BOE Easing In Question Following Fresh UK Inflation Spike

UK Inflation Rises

GBP is in focus today on the back of the latest UK inflation data released this morning. Annualised UK CPI was seen rising to 3.8% last month, up from 3.6% prior and above the 3.7% the market was looking for. Core CPI was similarly higher at 3.8%, above both the prior and expected 3.7% level. At this level, inflation has risen for two-consecutive months and is now at 18-month highs. Notably too, the breakdown of the data shows that services inflation (the reading the BOE has been most concerned with this year) was seen rising back up to 5% from 4.7% prior.

Market Reaction

Despite the data, GBP hasn’t gained much ground with GBPUSD seeing only light upside following the release. The market reaction suggests that the data hasn’t materially shifted traders’ BOE easing expectations. The BOE signalled at its last meeting that it was likely nearing the end of its easing cycle. On the back of that guidance, the market still sees one more cut this year. However, if we see another upside inflation print on the back of today’s data that could derail easing expectations altogether, leading to a fresh move higher in GBP.

FOMC Minutes Next

Looking ahead today, traders will now turn to the FOMC minutes. Given today’s bullish GBP data, any dovishness and subsequent USD weakness should help the pair push higher. However, if the Fed strikes a more neutral tone in the minutes, GBPUSD could remain capped ahead of Friday’s Jackson Hole symposium.

Technical Views

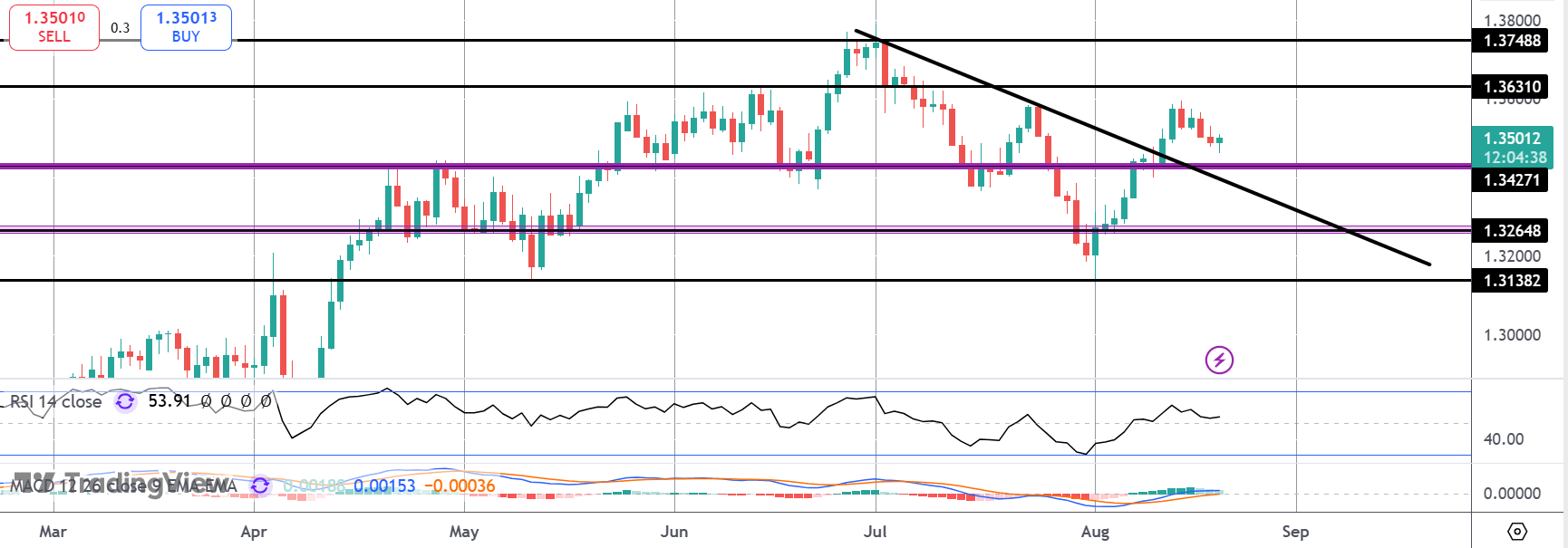

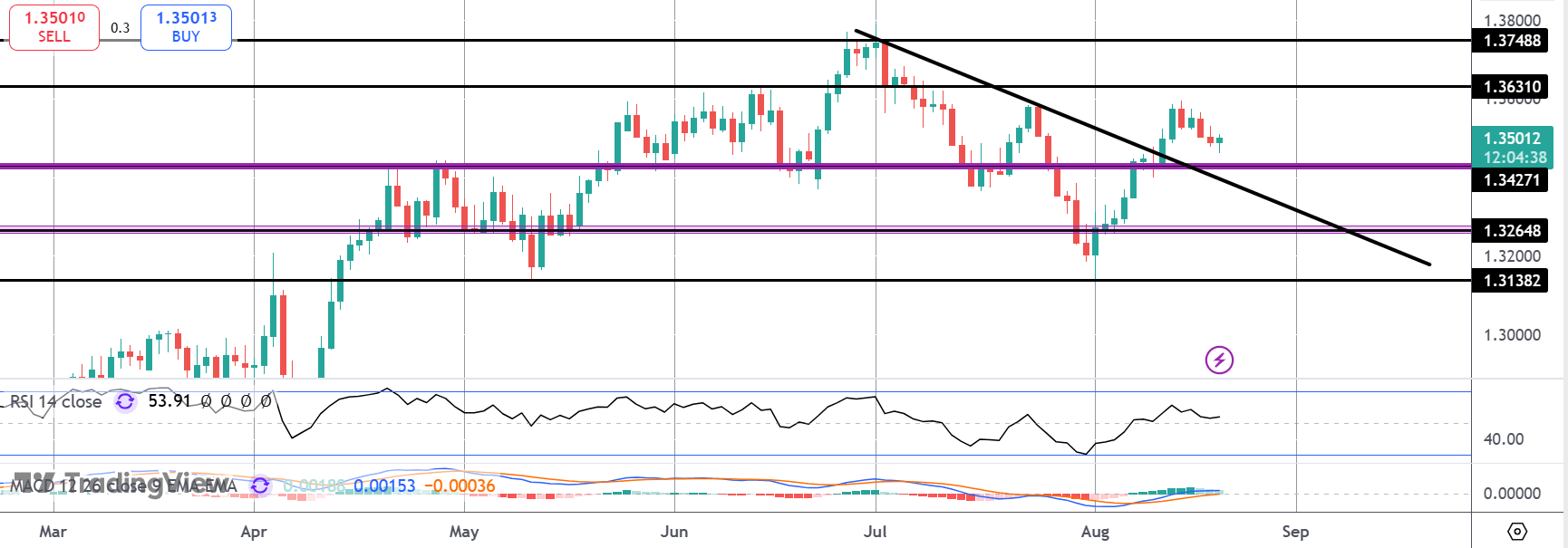

GBPUSD

For now, GBPUSD remains atop the 1.3427 level following the break of the bear trend line from YTD highs. While this level holds as support, focus is on a continuation higher with 1.3631 the next level to watch ahead of the 1.3748 level above.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.