Daily Market Outlook, August 6, 2020

Asian equity market is mixed this morning with China and Japan down despite gains yesterday in Europe and the US. Chinese stocks may have been hurt by US Secretary of State’s announcement of a plan to ‘clean the network’. It is thought that may include removing “untrusted” Chinese apps such as TikTok from US app stores. US Federal Reserve policymakers Mester and Clarida echoed previous comments from colleagues in calling for more fiscal support for the economy. In Australia, PM Morrison said the unemployment rate will peak at a higher level due to Victoria’s surge in Covid-19 cases. France saw its highest daily rate of infections in over two months.

As expected the Bank of England left monetary policy unchanged at today’s update. It said that it expected asset purchases to finish around late 2020 but stands ready to adjust policy to meet its remit and will not tighten policy until inflation is sustainably moving to target. BoE policy makers acknowledged that recent economic data had mostly pointed to a stronger-than-expected initial rebound from the slump in economic activity seen in March and April. But they said that the risks to recovery remained skewed to the downside and noted that GDP was only likely to reach its end 2019 level in Q4 2021, a little later than previously projected. BOE Governor Bailey will hold a press conference, which will not be streamed, at 8.30am. The details of that are embargoed until 10am. Markets will be looking for more specifics on future policy intentions. In particular whether the Committee has anything more to say about the likelihood of policy interest rates dropping below zero.

The UK construction PMI for July will provide a further update on recent economic conditions. In contrast to the manufacturing and services PMIs, an initial ‘flash’ estimate is not released for construction so this will be new data. In June the headline indicator picked up sharply to 55.3 (a 23-month high) from 28.9 in May led by stronger housing activity. Expect a further rise to 58.0 in July.

In the US, concerns that the economic rebound is faltering have been fuelled by rises in initial jobless claims over the past two weeks, the first increases in March. Too much should not be read into volatile weekly data but nevertheless a third consecutive rise, which is possible, will add to the concerns. Markets will also be watching for further indications of whether a deal on a further US fiscal stimulus package is imminent. Latest reports are that agreement is hoped for by Friday, which would allow Congress to vote on it next week.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1700 (1.1BLN), 1.1715-25 (1BLN), 1.1850 (250M), 1.1900 (250M)

- GBPUSD: 1.3000 (564M)

- AUDUSD: 0.7120 (473M), 0.7150 (520M), 0.7195-0.7205 (740M), 0.7250 (258M)

- USDJPY: 105.00 (2.7BLN), 105.25 (660M), 105.50 (330M), 105.60-65 (1BLN) 105.75-85 (1BLN), 106.00 (450M), 106.25 (1BLN), 106.50 (715M)

Technical & Trade Views

EURUSD Bias: Bullish above 1.1820 Bearish Below

EURUSD From a technical and trading perspective, as 1.1810 acts as resistance anticipate another corrective leg lower to test bids back towards 1.16. A daily close back through 1.1820 would negate the corrective thesis, opening a retest of 1.19 UPDATE 1.19 retest played out now there is a potential for a double top to develop, will need to see a H4 close sub 1.1850 to open a retest of 1.17 support

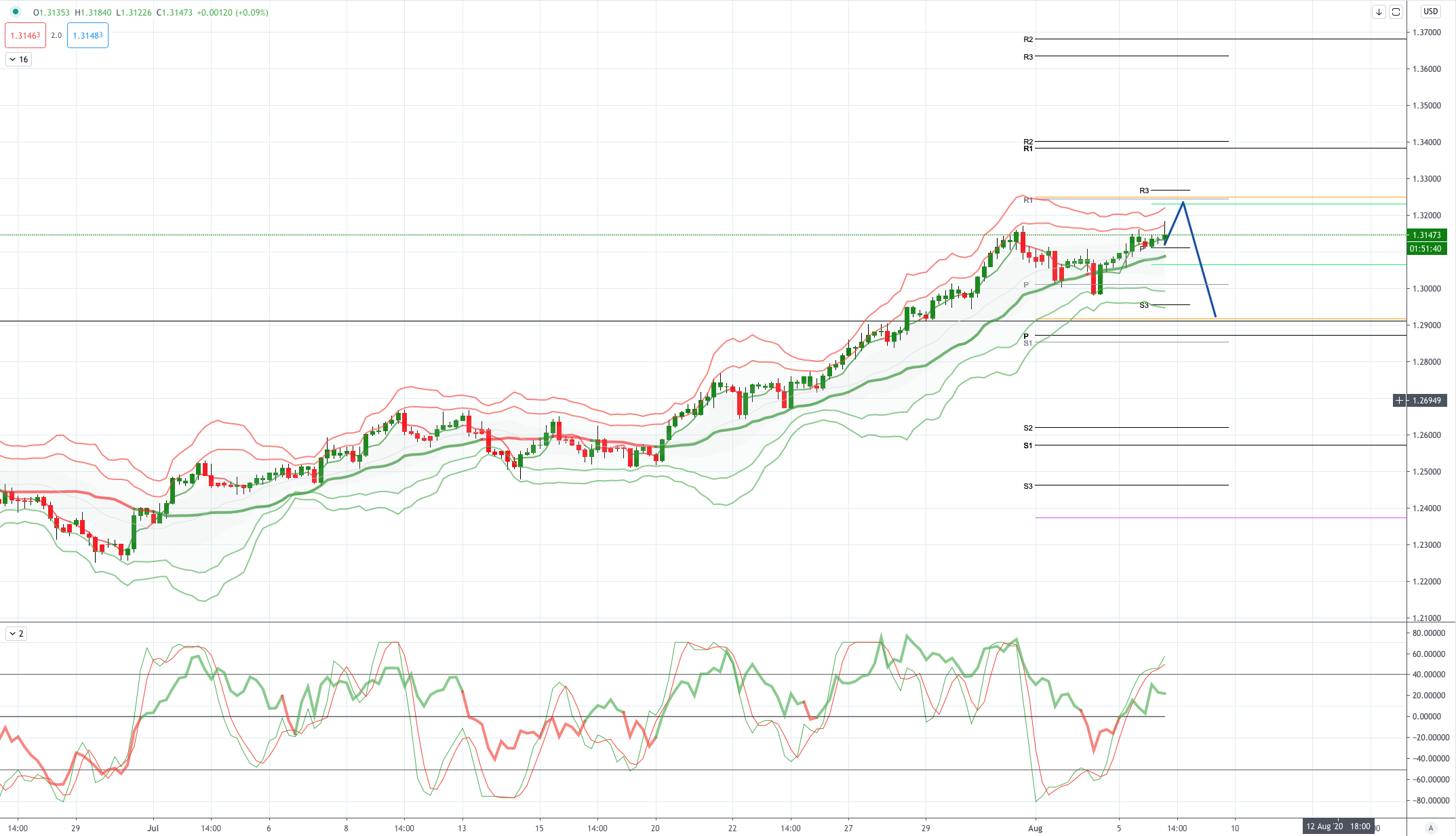

GBPUSD Bias: Bullish above 1.30 targeting 1.3250

GBPUSD From a technical and trading perspective, price tested pivotal trendline resistance at 1.3166, anticipated profit taking pull back playing out. As 1.30 continues to attract buying interest look for a test of 1.3250.

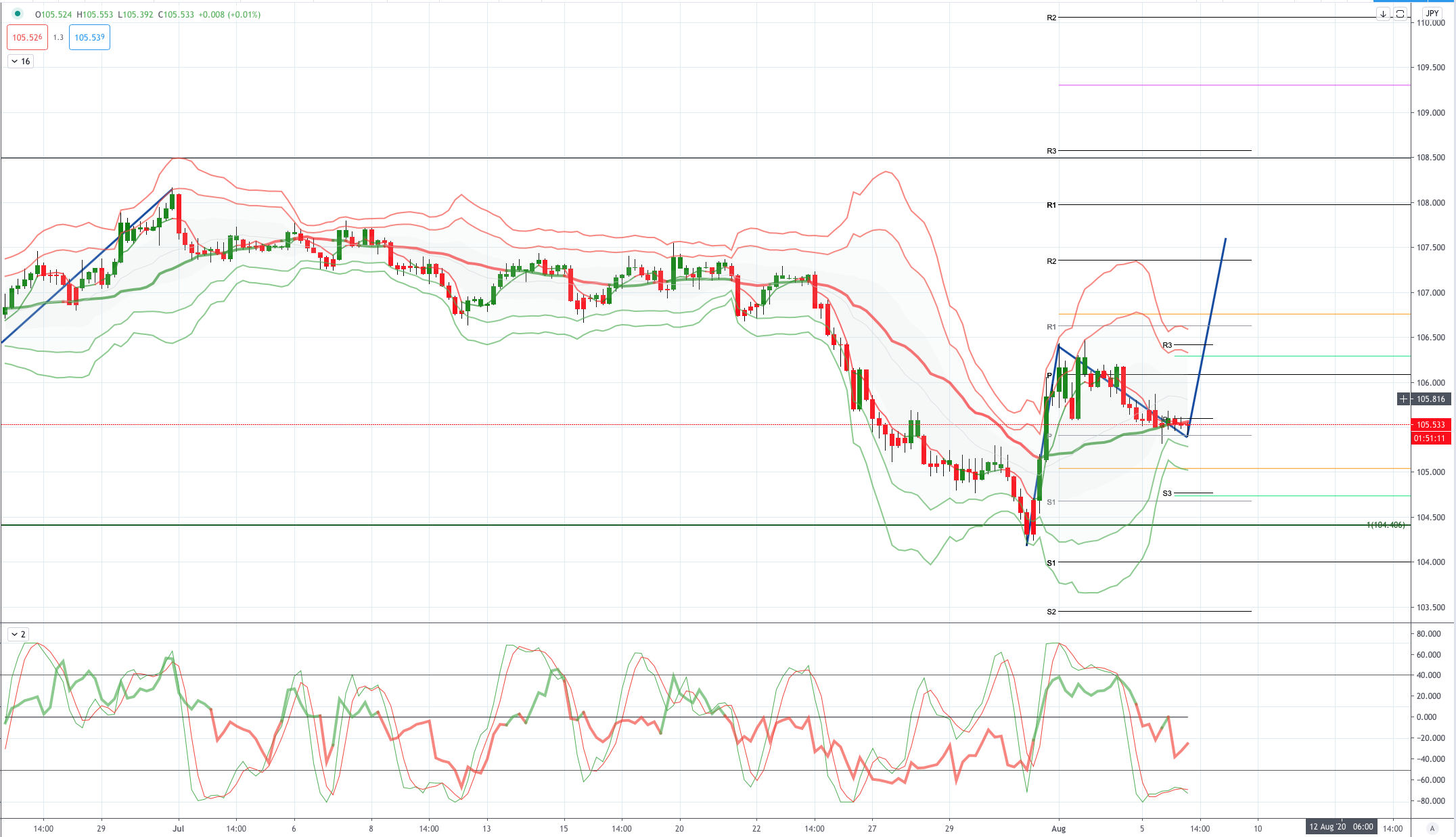

USDJPY Bias: Bullish above 105.50 targeting 107.50

USDJPY From a technical and trading perspective, anticipated test of the equality objective at 104.50 attract big bids, printing a key reversal pattern on Friday, as discussed in today’s Chart Hit, as 105.50 acts as a support look for a test of the equality objective to 107.50.

AUDUSD Bias: Bearish below .7170/90 targeting .6950

AUDUSD From a technical and trading perspective, test of stops and offers above .7220 has delivered the anticipated corrective phase, as .7170/90 now acts as resistance look for a test .6950 as ascending support.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!