Daily Market Outlook, April 2, 2024

Munnelly’s Macro Minute…

“Markets Return To An Uncertain US Rate Cut Narrative”

Asian equity indices are treading cautiously as they assess the potential timing and extent of US Fed rate adjustments. Yesterday saw a decline in US stocks and a selloff in Treasury bonds, notably spurred by the ISM manufacturing index surpassing the 50-point mark for the first time since September 2022, hinting at expansion. Eyes are now on Friday’s US monthly labor market data, while Fed Chair Powell's upcoming speech on Wednesday is eagerly anticipated.

The British Retail Consortium (BRC) shop price index, released overnight, hinted at March's inflation trends. It showed a decrease to 1.3% from February's 2.5%, marking the lowest since 2021. This decline was mirrored in both food and non-food inflation, according to the BRC data. Today's focus in the UK will be on money and credit data, offering insights into lending conditions, particularly regarding the housing market, speculated to be picking up with the presumed peak in interest rates. Additionally, the March manufacturing PMI, though a second reading, is expected to remain just below the 50 threshold at 49.9.

In Europe, attention centers on Germany's preliminary estimate of March CPI inflation ahead of tomorrow's Eurozone flash estimate. Forecasts suggest Eurozone headline CPI will remain at 2.6%, with core inflation dipping to 3.0%, the lowest in nearly two years. French and Italian data released earlier hint at potential downside risks to the Eurozone's outcome. The ECB’s consumer expectations survey this morning, featuring inflation expectations for both one and three years ahead, will be scrutinized by policymakers. Additionally, the Eurozone manufacturing PMI's final reading is expected to confirm contraction in contrast to growth in services.

Stateside, focus lies on the latest factory orders and speeches from several Fed officials. Recent Fed commentary has been mixed, with Chair Powell suggesting no rush to cut interest rates, yet a first reduction in June remains probable if inflation data align with expectations. Uncertainty shrouds potential follow-up moves in the latter half of the year.

Overnight Newswire Updates of Note

NY Fed's inflation gauge sees reduced price pressures in February.

There is a surge in long dollar bets as funds connect the dots.

Japan issues a warning about taking action against excessive yen volatility.

The JP Mar Monetary Base Year-on-Year expansion is at a slower pace.

Chinese state banks sell dollars as yuan hits a 4 ½-month low.

The Reserve Bank of Australia (RBA) did not discuss raising rates at the March meeting, according to the minutes.

RBA's Kent suggests a shift to an ample reserve system to set rates, with repo rates near OCR.

The outlook for inflation and policy remains uncertain, according to Kent.

In the UK, inflation in shops drops to the lowest level in two years, as reported by Guardian and FT.

A study by the Swiss National Bank (SNB) calculates the cost of intervention to curb franc gains.

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: EUR amounts

1.0735 1.3b

1.0750 582m

1.0800 1.3b

GBP/USD: GBP amounts

1.2600 400m

USD/JPY: USD amounts

151.15 1.4b

152.50 863m

153.00 1.1b

AUD/USD: AUD amounts

0.6500 2.3b

CFTC Data As Of 29/03/24

Japanese Yen net short position is -129,106 contracts.

Euro net long position is 31,194 contracts.

British Pound net long position is 35,170 contracts.

Swiss Franc posts net short position of -21,968 contracts.

Bitcoin net short position is -1,075 contracts.

Technical & Trade Views

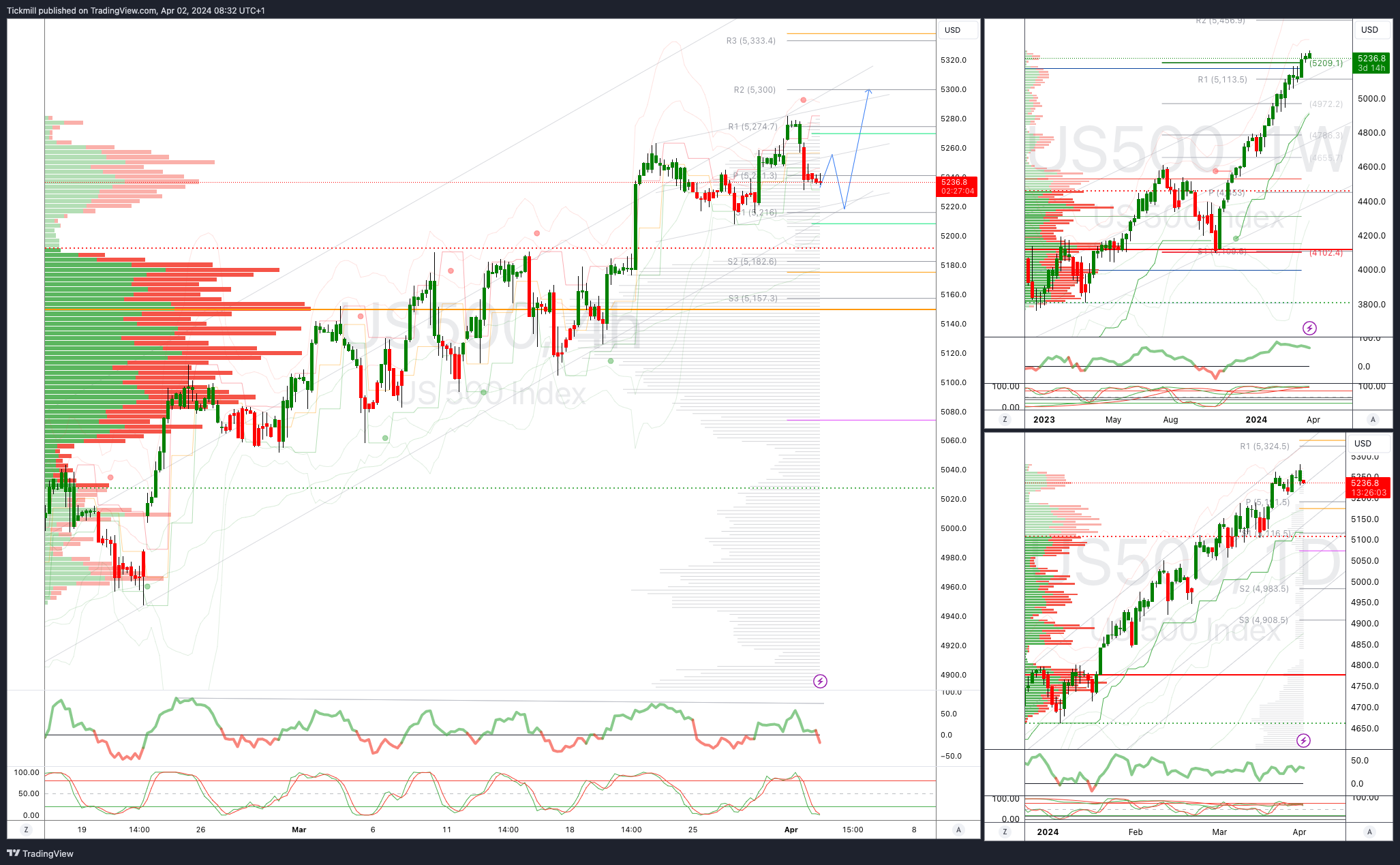

SP500 Bullish Above Bearish Below 5250

Daily VWAP bullish

Weekly VWAP bullish

Below 5190 opens 5160

Primary support 5160

Primary objective is 5300

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bearish

Weekly VWAP bearish

Below 1.0690 opens 1.0630

Primary support 1.0690

Primary objective is 1.0540

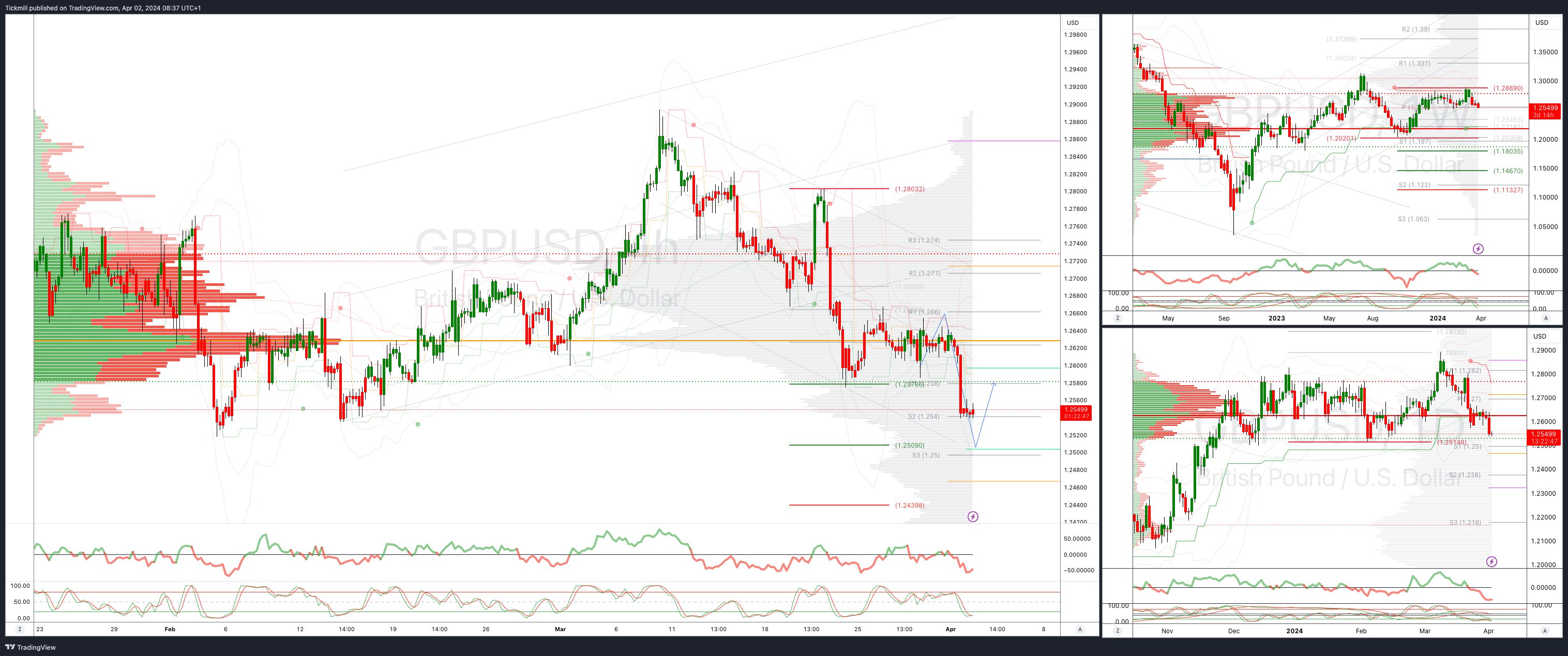

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bearish

Weekly VWAP bearish

Below 1.2570 opens 1.2510

Primary support is 1.2500

Primary objective 1.29 (Potential Objective Change Developing)

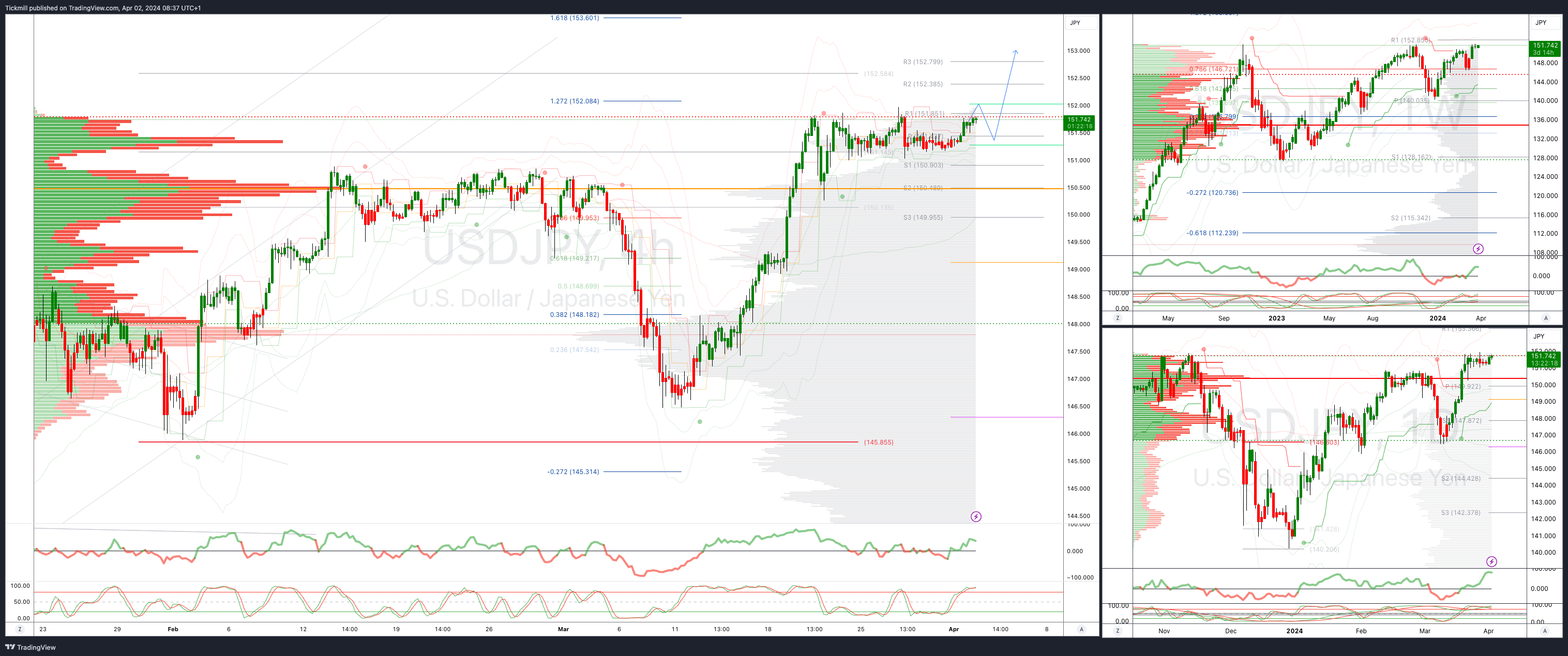

USDJPY Bullish Above Bearish Below 150.25

Daily VWAP bullish

Weekly VWAP bullish

Above 151 opens 152

Primary support 145.85

Primary objective is 153

AUDUSD Bullish Above Bearish Below .6570

Daily VWAP bearish

Weekly VWAP bearish

Below .6460 opens .6420

Primary support .6477

Primary objective is .6700 (Potential Objective Change Developing)

BTCUSD Bullish Above Bearish below 65000

Daily VWAP bearish

Weekly VWAP bullish

Below 64000 opens 59588

Primary support is 52800

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!