Can Powell Help Gold Finally Break its Range?

Gold Softer Again on Friday

Gold prices are softened again today with the futures market remaining in the red ahead of Powell’s keenly awaited Jackson Hole speech later today. Given the range which has framed price action in gold since April, traders will be hoping for a catalyst today to finally spur a fresh directional move beyond either range boundary.

Scenarios & Market Impact

If Powell strikes a dovish tone today, and signals forthcoming easing next month and the prospect of further easing as necessary over the remainder of the year, this should be firmly bearish for USD, allowing gold prices to rally and potentially breakout to fresh highs near-term. However, if Powell strikes a more neutral tone, refraining from giving a September easing signal, while focusing on lingering inflation uncertainty (recent PPI beat as an example) this should see USD rally firmly as traders scale back rate-cut bets. In this scenario, gold prices should come under fresh selling pressure.

Russia-Ukraine Peace Hopes

However, away from moves in USD, gold prices are also being driven by developments in the geopolitical space. Ongoing negotiations between Russia and Ukraine remain a key focus point for traders. The recent uptick in drone attacks from Russia has sparked fears that Putin is bluffing when it comes to peace. If talks fall apart this could well drive a fresh surge of safe-haven demand for gold, lifting prices again as we saw earlier in the year.

Technical Views

Gold

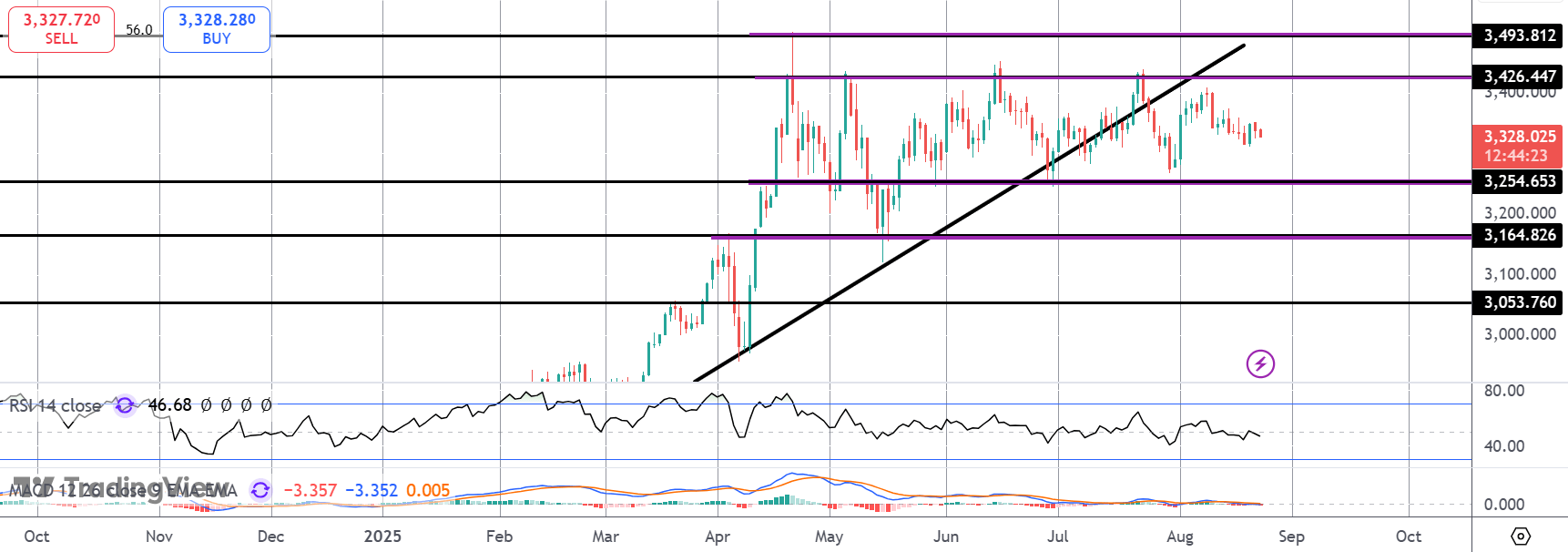

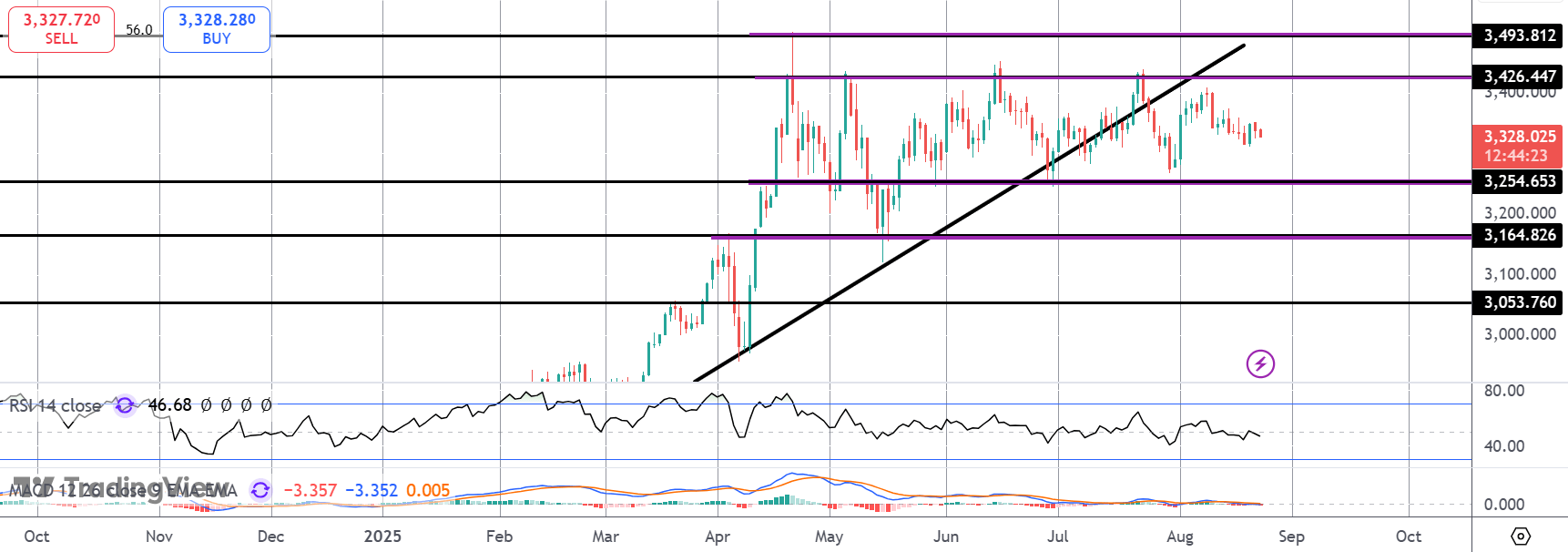

For now, gold prices remain within the 3,164.65 – 3,426.44 range which ahs framed price for much of the last four months. Momentum studies are flat, suggesting plenty fo room for a push on either side of the market. Topside, 3,493.81 is the level to watch if we break higher. Downside, 3,164.82 is the level to watch if we break lower.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.