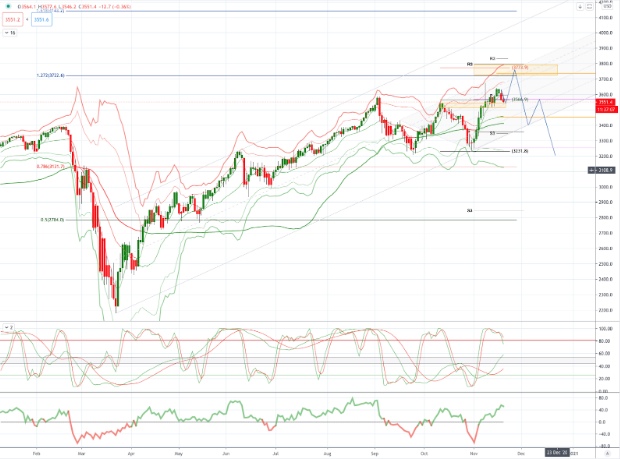

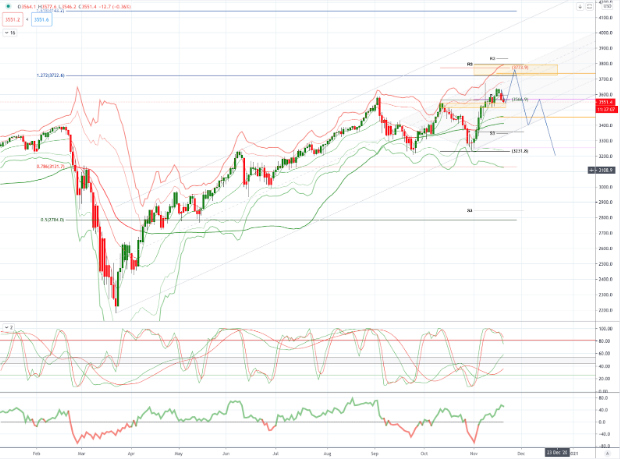

Chart of The Day US500 (S&P500)

Chart of The Day US500 (S&P500)

US500 (S&P500) Potential Reversal Zone & Probable Price Path

The vaccine jointly developed by the pharmaceutical company Pfizer and BioNTech has a final stage III clinical trial effectiveness of 95%, and plans to apply for authorization to the US Food and Drug Administration before Friday. The number of newly diagnosed cases in the United States has remained above 100,000 in a single day for 14 consecutive days, and the cumulative number of infections is close to 11.5 million. New York City announced the closure of schools throughout the city and warned of massive cuts in public transportation services. The Governor of Wisconsin extended the state of emergency order to January and forced residents to wear masks when going out

White House Chief of Staff Meadows said that the current stimulus package negotiations are led by Congress. Senate Republican leader McConnell pointed out that the scale of the plan should be around US$500 billion, which is far lower than the Democratic Party’s proposal of more than US$2 trillion. House Speaker Pelosi and Senate Democratic Leader Schumer call on McConnell to participate in negotiations this week

The S&P 500 slumped 1.16% and VIX rose to 23.84. UST bonds also fell as the 20-year bond auction tailed and was awarded at a 1.42% (highest since the tenor sales resumed in May) while the 10-year yield stood at 0.87%. The 3-month LIBOR was 0.2238% while the USD slipped

From a technical and trading perspective, US500 is slowing nicely in what appears to be a post election blowout. This technical momentum loss is not only important to create the necessary conditions for an eventual reversal but provides the market with plenty of time and opportunity to get itself long and eventually wrong. In this respect the US500 consolidation below the recent 3670’s high is corrective, there may be more consolidation before it can break up to a primary upside objective sited at 3722/72 this potential reversal zone represents the 1.272 Fibonacci extension of the Covid crash, projected interim trend channel resistance and the 1.61 Fibonacci extension versus the late October low, just above here we also have the monthly and weekly R3 levels in view, all of which should weigh on prices. In the near term the US500 will become vulnerable for a last leg of a correction back through 3515 before a final break higher. It is only after a test of the target zone or a loss of 3460 that bearish exposure should be rewarded for a test of bids back towards 3200.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!