Crypto Gains on Fed Action

Crypto traders are looking at a much more promising start to the week following the heavy losses we saw last week. News of the SVB collapse fuelled an aggressive sell-off across risk markets, with crypto hard hit by the news. Fresh on the back of the Silvergate incident, confidence in crypto was already shaken, as evidenced by the more than 20% slide from recent highs.

Bitcoin Gaps Higher

However, on Monday, Bitcoin has roared back with the leading crypto currency gapping higher by more than 5% at the open, trading up to highs of +11% when measures against last week’s lows. The driver behind the move is the news of the Fed stepping in to manage the SVB collapse and prevent broader fallout. The Fed announce that all SVB customers will have access to their funds today with no losses from the collapse to be shouldered by the taxpayer.

Fed Steps In

As part of the measures designed to manage the fallout from SVB’s collapse, the Fed announced that it will offer a new Bank Term Funding Program to help improve liquidity in the financial sector. With the Fed stepping in to backstop SVB’s clients, the prospect of a widespread bank run and liquidity crisis has been averted for now. While risk markets are still reeling in the wake of the news of SVB’s collapse, Bitcoin appears to be among the key beneficiaries of the situation. One argument is that this latest incidence of bank failure re-sharpens focus on the weaknesses of the fractional reserve banking system and the benefits of a decentralised currency system.

Less Hawkish Fed Outlook

Against the current backdrop, expectations have shift down ahead of the March FOMC. Traders are now looking for the Fed to opt for a smaller hike given the liquidity issues in focus and the stress being put on the banking sector. With this in mind, Bitcoin looks poised to gain further this week particularly if US CPI tomorrow is shown to have cooled.

Technical Views

BTC

The reversal lower in BTC has seen the market trading down to test the 20575 level which is holding as support for now. While this level remains, we are potentially seeing a large inverse head and shoulders being formed which suggests medium term bullishness for BTC. 24930 is the neckline of the pattern, a break of which should encourage fresh upside momentum towards 28110. 18420 is the next support level to watch should current lows break.

.png)

ETH

For now, ETH remains within the upper end of the 986 – 1695 range which has framed price action over much of the last year. While above the 1268 level the focus remains on an eventual break higher with a move beyond the current range top targeting an increase to 2025.5 as the next bullish objective.

.png)

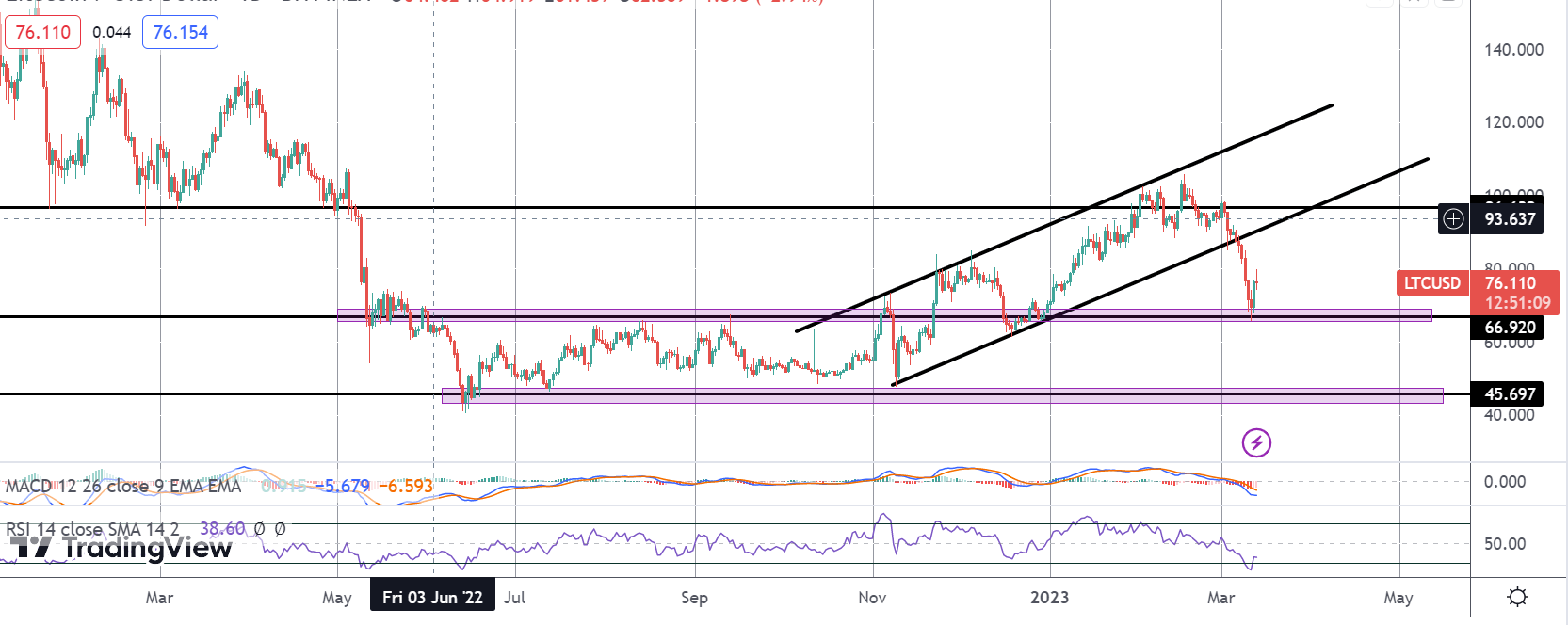

LTC

The sell off in LTC has seen price breaking down below the bull channel of last year’s lows. Price is currently stalled at the 66.92 level support. However, with momentum studies bearish, the focus remains on further downside for now with 45.69 the next support to watch should current lows break.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.

-1678705919.png)