Can Bitcoin Hit New Record Highs This Week?

BTC Pushing Higher

Bitcoin prices are on watch this week with the futures market now trading just below the all-time highs. BTC rallied up to highs of mid $106 earlier today before cooling a little ahead of the US open. The market has been bolstered recently by optimism over a shift in tone regarding the US trade war. News of a trade deal between the US and UK as well as a positive start to negotiations between the US and China, including initial tariff reductions, is fuelling a rally across the board in risk assets. BTC has been a strong beneficiary of the improved risk tone with the market up more than 40% from the April lows.

Soaring Institutional Demand

The uptick in BTC has been fuelled in part by a surge in institutional demand as mainstream investors flood back into Bitcoin following the correction lower earlier in the year. Indeed, as of May 8th, total BTC ETF inflows stood at just over $40.3 billion, surpassing the prior record peak set in February. BlackRock noted this week that its BTC ETF has seen a record two weeks straight of unbroken net daily inflows, now totalling around $365 million. ETF inflows have been a key signpost for higher prices in Bitcoin and while demand continues to grow, the rally is expected to continue.

Political Support

Bitcoin is also being bolstered by positive news on the political front. New Hampshire last week became the first US state to approve a state-level Bitcoin reserve, paving the way for state investment in crypto. The move is expected to see several other states follow suit soon, boosting the chances that we eventually see the US strategic crypto reserve make a shift to direct market purchases. This has often been cited as the holy grail for Bitcoin bulls and, as such, any further positive news flow echoing the news of New Hampshire should see BTC prices firmly higher.

Technical Views

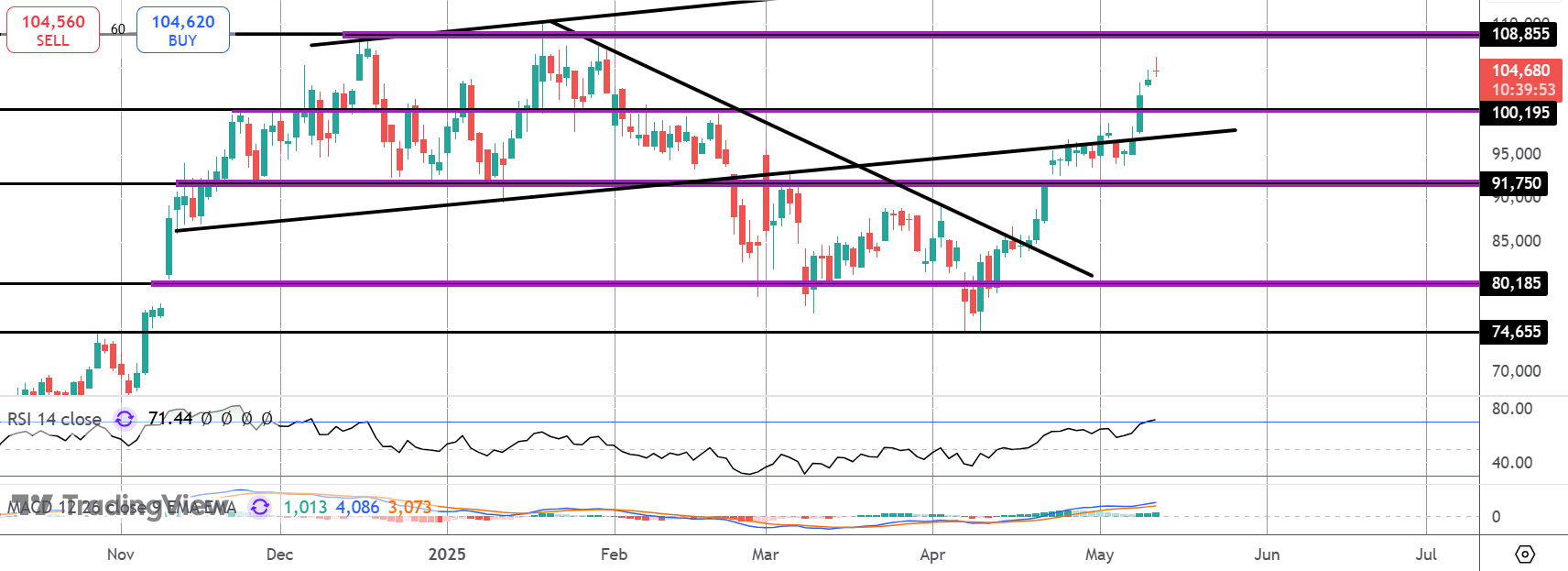

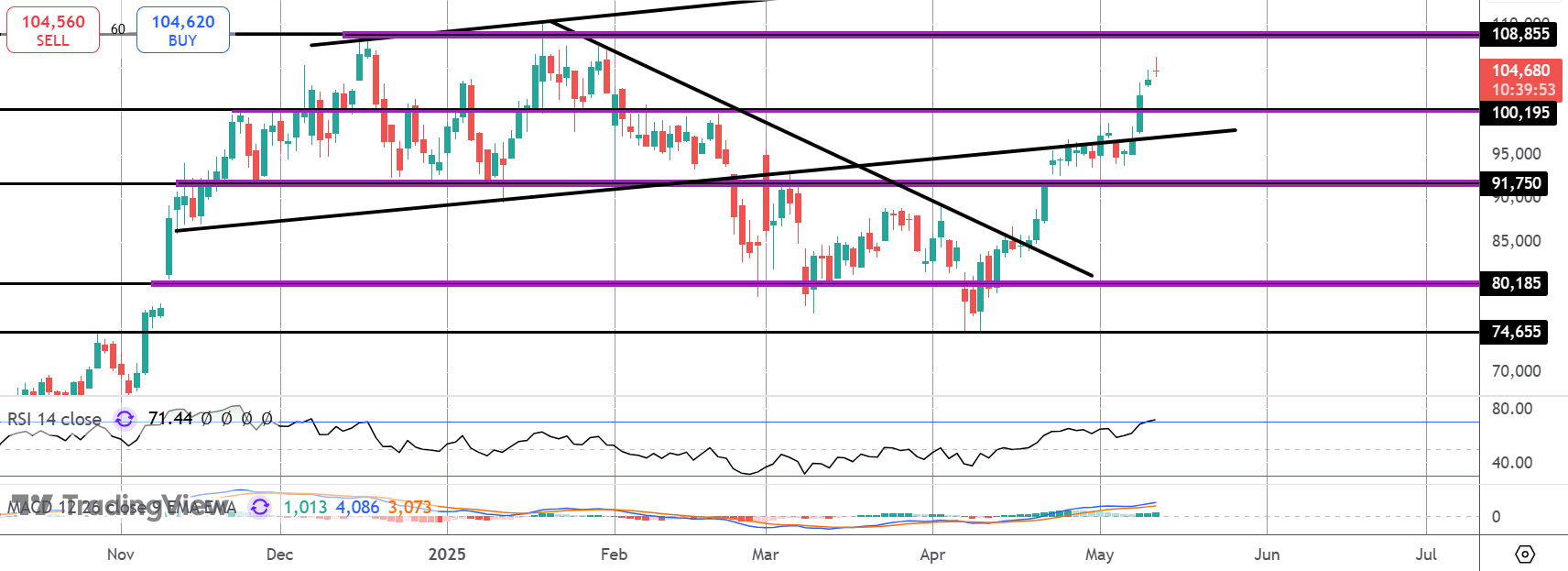

BTC

The rally in BTC has stalled for now just ahead of a test of the $108,855 level. While price holds above the $100k mark, and with momentum studies bullish, the focus is on a test of the level and a breakout to fresh highs. This view only shifts if we slip back below the $100k mark, turning focus to $91,750 as deeper supports.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.