Crude Ending Week Heavily Lower

Crude Down Amidst Trade Woes

The slide in crude prices continues ahead of the weekend with the futures market on track to print a weekly loss. The market is now down more than 6% on the week, down more than 10% from the prior week’s highs. The sell off has largely been fuelled by the sweeping return of US tariffs as the suspension period on Trump’s reciprocal tariffs came to a head last week. This uptick in trade uncertainty was accompanied by a fresh hike in OPEC+ output, announced at its latest meeting over the weekend. With global demand seen weakening amidst tighter trading conditions and OPEC+ hiking output for a fifth consecutive month, the near-term market view has turned more bearish.

Russia/Ukraine Peace Talks Optimism

Alongside US tariffs and OPEC+ increases, crude prices have also come under pressure this week from renewed optimism over potential Russia/Ukraine peace talks. Trump brought forward his deadline for a ceasefire and while there has been no pause in the conflict announced, both Russian and Ukrainian leaders are said to be meeting with Trump for peace talks next week, raising hopes that an end to the conflict might soon be in sight. If talks progress well next week, crude prices are likely to slide further on reduced supply disruption and the prospect of Russian supply returning to the broader market at some point in a post-war landscape.

Technical Views

Crude

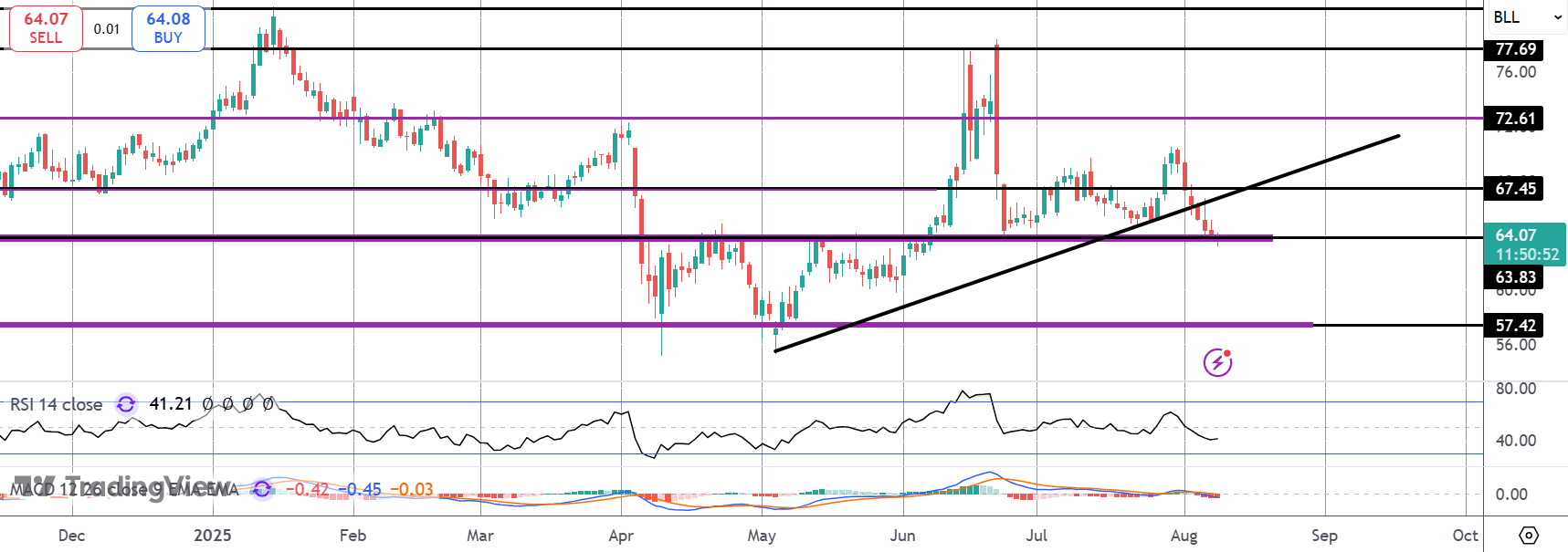

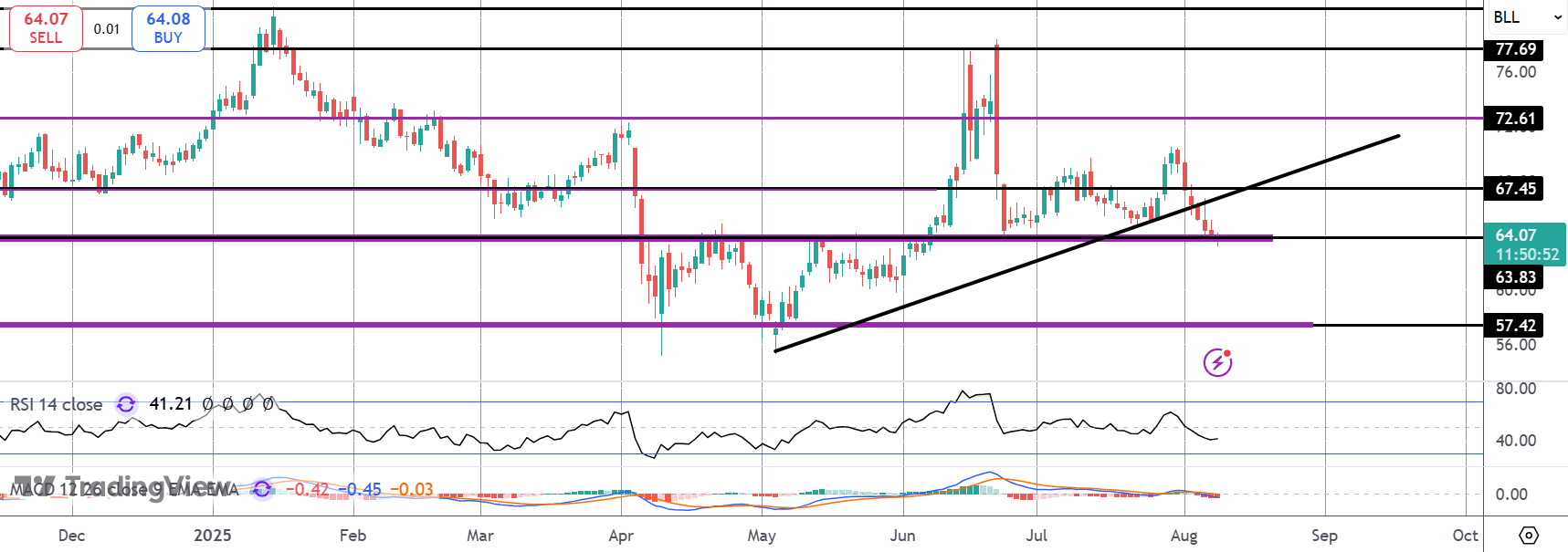

The sell off in crude has seen the market breaking beneath the rising trend line from YTD lows with price now testing beneath the 63.83 level. Below here, focus is on a move back down to the 57.42 level, in line with bearish momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.