Can the Virus Outbreak be Finally Tamed?

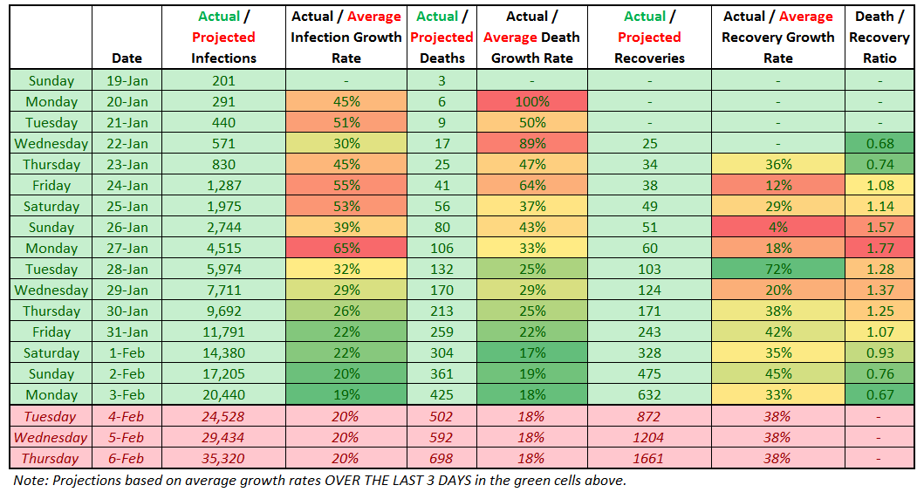

As a follow-up to my previous article about a possible time lag between China lockdowns and their reflection in the confirmed cases, I include the table that may serve as evidence to it. With very naive (for any epidemiologist) calculations, it convinces that the virus outbreak could be finally brought under control:

Look at the third and fifth columns – actual infection and death growth rates. They are calculated as relative increments (infected or deaths) compared to the previous day (in percent). It is fair to believe that since far from all investors are experts in epidemiology, the only “normal” data to be analyzed were the number of infected and deaths. Thus, such “naïve” outbreak characteristics as infection and death growth rates, could well be taken as markets’ criteria of the efficiency of control and lethality of the outbreak. Over time, you can see a gradual "cooling" in those two readings - reaching a peak of 65% on January 27, the growth rate of infected people slowed down to 19% on February 3, while the growth rate of deaths also gradually decreased and reached 18%.

As expected, the lockdown effects have been reflected in the data (confirmed cases) with a certain delay - after about a week and a half, since at the initial stages of the outbreak diagnosis were slower than the rate of the virus spreading.

Slow spreading and low mortality rate outside of China have substantially eroded positions of the virus as a threat to humanity. Together with the quarantine, stalling number of cases outside China increases the odds that the virus will not change its status from an “epidemic” to a “pandemic” further cooling market concern.

On Wednesday, the information has also appeared that researchers in the UK and some China university had made significant progress in finding a vaccine. As one of the UK researchers said, the drug will be tested on animals next week and in summer on people, provided that the financing of the project does not stop. The positive reaction of the stock market and the continuation of the rollback of gold could be associated with this news as well.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.