared in Jul 26-Jun 1 period, $IDX -0.72%

EUR$ -0.58% in period specs -5,168 contracts, now short 172,062

$JPY +1.75% in period, specs -1,464 contracts into strength now -79,216

GBP$ -0.95% in period, specs -9,433 contracts, specs sell into dip

AUD$ -2.61% in period spec -591; $CAD +0.82% specs +835- just noise

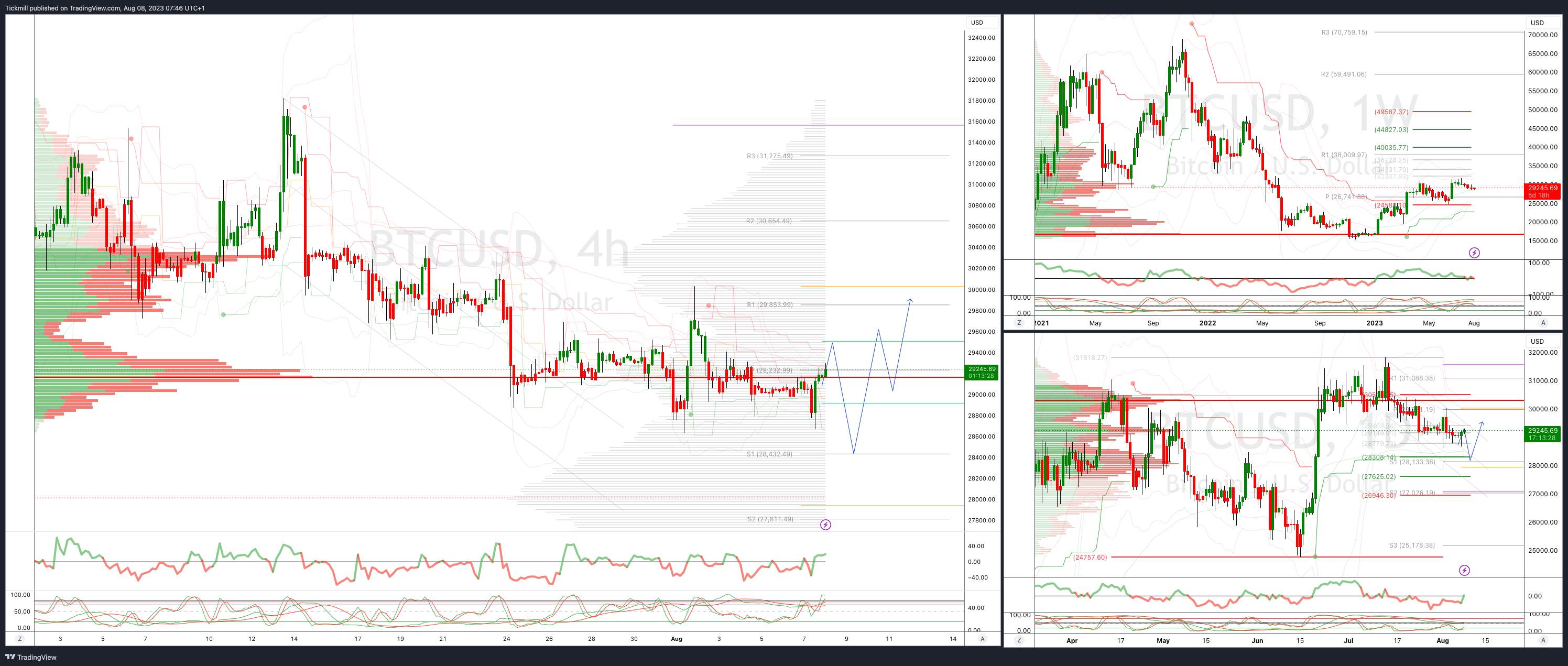

BTC -0.05% in period, specs +106 contracts now -539

Prevailing theme was more-dovish c.bank guidance, USD firm amid high-for-longer vibe (Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0870 (1.4BLN), 1.0900 (712M), 1.0970 (723M)

GBP/USD: 1.2750 (525M) . EUR/GBP: 0.8700 (818M), 0.8725 (543M)

AUD/USD: 0.6450 (1.4BLN), 0.6500 (526M), 0.6540-50 (320M)

USD/CAD: 1.3325-35 (950M). NZD/USD: 0.6130 (480M), 0.6235 (561M)

USD/JPY: 142.00 (380M), 143.00 (300M). EUR/JPY: 156.70 (630M), 158.00 (429M)

EUR/NOK: 11.25 (1BLN)

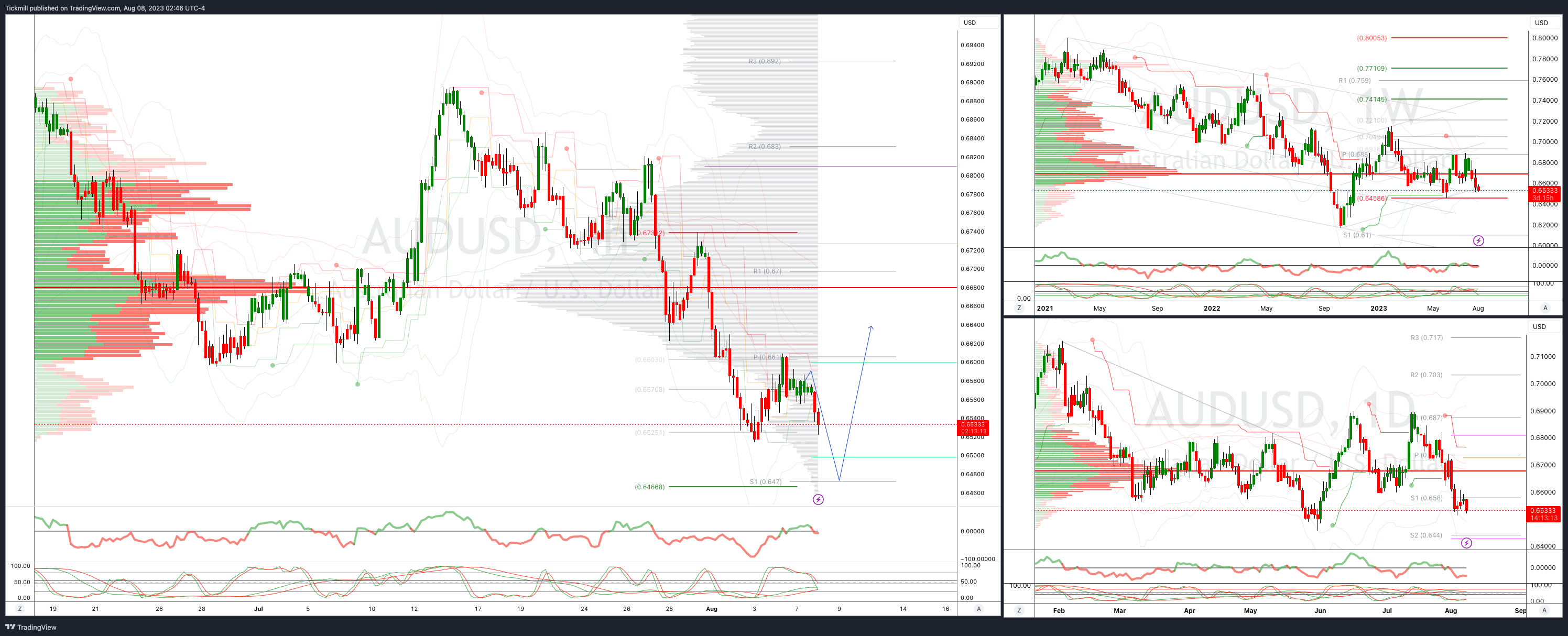

The decrease in volatility premiums for G10 foreign exchange (FX) options is indicative of the typical reduction in market activity during the summer months. Despite this trend, there has been increased interest in purchasing options for the AUD/USD currency pair, even amidst the decline in premium rates. Over the course of Monday, the benchmark 1-month implied volatility dropped from 10.9-10.6, settling at 10.7. It is likely that if the AUD/USD exchange rate surpasses the 0.6500 level, there will be a heightened demand for implied volatility options. The proximity of the AUD/USD exchange rate to the 0.6500 mark and the 2023 low of 0.6459 is anticipated to provide support for option prices. However, achieving the substantial 0.6450 strike expiry on Tuesday seems improbable at this moment. The reduction in volatility premiums for G10 FX options aligns with the customary decrease in market activity during the summer period. Despite this, there is notable interest in AUD/USD options, even with declining premiums. The movement of the AUD/USD exchange rate towards the 0.6500 level and its 2023 low is expected to influence option prices, while a significant strike expiry at 0.6450 on Tuesday appears difficult to attain presently.

Overnight Newswire Updates of Note

China’s Trade Plunges More Than Forecast In Blow To Recovery

Japan Declines To Confirm Report On Major Chinese Cyberattack

Fed Officials Sketch Case On Both Sides Of Rate Debate

Biden Signs Law Implementing First Part Of US Trade Pact With Taiwan

Goldman, JPMorgan Say Buy Treasuries After Last Week’s Selloff

Oil Steadies Ahead Of US Figures On Outlook, Crude Stockpiles

Apple Tests M3 Max Chip, Setting Stage For Most Powerful MacBook Pro Yet

Amazon To Meet With FTC In Final Push To Avoid Antitrust Suit

Moody’s Cuts US Banks On Mounting Funding Costs, Office Exposure

Carlyle, GIC Skip Ant's Buyback After Valuation Slumps 70%

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

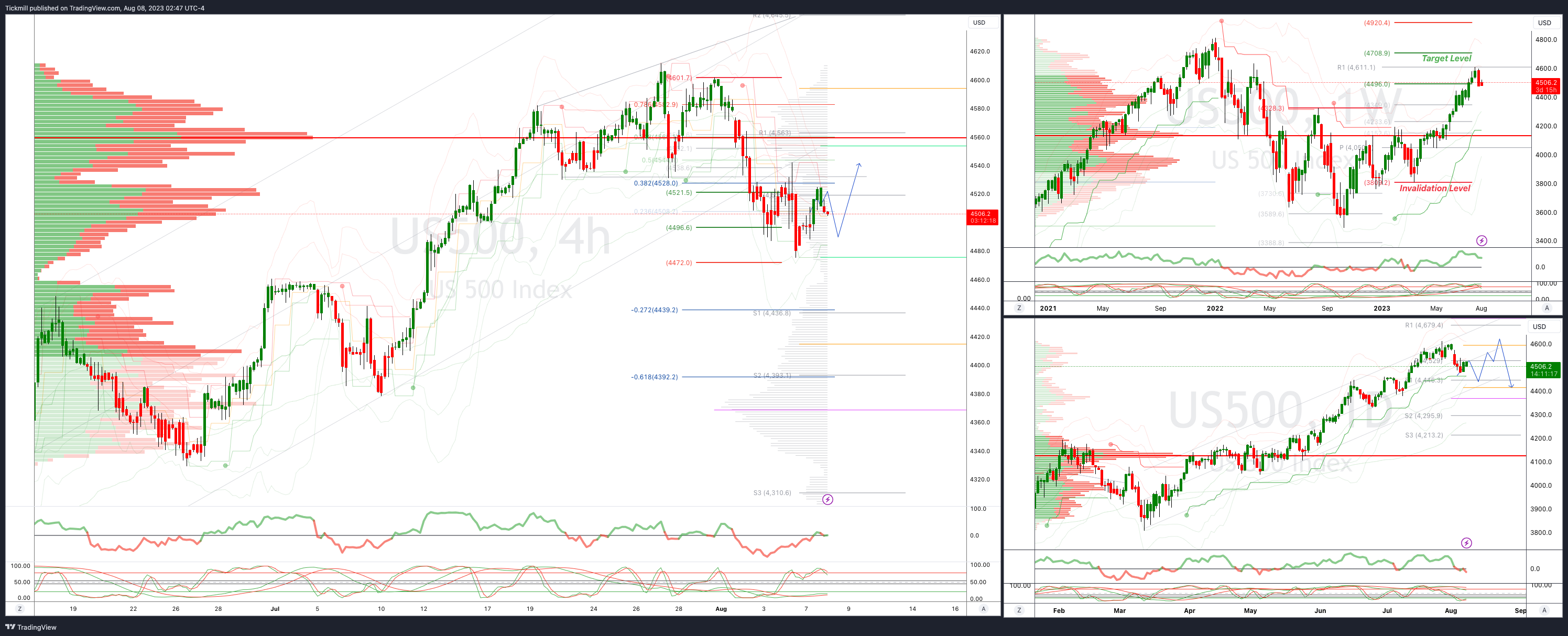

SP500 Intraday Bullish Above Bearish Below 4520

Below 4480 opens 4460

Primary support is 4370

Primary objective is 4630

20 Day VWAP bearish, 5 Day VWAP bullish

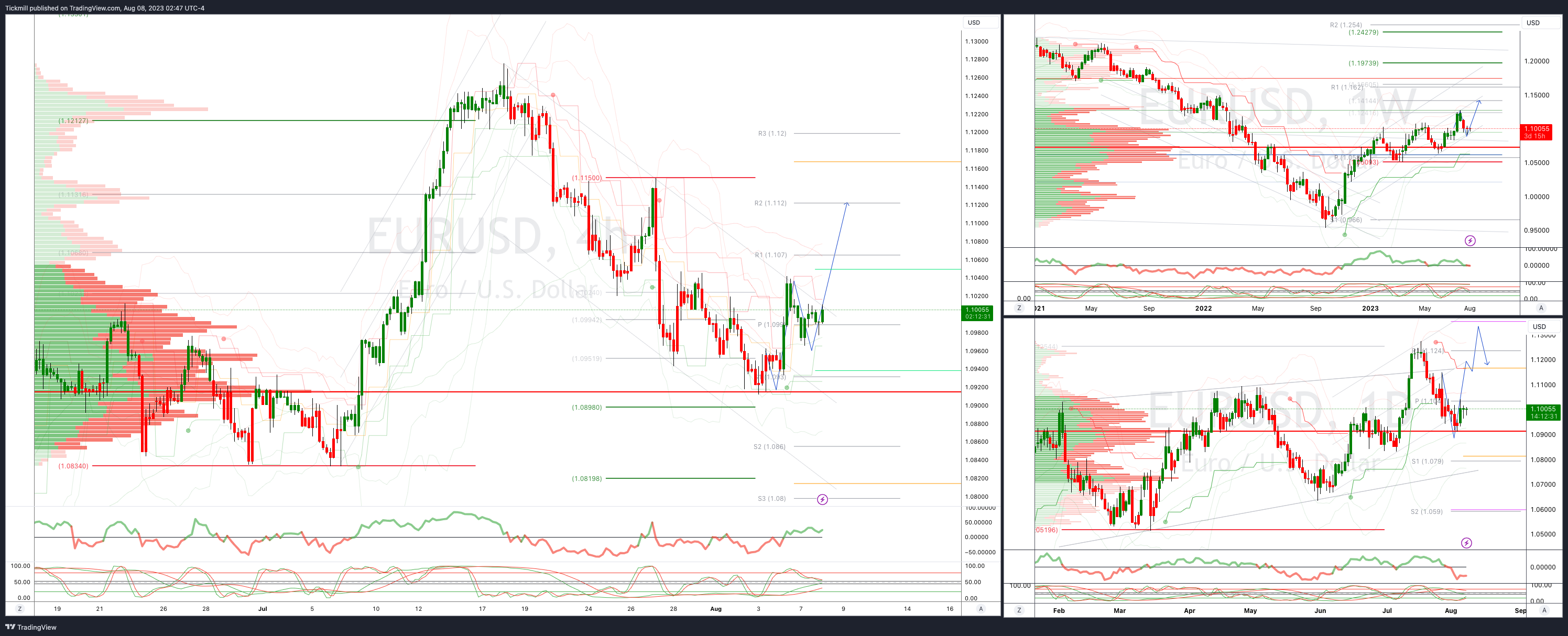

EURUSD Intraday Bullish Above Bearsih Below 1.1020

Below 1.890 opens 1.0830

Primary support is 1.830

Primary objective is 1.13

20 Day VWAP bearish, 5 Day VWAP bullish

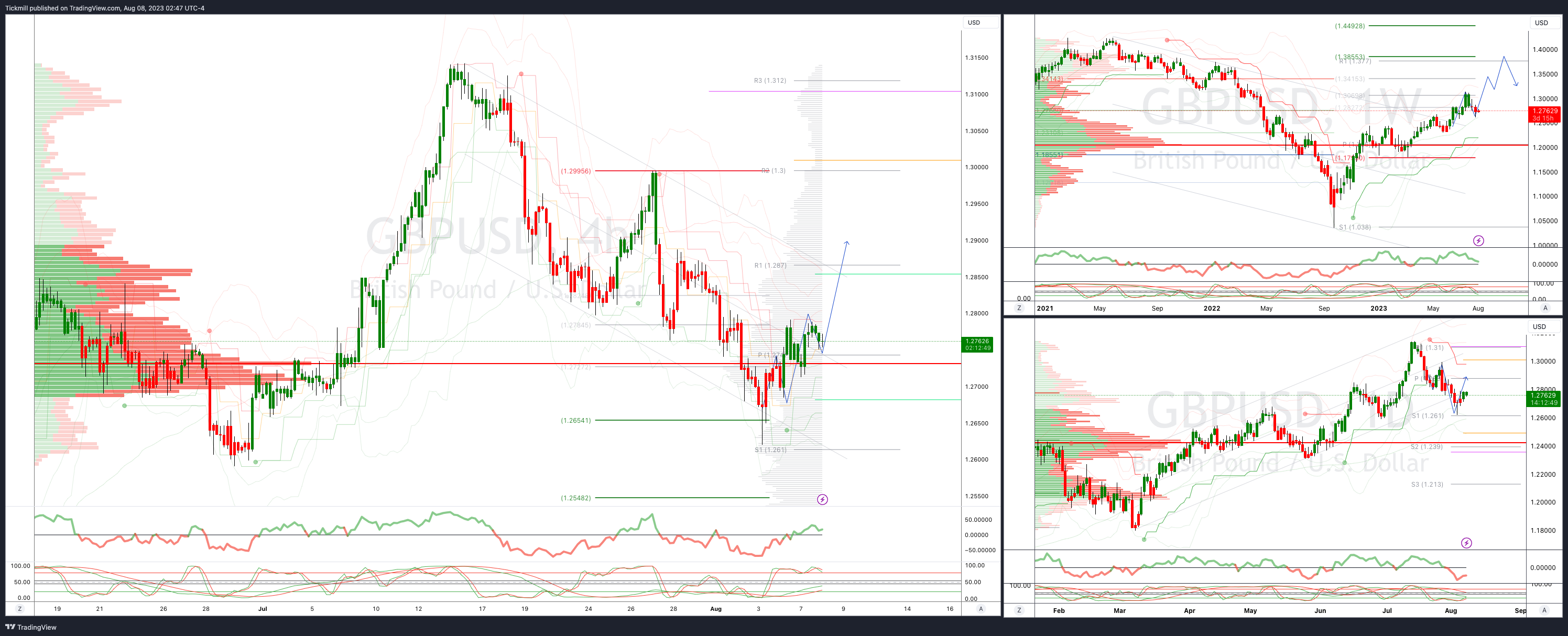

GBPUSD: Intraday Bullish Above Bearish Below 1.28

Below 1.2750 opens 1.2650

Primary support is 1.26

Primary objective 1.3850

20 Day VWAP bearish, 5 Day VWAP bullish

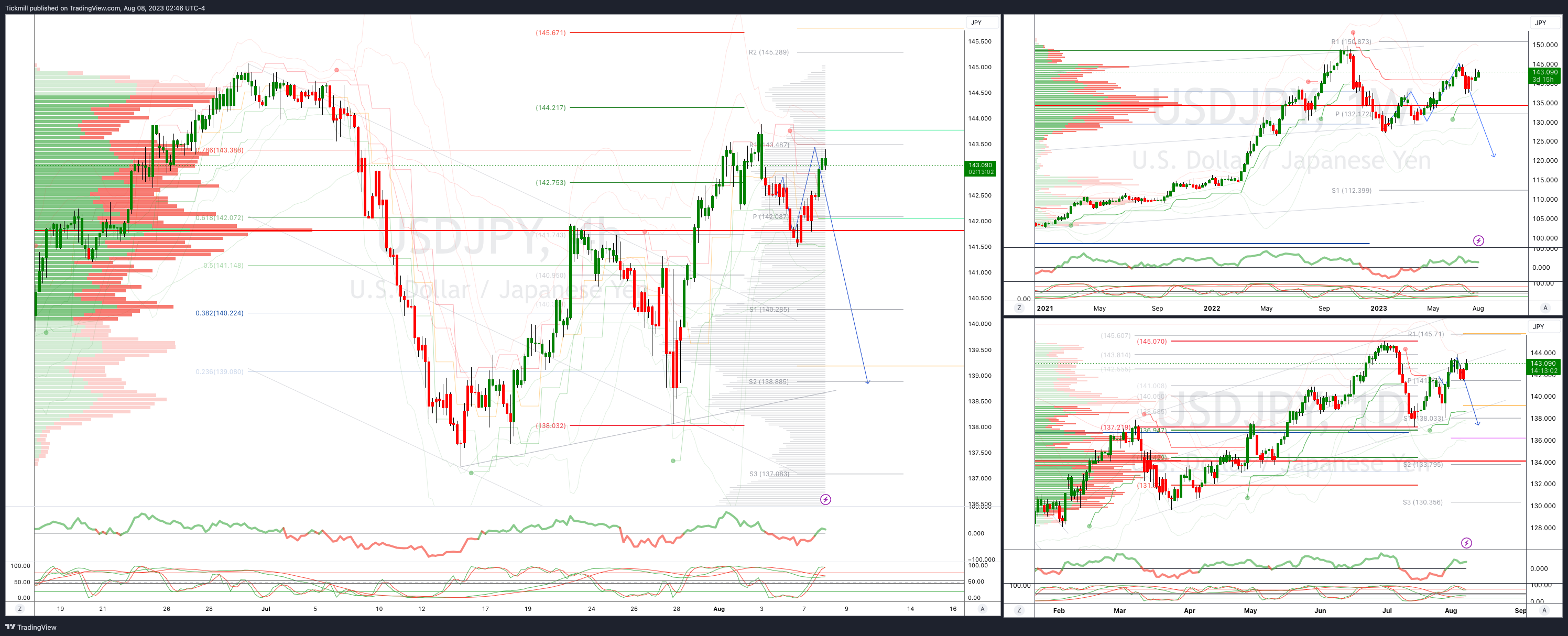

USDJPY Bullish Above Bearish Below 139.60

Above 143.50 opens 145

Primary resistance 143.40

Primary objective is 136.20

20 Day VWAP bullish, 5 Day VWAP bearish

AUDUSD Intraday Bullish Above Bearish Below .6660

Above .6750 opens .6820

Primary resistance is .6730

Primary objective is .6466

20 Day VWAP bearish, 5 Day VWAP bearsih

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28300

Primary support is 28300

Primary objective is 32750

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!