Crude Falling Ahead of Trump-Zelensky Meeting

Oil Lower on Monday

Oil prices are softer at the start of the week as traders continue to digest the details from Trump’s meeting with Putin over the weekend, the first since 2018. While a deal wasn’t agreed, the amicable tone to the meeting has assuaged fears of Trump applying stricter sanctions on Russia. Indeed, Trump has said that for now he won’t apply secondary sanctions to China for buying Russian oil. This atmosphere is expected to keep global oil flows in healthier shape, alleviate near-term upside pressures.

Trump -Russia/Ukraine Talks

This week, Trump will meet with Zelensky where he is expected to try and pressure the Ukrainian leader into accepting Putin’s demand of surrendering Donetsk for a peace deal. Given this proposal is unlikely to be accepted, oil prices are vulnerable to an upside squeeze if talks are seen stalling and a deal looks less likely. However, if Zelensky is able to suggest an alternative, or make some sort of compromise that keeps talks on track, oil prices could push lower on the view that a deal is more likely. As such, news flows around the meeting will be very important for oil traders this week with the issue continuing to take centre stage amidst other typical drivers such as global economic data and movements in USD.

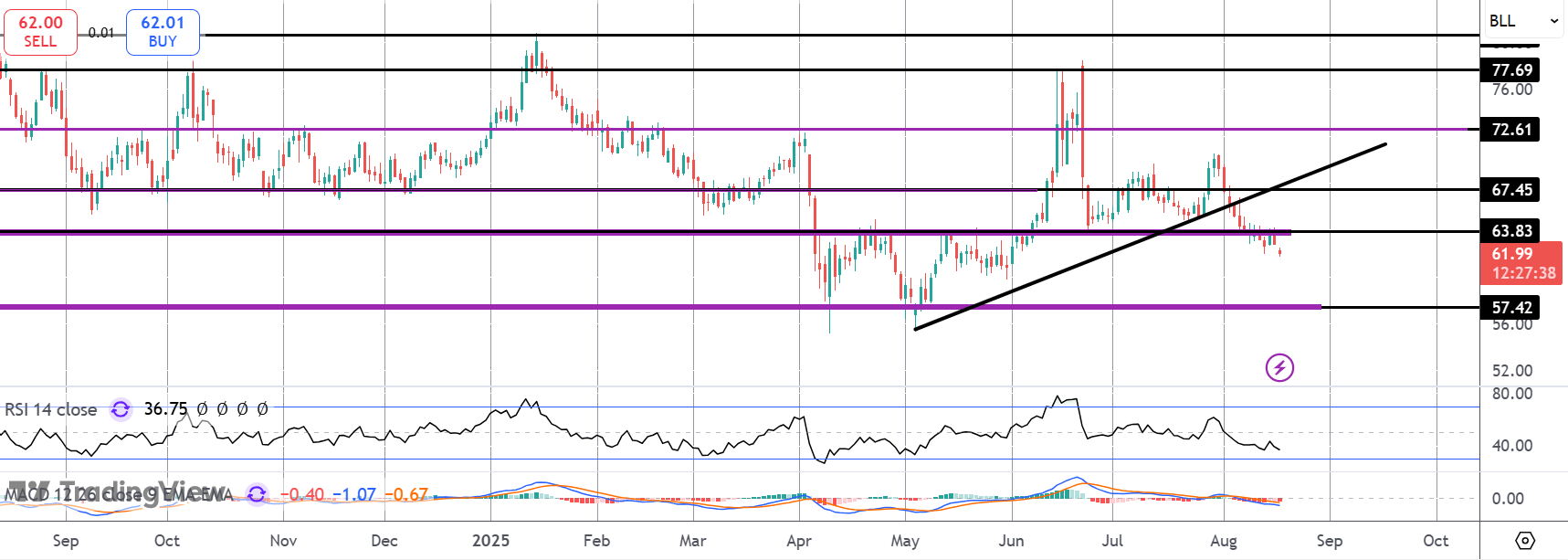

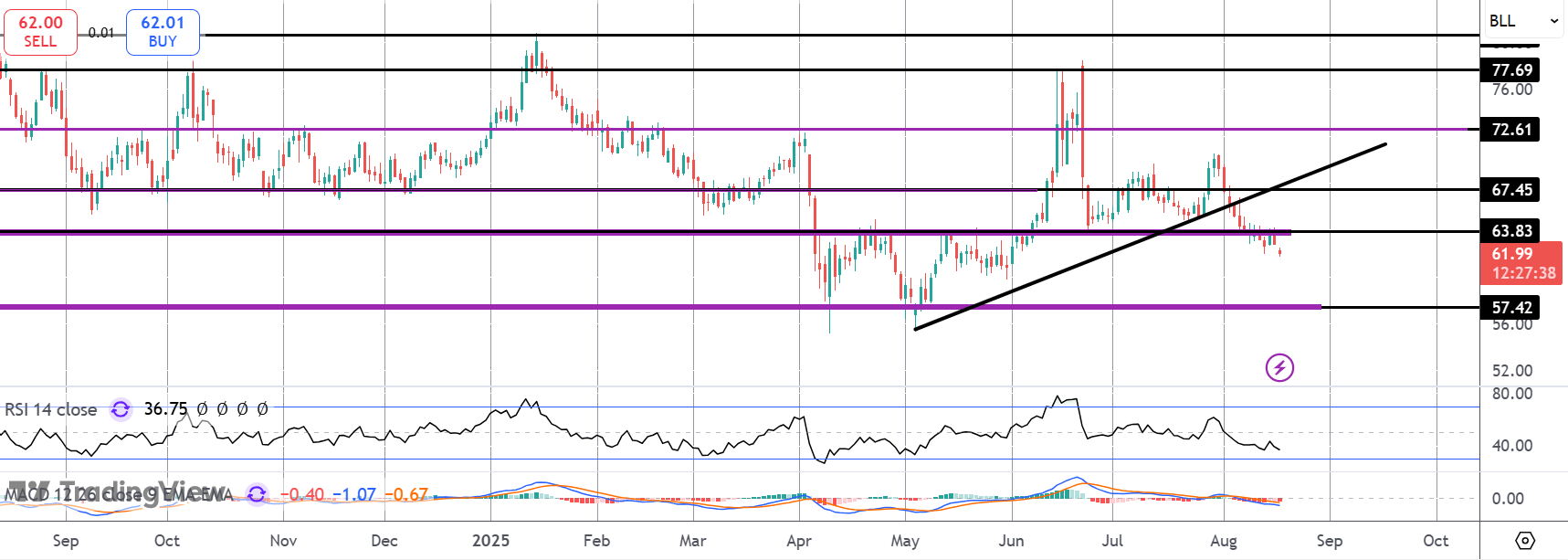

Technical Views

Crude

The sell off in crude has seen the market breaking down below the rising trend line from YTD lows and below the 63.83 level. While below here, prices are now vulnerable to a deeper fall to the 57.42 level and YTD lows, in line with bearish momentum studies readings. Bulls need price back above 67.45 to alleviate near-term downside risks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.