BTC Hits New Highs

The wave of crypto optimism on the back of Trump’s re-election last week continues to grow stronger. Bitcoin futures have printed fresh, record highs again today with the market now up around 35% on the month and over 80% on the year. Many forecasters are calling for above $100k by year end though, given the gains we have seen, some volatility is to be expected as we push higher.

Dogecoin on Fire

Heavy gains have been seen across the crypto sector this week with altcoin Dogecoin getting a huge amount of attention after rallying more than 100% since the election last week. The Musk-backed crypto asset has seen a boom in demand with price rallying from around $0.14 pre-election to around $0.43 currently. Many in the crypto community are calling for $1 by year end with some making even loftier predictions for where the coin is headed.

Great Expectations

A key driver behind the current rally in the crypto space is the uptick in institutional demand for BTC and ETH. BTC and ETH ETFs have added over $2 billion in the last week as Wall Street names flood the market looking to capitalise on the expected rally to come. With the broad expectation that Trump will heavily support the crypto sector once he takes office next year, crypto bulls are hopeful of a fresh bull cycle to match the gains seen in 2017/2018 and 2020/2021.

Technical Views

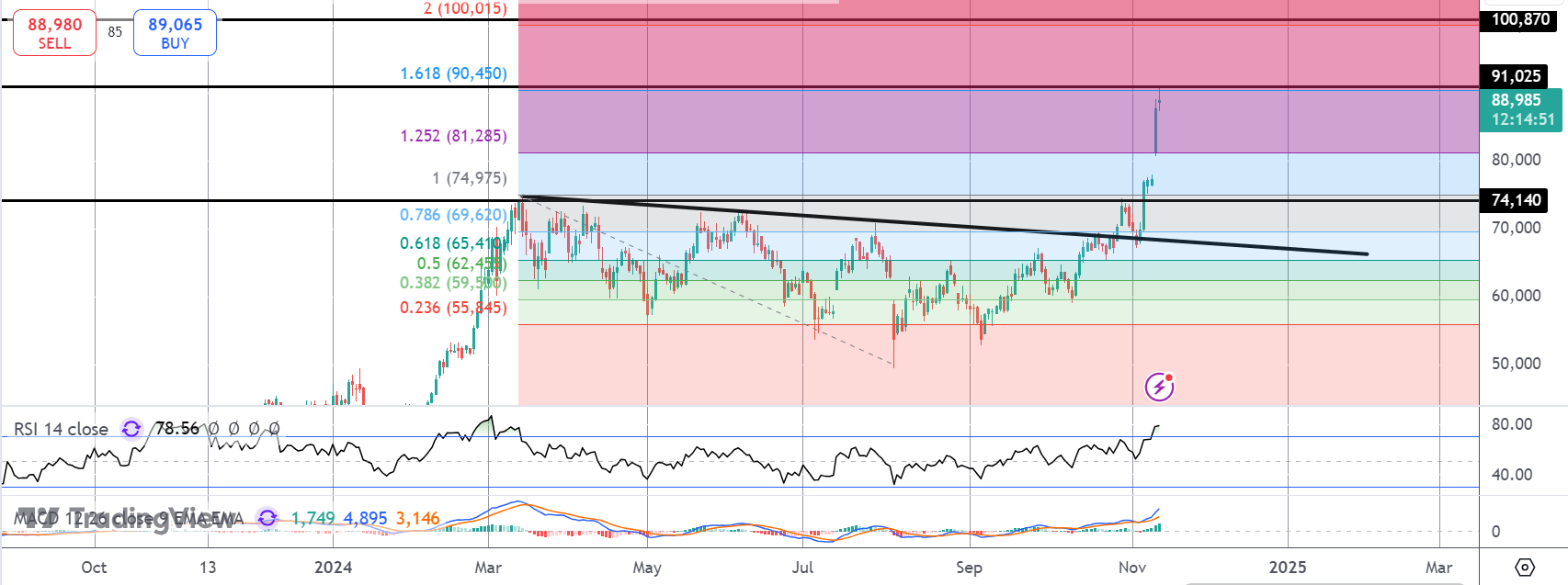

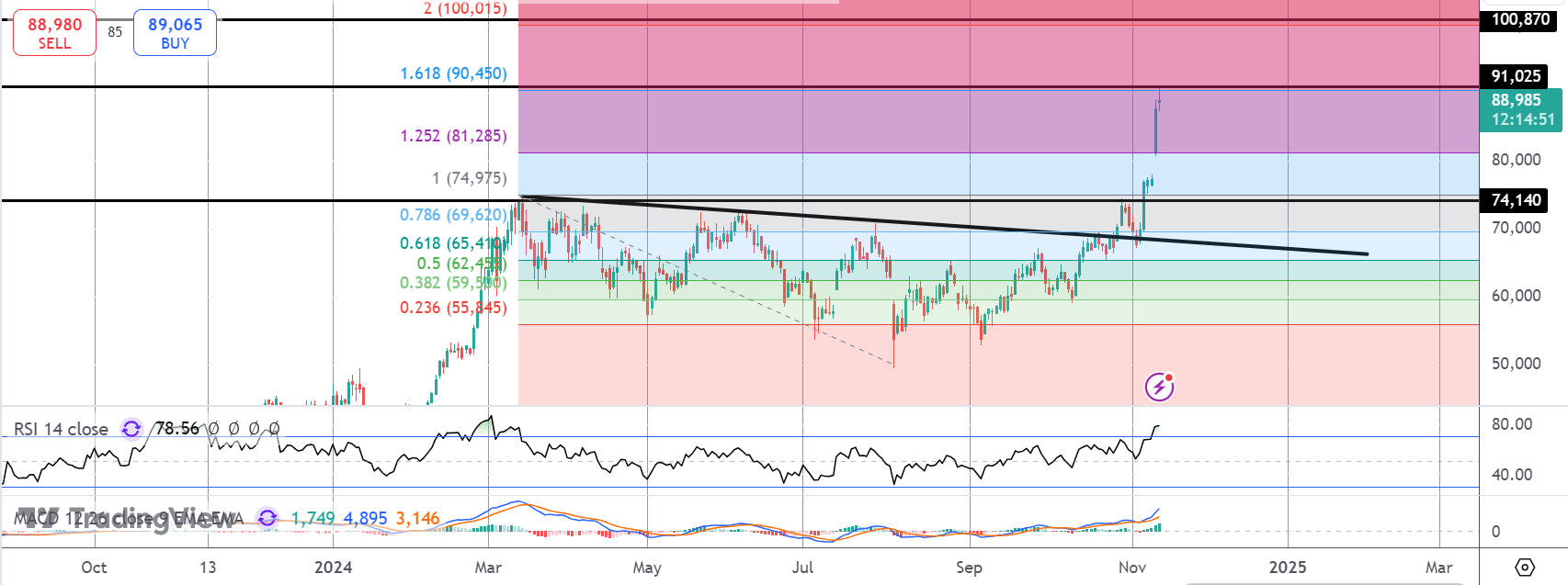

BTC

The rally in BTC has stalled for now into the 1.618% fib extension of the pre-breakout 2024 correction from March highs. While above the 74,14 level, however, focus remains on a further push higher with the 2% extension at 100,87 the next target for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.