Crude Comes Under Heavy Selling Pressure

Hurricane Fears Receding

Crude prices remain under pressure across early European trading on Tuesday with crude futures continuing to pull away from last week’s highs. The main driver behind the move is the shift in concern around Hurricane Beryl. Crude prices had been higher on the expectation of severe supply disruption. With the weather system having been downgraded to a tropical storm and altering course slightly, it looks as though the majority of the feared disruption to supply will be avoided. Crude prices had been higher on the expectation of severe supply disruption.

Middle East Impact

The latest news regarding the Israel-Hamas war is also helping oil prices cool off here. Reports that Hamas has given initial approval to a US-backed ceasefire deal has raised hopes that a cessation to violence will be agreed soon. While nothing has been confirmed yet and negotiations remain precarious, any encouraging news whatsoever is likely to add to bearishness in crude.

USD Focus

The move lower in crude over recent days comes despite a sharp pullback in the US Dollar. The greenback has slipped from highs on the back of a string of weaker-than-forecast US economic data. A better-than-forecast NFP on Friday did little to help fuel a recovery with the Dollar lower in response to a rising unemployment rate and weaker jobs growth. All eyes are now on US inflation on Thursday with comments from Fed chairman Powell due today and tomorrow. If we see a weaker US Dollar through dovish comments from Powell and weaker US CPI this should help crude prices stabilise near-term.

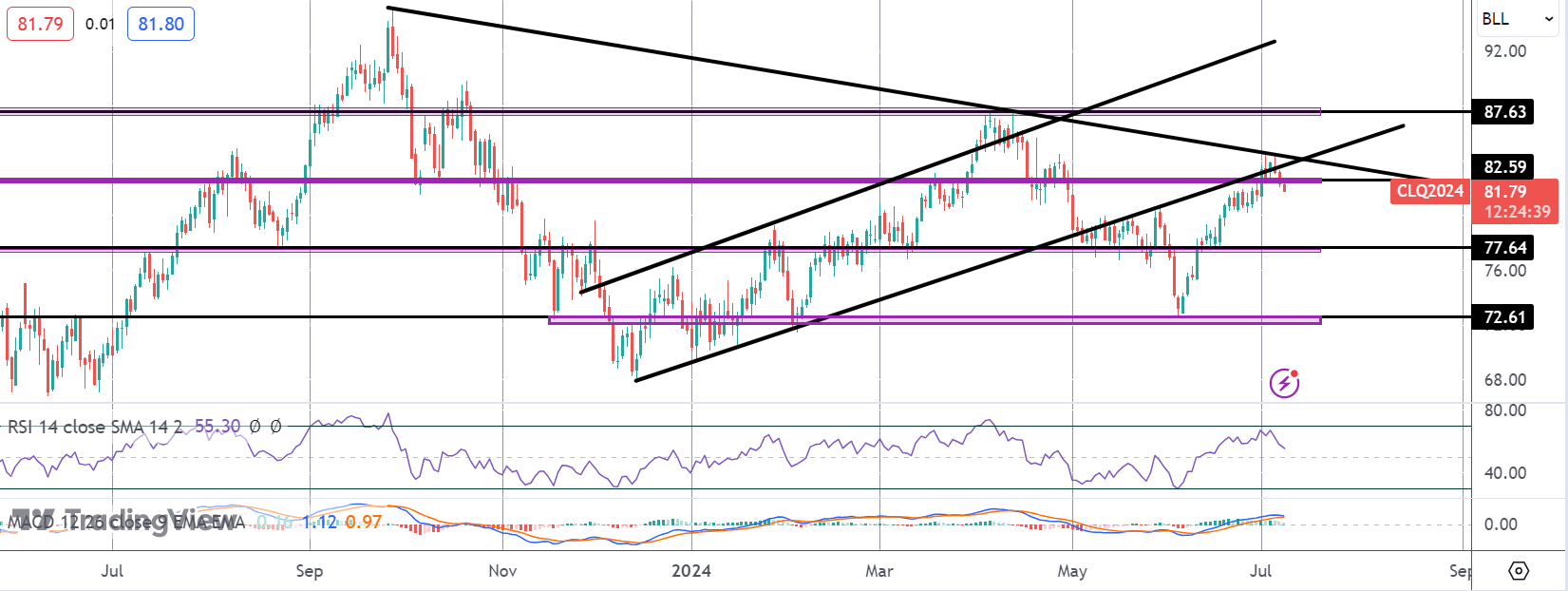

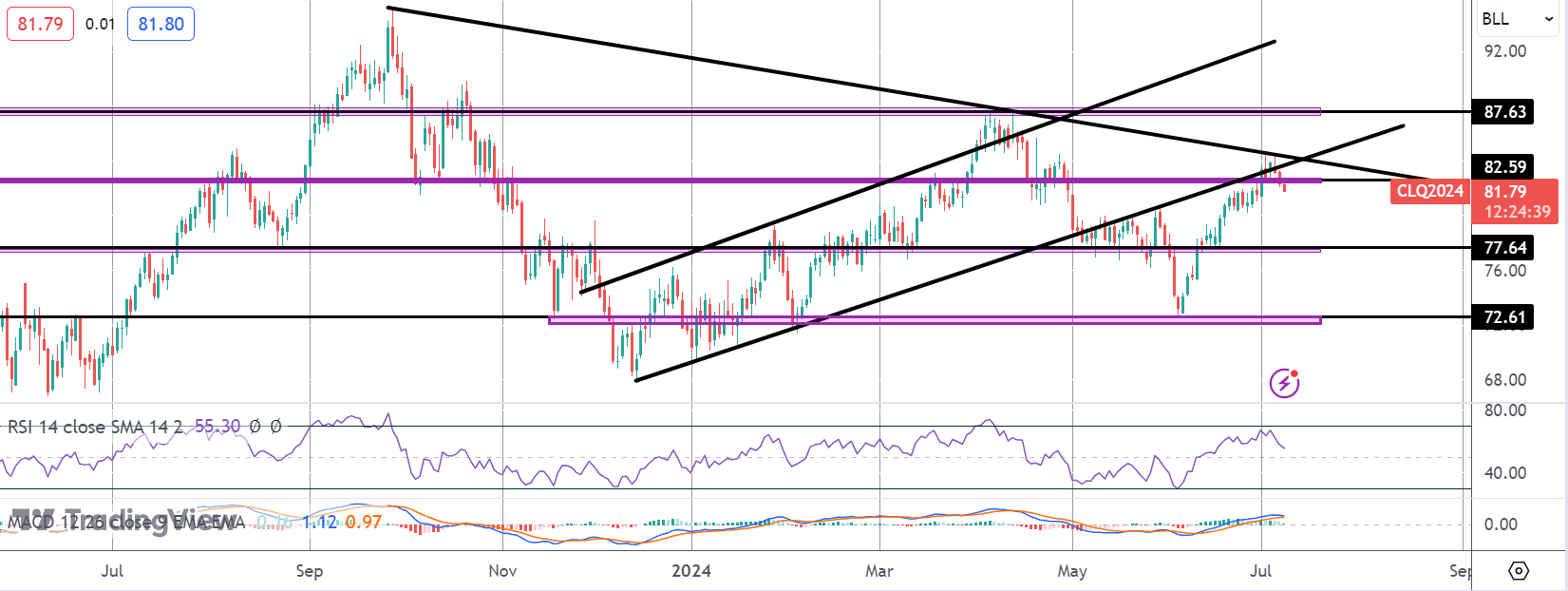

Technical Views

Crude

The rally in crude has stalled for now into the retest of the underside of the broken bull channel and a test of the bear trend line from 2023 highs. Price is now turning back below the 82.59 level and with momentum studies falling, focus is on a continuation lower with 77.64 the next support level to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.