Daily Market Outlook, April 4, 2022

Overnight Headlines

- Russia: Talks Had Not Progressed Enough For A Leaders' Meeting

- Ukraine Official: Draft Treaty Documents At 'Advanced Stage'

- EU Prepares More Sanctions After Apparent Atrocities Near Kyiv

- Chinese Vice Premier Calls For Greater Effort To Stabilise Foreign Trade

- China Finds New Virus Subtype As Daily Cases Exceed 13,000

- Two Chinese mRNA Covid Vaccines Move Toward Clinical Trials

- Entire Tech Hub Mega City Of Shanghai Placed Under Lockdown

- China Removes Key Hurdle To Allow US Full Access To Audits

- Australian Job Ads Numbers Suggest Steady Jobless Rate Drop

- Fed’s Daly Says Case For Half-Point Rate Rise In May Has Grown

- Fed’s Williams Sees Sequence Of Steps To Raise Rates To Neutral

- ECB’s Schnabel: Expects To Hike Rates After Ending Bond Buys In Q3

- Euro Weighed Down By Talk Of Fresh Russia Sanctions

- Oil Extends Losses On Reserves Release And Yemen Truce

- Iran Says Agreement to Revive Nuclear Deal With US Is Close

- German DefMin: EU Must Discuss Import Ban On Russian Gas Deliveries

- Stocks Up Amid China Step To Ease Dispute With US Over Audit Spat

- CanSinoBIO's mRNA Covid Vaccine Candidate Cleared For Trials In China

The Week Ahead

- Geopolitical tensions continue to simmer while markets are likely to focus on assessing central banks' position toward stagflation risks as the Federal Reserve and European Central Bank release minutes this week, while Australia's central bank delivers a policy decision.

- Day-to-day updates in the Russia-Ukraine crisis are impacting markets less, but major developments will still matter. Reports over the weekend hinted at direct talks between the countries' leaders, but were tamped down by Russia. There should be a relief rally for the EUR, support for equities and lower energy prices if that pans out.

- The Reserve Bank of Australia will likely remain on hold Tuesday, but the market is looking for any hints the bank might finally commence its tightening cycle. A 15-basis point hike has been priced in for June and for the cash rate to be 2.0% higher by end-2022. Some Reuters poll respondents expect tightening to begin in June, but most foresee an August start.

- The Fed will release minutes from their March meeting at which they hiked rates for the first time in over three years. Anticipate confirmation of the hawkish turn in expectations and more detail on plans to shrink the balance sheet.

- BoJ To Keep Rates Low As Strong, Not Weak, Yen Still Kuroda's Enemy No. 1. Sources familiar with the bank's thinking and people close to Kuroda, whose decade in charge ends next April, said he is likely to protect his legacy by avoiding tweaks to a monetary policy that continues to treat a strong yen as enemy No. 1. The BOJ's dovish signals may give markets a chance to drive down the yen further, as prospects of steady policy tightening by the Federal Reserve widen the Japan-U.S. interest rate gap. "The BOJ looks at inflation, not yen moves, in guiding policy," one of the sources said

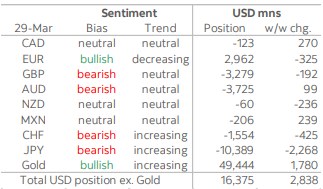

CFTC Data

- Bullish positioning in the USD improved for a third consecutive week to its highest aggregate long since early-January thanks to an USD2.8bn increase to USD16.4bn, according to analysis provided by Scotia Bank. The rapid improvement in speculative sentiment in the USD since dropping to a seven-month low of USD5bn in early-March coincided with solid gains in the dollar against the JPY, GBP, and EUR over the month

- The JPY’s losses to the 125 yen per USD mark last week were met with a sharp deterioration in the already large JPY bearish position; the yen was the worst performing major currency over the period with a 1.7% decline. Accounts took the JPY’s net short to USD10.4bn, a four-month-high, with a USD2.3bn move against it as longs were heavily cut (from 37k to 15k contracts) while outstanding shorts held relatively steady. The CHF’s position also worsened with a USD425mn move against the franc to take its aggregate short to USD1.5bn. The haven currencies experienced the largest positioning moves (be it bearish or bullish) of those covered in this report.

- Investors warmed up somewhat to the MXN as it led all the currencies tracked here over the period with a 1.5% gain. The small MXN short was reduced to USD206mn with investors placing a net USD239mn bet in favour of the peso in a week where the exchange rate breached the key psychological level of 20 pesos per USD. The MXN traded this morning at its strongest level in seven months.

- Accounts reversed a small part of last week’s large net bet against the CAD of USD1.8bn, trimming the small short to practically neutral at USD123mn on the back of a USD270mn adjustment in the CAD’s favour; while small, this was the biggest net bullish bet this week. Its commodity peers, the AUD and NZD, saw mixed results, with the net AUD short slightly falling by USD99mn to USD3.7bn (still the second largest short after the JPY’s) and the NZD’s small long was trimmed by USD236mn to a small net short of USD60mn.

- Sentiment in the EUR and GBP weakened over the week as speculators wagered against both currencies, in net terms, with the net EUR long clipped by USD325mn and the sizable net GBP short rising by USD192mn. Negative positioning in the GBP—which beat only the JPY this week with its 1.3% depreciation—is now at a 13-week-high of USD3.3bn after the pound’s failed test of the 1.33 zone last week. The decline in the net EUR long this week to USD3.0bn follows the currency’s failure to hold a 1.11 handle around mid-month and erases around half of last week’s move of USD713mn in its favour.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

- EUR/USD: 1.0800 1.2b, 1.0975 485m, 1.1000 1.1b, 1.1100 767m

- USD/JPY: 122.50 604m, 123.00 305m, 123.50 749m

Technical & Trade Views

EURUSD Bias: Bearish below 1.12 Bullish above

- EUR/USD dipped to 1.1026 early Asia after closing Friday at 1.1047

- USD gave back early gains and EUR/USD drifted higher into the afternoon

- It is settling above 1.1050 -around the session high at 1.1053

- Despite fall late last week, EUR/USD is in a bullish set-up

- The 5, 10 & 21-day MAs in bullish alignment and tilting higher

- A fall below the 21-day MA at 1.1010 would negate the bullish set-up

- Resistance is at Friday's 1.1076 high and break increases upward pressure

GBPUSD Bias: Bearish below 1.3350 Bullish above.

- -0.05% in a tight 1.3098-1.3120 range - busy as Asia fully opened then quiet

- Sterling will be led by external factors, risk, the USD and yield spreads

- Soft markets, E-mini S&P -0.1%, US2YT=RR +2bp to 2.484%, Brent -0.55%

- Charts; momentum studies edge higher - 10 & 21 DMAs slide gently lower

- 21 day Bollinger bands contract - modest net negative signals

- First major support is 1.3000 lower 21 day Bollinger band and the 2022 low

- 1.3146 London high Friday, then last week's 1.3181 high initial resistance

- Weekly charts remain bearish as 5, 10 & 21 week MAs track south

USDJPY Bias: Bullish above 120 Bearish below

- From 122.73 EBS in early trading, USD/JPY slumps to 122.28 into Tokyo fix

- Move down on low volume and met by good Japanese importer, other demand

- Bounce since to 122.69, confirms pair in consolidation mode

- Tokyo players eye 122.00-123.00 range for now

- $604 mln in option expiries today at 122.50 exert some gravitational pull

- BoJ YCC JGB 10s cap intact, BoJ offers to buy more long bonds

- Higher US yields post-US jobs report supportive, Tsy10s @2.415% TradeWeb

- Japan investors turning to front-end on inverted Tsy curve, 2s @2.484%

- Tokyo risk mood neutral, Nikkei around par at @27,626, E-Minis too @4533

AUDUSD Bias: Bullish above .7300 Bearish below

- Moves higher as buyers emerge after early dip

- AUD/USD eased to 0.7483 in early Asia after closing Friday at 0.7497

- AUD resilient as it was best performing major currency on Friday

- Buyers emerged at the lows and it tracked higher through the morning

- Heading into the afternoon it is just below the session high at 0.7513

- Resistance is at the March 28 high at 0.74540 and Oct trend high at 0.7555

- Support is at the 21-day MA at 0.7400 and 38.2 of 0.7165/0.7540 at 0.7396

- AUD/USD may see some volatility around RBA decision tomorrow

- RBA to remain on hold with focus on statement

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!