China Cannot Stop Importing Iranian Oil

China's crude oil import figures released by customs administration on Tuesday were interesting not only because of consumption trend, but also because of a such political nuance as China’s compliance with the US oil embargo against Iran. China’s reluctance to comply with sanctions could be based on an economic motive since Iran is likely forced to offer oil at hefty discounts. Then, along the way, the principle “the enemy of my enemy is my friend” would also be in effect. At the current level of escalation of the trade war, the benefits of such a decision probably outweigh the risks of further escalation. However, the data show that China is in no hurry to make such position official.

According to the data, not only China didn’t cut purchases of Iranian oil after the end of the waivers program on May 2, but also steadily increased oil imports in the following months. In July, China imported 900K barrels of crude oil from Iran, which is 4.7% more than in the previous month. State oil companies have not been involved in the import of Iranian oil since May, adhering to US sanctions, however, private oil companies in China continue to support Iran. In metric tons, imports increased by 8.2% compared with June, but fell by 71.9% compared with July last year. In general, the market for Iranian oil declined by 60% compared to last summer.

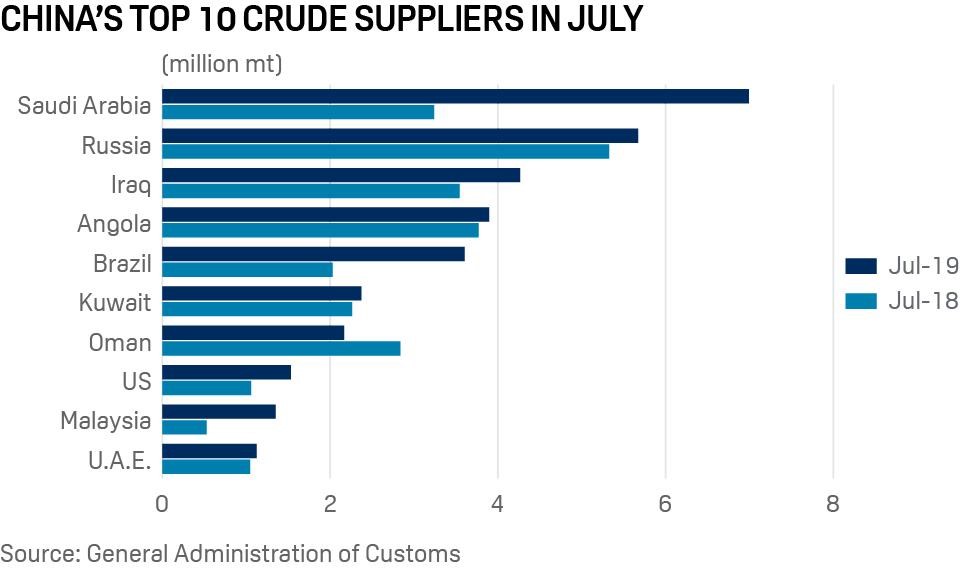

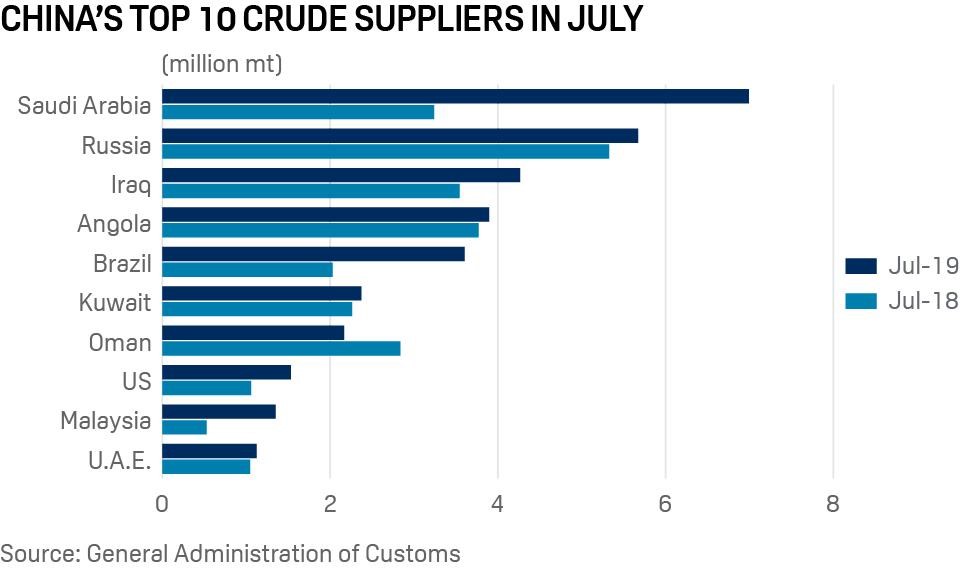

At the same time, oil purchases from Iran’s main competitor, Saudi Arabia, rose to a record level, reaching a historic high of 1.89 million barrels per day, but then dropped to 1.65 million barrels in July. Russia and Iraq were in second and third place respectively in the list of oil suppliers for China.

At the same time, the United States also entered the list of 10 largest oil suppliers in China, despite the trend for worsening of the trade ties. At the same time, US oil imports increased in annual terms by 45% to 1.53 million metric tons.

Customs data was published just after the arrival of Iranian Foreign Minister Javad Zarif in China, where he tried for the third time in a year to strengthen economic partnership under the conditions of sanctions, although with little success.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.