Daily Market Outlook, August 2, 2023

Munnelly’s Market Commentary…

Asian equity markets are trading lower, following a negative lead from Wall Street. The sentiment has been dampened by higher yields and weak economic data. One of the factors affecting the market is Fitch's credit rating downgrade for the United States from AAA to AA+.

The Nikkei 225 index is down 2.3% and has fallen below the 33K handle. The focus has shifted to corporate earnings despite comments from the Bank of Japan's Deputy Governor Uchida, who maintained a dovish tone and emphasised that last week's decision was a pre-emptive step to continue monetary easing without disruptions. The Hong Kong market is down 2.1%, following the overall risk aversion sentiment. The mainland Chinese market is down 0.8%, initially cushioned by policy support and jawboning from agencies like the People's Bank of China (PBoC). The PBoC has pledged to support the stable and healthy development of the real estate market, maintain reasonable liquidity, and promote a steady decline in financing costs for enterprises and interest rates for residents.

In terms of the economic data docket for the rest of the day, there are no official data releases scheduled for the UK, Eurozone, or the US. This lack of economic data may lead to market speculation about the outcome of Thursday's Bank of England monetary policy update. Current market pricing indicates a high probability of another interest rate hike, with a 25-basis point increase seen as more likely than a second consecutive 50-basis point rise. A Bloomberg survey of 56 economists showed that 41 of them expect a 25-basis point hike.

Stateside, the July ADP survey of private sector employment is being closely watched as an indication of the likely outcome of the official employment data due on Friday. The forecast for the ADP measure is a 190k rise in private sector employment. However, it's worth noting that despite a revamp, the ADP measure has not proved to be a reliable preview of the official payrolls series in recent months. Last month, it over-predicted payrolls by almost 350k, although prior to that, it had been an under-predictor more generally.

CFTC Data As Of 25-07-23

USD net spec short grew in Jul 19-25 period, $IDX +1.34% in period

Rates remain key driver, after period close Fed, ECB lilted dovish

BoJ adjusted YCC JGB 10-yr intervention lvl to 1%, yen whipsawed

EUR$ -1.52% in period, specs -1,602 contracts now -177,230

$JPY +1.34% in period, specs +12,487 into strength now -77,752

GBP$ -1%, specs -4,734 contracts, now +58,995; after below f/c CPI

AUD$ -0.3% in period, specs -800 contracts; $CAD +0.03%, specs +5,009

BTC -1.86% in period specs +516 contract by trend lows now -645 contracts(Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0975-80 (877M), 1.0990 (817M), 1.1000 (301M)

1.1050 (411M), 1.1065 (553M). Huge strikes Thursday

USD/CHF: 0.8550 (600M), 0.8750 (265M)

AUD/USD: 0.6660 (630M), 0.0.6675-85 (1.1BLN), 0.6700 (535M)

NZD/USD: 0.6330 (1BLN). USD/CAD: 1.3150-65 (520M), 1.3270 (400M)

USD/JPY: 142.00 (352M), 142.40-50 (638M), 143.00 (670M)

Options Market Positioning

Options analysis suggests that the GBP/USD pair is susceptible to further gains in the USD and may face challenges from an underwhelming rate hike decision by the Bank of England on Thursday. However, the lack of premium or demand for downside versus upside strike options indicates that there might not be strong hedging activity or significant bets on downside moves.

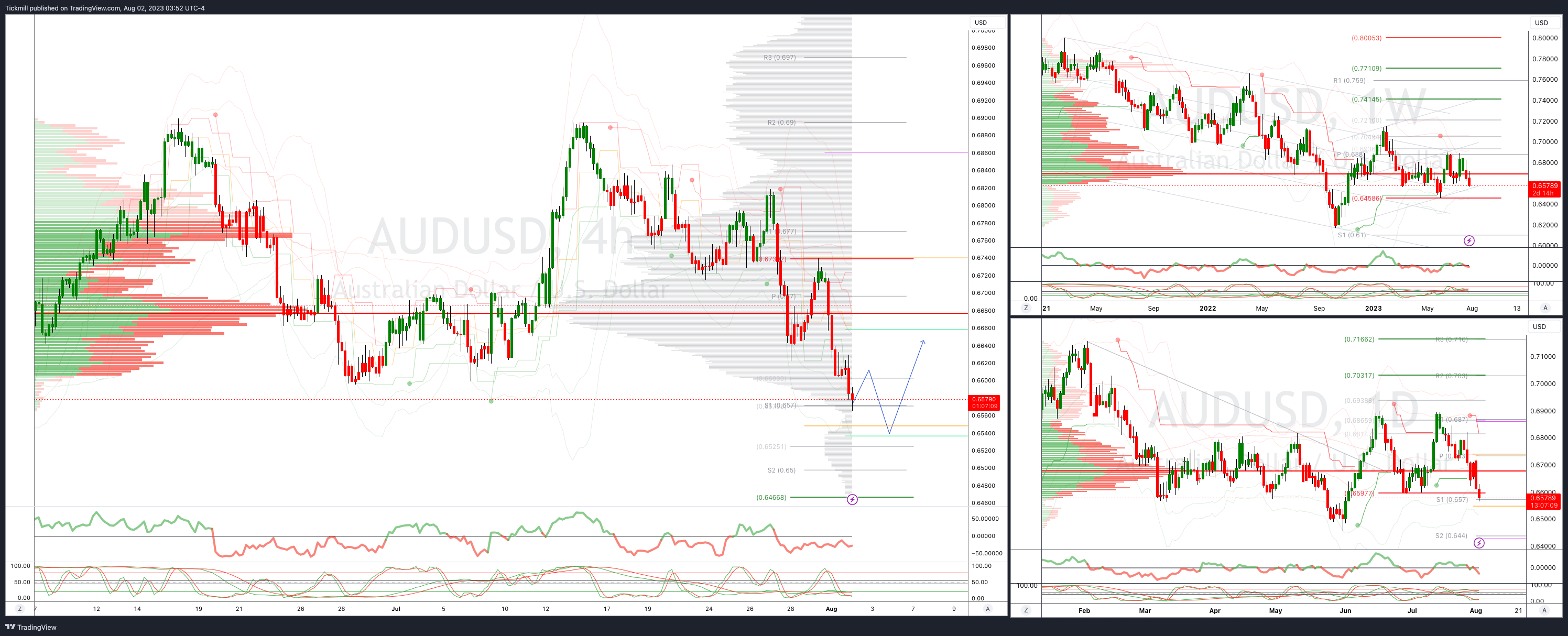

On the other hand, the AUD/USD pair is experiencing volatility premiums supported by a setback in the spot price after the Reserve Bank of Australia (RBA) meeting. This setback puts key support at 0.6595 at risk, meaning that the Australian dollar may face further downward pressure against the US dollar.

In summary, the outlook for GBP/USD leans towards potential USD gains and a potentially underwhelming rate hike from the Bank of England, while AUD/USD is facing volatility premiums due to a post-RBA spot setback. Both currency pairs are influenced by their respective central bank actions and broader market sentiment.

Overnight Newswire Updates of Note

Fitch Downgrades US’ Long-Term Ratings To 'AA+' From 'AAA'; Outlook Stable

Dollar Shaky After US Credit Rating Downgrade, US Tsy Yields Edge Lower

BoJ Debated Inflation Overshoot Risk In June, Offering Insight Into July Tweak

BoJ's Uchida: Took Steps To Prepare For Future Economic Changes

China Moves To Roll Out Pro-Growth Policies As Economy Struggles

Fed’s Bostic Urges Caution With More Hikes As Inflation Recedes

Fed’s Goolsbee Wants To See More Inflation-Easing Data Before Sept Decision

Top Republican Candidates Split On Trump Indictment

US Rejects Another Round Of Offers To Replenish Oil Stockpile

AMD Gains After Chipmaker Tops Estimates, Makes AI Inroads

Chesapeake Energy Profit Slides On Lower Natural Gas Prices

Starbucks Misses Quarterly Sales Estimates, China Sales Buoy

Dan Loeb’s Third Point Laments Missing ‘Obvious’ Tech Rally, Pivots To AI

Goldman’s Last Bearish Analyst Upgrades Stock As Risks Fade

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

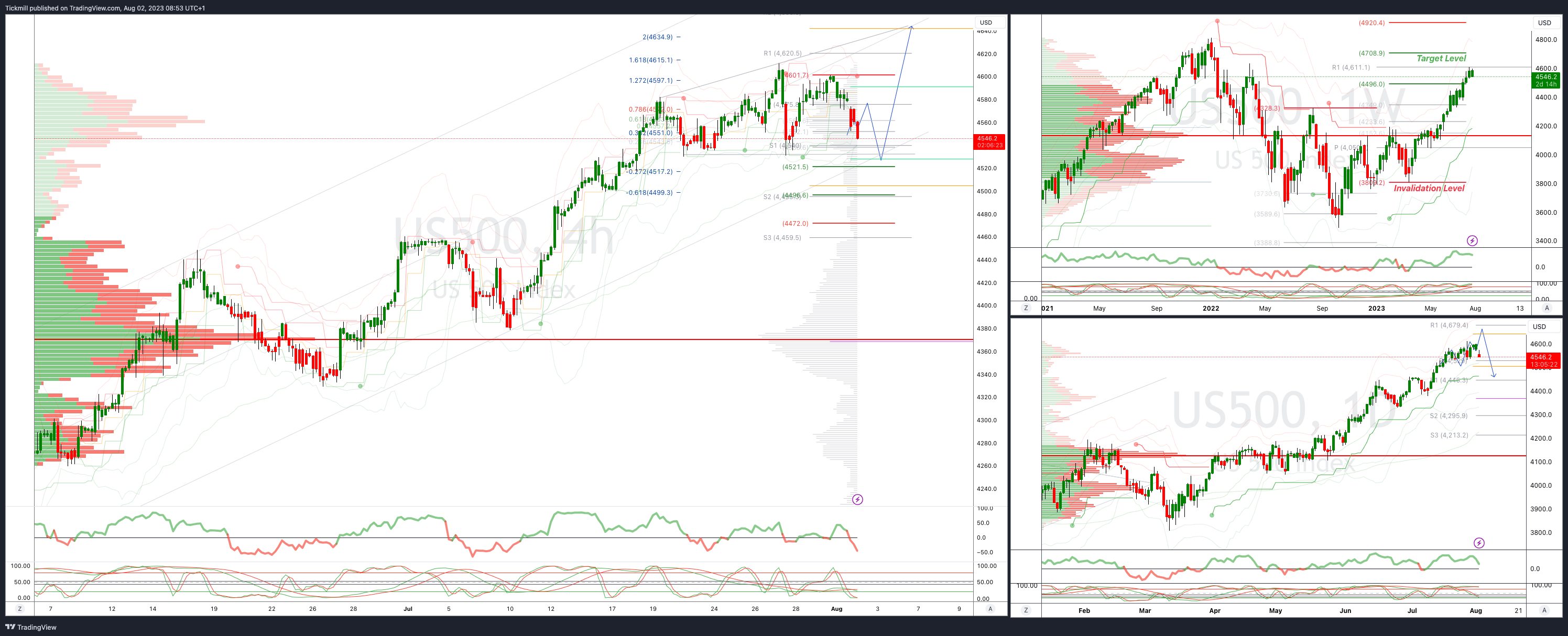

SP500 Intraday Bullish Above Bearish Below 4520

Below 4520 opens 4500

Primary support is 4370

Primary objective is 4630

20 Day VWAP bullish, 5 Day VWAP bearish

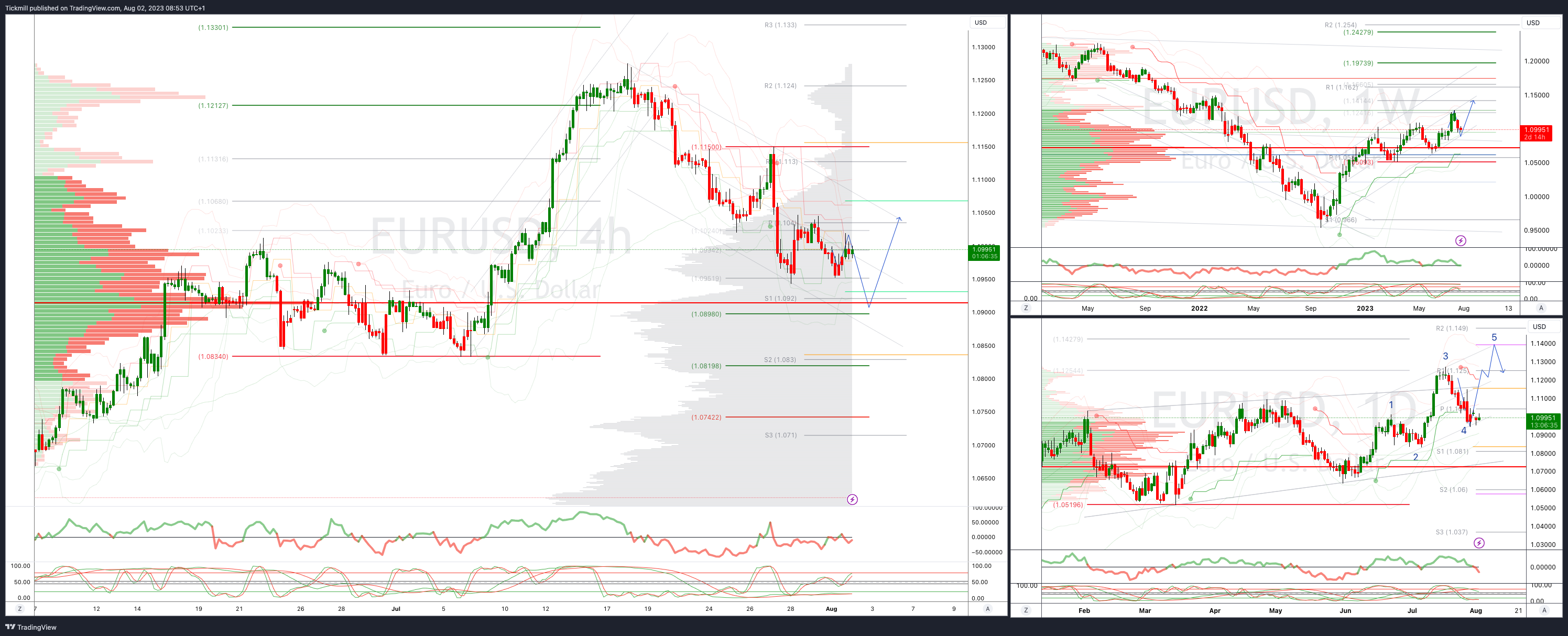

EURUSD Intraday Bullish Above Bearsih Below 1.1020

Below 1.890 opens 1.0830

Primary support is 1.830

Primary objective is 1.13

20 Day VWAP bullish, 5 Day VWAP bearish

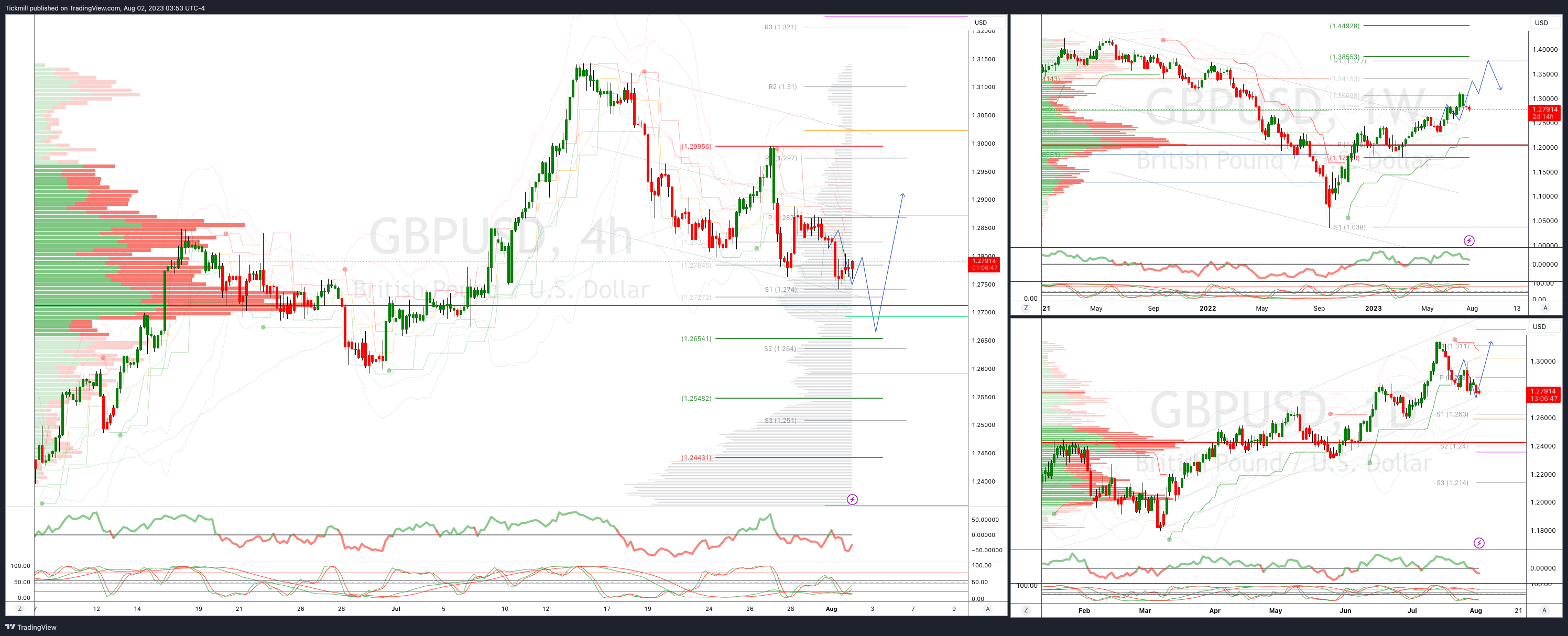

GBPUSD: Intraday Bullish Above Bearish Below 1.28

Below 1.2750 opens 1.2650

Primary support is 1.26

Primary objective 1.3850

20 Day VWAP bullish, 5 Day VWAP bearish

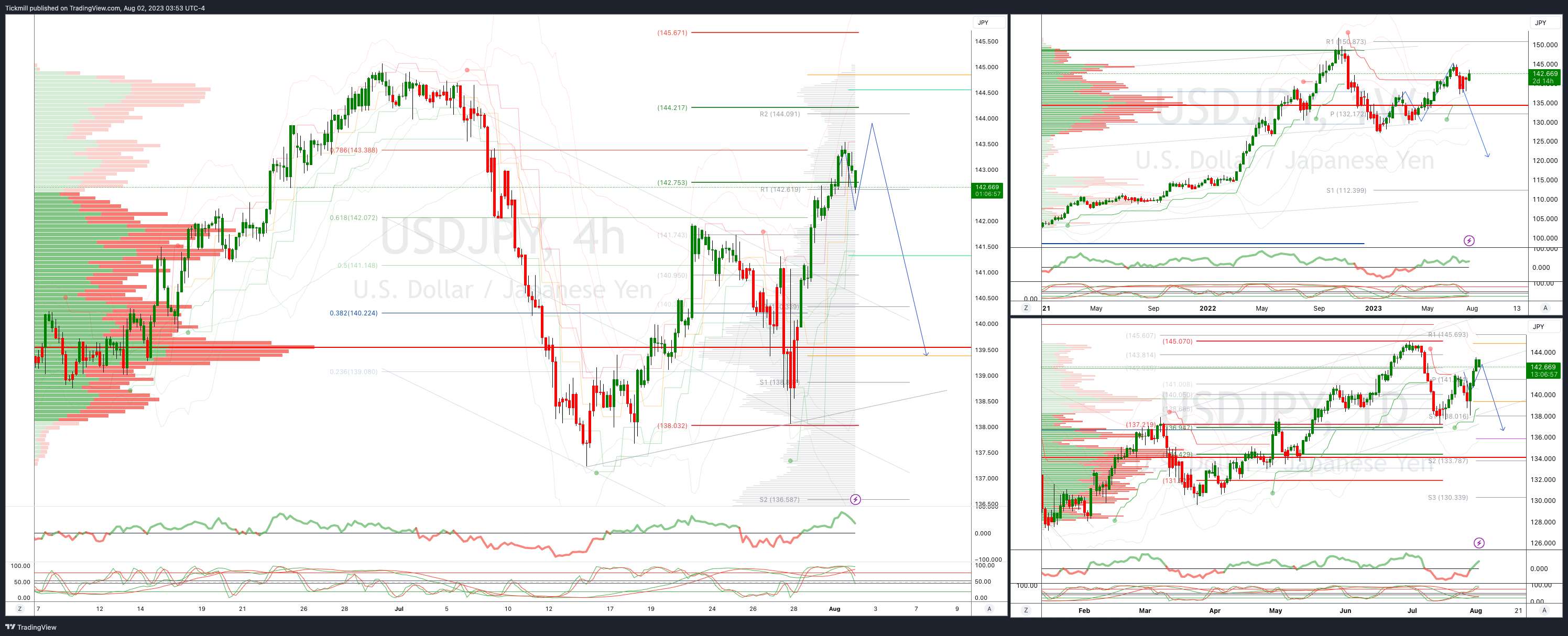

USDJPY Bullish Above Bearish Below 139.60

Above 143.50 opens 145

Primary resistance 143.40

Primary objective is 136.20

20 Day VWAP bullish, 5 Day VWAP bullish

AUDUSD Intraday Bullish Above Bearish Below .6660

Above .6750 opens .6820

Primary resistance is .6730

Primary objective is .6466

20 Day VWAP bearish, 5 Day VWAP bearsih

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28600

Primary support is 28400

Primary objective is 32750

20 Day VWAP bullish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!