Copper Hits Record Highs on Trump Tariff Shock

Copper Holds Near Highs

Copper prices exploded higher yesterday, clocking a more than 18% one-day gain, the largest single-day move since the 1980s. The rally came in response to news of Trump threatening a 50% tariff on copper imports. Speaking during a White House meeting, the president signalled his plans to dramatically change the fees for US-bound copper shipments. Copper has seen strong demand this year ahead of expected tariffs with importers looking to stock up on the metal ahead of those levies coming in.

Traders Waiting on Further Details

However, with Trump now signalling a much more aggressive tariff amount, copper prices ballooned as global inventories tanked on a surge in speculative buying. While the metal has cooled from the initial reaction highs printed yesterday, copper futures remain above the prior all-time highs of 5.3625 and look poised to continue higher while they remain atop that level. Traders will now be carefully monitoring incoming news for details on the tariff, regarding and timing and clarity on which copper products will be included. For now, however, the market looks set to remain in bull territory as traders continue to front run tariffs being implemented. Once tariffs come into effect, however, copper prices are vulnerable to a sharp move lower as demand dries up.

Technical Views

Copper

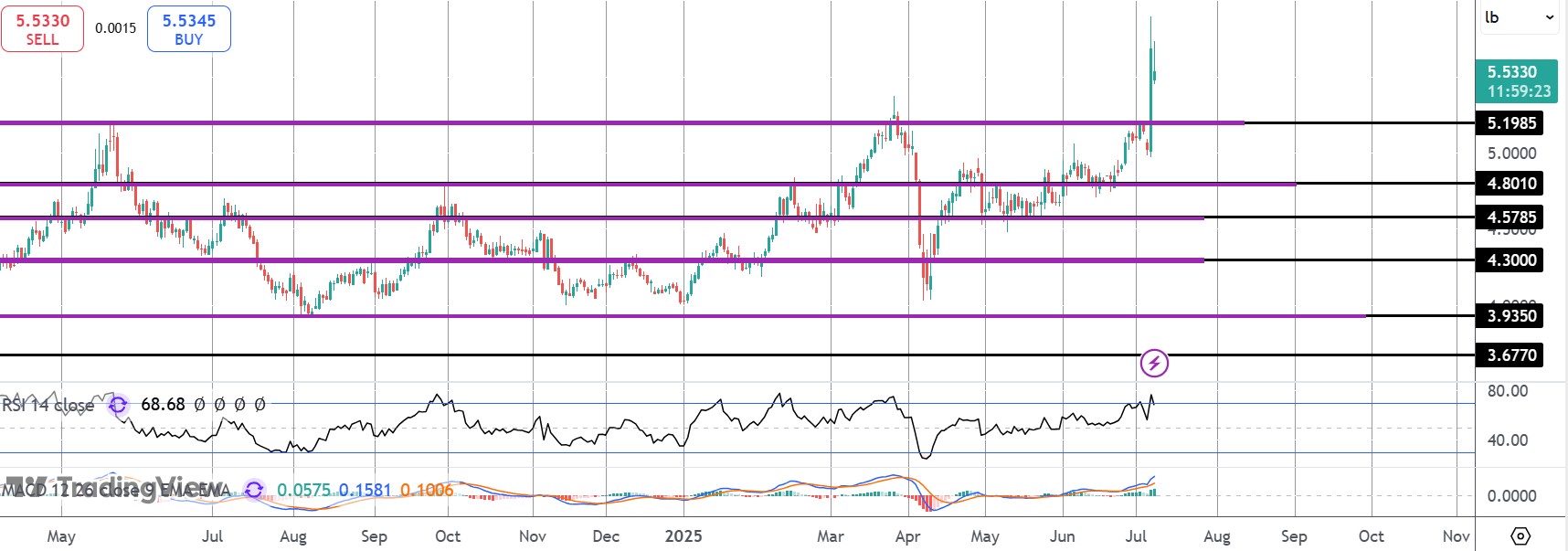

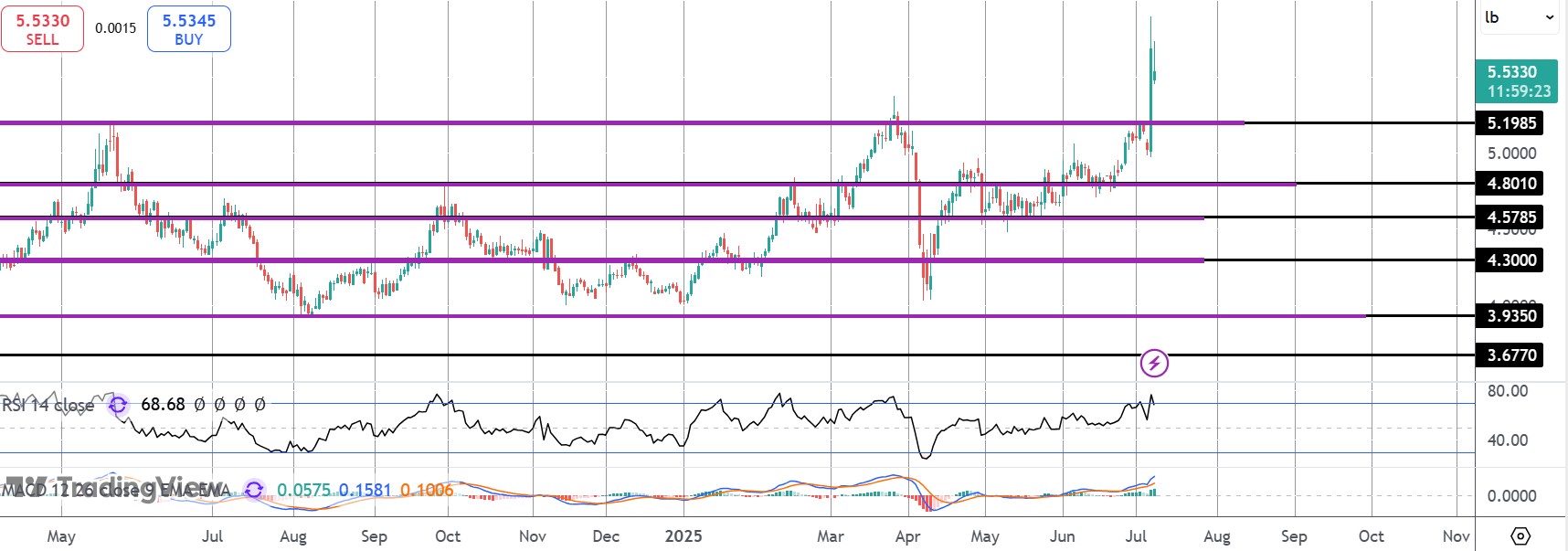

The surge higher in copper yesterday takes the market into uncharted territory. While above the 5.1985 level, focus is on a continuation higher, in line with bullish momentum studies readings. If prices do move back under 5.1985, 4.8010 will be the next support area to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.