BTC Implodes Amidst Huge Market Volatility

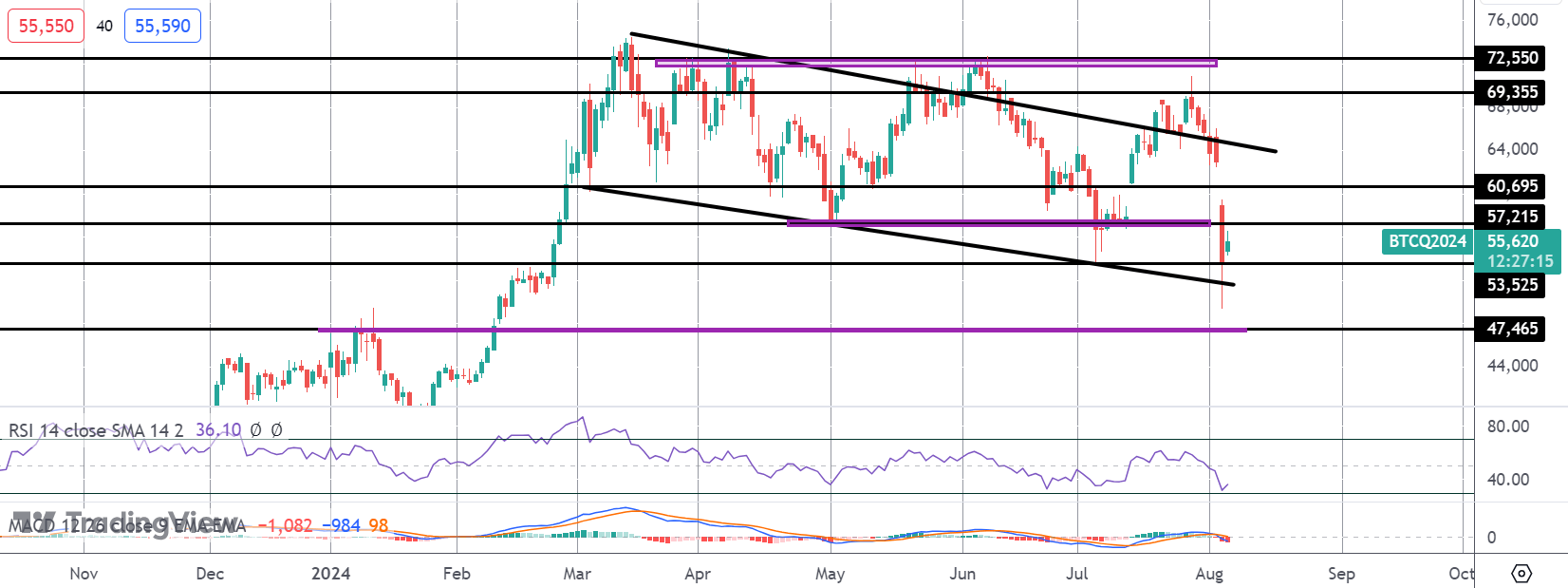

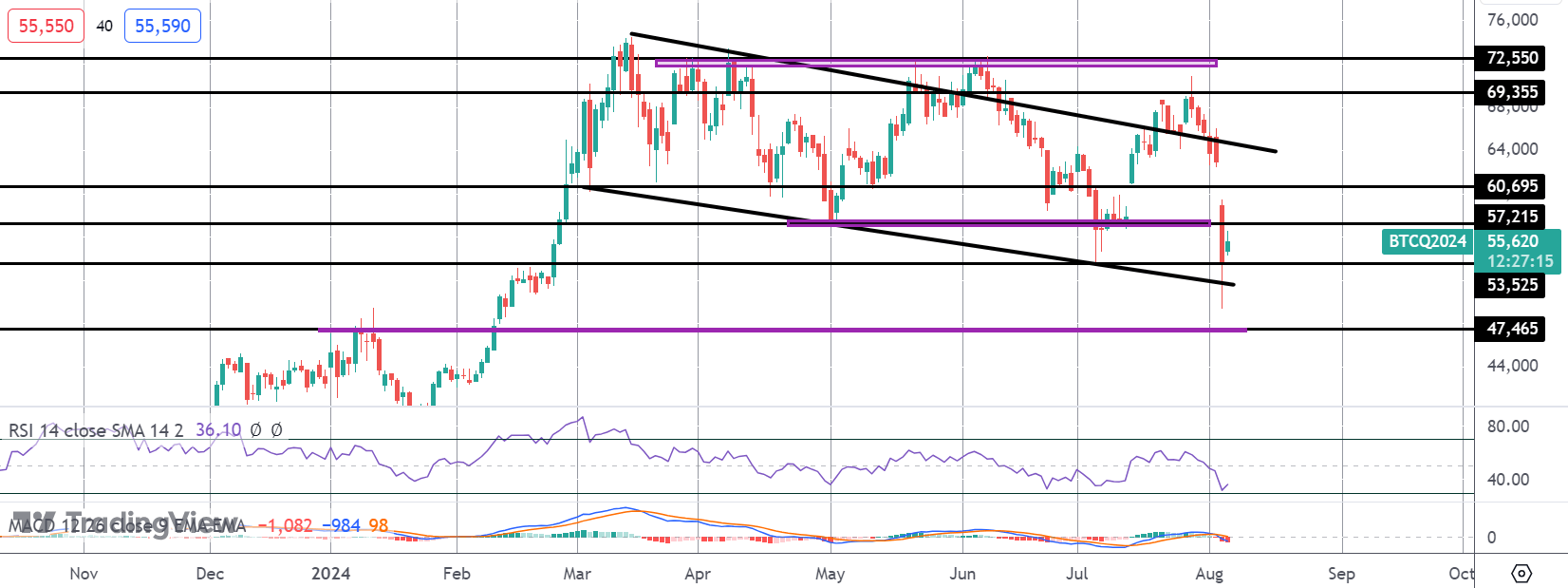

The pullback in Bitcoin over recent weeks is attracting plenty of media attention with many calling for the start of a fresh bear market and a deeper move lower. However, looking at the current price action, there is plenty of reason to remain bullish on BTC. Indeed, the current correction is likely to prove an attractive entry re-entry point for bigger players and long term holders looking to position for a fresh rally. It’s worth noting that the decline only pierced the 53,525 support before bouncing back above, similarly with the bear channel lows. As such, the corrective bull flag pattern can still be seen as holding, suggesting room for a recovery higher and an eventual breakout.

Bullish Drivers Remain

Seismic shifts across FX markets have had a visibly negative impact on BTC and the wider crypto market in recent weeks. However, with the Fed now firmly expected to pursue a more aggressive easing path in a bid to buffer against recession, BTC stands to gain steadily through the remainder of the year. Indeed, further support could arrive if Trump wins the US elections in November. With the former president promising huge support for the crypto sector, a reversal of regulatory restrictions could usher in a fresh era of demand for BTC allowing it room to run higher into next year.

Technical Views

BTC

The sell off in BTC has stalled for now into a test of the 53,525 lows and the bear channel lows. While price holds here, the focus is on a recovery back above the 57,215 level next and a rotation back higher within the range towards the bear channel highs and above. If we turn lower again, however, 47,465 will be the next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.