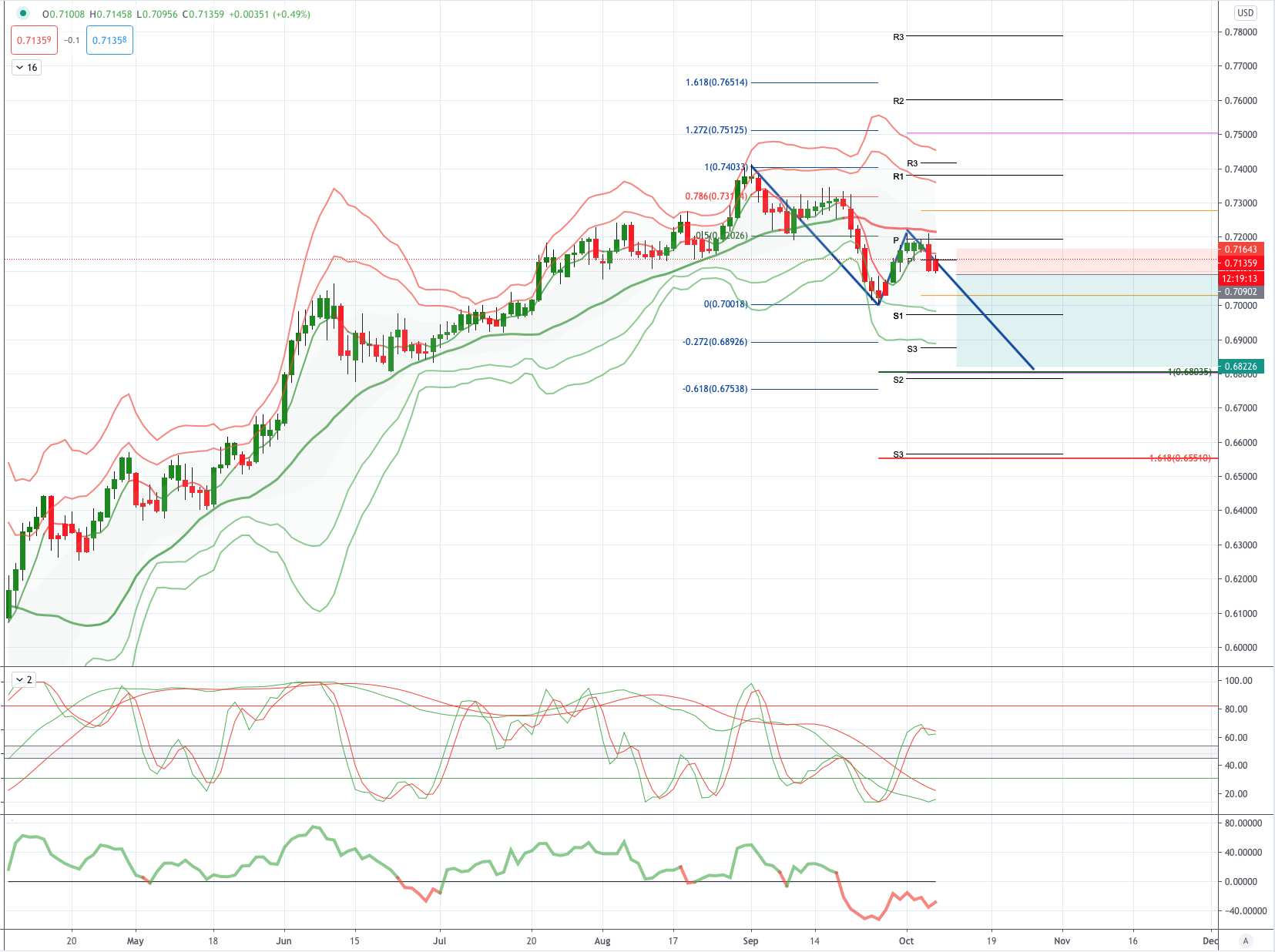

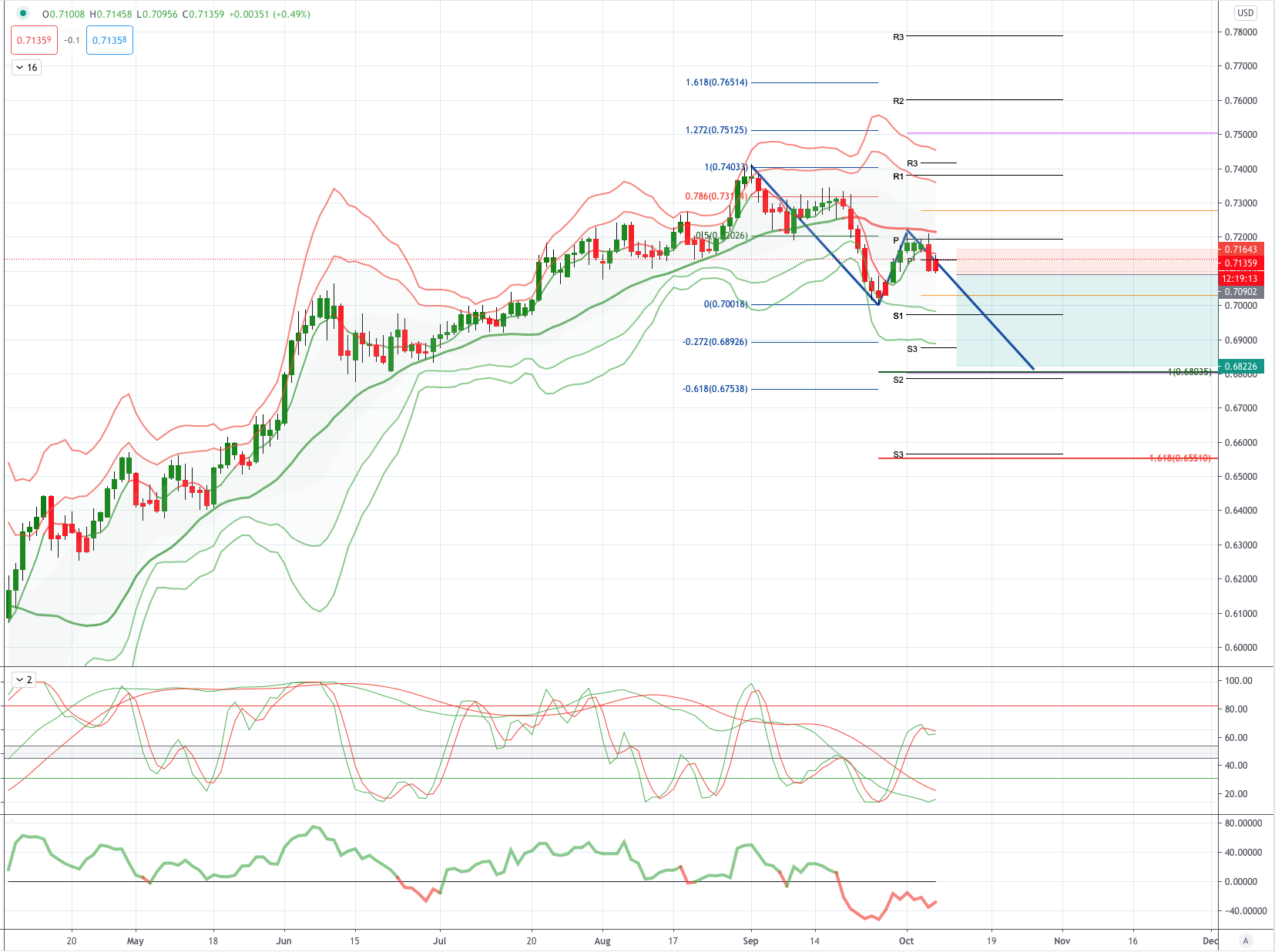

Chart of the Day AUDUSD

AUDUSD Potential Reversal Zone - Probable Price Path

AUD: In Australia, the RBA kept its policy settings unchanged, as expected, at its Board meeting yesterday. The Statement was suitably dovish to reinforce expectations that theRBA will ease next month, with our NAB colleagues looking for a 15bps cut in the cash rate, 3-year yield target and term lending facility (all to 0.1%)alongside QE programme centred on 5-10 year bonds. In an article overnight, closely-followed RBA watcher Terry McCrann claimed that the RBA would indeed ease next month. Australia pledged billions in tax cuts and measures to boost jobs on Tuesday in a budget that tips the country into its deepest deficit on record. Australia's response to Covid-19 has been exceptional among G10 countries and this is helping the AUD bounce back from the pandemic. China’s fast recovery from the virus and the US’s poor handling of Covid-19 has added to the AUD’s outperformance. Australia’s exposure to the relatively stronger economic recoveries from Covid-19 in Asia will continue to support the AUD in 2021. A high level of domestic household debt is a risk for the AUD when fiscal support for the economy is wound back and loan repayment holidays end.US-China trade tensions are also a downside risk.

USD: US equities initially rallied on hopes that there would be a second relief package to prop up financial markets as the COVID-19 outbreak rages on. However, the major US equity indexes tumbled after US President Donald Trump’s tweet that the White House is halting talks with Democrats about a second COVID-19 stimulus deal. US 10-year, 20-year and 30-year yields rose to their highest level since June before retreating. The yield curve steepened again, the spread of 2-year and 10-year yields hit its widest since June, whilst that between the 5-year and 30-year reached 127bps, the largest gap since early June.

From a technical and trading perspective, the AUDUSD declined from its September peak and has subsequently retraced back to the 50% retracement level of the decline and prior support at .7200, this level also represents the October monthly pivot point. Yesterday's candle printed a key reversal pattern eclipsing the prior four days of trading range to the downside. Bearish exposure should now be rewarded on a breach of the overnight lows at .7090, bears will be targeting an equality objective sighted at .6822, on the day only a closing breach above yesterday’s high would negate the downside thesis.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!