Chart of The Day AUDJPY

Chart of The Day AUDJPY

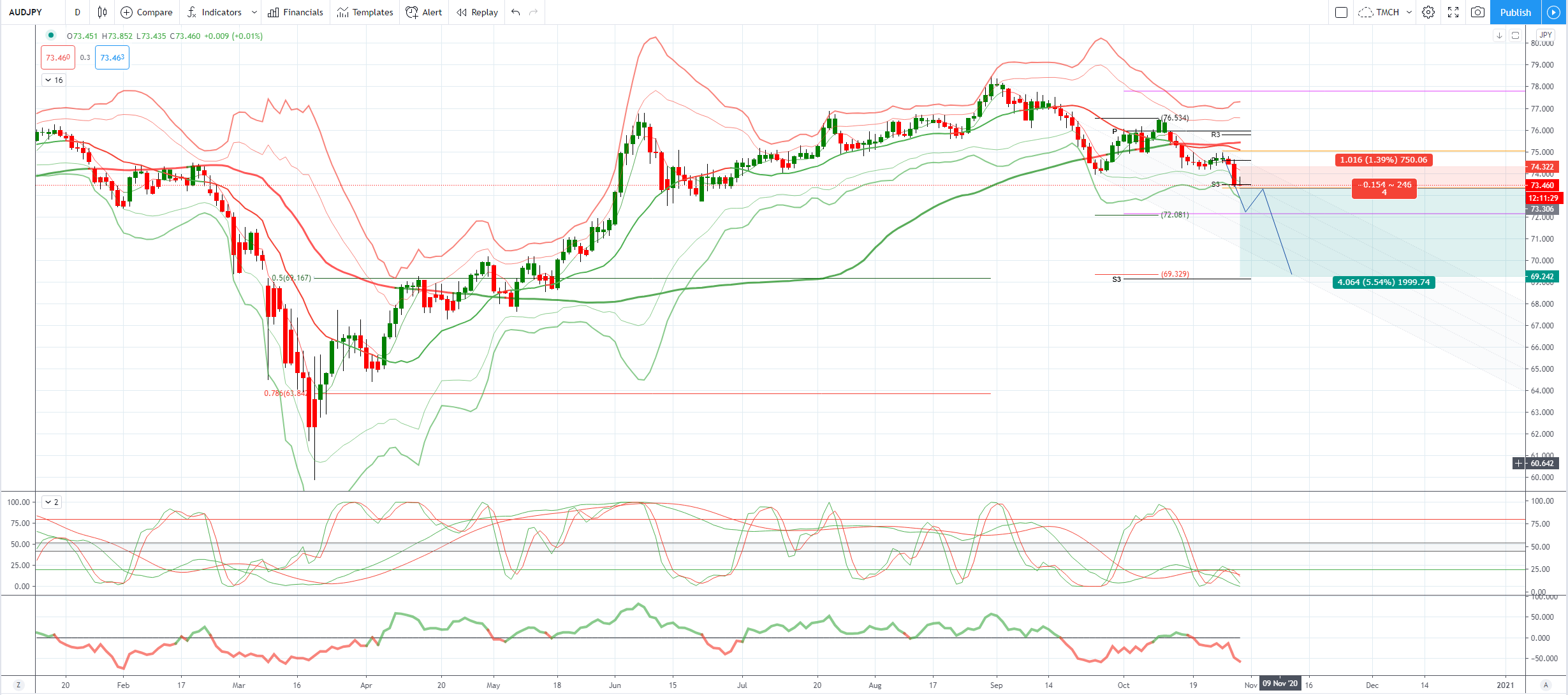

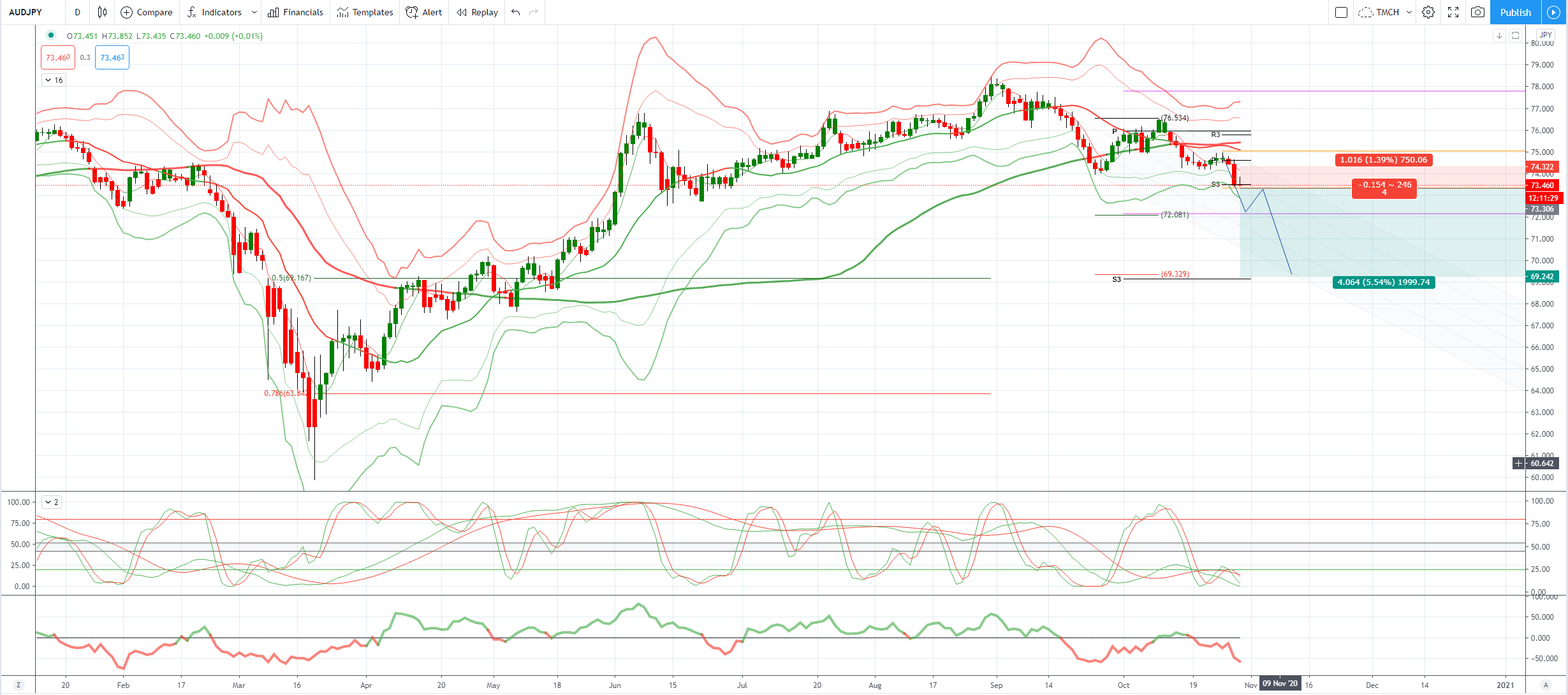

AUDJPY Potential Reversal Zone & Probable Price Path

AUD: Risk aversion in the market heats up, weighing on the performance of commodity currencies such as the Australian dollar. The market is worried that the epidemic in Europe and the United States may drag down the economic recovery, and risk aversion is elevating again. Second tier data out of Australia on Thursday was mixed, with NAB business confidence improving, while export and import prices were softer. Key standouts on Thursday’s calendar include US GDP, US initial jobless claims, and US pending home sales.

JPY: The financial market may continue to fluctuate before the US election, and the yen may benefit from demand for safe-haven. The Bank of Japan as expected kept its policy unchanged today. Japan’s retail sales fell by 0.1% month-on-month, which was worse than the market’s expected 1% increase, which may reflect that the effect of government-provided cash payments on stimulating consumption has diminished.

From a technical and trading perspective, the AUDJPY look set to extend its decline, bearish exposure should be rewarded on a breach of yesterday's lows, bears will initially target the equality objective sited just ahead of 72.00, however as any corrective action from this level is contained again at the 74.00 handle then look for a further extension to the downside to target the 161% extension and 50% retracement level of the advance from the March lows to the August highs at the pivotal 69.30 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!