Daily Market Outlook, August 23, 2022

Daily Market Outlook, August 23, 2022

Overnight Headlines

- Hedge Funds Pile Into A Record Hawkish Rate Bet Pre-Jackson Hole

- ING: Euro Woes Set To Worsen On Asia Fx Intervention Sales

- USD Steady, Euro At Two-Decade Low On Energy, Growth Woes

- Pound Dives And Inflation Bets Hit A Record On UK Energy Crisis

- Japan's Aug Factory Activity Grows At Slowest Pace In 19 Months

- China May Cut RRR This Year To Offset MLF Maturity - Sec.Times

- Chinese Banks Are Inflating Their Loan Numbers As Demand Sinks

- Inflation And Lockdowns Hurt New Zealand's Ruling Party In Polls

- U.S. Yields Advance As Markets Position For Hawkish Fed

- Oil Gains After Saudis Flag OPEC+ Action To Arrest Price Slide

- Saudi Says OPEC+ Can Cut Output To Address Oil Slump

- Iran Says U.S. Delaying On Nuclear Deal, U.S. Sees Progress

- Asian Stock Gauge Drops Tuesday Amid Rise in Yields, Crude

- Asian Energy Shares Rally As Natural Gas, Oil Prices Gain

- Chip Sales Set To Slow Further As Global Recession Fears Mount

The Day Ahead

- Asian equity markets are trading mostly lower following the biggest one-day fall on Wall Street for over two months. Investors are preparing for a potentially hawkish message from US Federal Reserve Chair Powell at the Jackson Hole Economic Symposium later this week. The risk-off sentiment has continued to support the US dollar and weighed on oil prices, although the latter rebounded on reports of possible supply cuts. Markets shrugged off weaker Australian and Japanese PMI reports.

- This week’s data calendar is relatively light with no official releases in the UK. However, today’s August PMIs in the UK, Eurozone and the US will provide timely updates. Both the manufacturing and services measures have been trending down of late in all three economies. Overall, that trend seems set to continue this month although there may be small rebounds in the headline services readings for both the UK and the US.

- Earlier this year, the primary message from the PMIs seemed to be that demand was still robust, but supply constraints were holding back production. Now it seems that demand is faltering, pointing to the risk that the economic downturn may gather pace. More positively, there have been consistent signs in recent readings that cost pressures are moderating as supply-side constraints let up. That holds out hope that consumer price pressures may soon peak. However, the evidence on labour market pressures easing is far less compelling, while the ongoing rise in natural gas points to inflation rising significantly further in the near term.

- The UK CBI’s August industrial trends survey will also be released today. It covers similar ground to the manufacturing PMI and the consensus expectation is for headline net balances for total orders and selling prices to moderate further.

- In the Eurozone, this afternoon’s consumer confidence release is forecast to fall to a new record low. US new home sales, meanwhile, are expected to provide further signs that the housing market is under pressure due to higher interest rates.

FX Options Expiring 10am New York Cut

- EUR/USD: 0.9945-50 (752M), 0.9970-80 (800M), 1.0000 (487M)

- 1.0095-00 (667M)

- USD/JPY: 136.00 (515M). EUR/JPY: 135.00 (405M), 136.70 (302M)

- GBP/USD: 1.1730 (248M), 1.2025 (284M)

- AUD/USD: 0.6850 (273M), 0.6895-00 (361M)

- USD/CAD: 1.2950-60 (560M)

Technical & Trade Views

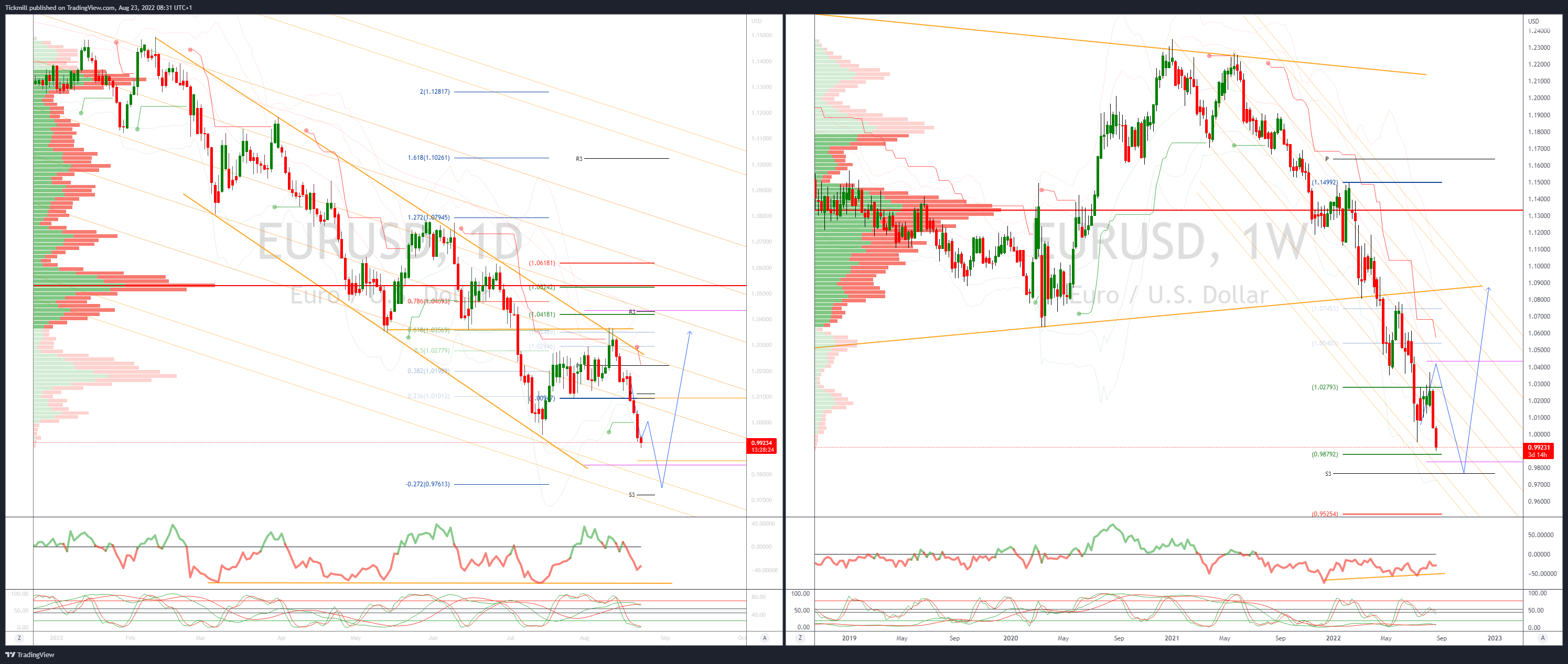

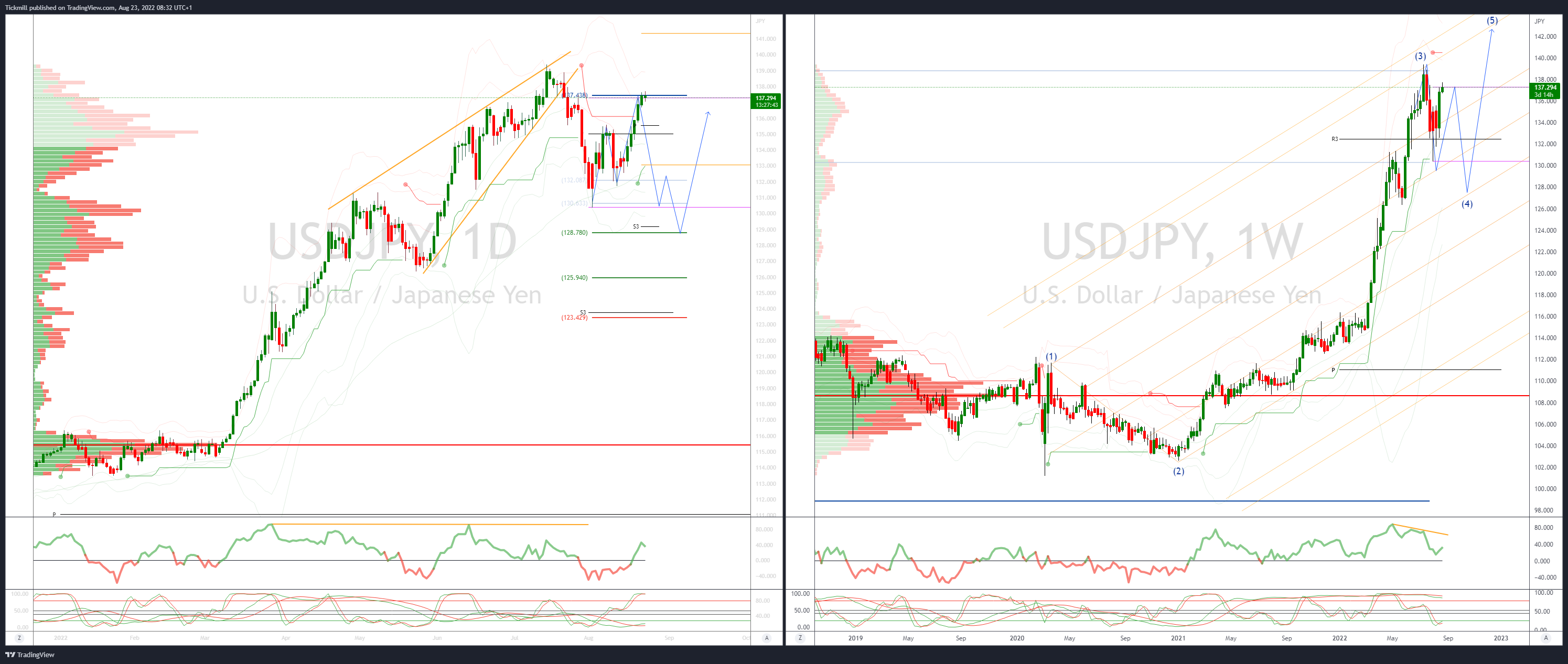

EURUSD Bias: Bearish below 1.0250

- EUR struggled as a result of Chinese ripple effect and European energy trouble.

- Sellers encountered at 0.9950, offers kept replenishing

- Funds are short futures, betting Fed will stick to its hawkish tone at Jackson Hole

- Bloomberg report Eurodollar futures, short bets from hedge funds are near this year’s highest levels at just over 2.6mln contracts, on a net basis.

- More than €2bn of 0.9850 put strikes due this Friday

- Monthly and weekly projected range support sited at 9830/50

- 20 Day VWAP bearish, 5 Day bearish

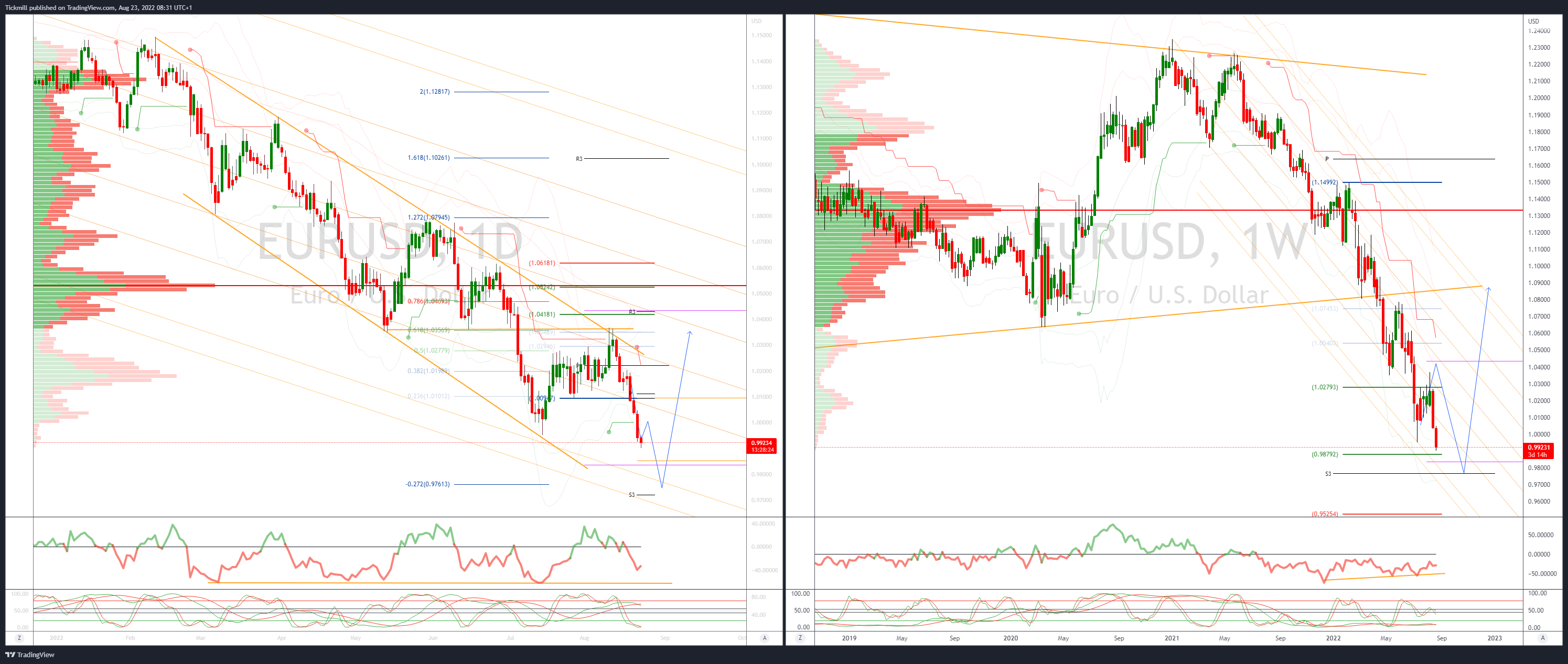

GBPUSD Bias: Bearish below 1.2130

- Sterling weak ahead of UK PMI

- +0.05% in a 1.1758-1.1784 range - busy earl

- Manufacturing PMI poll 51.1 and services poll 52 are UK event risk

- Sterling needs good news after surging CPI, soft confidence last week

- 20 day VWAP bands expand - strong bearish trending setup

- Close below 1.1761/43 July and Monday's low to target 1.1413 March 2020 base

- 20 Day VWAP is bearish, 5 Day bearish

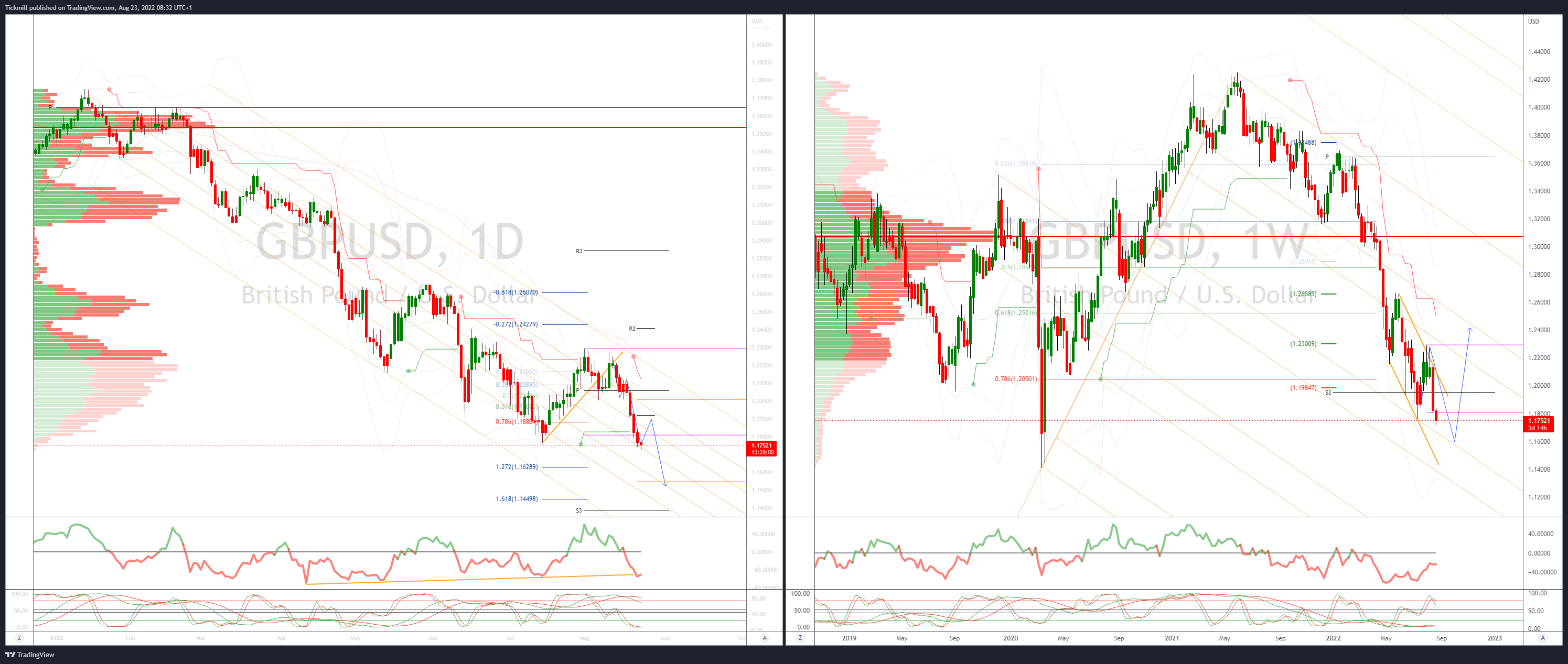

USDJPY Bias: Bullish above 136

- Japan August mfg PMI 51.0, pace of growth slower but still in expansion

- Follows July mfg PMI at 52.1, new order declines deepened

- That said, economic activity in Japan in August usually on very slow side

- Many firms shut down plants for re-tooling, Obon holidays across nation

- Economic activity usually picks up in September

- With JPY weak and exports booming, Japan to remain on recovery path

- No impact seen on current BoJ easy policy, rates, BoJ scenario playing out

- Close above 137.26 would target a test of 139.38 July high

- 20 Day VWAP is bullish, 5 Day bullish

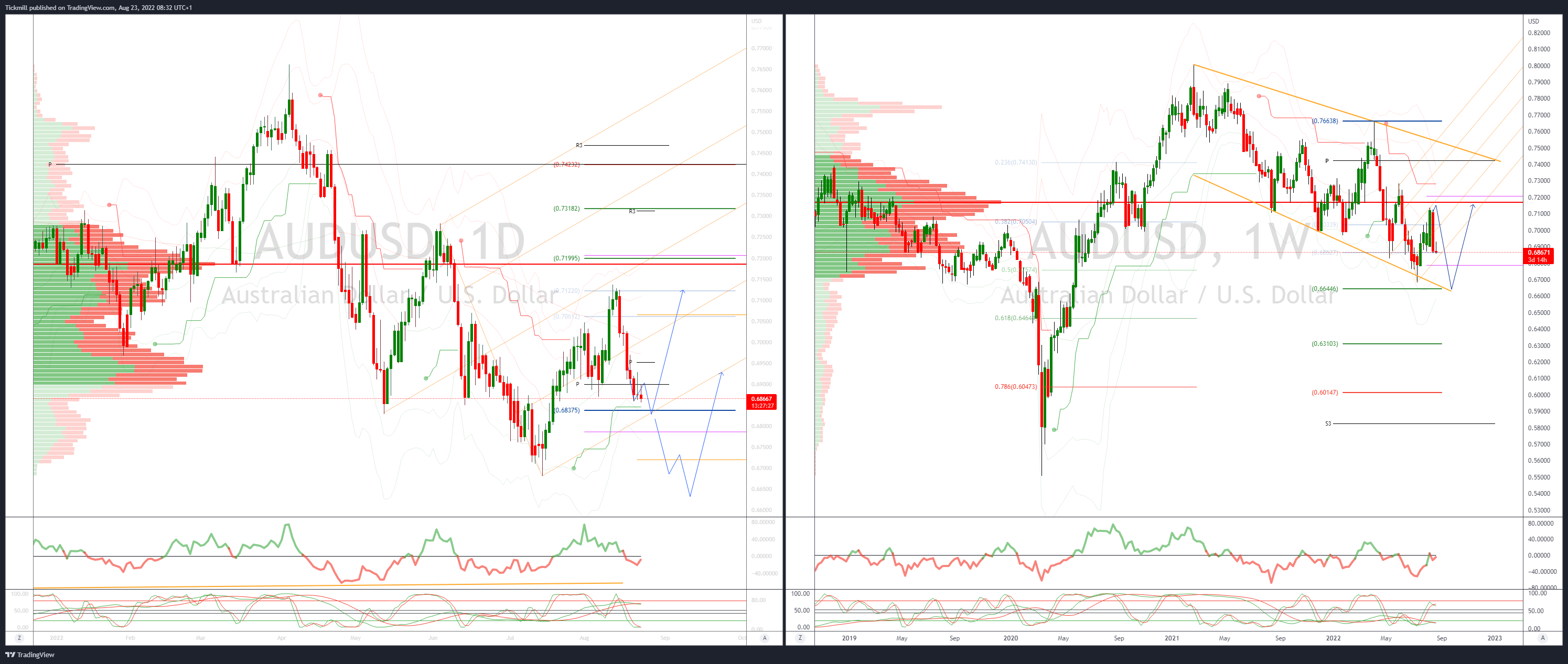

AUDUSD Bias: Bearish below .71

- AUD/USD gets another shove lower as risk bounce fizzles

- AUD/USD fumbles to 0.6856 from 0.6875 as risk sours

- Failed to stay above 23.6% Fibo 0.6913 on Monday

- Now firmly inside VWAP downtrend channel; cap at 0.6904

- Risks a pivotal fall through base 0.6836

- Deeper drop to 0.6700 could follow as weak longs bails

- Fledging bounce in S&P futures reverses, now -0.4%

- A break below 0.6850 would open the way to the trend low at 0.6682

- 20 Day VWAP is bearish, 5 Day bearish

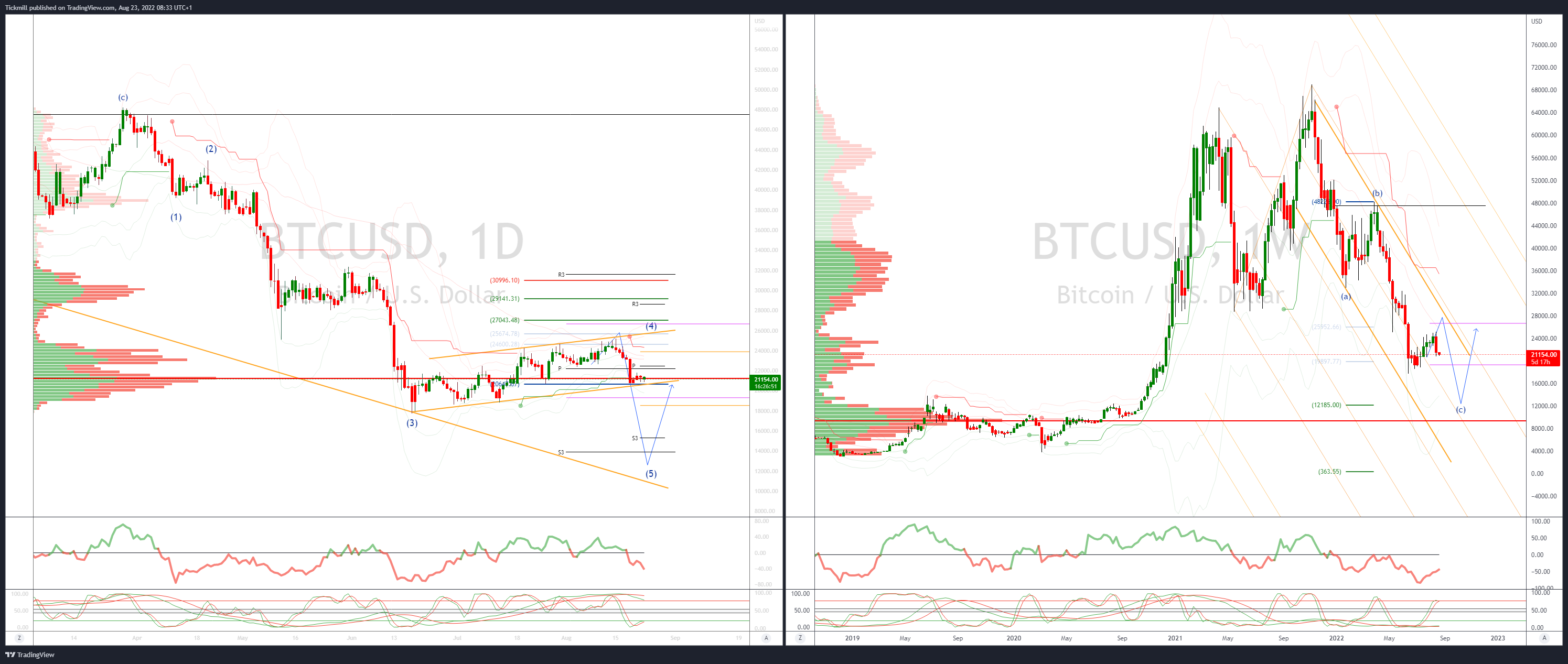

BTCUSD Bias: Bearish below 25.3K

- BTC testing pivotal 21k

- The grand crypto project has declined in 2022

- Total user funds deposited has shrunk to about $61 billion from over $170 billion at the start of the year, according to figures from data aggregator Defi Llama

- The U.S. intervention this month has forced many DeFi projects to block cash from wallets

- Bulls need a close above 25k to gain significant upside momentum

- Closing below 21k would be a noteworthy downside development

- 20 Day VWAP is bearish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!