Chart of the Day Bullish CHFJPY

CHF: The SNB remains uncomfortable with Franc appreciation and continues to remind the market it will need to be careful about any attempts at trying to force an appreciation in the currency. But the SNB will also need to be careful right now, as its strategy to weaken the Franc is facing headwinds from a less certain global outlook. Any signs of sustained risk liquidation, will likely invite a very large wave of demand for the Franc that will put the SNB in the more challenging position of needing to back up its talk with action, that ultimately may not prove to be as effective as it once was, given where we're at in the monetary policy cycle.

JPY: BOJ Sakurai was out on the wires with dovish comments, which may have been contributing to some of the recent Yen weakness. Still, with the comments mostly consistent with the central bank's outlook, the moves weren't going to be all that aggressive. Most of the Yen selling of late has come from the upbeat sentiment around US-China trade and ongoing easy money policy around the globe, which has been helping to bolster investor confidence. Market conditions will thin out for the remainder of the week as the US heads off the desks for the Thanksgiving holiday weekend.

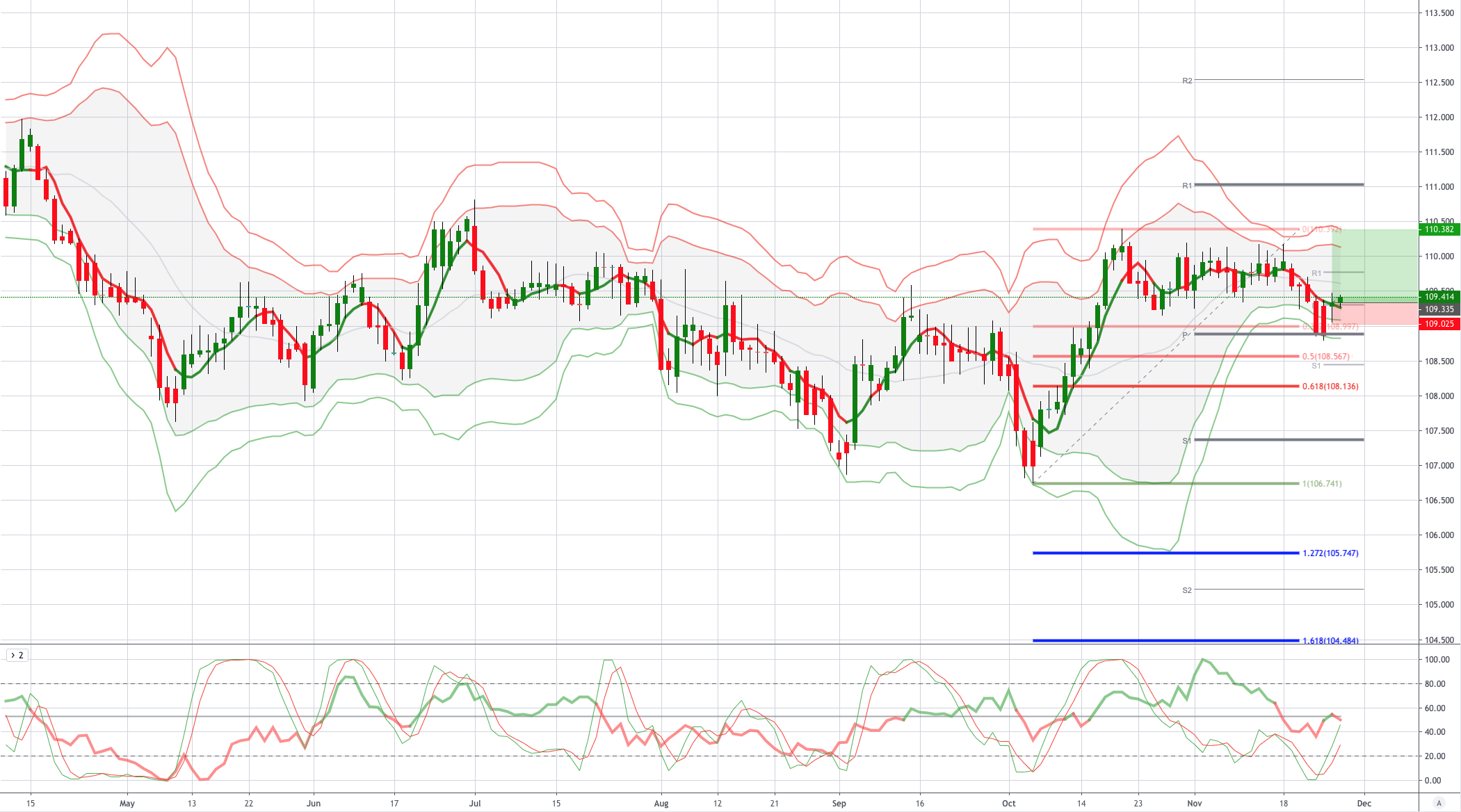

From a technical and trading perspective, the CHFJPY has tested and held the confluent support area at 109 which represents a 38.2% pullback against the October advance and the November monthly pivot. Yesterday's reversal candle flipped the daily chart bullish as per the near term volume weighted moving average as such i will venture long with a stop below yesterday's low targeting a move higher to retest the OCtober swing high towards 110.50

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!