Crude Plunges As Trump Election Odds Soar

Trump Impact Growing

Oil prices remain under pressure at the start of the week following a heavy sell off in crude futures on Friday. News that Biden is stepping down from the Presidential election race has further amplified expectations of a Trump win in November. While Trump is seen as the more pro-oil candidate, his mantra of ‘drill, baby, drill’ at a time when US production levels are already at record highs looks to be weighing crude sentiment rather than bolstering it. Additionally, fears of a return to the trade wars of Trump’s first presidency are also clouding the outlook. A stronger US Dollar, linked to expectations of a Trump win, is also weighing on oil prices here.

OPEC+ & US Demand

The supply/demand environment for crude has been in sharp focus recently on the back of news that OPEC+ plans to gradually increase output again through late Q3/Q4 this year. While production curbs were recently extended once again, plans to reintroduce supply later in the year have caused some dismay amongst oil bulls. In the US producers have seen record output levels this year have been finely balanced against the demand backdrop. While demand is expected to remain firm over the summer months linked to holiday-travel demand, refiners have stressed a focus on only growing output moderately, instead looking to return profits to shareholders on the back of the losses suffered during the pandemic.

Technical Views

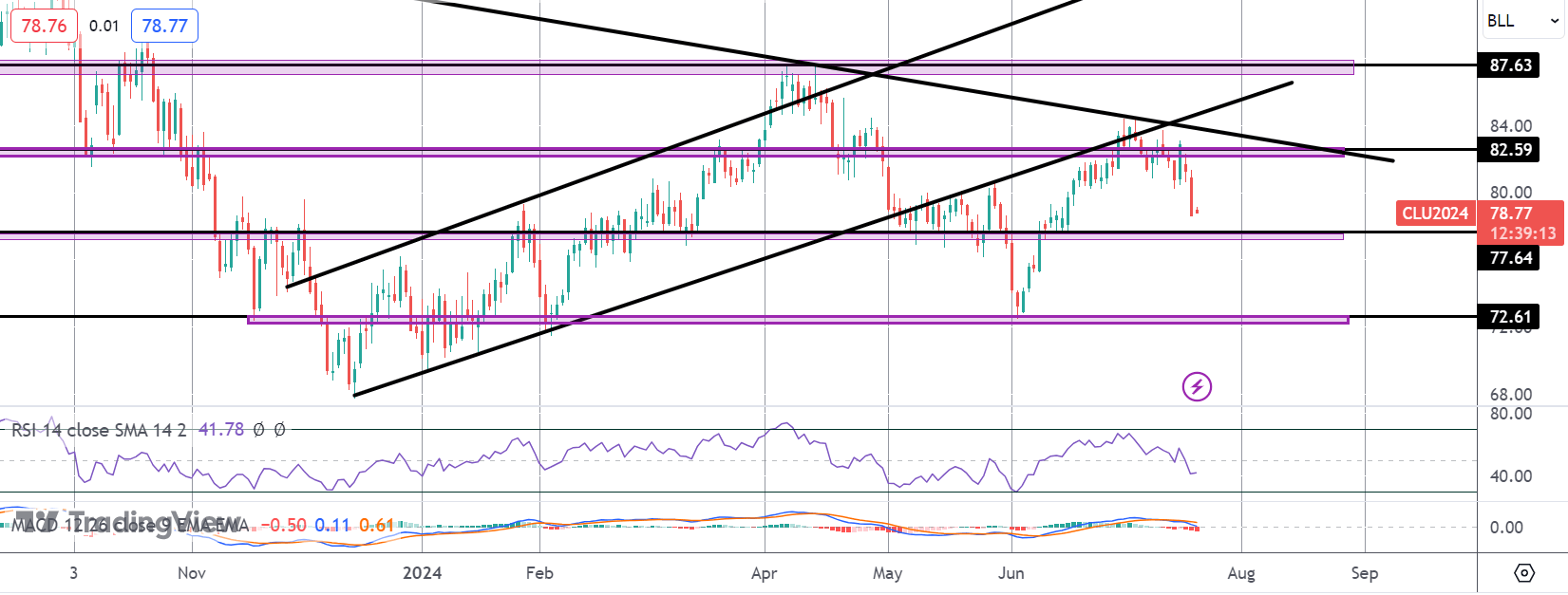

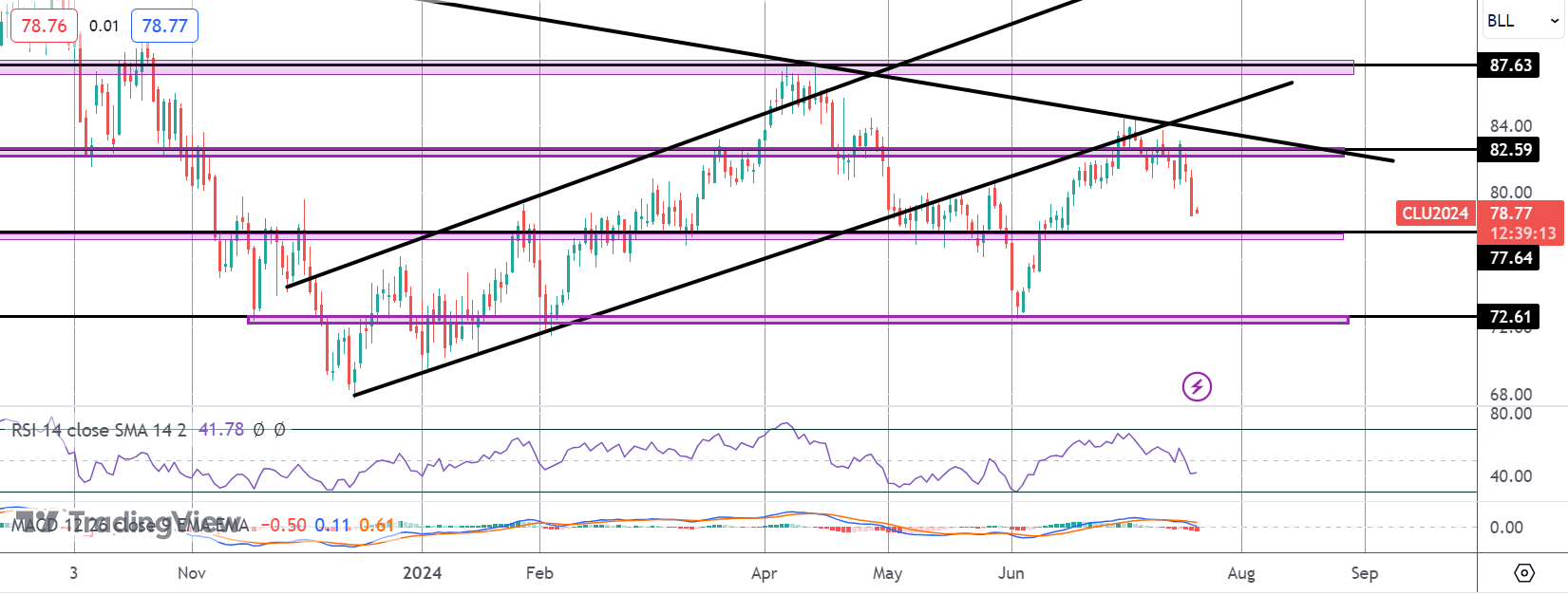

Crude

The sell-off in crude has seen the market turning back down sharply below the 82.59 level. With momentum studies bearish, focus is on a continuation lower and a test of the 77.64 level next. If broken, 72.61 will be the deeper support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.