BOJ Tightening Risks Seen on CPI Beat

Japanese Inflation Tops Forecasts

The Japanese Yen is seeing better demand across early European trading on Tuesday. Overnight, the latest Japanese inflation data has once again turned for onto potential BOJ policy normalisation. National Core CPI was seen coming in at 2% last month, above the 1.9% the market was looking for. The data increases the likelihood that upcoming labour-management wage talks will result in sizeable raise being offered out. If seen, this would put greater pressure on the BOJ to normalise monetary policy with traders currently anticipating a potential rates shift in March or April.

Wage Growth in Focus

Expectations of a fresh spike higher in inflation, linked to base effects from last year’s energy subsidies kicking in, are also bolstering the view that a shift is coming at the BOJ. However, there are still plenty of downside risks. On the back of two consecutive quarters of falling GDP growth and with private consumption still very weak, the BOJ needs to see that wage hikes are outstripping inflation enough to foster stronger purchasing power in Japanese households. If the bank gets the sense this is the case, then April could well be the lift off point for rates, raising risks of a sharp reversal in JPY.

Technical Views

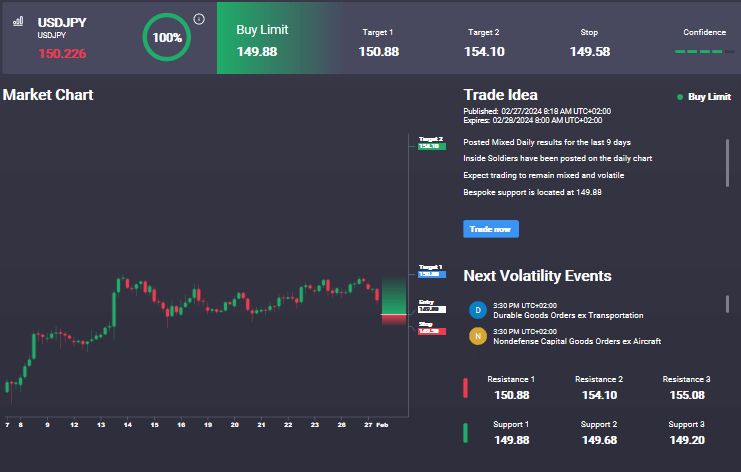

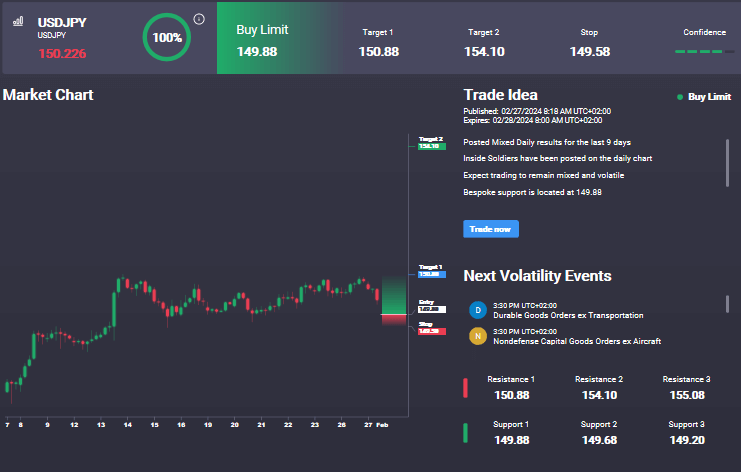

USDJPY

The rally in USDJPY has stalled for now ahead of a test of the 151.81 level resistance and a retest o the broken bull trend line. With momentum studies weakening, risks of a deeper correction are growing. Bulls will need to defend 148.98 to the keep the focus on a continuation higher or risk a test of 145 next. Notably, we have a buy signal in the Signal Centre today set below market at 149.88.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.