China Warns US Over Trade Deal Impact of Hong Kong Interference

Rising tensions in Hong Kong are not only creating tensions between the autonomous state and China, but are now threatening to impact relations between the US and China. When questioned last week on how the situation in Hong Kong might impact any potential trade deal, President Trump told reporters “I think it’s a very hard thing to do if there’s violence”.

China Warns US About Interfering In Hong Kong Situation

This week, China seemingly responded to these comments. In a brief commentary published in the state run People’s Daily newspaper late on Monday, it was noted that “making a fuss about Hong Kong will not be helpful to economic and trade negotiations between China and the US…They would be naive in thinking China would make concessions if they played the Hong Kong card.”

The commentary went on to say that “the US should stop its meaningless threat of linking the China-US trade talks with the Hong Kong problem. Beijing did not expect to quickly reach a trade deal with Washington. More Chinese people are prepared that China and the US may not reach a deal for a long time.”

These comments come at a time when China is reportedly gathering troops at the border crossing to Hong Kong with many fearing that another Tiananmen Square type situation could unfold if troops are sent in.

Trade Talks in Focus

The US and China are due to hold a further round of trade talks in September and the market is wary of the potential that the ongoing tensions in Hong Kong have to disrupt the talks. Last week, the market was buoyed by news that a portion of the $300 billion of Chinese goods due to fall under a new set of 10% tariffs will now be exempt until December 15th. The market is hopeful that this compromise will incentivise China and the US to deliver a deal this time around.

Pimco Warn of Bond Market Reversal Risk

Indeed, it seems that some big names in the industry are starting to shift their view. Dan Ivascyn, chief investment officer of Pimco group, the larges actively managed fixed-income fund in the world, noted upside risks. Ivascyn said that although bond yields are likely to stay relatively low in the near term, the rally over the summer has shifted the risk outlook. Ivascyn told reporters “We are lot a more defensive… Even if we get a narrow trade agreement (between the U.S. and China) we could see a pretty powerful snapback in yields,”

Explaining that several of Pimco’s largest funds have been pairing back their exposure to bond markets in the UK and Europe, Ivascyn said “We like the U.S. market more — it still has more room to rally in a global flight to safety,” Ivascyn said, before adding: “But, it wouldn’t take much of an uptick in inflation to cause a meaningful repricing.”

For now, the market waits tentatively to see if the next round of trade talks will take place and if any progress can be achieved, with strong two way risk around headlines.

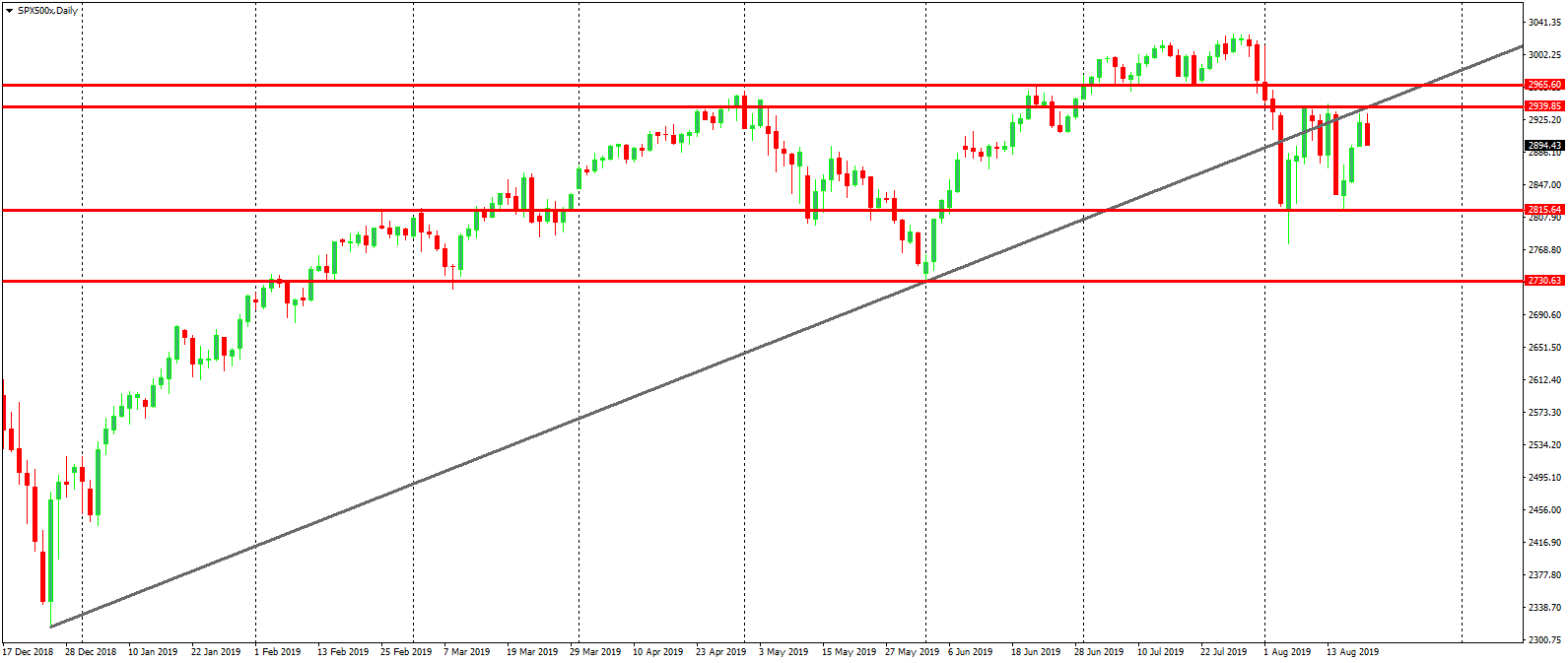

Technical Perspective

The recovery in the S&P this week has stalled just shy of retesting the broken bearish trend line and the 2939.85 resistance. For now, price remains range bound between this level ( which has been tested three times over the last week) and support at the 2815.64 level where price recently put in a higher low. If we break to the topside, the next level to watch is the 2965.60 level while to the downside, the next level is the 2730.63 zone.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.