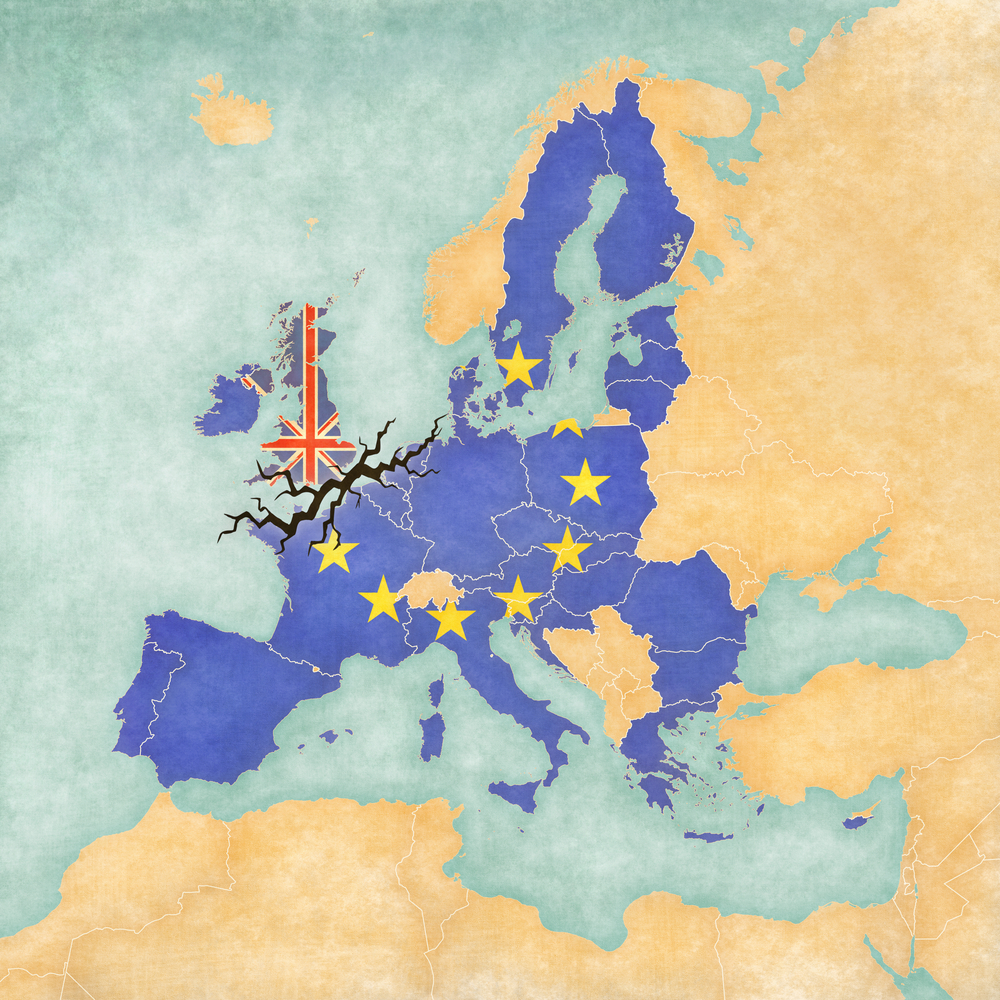

Article 50 has been triggered. The UK has two years to sort the mess out and ensure it maintains a financial advantage to make leaving the EU worthwhile. The City of London has been warned to prepare for a worst-case scenario if a NO DEAL Brexit with Europe becomes reality. The outcome may have a huge significance to the global financial system for years to come. But how did we find ourselves in this position and are there more serious risks afoot? I think we have totally underestimated the potential for mass European instability.

The origins of the EU

The EU for all intents and purposes was set up so that France and Germany would never again go to war with each other. Since 1945, Germany has become Europe’s greatest manufacturer by downing weapons for tools.

What began in 1951 as the European Steel and Coal Community involving 6 nations, has now become the 28 nation EU with an ideological mantra of ‘ever closer union’. However, the financial crisis of 2008 has hit the Union hard and has led many to question the validity of such an ideology.

This Union led 19 of the 28 members to the single currency - the Euro – and all 28 members, except the UK and Denmark, are committed to joining the Euro, once they achieve threshold criteria.

The challenges – old fears resurface

What is painfully obvious now is that when the Euro launched in 1999, many countries that did join were simply not ready to make that leap. All countries were meant to have levels of inflation, debt and unemployment within various limits. The problem was that some did not. The Euro crisis exposed these vulnerabilities, especially in countries like Greece.

Europe has seen seven decades of peace, but what of Germany? It has been one of the most peaceful (and reticent) members since 1945 but if the EU fragments, will the old fears of Germany resurface?

It is Europe’s wealthiest nation and the world’s third largest exporter of goods and services, and has no intention of seeing its closest trading partners fall into protectionism, if it can possibly help them.

The legacy of the 2nd world war still hangs over Germany when confronted with foreign policy and on a global level, it is sometimes difficult to hear its voice at all. However, look closer to home and the language and voice - or non-voice - is far more telling, especially where events may significantly impact German economic potential.

Germany was involved in the overthrow of the Ukrainian president Yanukovych in 2014 and was critical of Russia’s ‘annexation’ of Crimea but, ever mindful of the gas pipelines coming from Russia, it has tempered its criticism, in comparison to other states, as it is significantly more reliant on Russian energy than countries such as the UK.

So, while Germany is firmly rooted in Western Europe for the moment, it is not beyond reason to expect it to shift its focus towards the East, if the EU started to significantly unravel.

What of the UK?

The UK has always had a habit of engaging with its neighbours to maintain power. This has been somewhat diminished in recent times and where it can no longer exert influence, between the likes of Germany and France for instance, it plays truant by looking to smaller countries and forge alliances from which to agitate on policy discussions.

As an island, it has natural advantages of border security, fertile land, access to the seas and fish stocks. It is close enough to continental Europe to trade and yet is protected by being an island race. Such conditions helped it eventually to become a global power (though somewhat diminished today). However, the ‘memory’ of being a superpower still abounds but is actually a thorn in the collective side of the people.

40 years after joining the EU we still do not know if we are, or indeed want to be, European or British or some derivative thereof. Our timeless policy for ‘wanting the cake and eating it too’ has always led to exasperation with our closest European partners.

The referendum was apparently fought over three main themes:

- Immigration

- Sovereignty

- Mistrust of the establishment

The result of the referendum we know would have been significantly different if only people under 60s had been allowed to vote. However, had the ballot paper asked if we wanted to stay in Europe but with the ability to address the themes above then, I would speculate that a significant majority would have said ‘yes’.

Negotiating a new relationship

As it is Britain is now ‘OUT’. Untying the country from the old membership would mean agreeing on a new trading relationship and obligations, such as free movement, establishing new tariffs and barriers, setting out a series of international bilateral trade deals and revising its own governance as the supremacy of the EU law will no longer apply.

The divorce with the EU and the related uncertainty would be harmful to the UK economy and would have a significant effect on the rest of the EU member states. The exports, supply chain, investments and interests of many businesses would be severely affected, but what is likely to be influenced the most would be the cost of raising finance in Europe.

European financial leaders want to avert economic damage, but political leaders say negotiations will be ruthless to discourage other members from following Britain’s lead. The EU is looking like it is starting to splinter. At the same time, NATO is starting to wobble.

A ‘litmus’ test

Can we really be witnessing the beginning of the end of the great EU experiment? Is the return to a Europe of sovereign nation states viable, where each country vies for alliances in a balance of power struggle? For the Germans, a fear of encirclement from Russia and France. For France, a fear of Germany.

The Dutch elections held in March saw the anti-EU populist Geert Wilders gaining power, while the upcoming French elections on April and May are shaping up to be the most unpredictable in history, with Marine Le Pen pledging to extract France from the single currency. The German elections will surely be Merkel’s biggest test in September. Any political shift away from ‘an ever closer union’ would surely signal the end of the EU and the Euro as we know it.

Stay tuned for more and trade with Tickmill!

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Duncan’s financial training started on the old ‘open outcry’ floors of LIFFE, LME and the CME in Chicago. He managed the US Equity risk desk for a well-known broker-dealer, before becoming UK CEO of a Japanese CFD broker. He has also been actively involved in the building of systematic trading strategies and advises to CTA funds.