Crude Spikes On Venezuela Tariffs

Trump Announces New Tariffs

Oil prices are rising firmly this weekly this week in response to a tightening in the crude supply outlook as a result of fresh US tariffs. Yesterday, Trump announced tariffs on countries importing Venezuelan gas and oil, along with the threat of further tariffs if restrictions are not adhered to. The 25% levy, which has been applied to countries including China, has had a meaningful impact on global supply with crude futures up around 6% off the March lows.

Chinese Demand

The tariffs on China in particular are having a big impact. Coming at a time when the domestic demand outlook is improving there, the restrictions on crude imports are expected to add to price rises. Recent measures announced by the Chinese government aimed at bolstering household incomes and consumer spending are expecting to further lift demand this year, creating expectations of a continued recovery in crude near-term as the market adjusts to the new measures.

EIA Data

Looking ahead this week, traders will be watching the latest EIA inventories update tomorrow. US demand has faltered recently. However, with recession fears seen cooling this week in response to news that Trump will take a more limited approach with tariffs on April 2nd, demand could start to pick up again near term which should further boost prices, if seen.

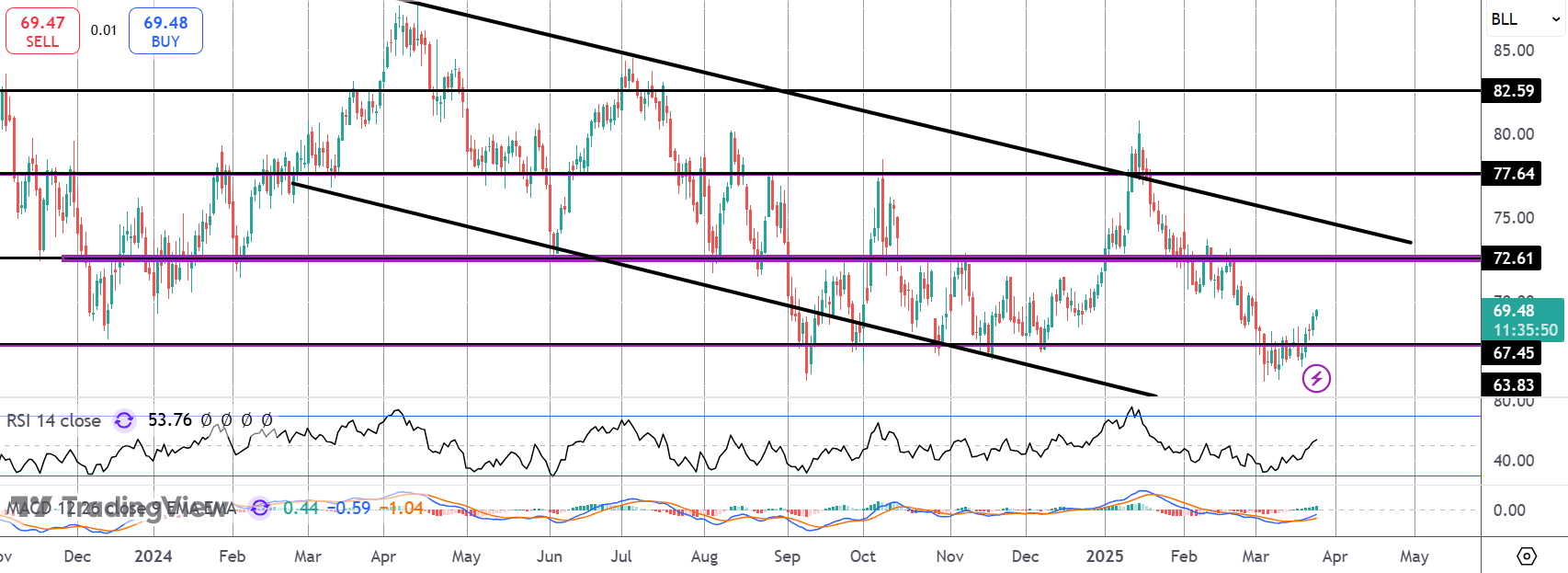

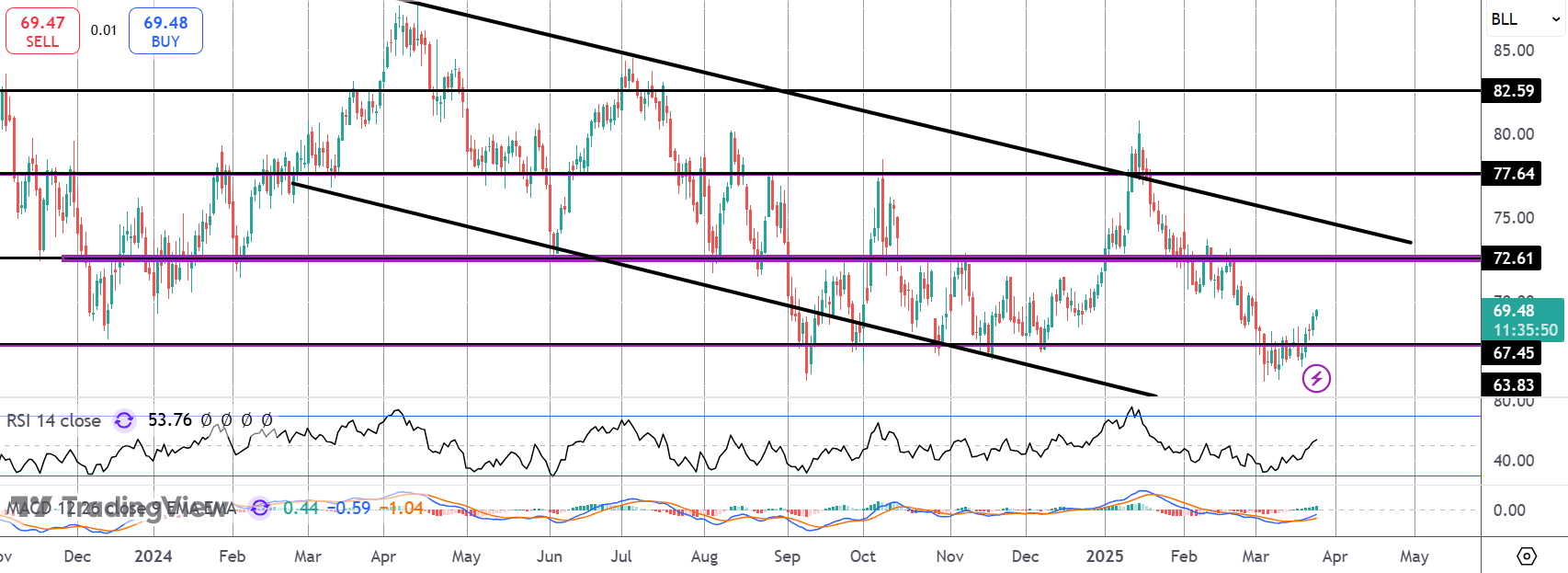

Technical Views

Crude

The rally in crude has seen the market breaking back above the 67.45 level. Given this is a big, multi-year support zone, the recovery here is important and puts focus on a move back up to 72.61 and the bull channel top. If bulls can break higher there, 77.64 is the next target.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.