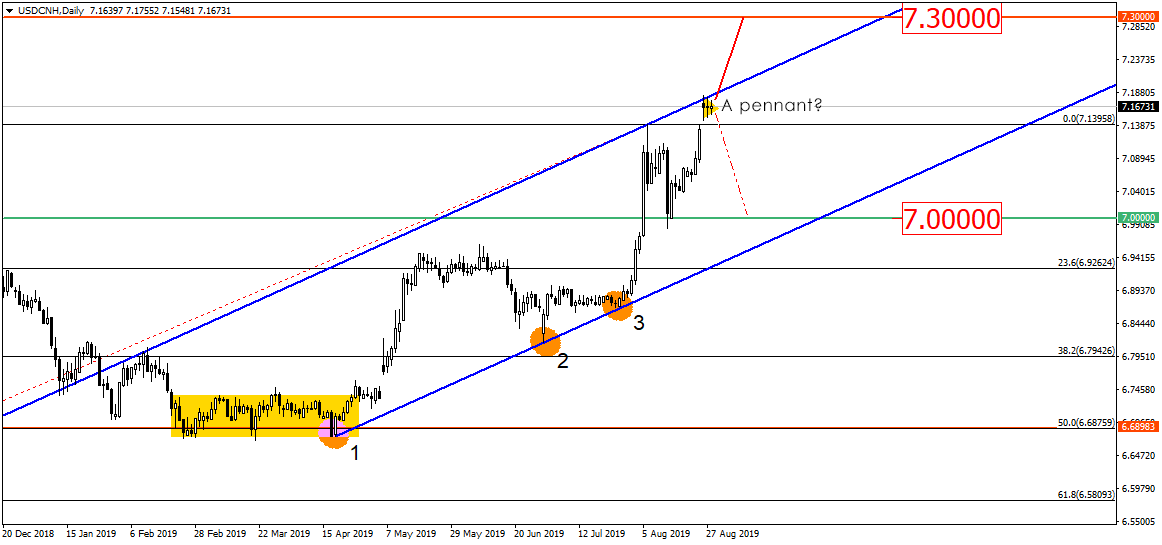

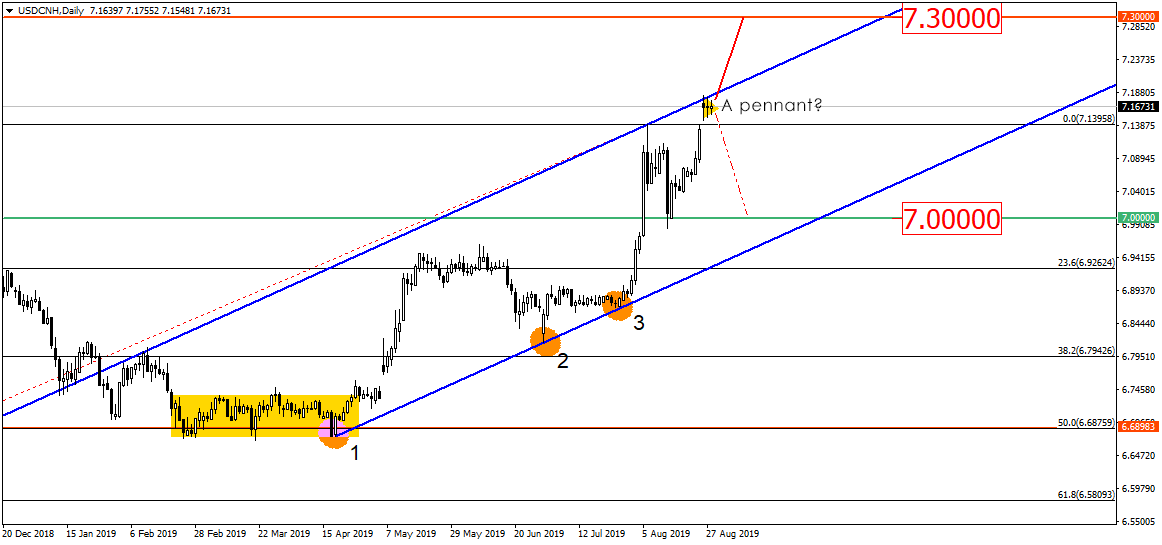

Is the Chinese Yuan Ready to Move Forward?

Good day!

It is a well-known fact that there is now a trade war going on between the USA and China. Now it’s become clear that China has decided to diversify and start a currency war, depreciating national currency and breaking the 7.0000 key level.

In the daily chart, the currency pair USDCNH is heading up after remaining still for a while and then pulling back from the 6.6875 level. For now, the offshore yuan has reached the upper boundary of the uptrend and is about to form a pattern resembling a pennant where the handle is also present. Should this pennant pre-empt the asset jumping, the currency pair may then test the 7.3000. levels.

Should the pennant get broken down, the asset could potentially pull back from the trend and fill the formed gap. So, the yuan might even target the 7.0000 level:

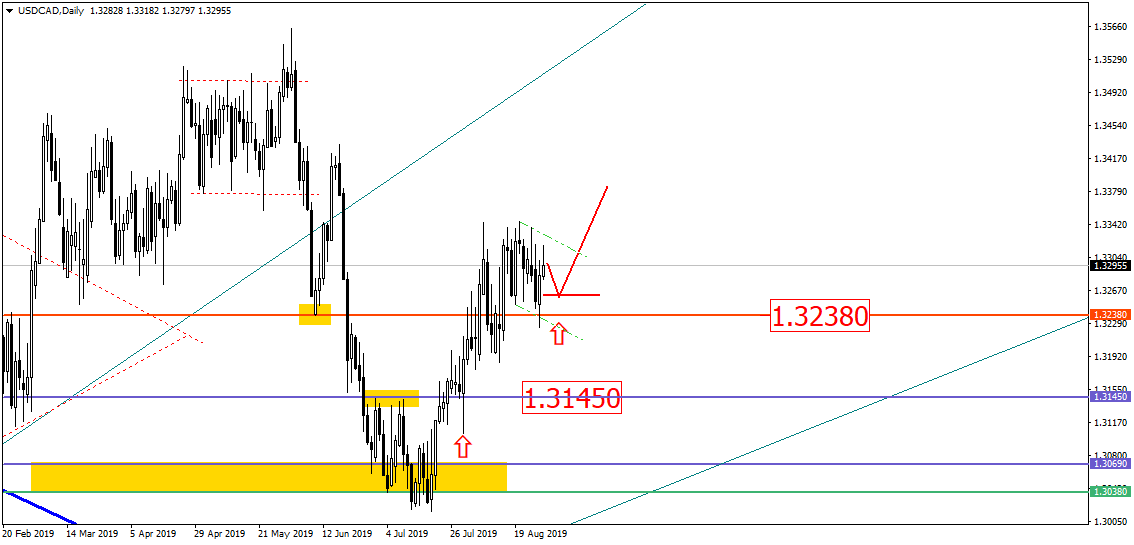

The Canadian dollar got back to the broken 1.3238 level and formed a bullish engulfing pattern. So far, we assume that the asset will pull back to the middle point of the engulfing pattern and then the currency pair could potentially jump:

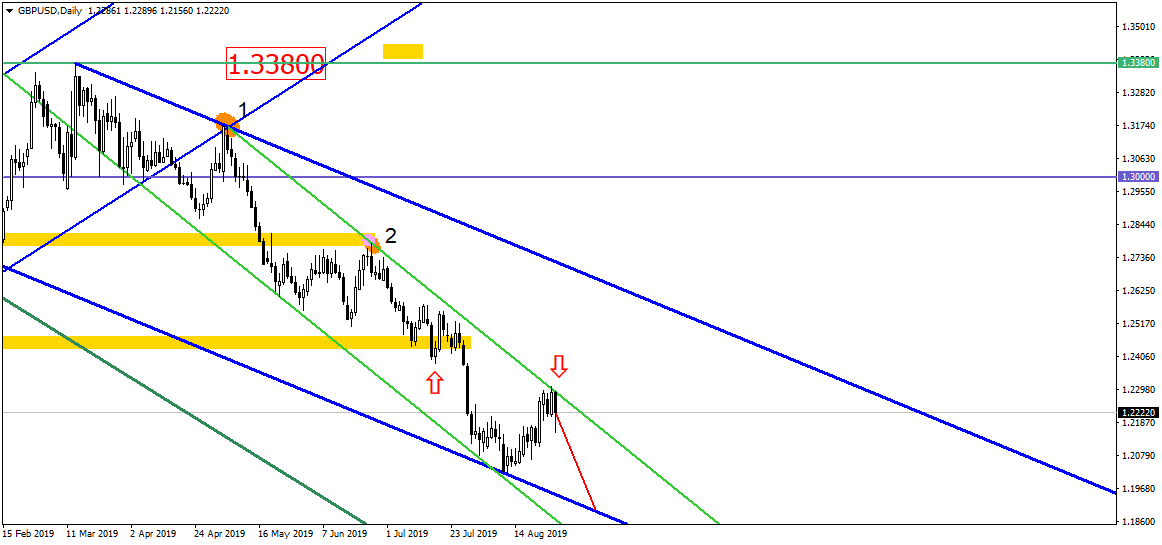

The British pound rate approached the downtrend, trying to close the trading day with a bearish engulfing pattern. We could assume that this asset may drop:

Let us remind you that this material is provided for informative purposes only and cannot be considered as a direct go ahead to implement transactions in the financial markets. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.