Crude Falls Following Fresh OPEC+ Output Increase

OPEC+ Output Hike

Oil prices remain under pressure today with the market lower in response to the latest output hike from OPEC+. The group announced over the weekend that it will hike output once again next month, marking a fifth consecutive month of supply increases. While the move was well signalled, the increase comes amidst an uptick in global uncertainty linked to fresh US tariff increases announced last week. With oil demand heavily weakened by the ongoing US trade war, the near-term outlook has turned more bearish, putting crude prices at risk of a deeper move lower.

US Economic Fears & Tariff Uncertainty

Alongside the OPEC+ output hike and fresh US trade tariffs, oil prices are also being weighed on by the sharp drop in US labour market data. On Friday, the NFP came in well below expectations, printing sub 100k, while the two prior month’s readings saw heavy downward revisions. The data has fuelled fresh concern over the health of the US economy, putting renewed focus on Fed easing expectations. While this dynamic might prove helpful to crude prices medium term, via fresh Fed easing, the near-term impact is lower prices as traders mull US crude demand prospects in light of the data. If the EIA update this week shows softer domestic demand, this should see crude prices continue lower through the week.

Technical Views

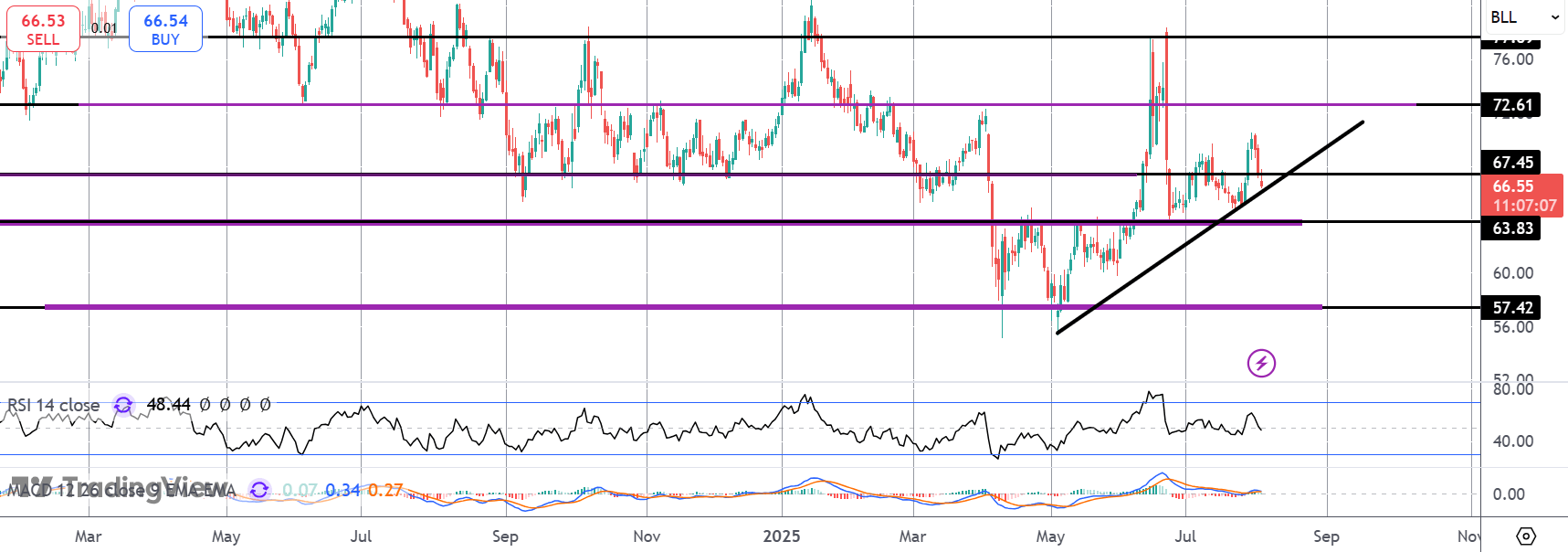

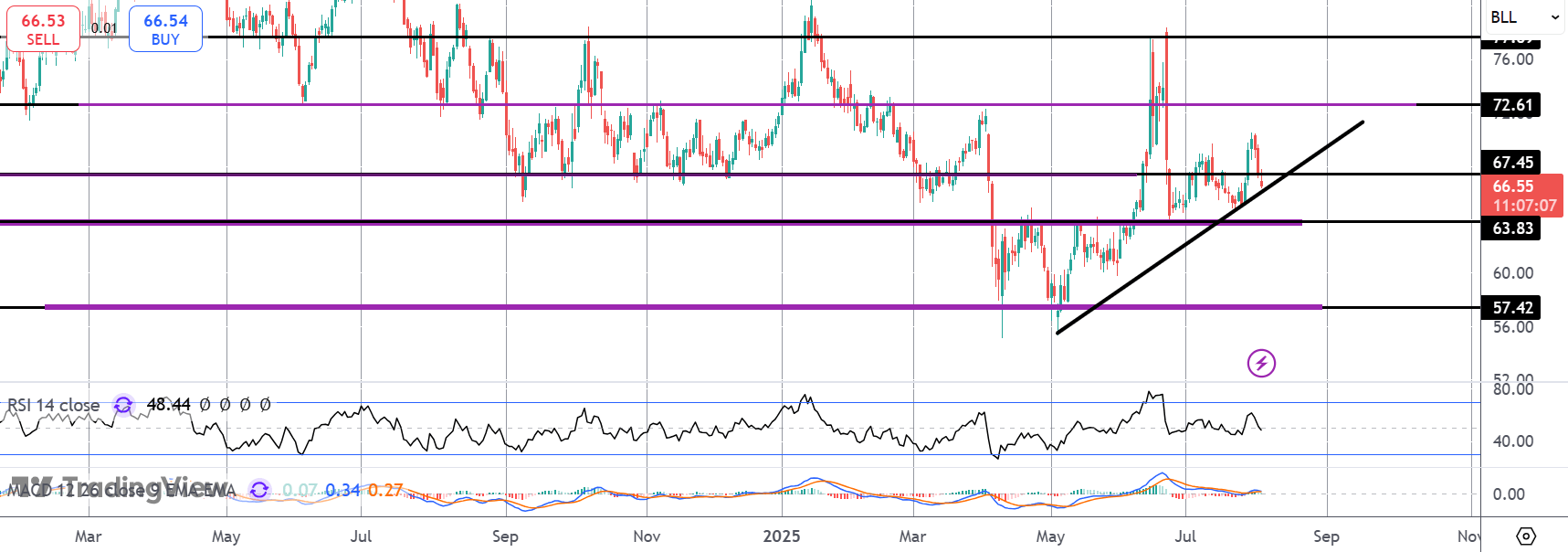

Crude Oil

Crude prices have slipped back under the 67.45 level and are now once again testing the bullish trend line from YTD lows. If the trend line breaks, 63.83 will be the next support to watch. Bulls need to defend this area to prevent a collapse back towards the YTD lows. Topside, 72.61 will be the first objective should the market recover from current levels.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.