Brent Soaring on OPEC Drivers

Oil prices are soaring this week with Brent crude oil trading up to fresh highs on the year, hitting levels not seen since November 2022. Brent is now trading around 32% higher off the YTD lows and looks poised for further gains near term against a highly supportive backdrop. The key driver behind the recent rally has been the extension of production cuts put in place by OPEC+ leaders Saudi Arabia and Russia. The two producers have extended their additional cuts (totally around 1.6% of daily global supply) through year end. This news had a firmly bullish effect on the market given the falling demand outlook we’re seeing globally linked to rising recession concerns.

Tight Market Fundamentals Supporting Oil

Market fundamentals have come under close scrutiny recently. This week, OPEC issued its latest global forecast which projects a deficit of 3.3 million barrels per day, highlighting the tightness in the market currently. Looking at Q3 data, OPEC reported that output from its producers had fallen short of market needs (by its own calculations) of around 1.8 million barrels per day. While focus remains on tight supply/demand metrics, oil prices look likely to continue firmly higher.

Technical Views

Brent Crude

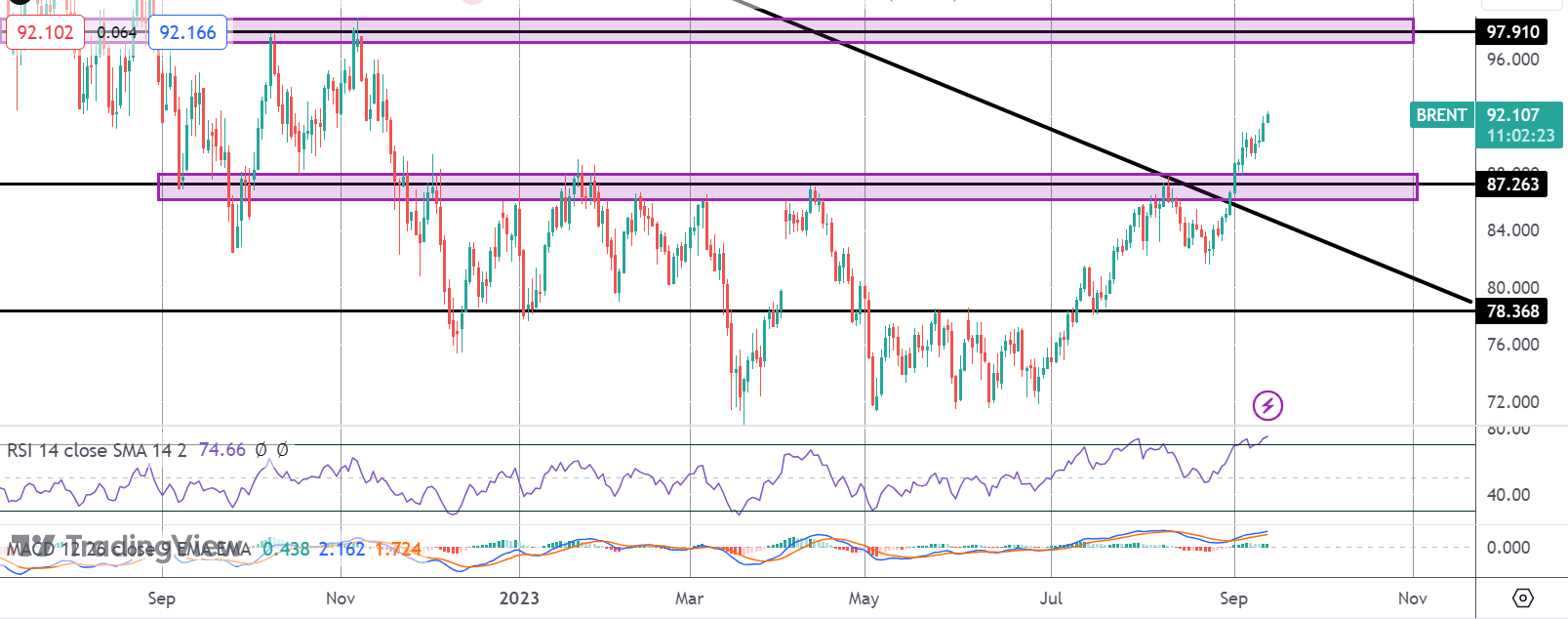

The rally in Brent has seen the market breaking out above the bearish trend line from all-time highs as well as above the 87.26 level. This is a major multi-year resistance area for the market and the break here is an important technical development. While above here, the focus is on a continuation higher with 97.91 the next resistance level to note. Interestingly, we have a bullish signal in the Signal Centre today set at 88.91 showing strong support back into that breakout area.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.

-1694599577.png)