Daily Market Outlook, August 7, 2023

Munnelly’s Market Commentary…

Asian equity markets started the week on a mostly negative note, influenced by last Friday's late decline in Wall Street. The drop in Apple shares post-earnings and reactions to weaker-than-expected Non-Farm Payrolls and higher US hourly earnings contributed to the subdued mood in the region.

In Japan, the Nikkei 225 initially faced selling pressure, opening below the psychological level of 32K handle. However, it later staged a recovery and moved back above that level. On the other hand, the Hang Seng index in Hong Kong and the Shanghai Composite index in China showed mixed performances, with the gains in energy sectors being overshadowed by uncertainties surrounding Chinese developers. Investors in the region remained cautious ahead of crucial upcoming releases, including trade data on Tuesday and inflation figures on Wednesday.

The recent policy rate hikes by the US Federal Reserve, European Central Bank, and Bank of England have left a considerable time gap until the next set of policy updates in mid-September. All three central banks have emphasised that any further rate increases will be data-dependent, intensifying market focus on economic releases during the current holiday period. The market currently attaches an 85% probability to a rate hike by the Bank of England in September, while the likelihood of similar moves from the ECB and the Fed is seen as less likely at 36% and 16%, respectively.

Investor confidence in the Eurozone is expected to have declined for the fourth consecutive month in August, according to the Sentix investor confidence survey. Comments from Bank of England Chief Economist Huw Pill will be closely watched for hints about the possibility of another interest rate increase next month. Pill previously stated that there are increased risks of inflation persisting in the UK, aligning with the market's expectation that the Bank of England is not yet finished raising interest rates.

Stateside this week's key data release is the July US Consumer Price Index (CPI) report on Thursday, which will be closely monitored by investors. Ahead of this, there are few major distractions in today's calendar, but comments from Federal Reserve members Bowman and Bostic are likely to attract interest. Bowman, a voting member of the Federal Open Market Committee (FOMC) this year, indicated over the weekend that further rate hikes are likely needed to bring inflation to the 2% target, suggesting she may support another 25 basis points increase at the September meeting. Bostic, a non-voting member of the FOMC this year, stated that he didn't see the need for additional rate hikes following the mixed US labour market report on Friday.

CFTC Data As Of 25-07-23

USD spec net short pared in Jul 26-Jun 1 period, $IDX -0.72%

EUR$ -0.58% in period specs -5,168 contracts, now short 172,062

$JPY +1.75% in period, specs -1,464 contracts into strength now -79,216

GBP$ -0.95% in period, specs -9,433 contracts, specs sell into dip

AUD$ -2.61% in period spec -591; $CAD +0.82% specs +835- just noise

BTC -0.05% in period, specs +106 contracts now -539

Prevailing theme was more-dovish c.bank guidance, USD firm amid high-for-longer vibe (Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0900 (620M), 1.0920-25 (751M), 1.0940-50 (1.6BLN)

1.1000 (457M), 1.1020-25 (433M), 1.1050 (382M)

EUR/GBP: 0.8550 (1.3BLN) , 0.8610-20 (1BLN), 0.8650 (594M)

0.8675 (600M), 0.8700 (790M)

AUD/USD: 0.6500 (585M), 0.6540-50 (490M), 0.6590-0.6600 (670M)

USD/JPY: 141.50 (659M), 142.00 (500M), 142.20 (250M)

142.50 (287M), 143.00 (901M)

The recent decline in implied volatility indicates that FX traders are perceiving lower actual FX volatility risk in the market. This decrease in implied volatility suggests that investors are selling options to capitalise on the reduced perceived risk, as actual volatility has been performing below expectations. This week's main event risk is the release of the US Consumer Price Index (CPI) on Thursday, which is likely to impact one-week options. If the CPI data comes in as expected, with no major surprises, it could further contribute to a decrease in implied volatility, pushing it even lower. Lower implied volatility may indicate a sense of market stability and reduced uncertainty among traders. As actual volatility has not been as high as anticipated, selling implied volatility has allowed traders to benefit from the decline in option premiums.

Overnight Newswire Updates of Note

BoJ Debated Prospects Of Sustained Inflation At July Meeting

Australia Urges China To Remove All Trade Restrictions

China's July Economic Losses From Disasters Exceed January-June

Fed’s Bowman Signals More Rate Hikes Likely Will Be Needed

EU Trade Chief To Push China On Barriers To Exports

Oil Extends Gains, Hovers At Four-Month Highs On OPEC+ Cuts

Foxconn's July Sales Drop 1.23% Y/Y, Forecasts Q3 Rebound

Berkshire Posts Record Operating Profit, Rising Rates Boost Buffett's Returns

Trucking Firm Yellow Goes Bankrupt As Debt, Labour Woes Pile Up

Daimler Truck CFO Jochen Goetz Dies In 'Tragic Accident'

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

SP500 Intraday Bullish Above Bearish Below 4520

Below 4480 opens 4460

Primary support is 4370

Primary objective is 4630

20 Day VWAP bearish, 5 Day VWAP bearish

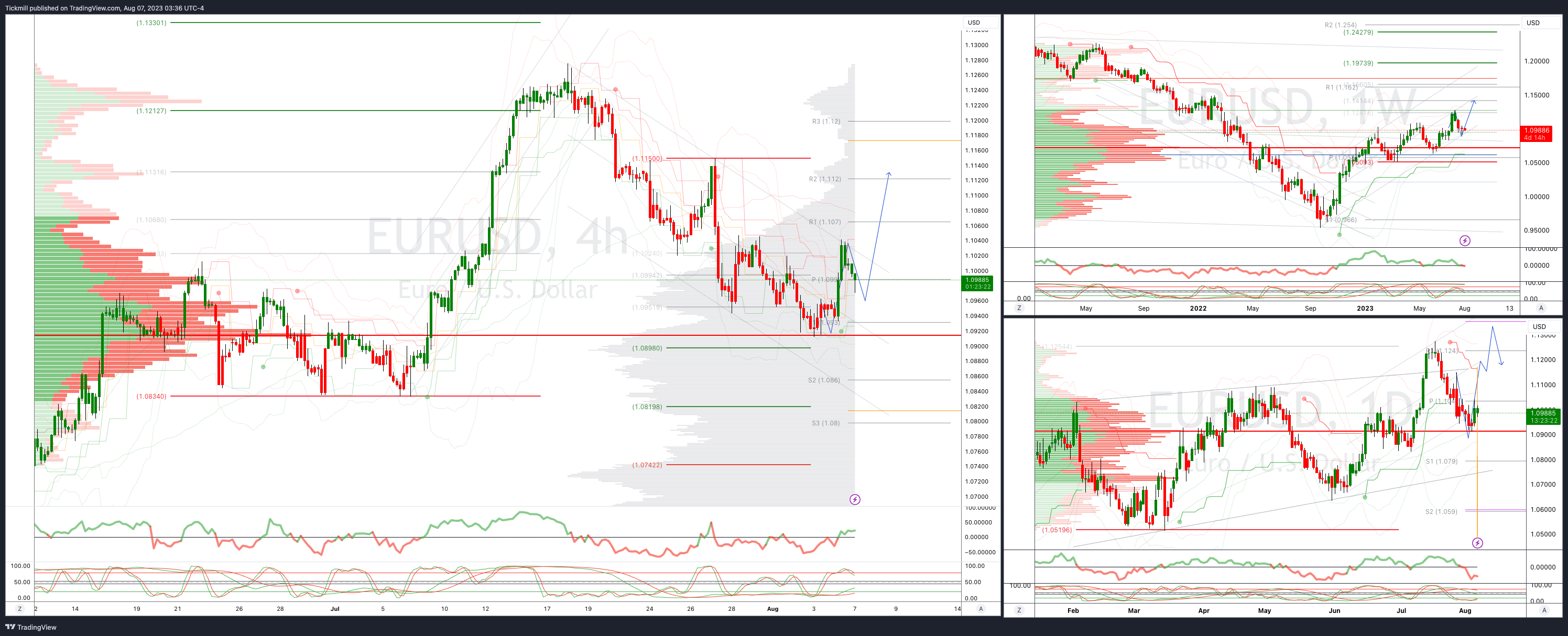

EURUSD Intraday Bullish Above Bearsih Below 1.1020

Below 1.890 opens 1.0830

Primary support is 1.830

Primary objective is 1.13

20 Day VWAP bearish, 5 Day VWAP bullish

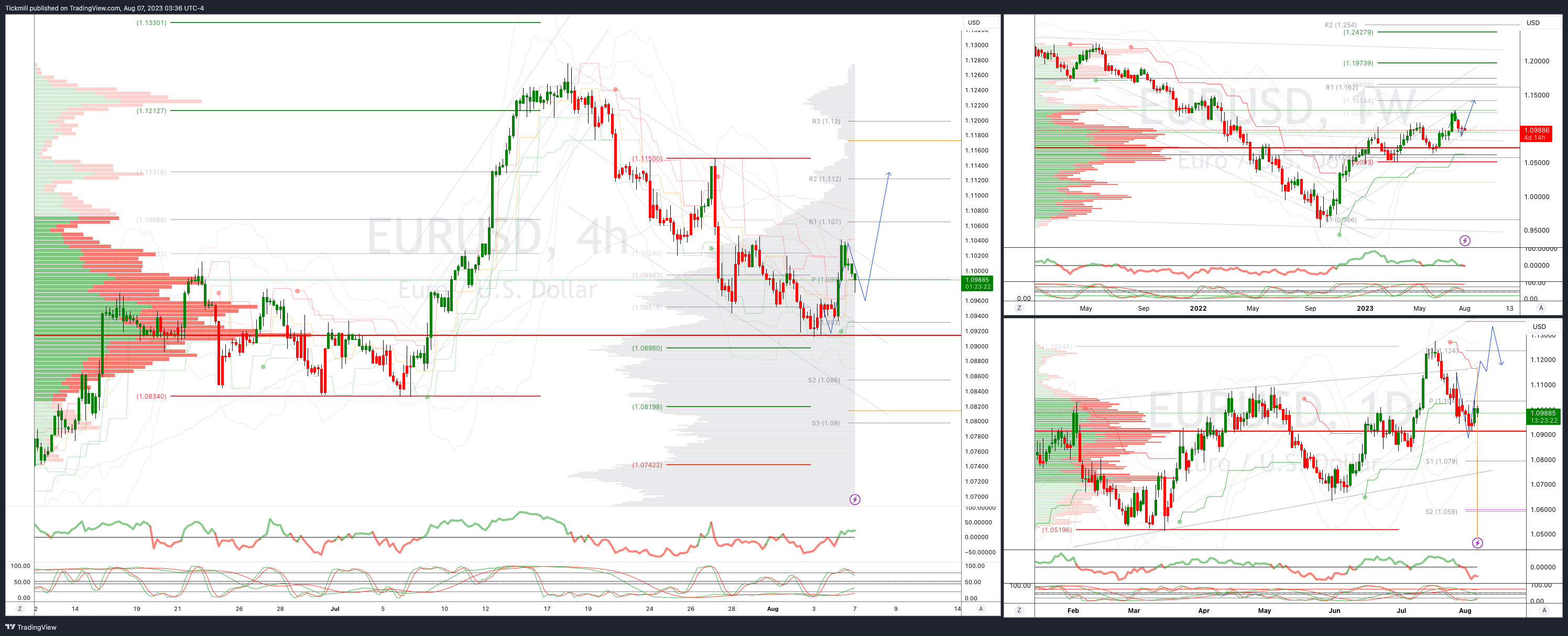

GBPUSD: Intraday Bullish Above Bearish Below 1.28

Below 1.2750 opens 1.2650

Primary support is 1.26

Primary objective 1.3850

20 Day VWAP bearish, 5 Day VWAP bearish

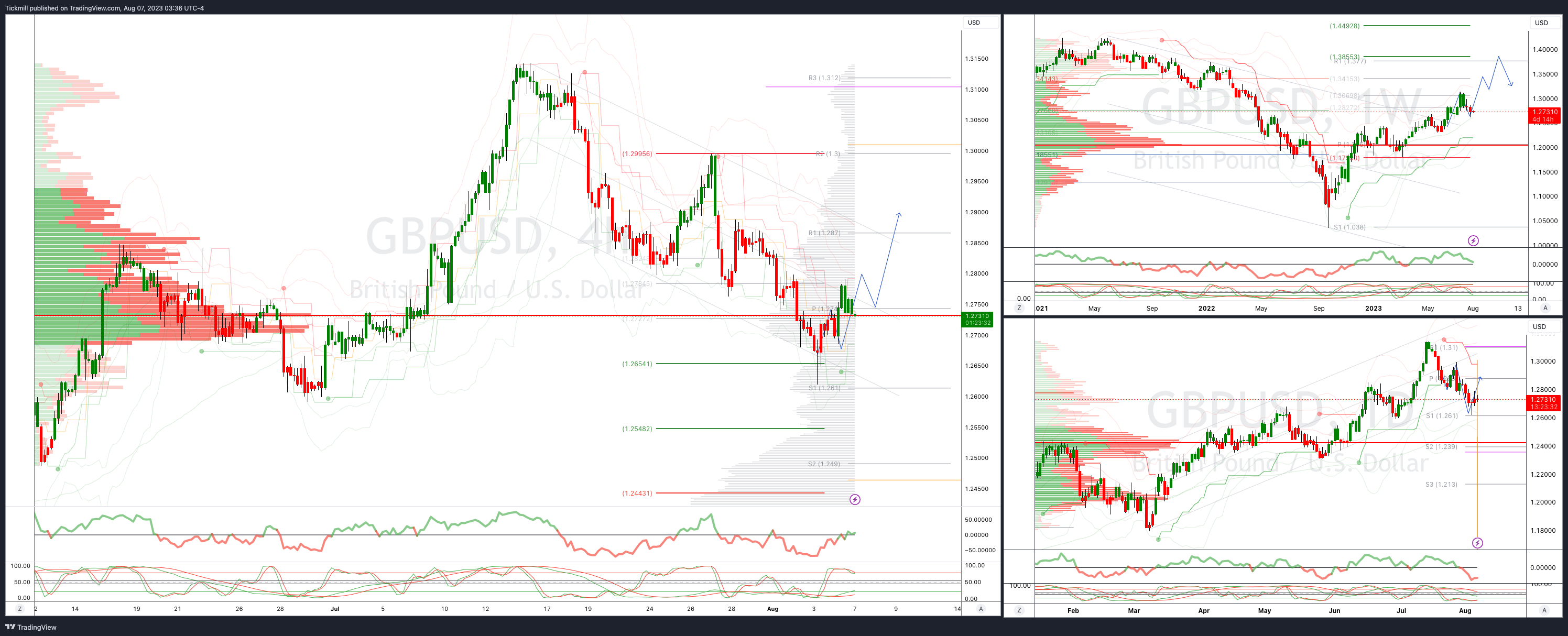

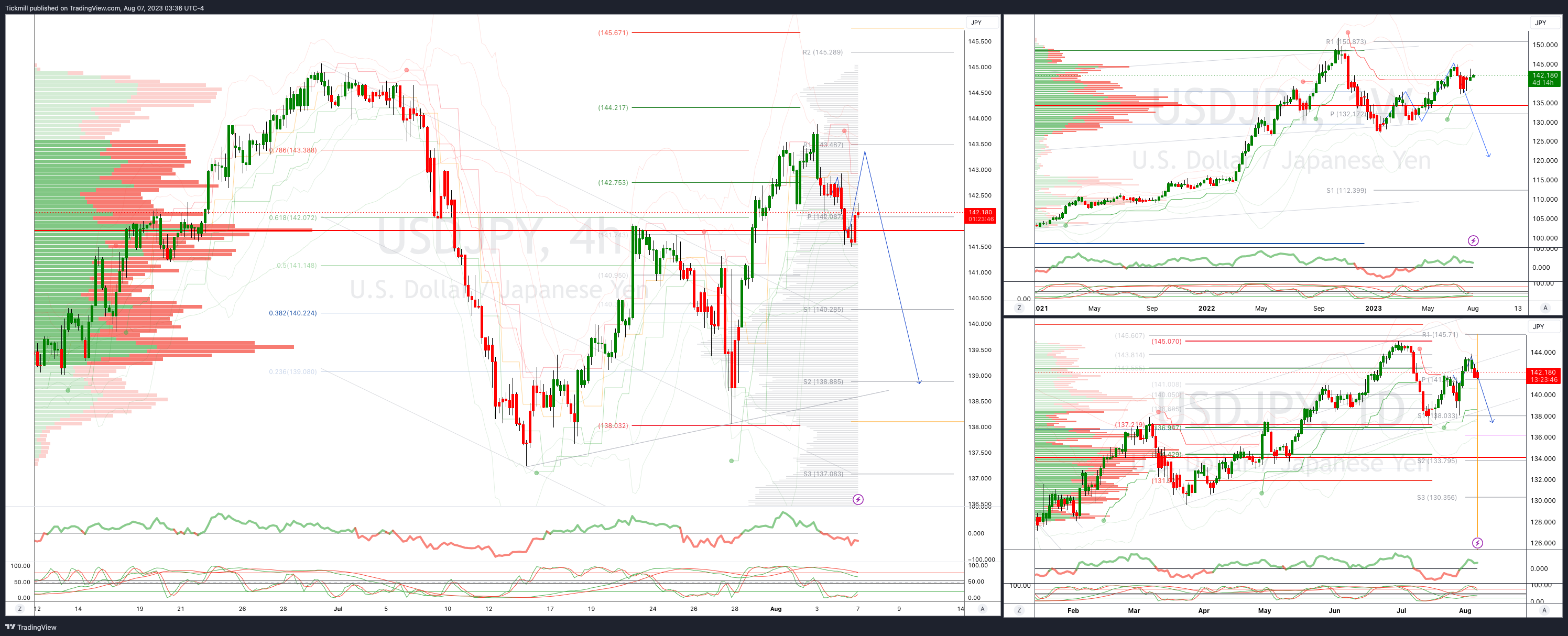

USDJPY Bullish Above Bearish Below 139.60

Above 143.50 opens 145

Primary resistance 143.40

Primary objective is 136.20

20 Day VWAP bullish, 5 Day VWAP bearish

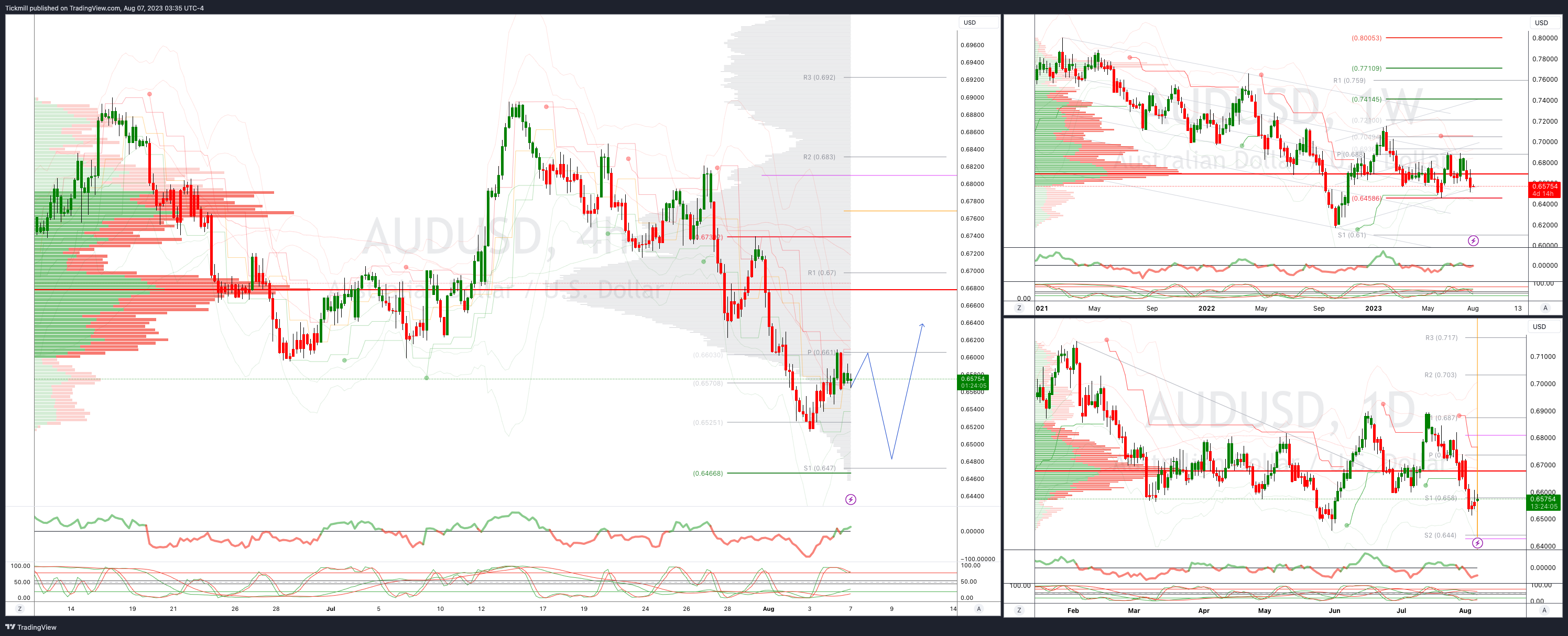

AUDUSD Intraday Bullish Above Bearish Below .6660

Above .6750 opens .6820

Primary resistance is .6730

Primary objective is .6466

20 Day VWAP bearish, 5 Day VWAP bearsih

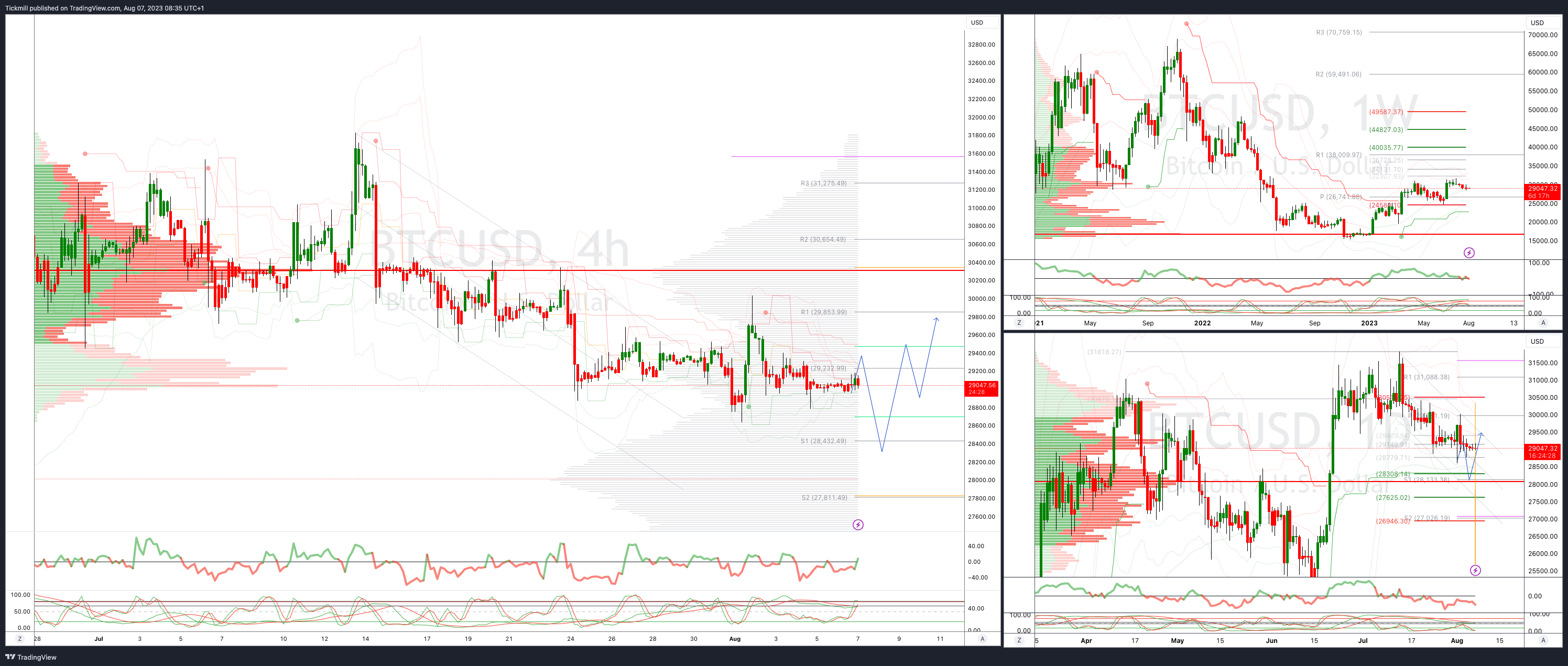

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28300

Primary support is 28300

Primary objective is 32750

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!