Copper Rallying on China Demand Boost & Fed Outlook

Copper Turning Higher

Following a period of heavy stagnation over the last week, copper prices are pushing higher today. The futures market is trading back up towards the 4.3000 August highs amidst signs of improving demand in China and a boost from the latest US inflation figures. In China, data shows copper inventories in Shanghai have been falling again in recent weeks following a heavy buildup over July. Market chatter is pinning the recent inventories draw to a surge in demand from electric vehicle makers. A weaker demand outlook in China has been one of the major headwinds for copper bulls this year and signs that demand might now be improving hold the potential to drive a sharp shift in sentiment for the metal.

Risk-On Driving Copper

Copper prices are also receiving a boost from the general uptick in risk appetite on the back of the latest US inflation figures yesterday. Annualised inflation was seen falling to 2.5% from 2.9% prior last month, below the 2.6% the market was looking for. A small uptick in monthly core inflation appears to have cemented the view that the Fed will opt for a smaller .25% cut next week, over a deeper .5% reduction. Risk markets appear to be revelling in the news however, setting copper up for a potential breakout next week in response to the FOMC.

Technical Views

Copper

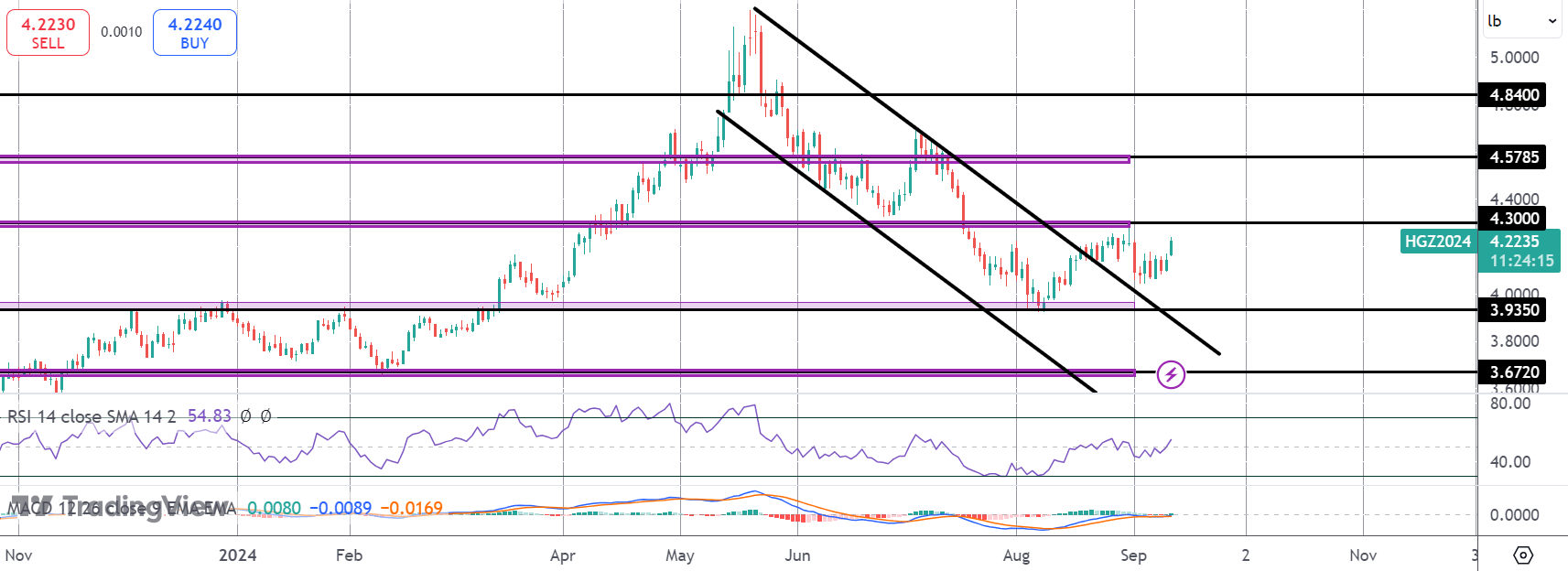

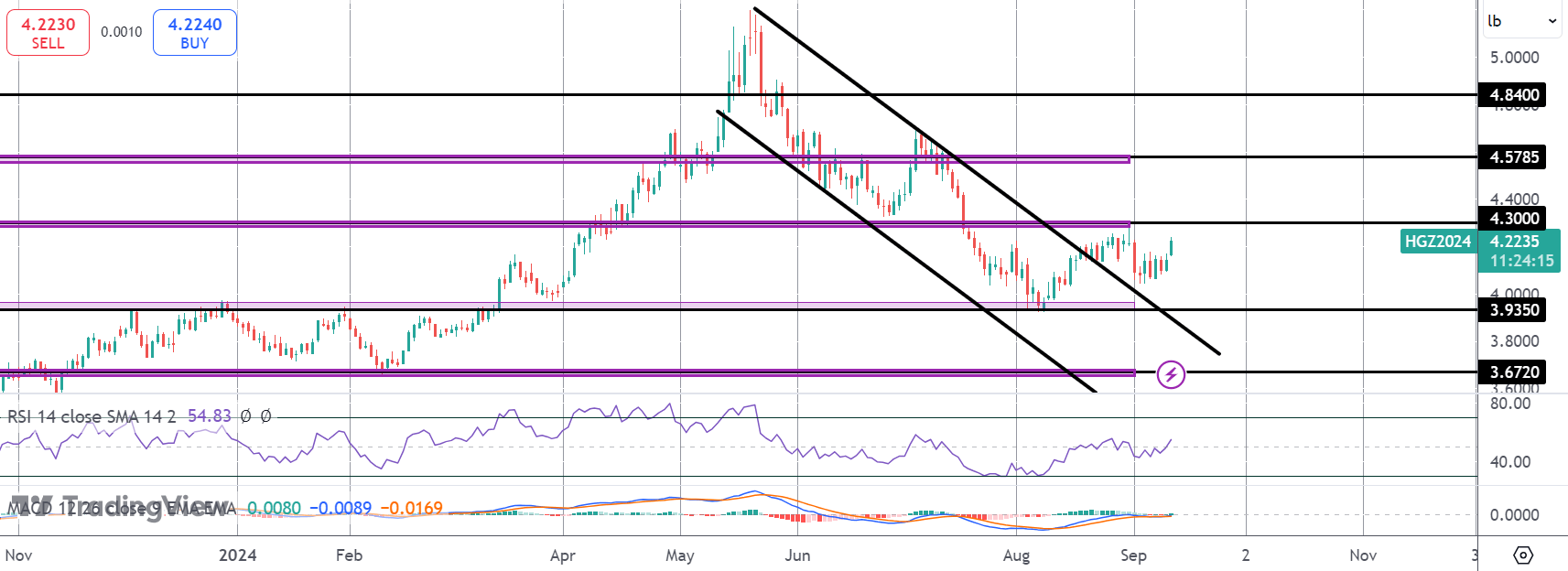

The sell off in copper has stalled for now into the 3.9350 with the market since trading in a range between that level and 4.3000. Having now moved through the bear channel top and with momentum studies turning higher, focus is on a fresh topside break and a continuation towards 4.5785 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.