Daily Market Outlook, April 10, 2024

Munnelly’s Macro Minute…

“All Eyes On US Inflation For The Next Move In Markets”

On Wednesday, Asian stocks traded higher despite Fitch's rating downgrade of China, which caused a slight domestic sell-off. However, analysts believe that the downgrade does not accurately reflect the future performance of the economy. China's Shanghai Composite was down by just under half a percent. However, Hong Kong's Hang Seng Index managed to escape the selling and was trading up by nearly two percent. In other markets, Japan's Nikkei is taking aim at the 40k handle again, with the yen's decline expected to contribute to this push. Bank of Japan Governor Ueda emphasized that the central bank has no intention to adjust monetary policy directly based on fluctuations in the yen's strength or weakness.

Today’s release of the US March CPI report is anticipated to hold primary significance as the pivotal data release of the week for markets. The prior two US CPI reports for this year have sparked concerns regarding a potential slowdown in disinflation. Notably, both January and February witnessed month-on-month increases in core inflation (excluding food and energy) at 0.4%, marking the most substantial upticks since last May. However, it is probable that some of these gains are attributable to seasonal adjustment factors. As the March CPI is expected to offer a more accurate representation, markets expect a moderation in the monthly core inflation increase to 0.3%, consequently leading to a modest dip in the annual rate to 3.7% from 3.8%.

Conversely, headline inflation is poised to receive a boost from recent oil price escalations, with market expectations indicating a surge in the annual rate to 3.5% from 3.2%, marking a six-month high. Furthermore, the sustained surge in oil prices observed in early April suggests potential upward risks for April figures, further complicating the decision-making process for the US Federal Reserve regarding potential interest rate adjustments. The March CPI release stands as the sole data unveiling preceding the next Fed announcement on May 1st, with two additional reports scheduled before the subsequent policy update on June 12th.

Market expectations regarding US interest rate cuts have experienced a recent moderation following last week's unexpectedly robust employment data. A prospective move in June is currently perceived as a 50:50 proposition, and the complete endorsement of three 25-basis-point cuts by year-end is no longer entirely anticipated. While recent remarks from Fed policymakers underscore the importance of exercising caution in response to the robustness of economic indicators, many still lean towards the likelihood of three reductions throughout the year. Hence, the reaction to today's data will be vigilantly observed for any indications of wavering from this consensus.

Furthermore, the release of the March Fed policy meeting minutes today is anticipated. Although potentially perceived as outdated, these minutes may hold some interest in revealing any specific details concerning the developments policymakers are keen on observing to warrant rate adjustments.

Goldman Sachs Note To Clients Ahead of CPI

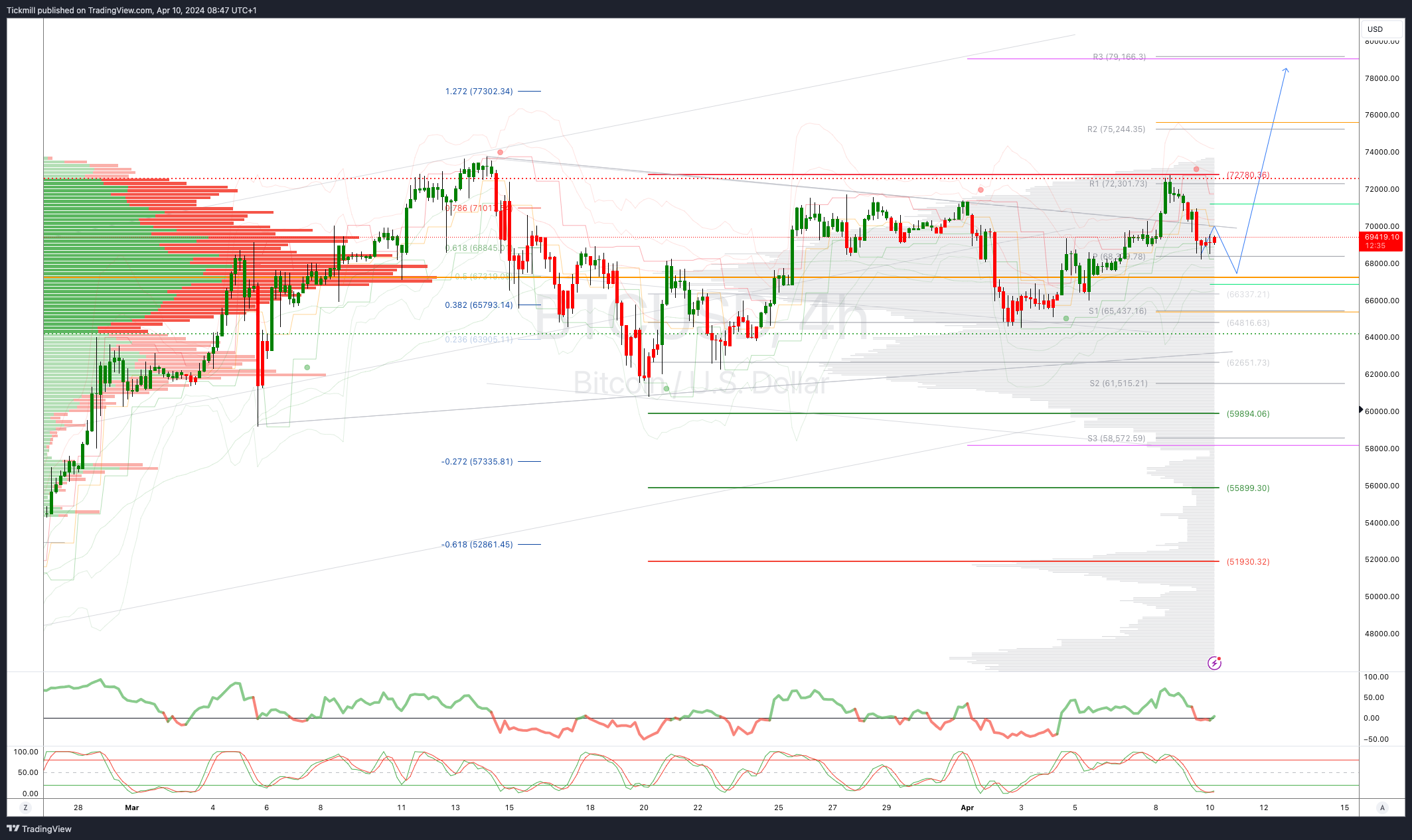

“We expect a 0.27% increase in March core CPI (vs. 0.3% consensus) and a year-over-year rate of 3.70% (vs. 3.7% consensus). Additionally, we anticipate a 0.29% increase in March headline CPI (vs. 0.3% consensus) and a year-over-year rate of 3.37% (vs. 3.4% consensus). If the numbers are in line or lower, it could lead to a rally in equities, bonds, gold, bitcoin, etc. A high number would result in a risk-off sentiment due to it being the third consecutive hot print and stretched positioning.”

Overnight Newswire Updates of Note

New Zealand Holds Rates, Sees Ongoing Need For Tight Policy

BoJ’s Ueda: BoJ Won’t Alter Policy To Respond Directly To Weak Yen

Kishida: Japan Ready To Step Up As US 'Global Partner' At Biden Summit

Japan March PPI Up +0.2% M/M Below Estimates - FXL

Fitch Cuts China Outlook To Negative On Steady Rise In Debt

March Inflation Data To Prolong Drama Around Fed Rate-Cut Timing

Fed’s Bostic Sees One Cut, But Leaves Door Open To Changing View

NZD/USD Rebounds Toward 0.6100 After RBNZ's Hawkish Hold Decision

Oil Falls As Rally Pauses While Traders Take Stock Of Middle East Tensions

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0810 (600M), 1.0875 (900M), 1.0900 (2.3BLN), 1.0945-50 (2BLN)

EUR/CHF: 0.9800 (500M). USD/CHF: 0.9070-75 (258M)

GBP/USD: 1.2675 (960M), 1.2750 (436M). NZD/USD: 0.5850 (625M)

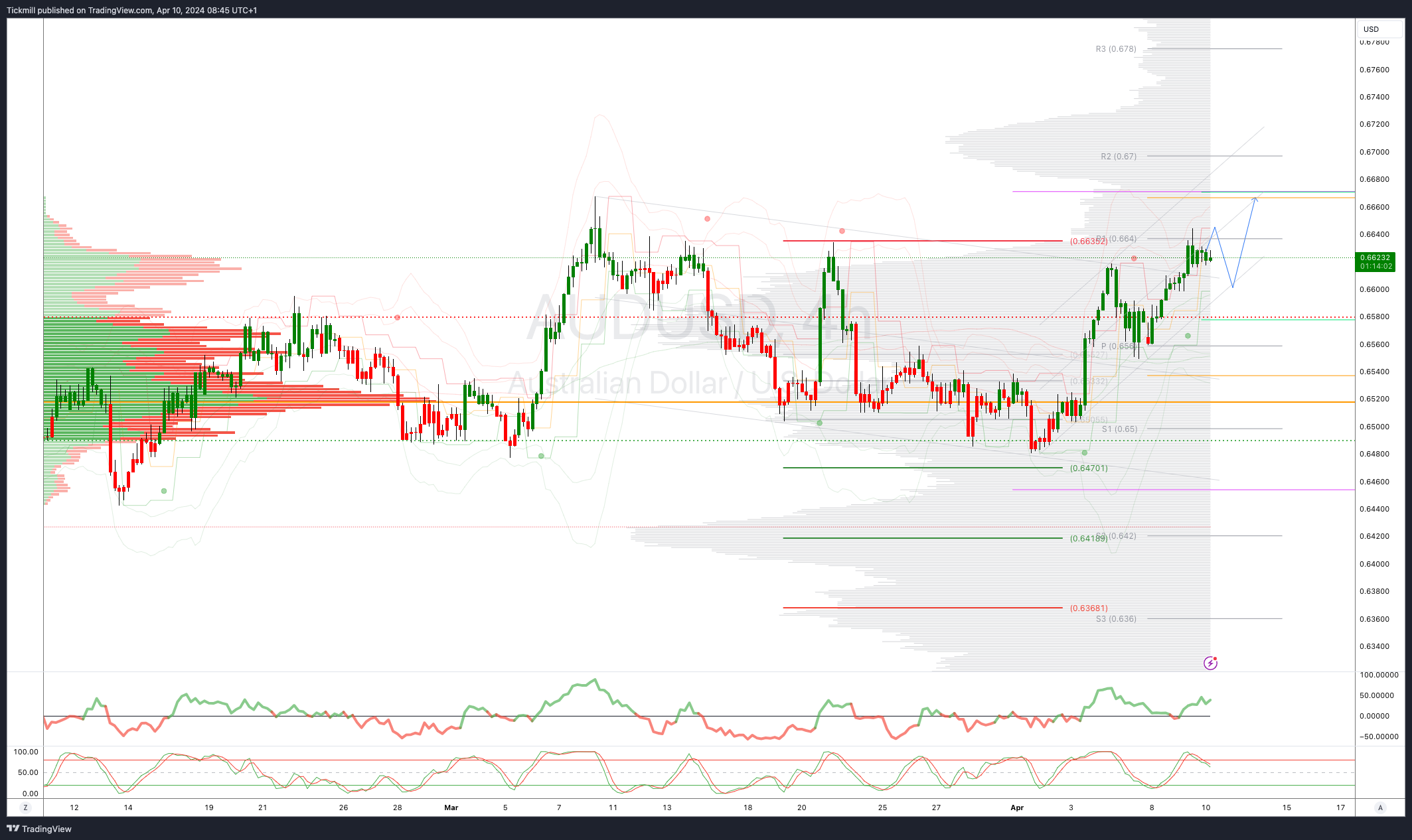

AUD/USD: 0.6530 (466M), 0.6630 (291M), 0.6645 (1.5BLN), 0.6650-55 (855M)

USDCAD: 1.3650 (531M), 1.3720 (863M), 1.3750 (727M)

USD/JPY: 151.00-05 (545M), 151.50 (1.2BLN), 151.75 (428M), 152.00 (495M)

CFTC Data As Of 29/03/24

Bitcoin net long position is 160 contracts

Swiss Franc posts net short position of -22,370 contracts

British Pound net long position is 43,414 contracts

Euro net long position is 16,794 contracts

Japanese Yen net short position is -143,230 contracts

Equity fund managers cut S&P 500 CME net long position by 26,140 contracts to 930,132

Equity fund speculators trim S&P 500 CME net short position by 83,217 contracts to 365,684

Technical & Trade Views

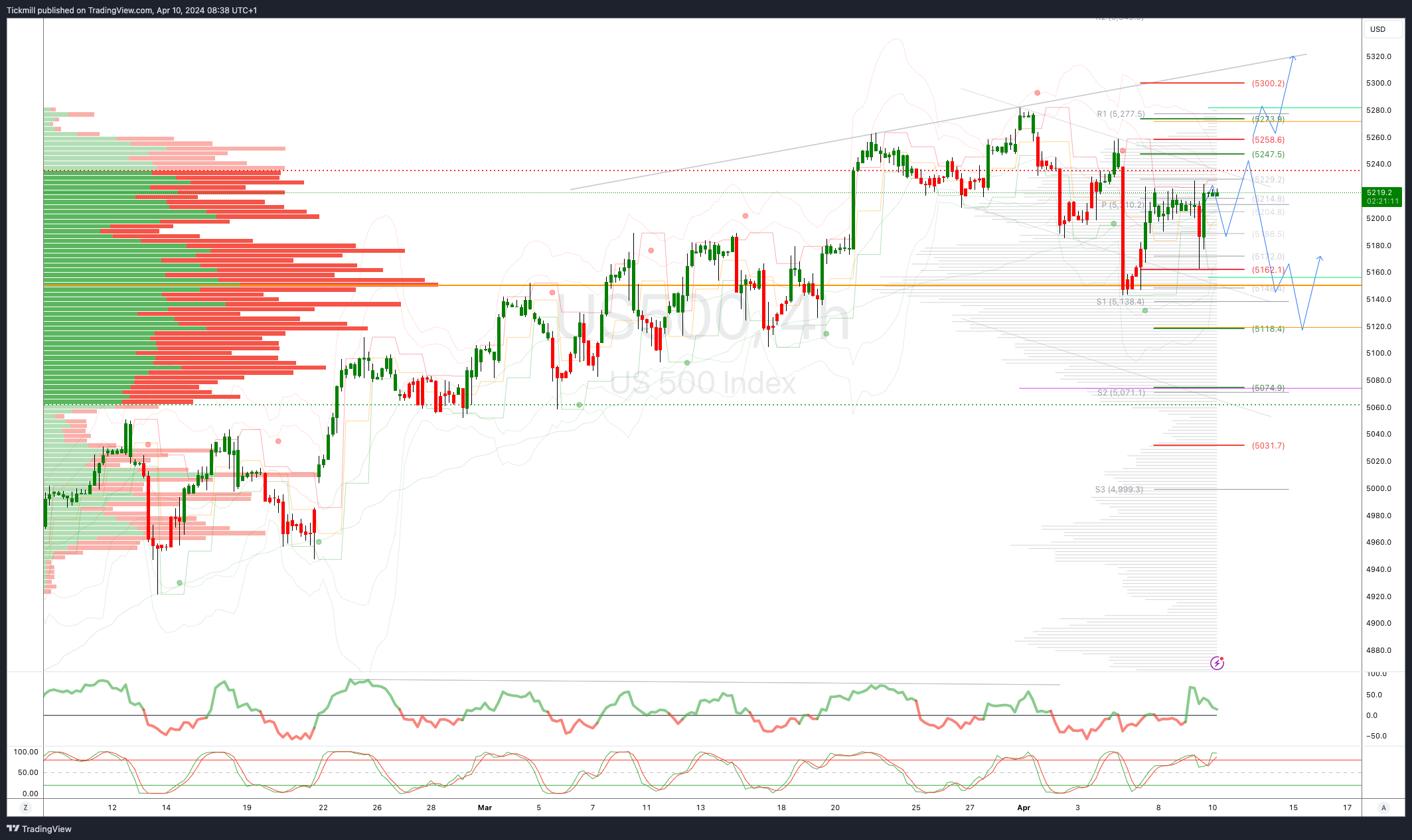

SP500 Bullish Above Bearish Below 5250/60

Daily VWAP bullish

Weekly VWAP bullish

Below 5140 opens 5118

Above 5260 opens 5320

Primary resistance 5230

Primary objective is 5118

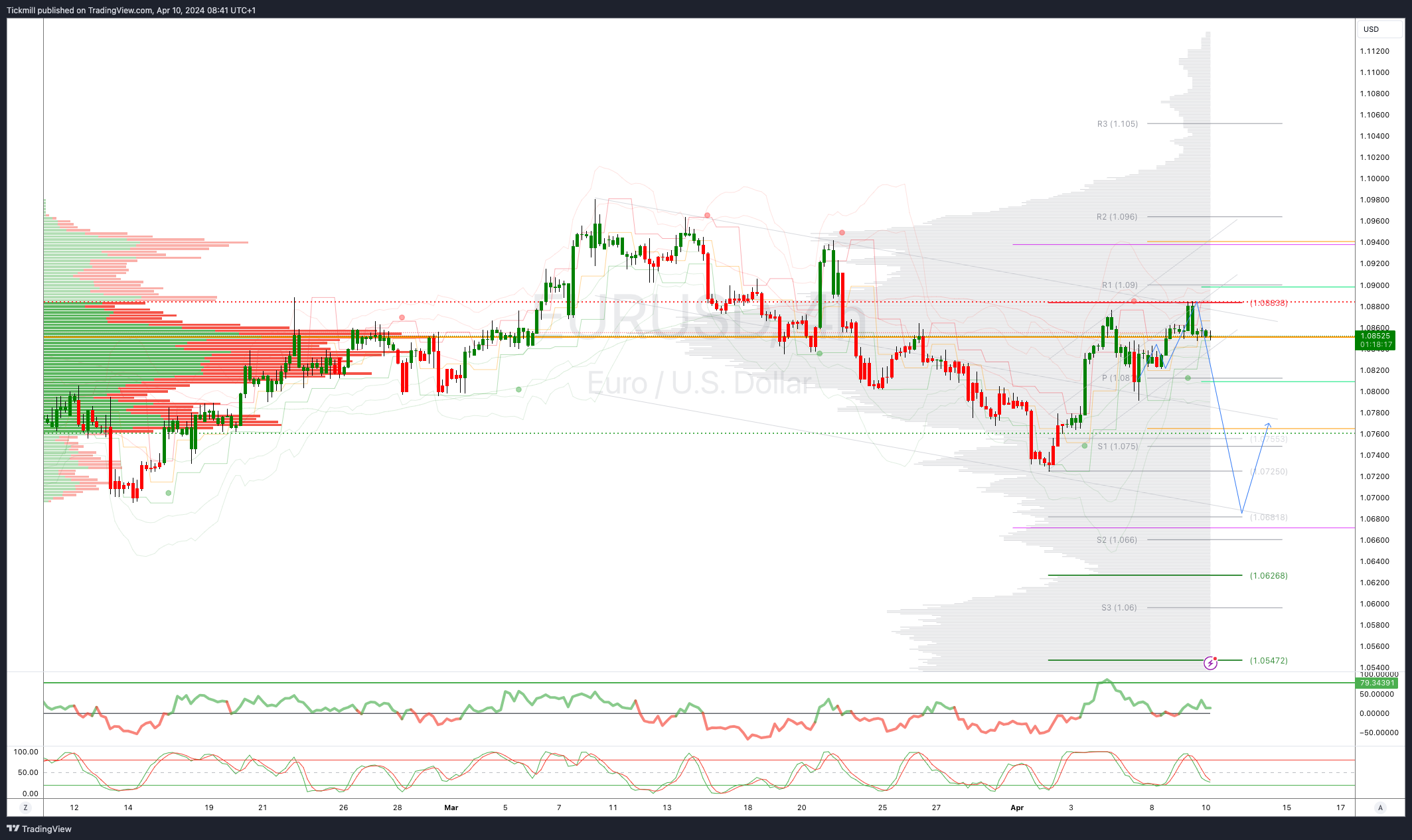

EURUSD Bullish Above Bearish Below 1.0880

Daily VWAP bullish

Weekly VWAP bearish

Below 1.0690 opens 1.0630

Above 1.09 opens 1.0940

Primary support 1.0690

Primary objective is 1.0685

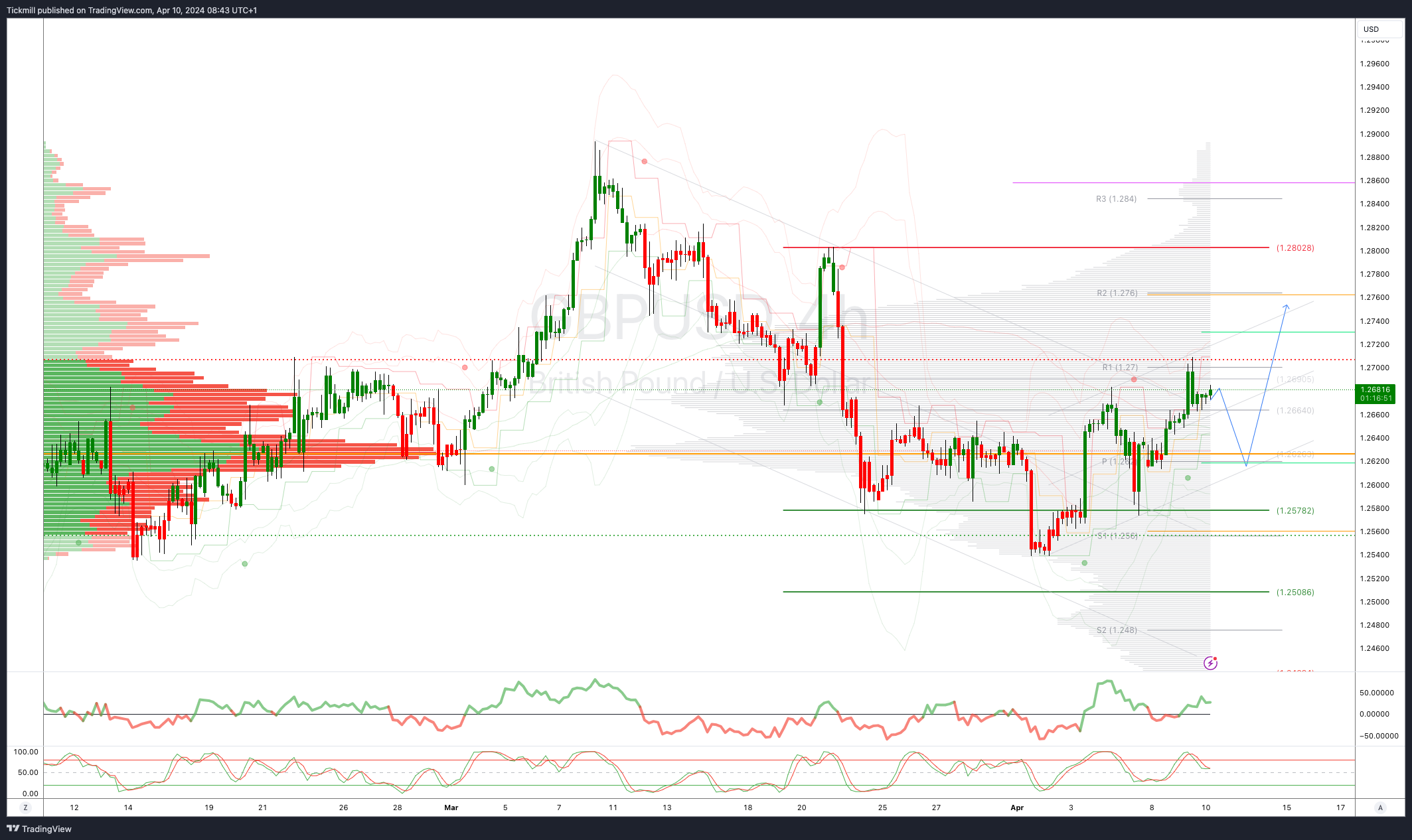

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bullish

Weekly VWAP bearish

Below 1.2570 opens 1.2510

Above 1.27 opens 1.2760

Primary support is 1.2500

Primary objective 1.29

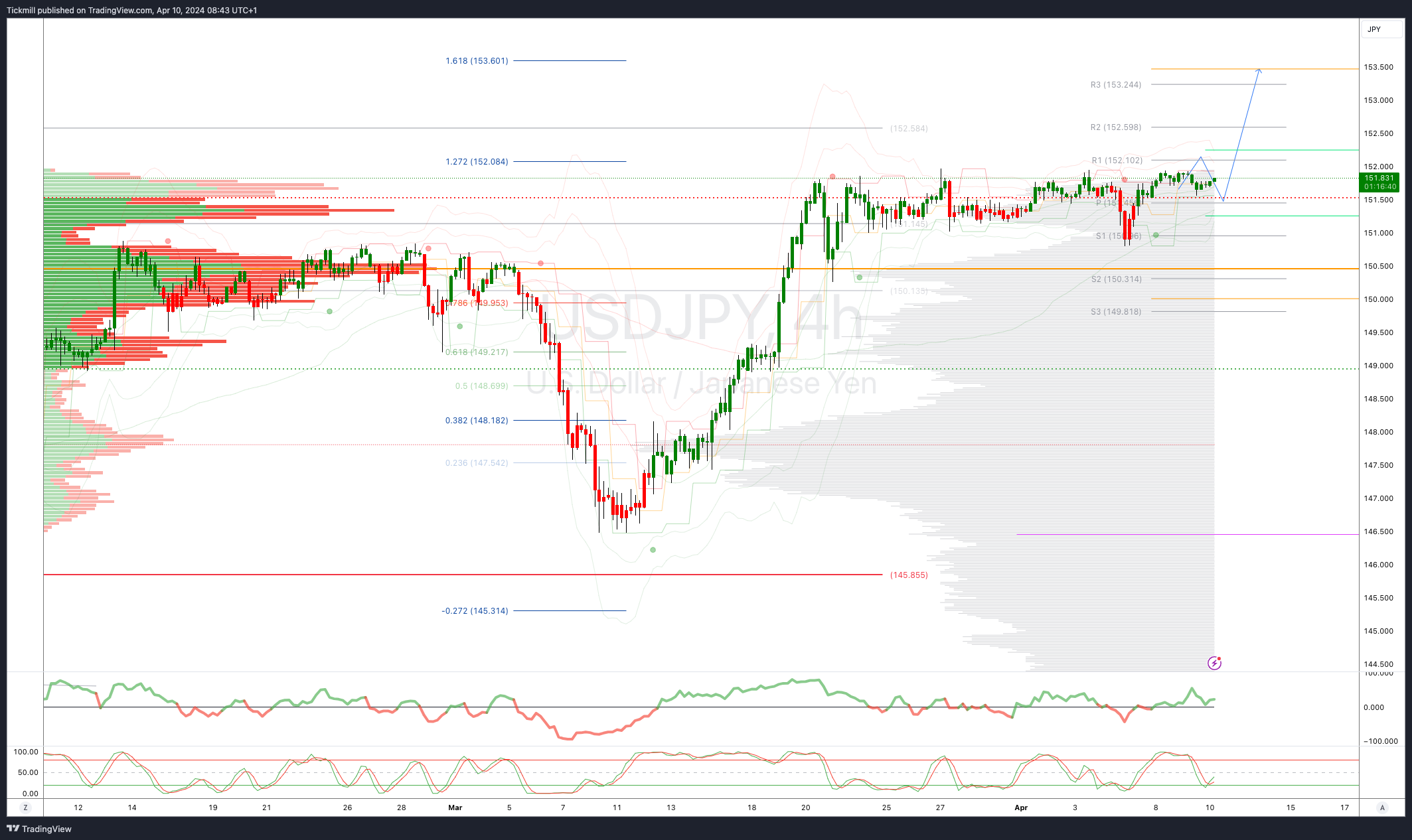

USDJPY Bullish Above Bearish Below 151.50

Daily VWAP bullish

Weekly VWAP bullish

Above 152 opens 153.50

Below 151 opens 150.50

Primary support 145.85

Primary objective is 153.50

AUDUSD Bullish Above Bearish Below .6600

Daily VWAP bullish

Weekly VWAP bearish

Below .6580 opens .6520

Primary support .6477

Primary objective is .6700

BTCUSD Bullish Above Bearish below 68000

Daily VWAP bearish

Weekly VWAP bullish

Below 68000 opens 67250

Primary support is 63000

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!