Bitcoin Testing Key Level As ETF Buying Balloons

Institutional Demand Keeps Growing

Bitcoin prices are on course to print their fourth consecutive positive day today as the market continues to push back towards all-time highs. Soaring institutional demand has been a big driver of the recovery off Monday’s lows. This week, Japanese hotel group turned crypto investor, Metaplanet, announced a further purchase of more than $125 million worth of Bitcoin. The group has been tracking the buying patterns of Michael Strategy’s Saylor fund. Additionally, BTC ETFs have continued to attract deeper inflows this week with overall ETF inflows pushing north of $1.5 billion this week alone.

Major Crypto Milestone

Bitcoin prices are also being helped this week by news that the Senate Banking Committee has introduced a major new crypto bill. The legislation aims to limit SEC oversight of digital assets in a move which would help bring the US back up the rankings in terms of global crypto dominance. The move comes on the back of the Senate last week passing a stablecoin bill aimed at prohibiting yield-bearing consumer stablecoins. The bill is seen as a major win for the crypto community, requiring tokens to be backed liquid US assets (USD or US treasuries). If the bill passes the House it will then go to Trump for final approval with a fresh wave of BTC demand expected if the bill succeeds.

Technical Views

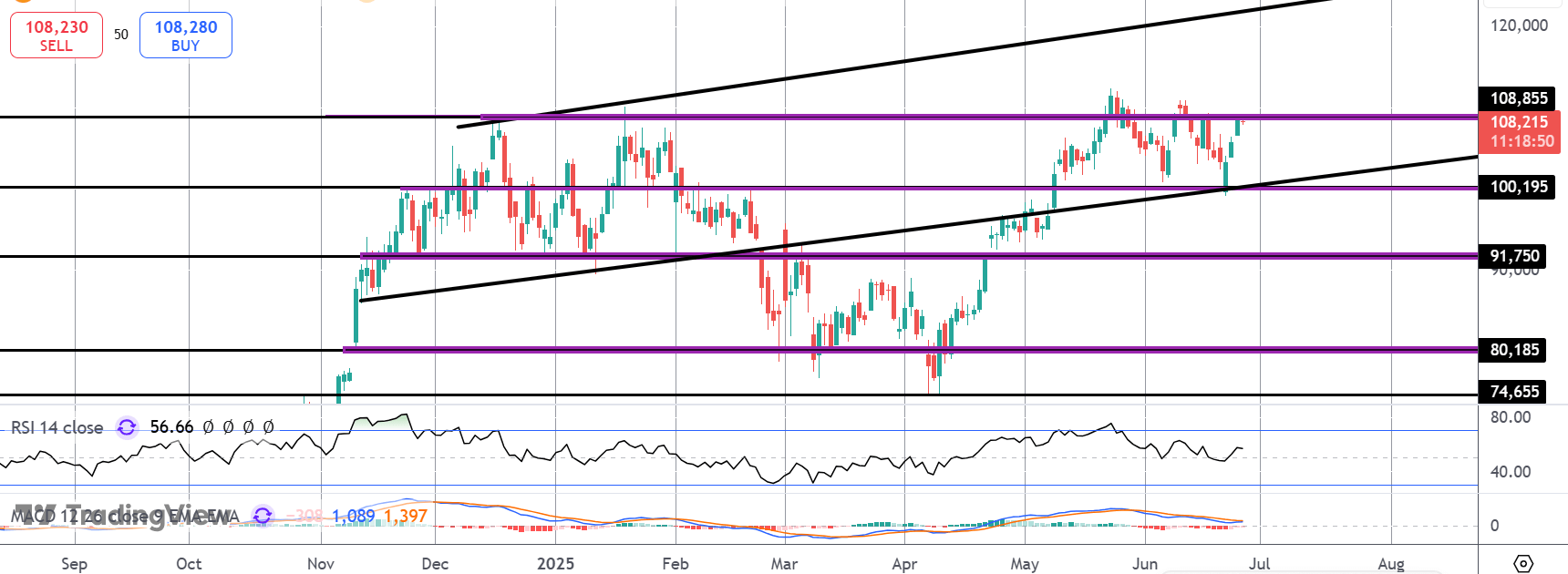

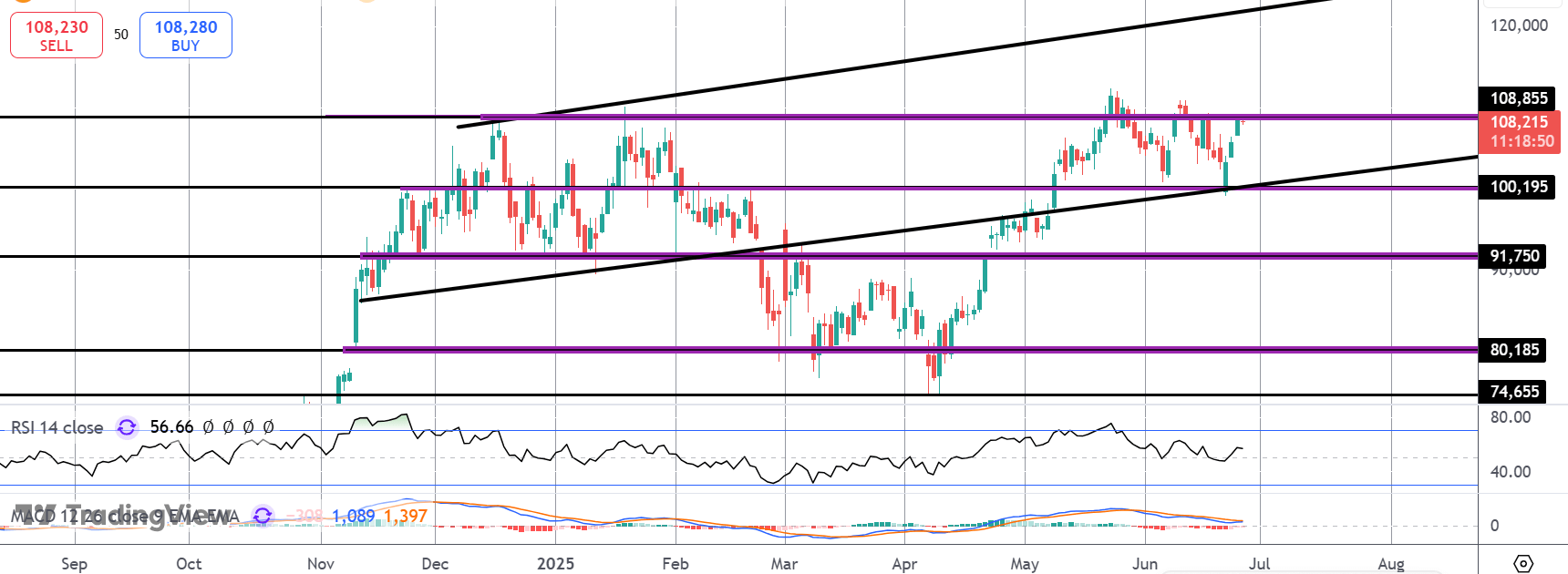

BTC

Price is now once again testing the key $108,855 level. This has prove a hard resistance level over the last year and a break higher here will be firmly bullish. Above the level, the $120k mark and bull channel highs will be the next objective for bulls. To the downside, the $100k mark remains key support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.