Are Buybacks the Only Foothold for Stocks Currently?

After the tax relief package was approved in the US in 2017, share buybacks pace of growth switched to the mode of “updating records”, and 2019 seems to be no exception. The ‘convenient’ and ‘easy to use’ tool, to maximize the company's market valuation, was especially liked by technology companies. One recent example was Microsoft, which announced a buyback of shares to the tune of $40 billion. The company's shares climbed 2.8% on the welcomed news.

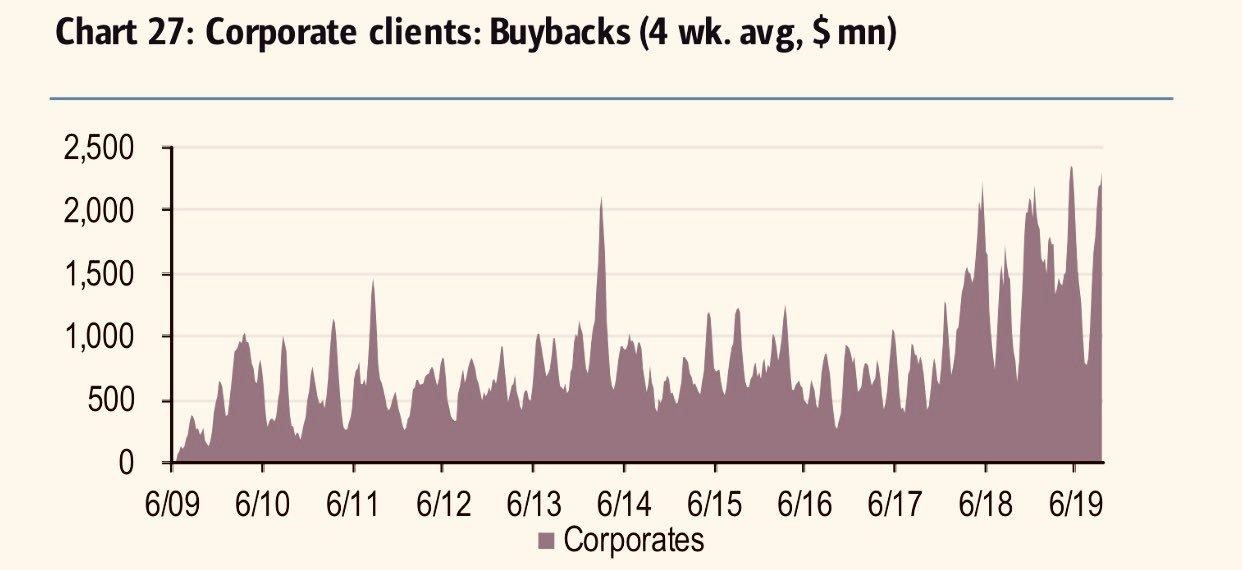

According to BofA estimates, the cumulative stock repurchases increased by 20% in annual terms, and the average value for 4 weeks is even more often, at record levels of 2018. Such dynamics remain robust, despite a decrease in revenue due to tariff tensions, decrease of foreign trade, moderate wage growth and slowing rate of return in the economy.

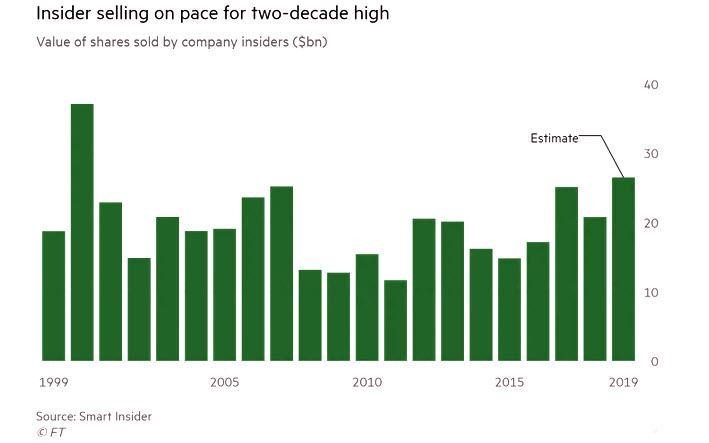

Along with an increase in buybacks, company insiders have been also increasing share liquidations, whose compensation often includes shares. Among the many explanations of company managers about the nature of buybacks, this reason, oddly enough, is avoided. According to Small Insider, insider sales in 2019 may become the highest in 19 years:

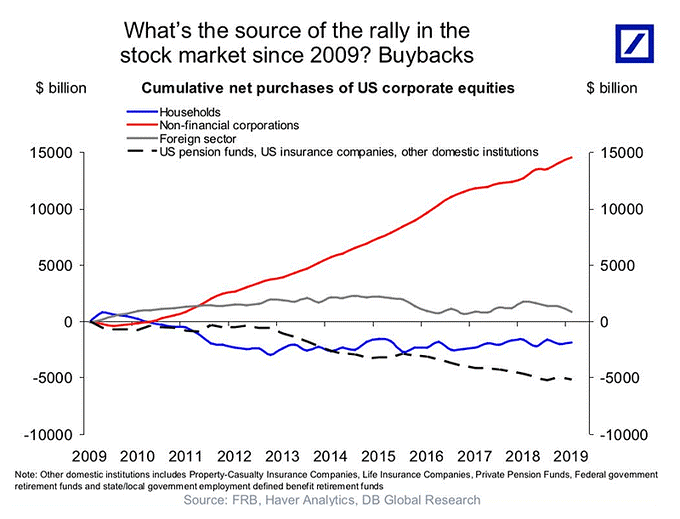

The most active buyers of shares since 2009 were non-financial corporations, while the remaining groups of buyers either reduced their investments or increased slightly (households):

A more serious and less obvious issue is the use of financial leverage by companies to finance repurchases, which is generously encouraged by the Fed's credit easing. Fed official Robert Kaplan cites the following figures: the volume of BBB bonds (the lowest investment grade) grew from $800 million in 2008 to 2.7 trillion. by early 2019. The average US corporate debt jumped from 40% in 2008 to 60% in 2018. All this was accompanied by loosening of the terms of issues.

The volume of capital investments, expenses on mergers and acquisitions, respectively, grew on average at a slower pace, which makes it possible to isolate the channel of expenditures on borrowed funds – which is exactly buybacks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.